All your company’s research. One platform.

Remove redundancies, reduce costs, and decrease time to value with a single, modern platform for all your research requirements

MARKET SEGMENTATION

Track consumer behavior across unique segments, and take specific actions based on the value associated with each customer type.

PRODUCT DEVELOPMENT & PRICING

Gather customer feedback on new products and services early and throughout the development cycle to save time and money.

COMPETITIVE BENCHMARKING

Put everything into perspective by gaining an understanding of where you stand in relation to your competitors. Capitalize on key business differentiators and identify gaps in products and services.

ACADEMIC RESEARCH

Give professors, academics and students access to the most powerful research platform trusted by 99 of the world’s top 100 business schools.

PURCHASE BEHAVIOR

Take your level of customer understanding beyond “who is buying” to “why they are buying”. Dive into the behaviors that influence purchase decisions.

MARKET TRENDS

Where is your industry heading? Monitor industry and market trends to keep your company ahead of the curve.

CONJOINT ANALYSIS

Understand the value your customers attach to unique attributes of products and services offered by your business. Optimize the customer experience without breaking your budget.

A/B TESTING & EXPERIMENTS

Go from “we think” to “we know” and make data-informed decisions by A/B testing across every segment. Test questions, products, experiences, or features in order to truly understand the effect of change.

PANEL MANAGEMENT

Turn email lists, site visitors, members of your social media groups, and others into your own research panels. A ready and willing panel increases response rates and turnaround times for any research you’re conducting.

AD TESTING

How does ad content influence the way customers perceive your brand and/or encourage purchases? Answer these questions and more by conducting in-depth ad testing across key customer segments online and direct.

WEBSITE & MOBILE EXPERIENCE OPTIMIZATION

Understand how customers interact with your desktop and mobile experiences and make improvements based on customer feedback.

RESPONDENTS ON DEMAND

Purchase access to millions of respondents to collect feedback from exactly the people you need for your research. We can even run your project for you to ensure you achieve your goals.

Impactful insights, in the blink of an eye

Regressions, segmentation, crosstabs, MaxDiff - you name it, iQ has it covered. The most advanced statistical tests are applied across your entire dataset automatically to uncover insights in a fraction of the time of traditional research.

Open text, structured

Automatically analyze tens of thousands of open text comments with Text iQ. AI and natural language processing take open text and automatically categorize it by topic and sentiment so you can draw insights from the richest feedback of all — human language.

Prioritize what matters most

Instantly see the key drivers of anything from purchase intent to customer satisfaction with Driver iQ. Our automatic key driver analysis learns across your entire dataset to surface the key drivers you can focus on to have the biggest impact on the business.

Uncover trends and patterns

No matter how big your dataset, or how many teams are involved, Stats iQ connects the dots for you. It’s always running in the background, identifying the right test, running it, and alerting you to new trends, relationships and connections across the business.

