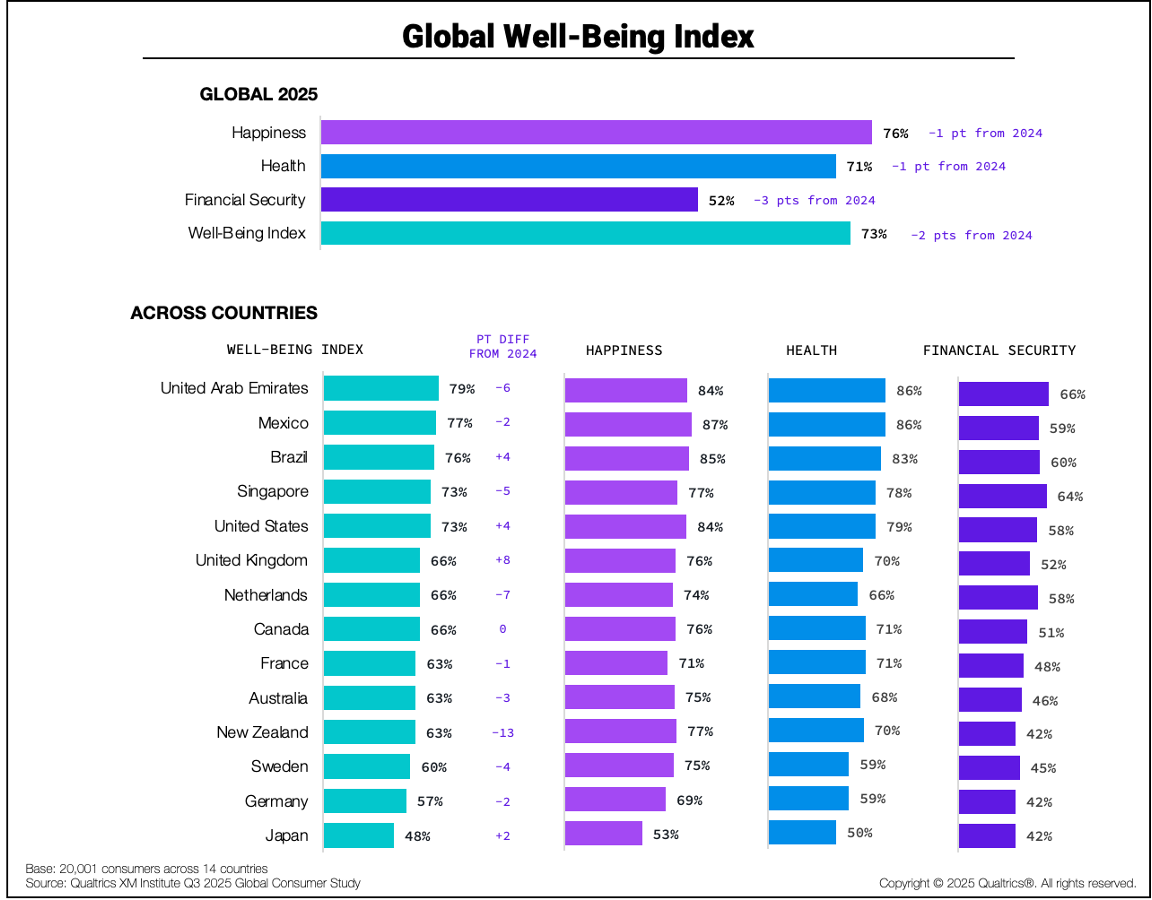

To assess such sentiment broadly, Qualtrics XM Institute’s Q3 2025 Global Consumer Study measured three elements of well-being to create the Well-Being Index (WBI):

- Happiness: I am happy

- Health: I am healthy

- Financial Security: I am financially secure

Global Well-Being declines

Since 2024, the Well-Being Index has declined 2 points globally. Seventy-six percent of the global population considers themselves happy, while just 52% say they are financially secure. Of the three components, financial security declined the most (-3 pts). We also found that:

- Well-Being increased the most in the United Kingdom. Well-Being increased 8 points in the United Kingdom, the largest rise across 14 countries and double the increase of any other country. New Zealand, meanwhile, reported the greatest decline in Well-Being since 2024, at -13 points.

- The United Arab Emirates tops the Well-Being Index. Despite a decline of 6 points in their WBI from 2024, the UAE reported the highest WBI score across all countries (79%). Mexican (77%) and Brazilian (76%) consumers follow, while Japanese consumers (48%) report the lowest Well-Being rating.

