Poor customer experiences could cost businesses nearly $3 trillion in sales globally as customers cut their spending in response to a bad experience, according to a new analysis of global consumers from Qualtrics XM Institute.

Against the backdrop of rising inflation and consumer sentiment hitting six-month lows, the findings reveal how poor customer experiences undermine businesses’ ability to maintain and grow revenue in uncertain economies: 34% of consumers reduce their spending with a company after a negative experience, and 13% cut their spending entirely.

"Leaders can't treat delivering excellent customer experiences as a nice-to-have strategy -- it's essential to business success," said Isabelle Zdatny, Head of Thought Leadership at Qualtrics XM Institute. "Poor customer experiences are eroding loyalty and they are costing businesses real revenue today, showing up in quarterly results. The organizations that survive economic uncertainty will be the ones that prioritize customer experience as a buffer against financial risk.”

Economic uncertainty creates friction

What's driving these losses reveals an uncomfortable truth about how customers are adapting to economic uncertainty.

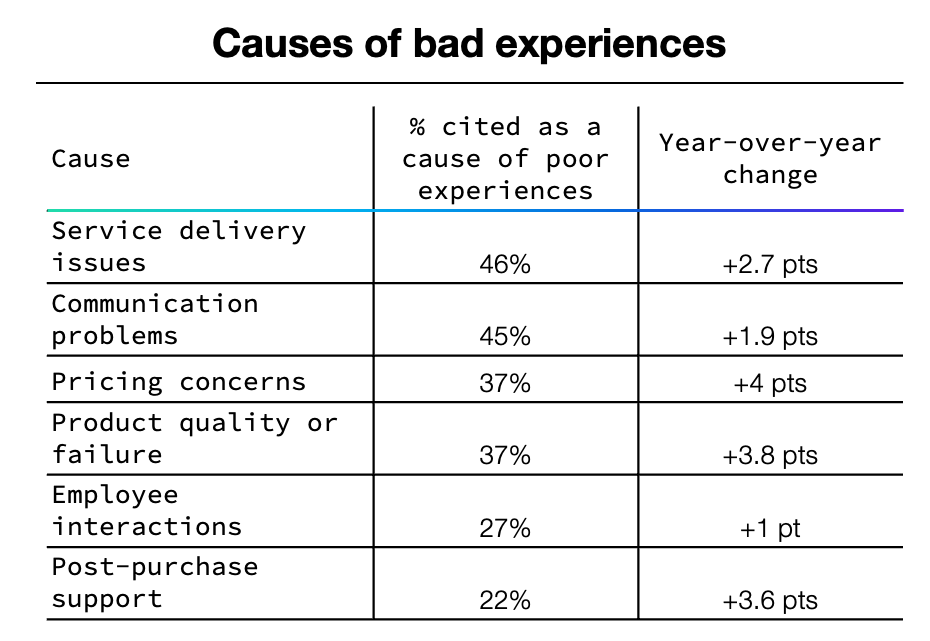

While fewer customers cut spending after a poor experience compared to last year, pricing concerns as a cause of poor experiences jumped 4 percentage points - a larger increase than any other complaint. This signals that economic uncertainty, inflation, and concerns about tariffs are creating new friction points.

"Frankly, in a tough economic climate, customers will put up with worse experiences for lower prices. But when the issue is the pricing itself, customers’ tolerance disappears," said Zdatny.

This creates a narrow window for businesses: customers are more willing to accept operational issues during economic downturns as long as they’re balanced by lower costs, but less forgiving of pricing issues. And in the long run, great experiences are what ultimately drive stronger long-term loyalty.

Companies must avoid compounding pricing pressure with service failures, communication breakdowns, or product quality issues. A problem they might have overlooked in better times now becomes the trigger for switching to a competitor.

Customer silence exacerbates the problem

Many companies are turning to AI to scale their customer service efforts, but early results are concerning. According to Qualtrics' 2026 Consumer Experience Trends Report, nearly 1 in 5 consumers who used AI for customer support saw no benefits at all, a failure rate almost four times higher than other AI use cases. Rather than solving customer problems, poorly deployed AI risks creating more frustrated customers who decide to walk away.

The challenge for businesses is that these spending cuts often happen silently. Fewer than 1 in 3 consumers provide feedback to companies, marking an all-time low. It means that rather than giving companies a chance to make things right, customers will simply spend less or take their business elsewhere, leaving organizations to discover the revenue loss after the fact.