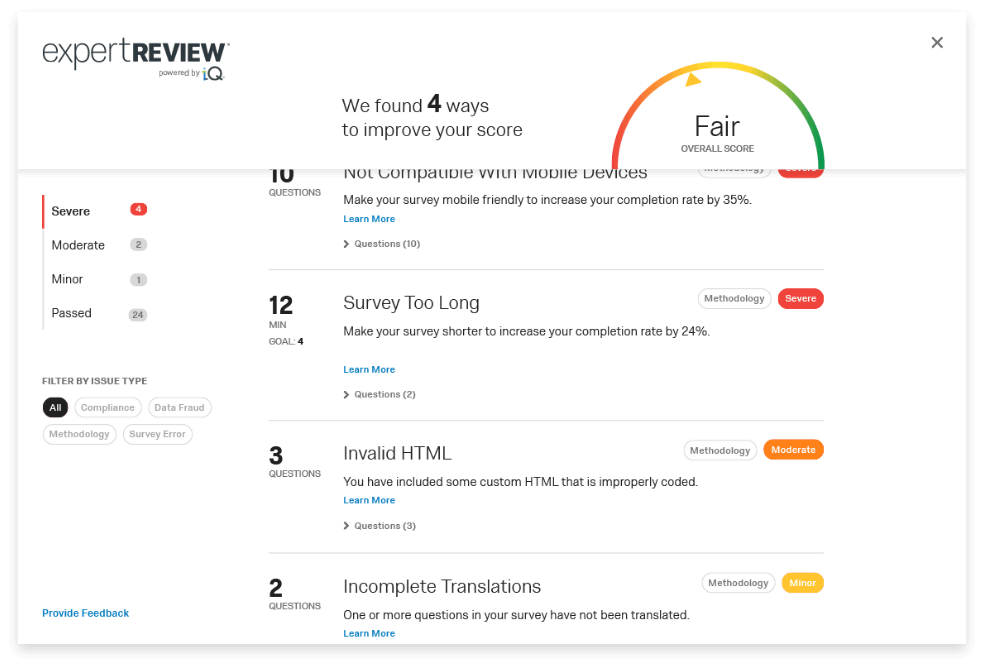

expert review

Improve research quality and avoid costly errors with ExpertReview

ExpertReview is your personal research assistant that uses AI to detect and remove quality gaps at every stage of the insights lifecycle.

- Avoid painful and costly errors when conducting research, and eliminate errors that come from poorly-designed studies

- Automatically flag problems like broken question logic, methodology errors, mobile compatibility, and even compliance issues

- Flag any sensitive or PII data, or poor-quality responses coming from bots, duplicates, cheaters, gibberish and other forms of disengaged respondents

- Detect, delete and redact poor quality responses with a single click

Launch in minutes, not days with fully automated, guided research solutions. Each solution comes with expert-designed, pre-built listening instruments, analytics and reporting. Choose from 25+ solutions designed by Qualtrics XM scientists . Streamline your data collection and increase insights outputs.

SCALE YOUR IMPACT

Access experts and a flexible engagement model to scale your team and expertise

- Access to 75+ experts, XM scientists and research managers to help you with design, analytics, reporting and respondent sourcing.

- 12,000+ customers, including 75% of F500. Top awards by Forbes, Fast Company, CNBC, Gartner Tech, Greenbook, Quirks, Trust Radius, G2 Crowd and more

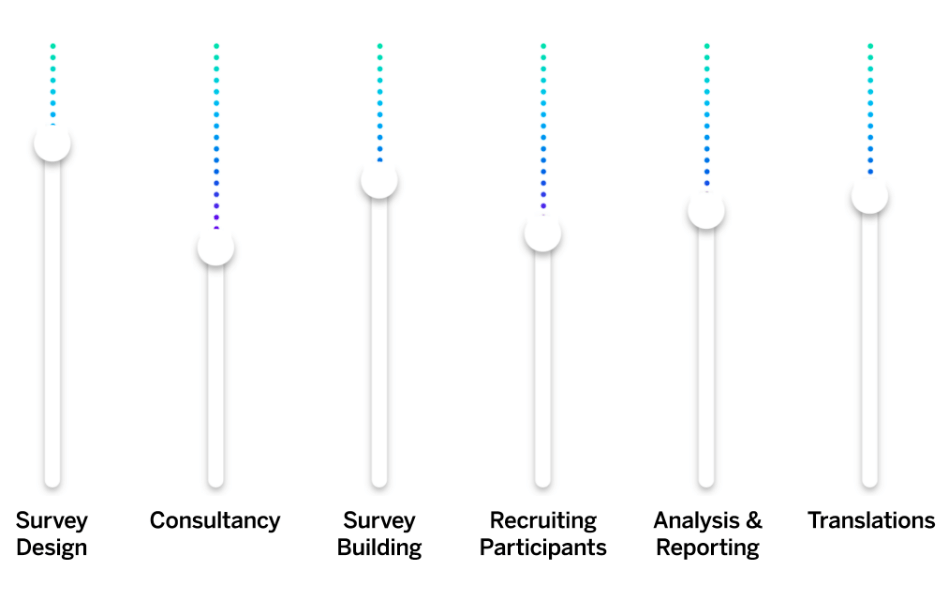

Qualtrics’ Flexible Service Model

We know that sometimes you need someone else to manage a project so you can allocate energy to other initiatives. Other times, you need the flexibility and agility to manage the details yourself. Our offering gives you the freedom and power to dial up or dial back the services at any time during the program.

Advisory

- XM Scientists

- XM Institute

- Tech Consultants

Deliver

- Tech Consultants

- Solution Architects

- Program Architects

Support

- Customer Success

- Qualtrics Support

- Technical Account Manager

- Experience Basecamp

Customization

- Engineering Services

QUALTRICS RESEARCH SERVICES

Make your research work harder for you

Uncover deeper and more targeted insights with Qualtrics Research Services and our network of partners. Trained research experts help unlock cost and time savings, while flexible service options let you choose how much – or how little – support you need.