Where poor experiences cost the most

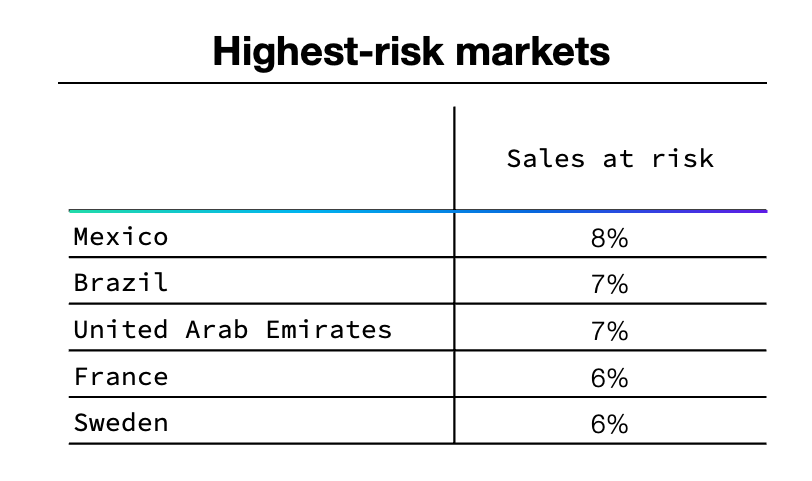

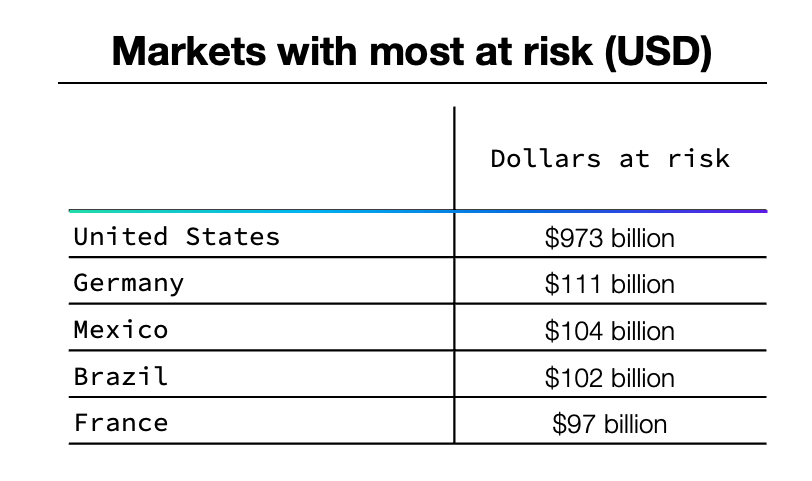

The financial exposure of poor customer experience isn’t evenly distributed. Mexico faces the highest risk at 8% of sales, followed by Brazil and the United Arab Emirates (both 7%). The U.S. leads in absolute dollars at risk - $973 billion, followed by Germany at $111 billion, and Mexico at $104 billion.

Fast food leads in spending cuts

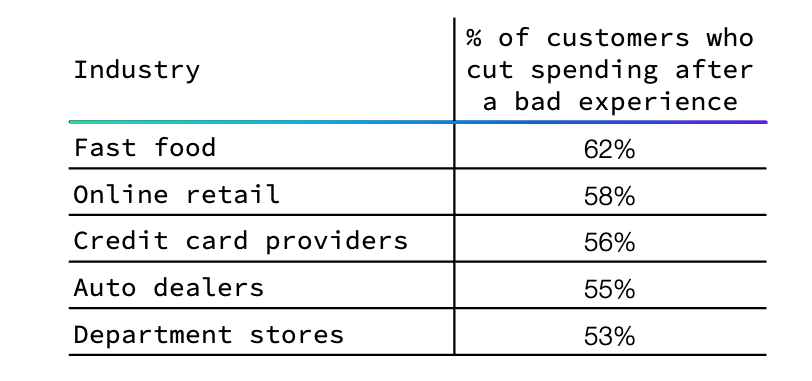

Industry matters too, with fast food restaurants at most risk of spending cuts after a poor experience (62% of customers will stop or reduce spending after a problem). In industries where it is easier to switch to a different brand, poor experiences can be especially costly.

Industries where bad experiences most often lead to spending cuts

How organizations can protect themselves from experience failures

According to Zdatny, organizations that want to protect their bottom line from customer experience failures should:

Understand their specific customer needs. The winning organizations know what excellent experience means for their specific business and customers and build around executing on that definition.

Empower employees to solve problems. In many organizations, front-line staff can see problems but lack the power and authority to fix them. Closing that gap is essential.

Earn executive support by framing CX as risk mitigation. Underscore the financial risk of poor experiences to gain buy-in across leadership to invest in delivering great experiences. Highlight the upside as well. Companies with top-rated customer experiences consistently outperform their peers in the stock market.

"Companies cannot afford to treat customer experience as a separate initiative," said Zdatny. "It is a fundamental business discipline that directly impacts revenue and should be measured and invested in with the same rigor applied to other financial metrics. The potential costs are very real."

Methodology: The data for this analysis comes from a global consumer study conducted by Qualtrics XM Institute in Q3 2025, surveying 20,001 consumers across 14 countries: Australia, Brazil, Canada, France, Germany, Japan, Mexico, Netherlands, New Zealand, Singapore, Sweden, United Arab Emirates, United Kingdom, and United States. Responses reflect the gender, age, and income demographics within each country.