- Emirati consumers are the healthiest and most financially secure. Emirati consumers most often consider themselves healthy (86%) and financially secure (66%). Japanese and German consumers are equally dismal about their financial security (42% each).

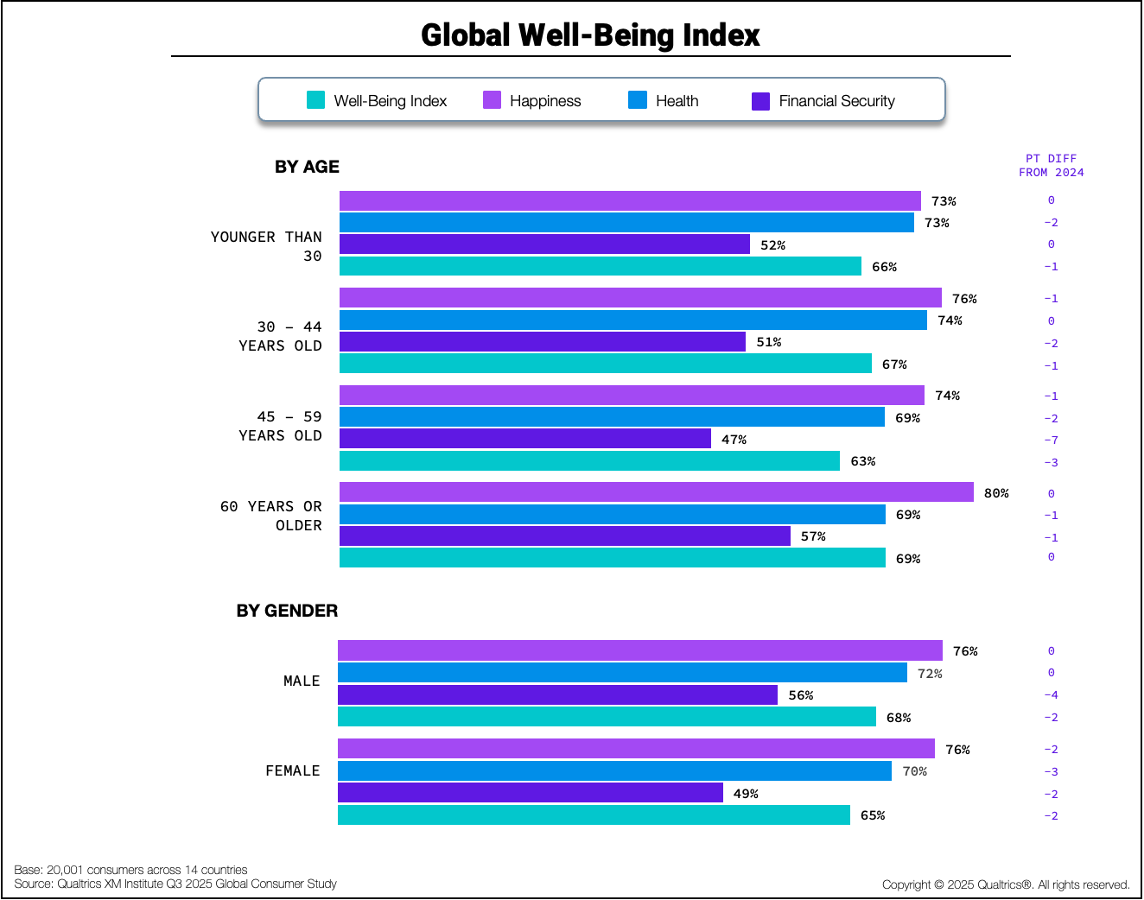

Well-Being varies by age and gender

- Well-Being is highest among older people. People over 59 score highest on the Well-Being Index (69%). About two-thirds (66%) of consumers under the age of 30 are doing well, while consumers ages 45-59 score 63% on the WBI, 7 points lower than their older peers.

- Women’s Well-Being is lower than men’s. Globally, women have a WBI score of 65%, 3 points lower than men. While their happiness scores are the same (76%), the division appears in their health (2-pt difference) and financial security (7-pt difference).

- Well-Being decreased the most among the middle aged. Well-Being declined 3 points for consumers ages 45-59. This drop is driven primarily by a nearly 7-point decrease in financial security among this group. Men and women experienced a similar drop (-2 pts) in their WBI.

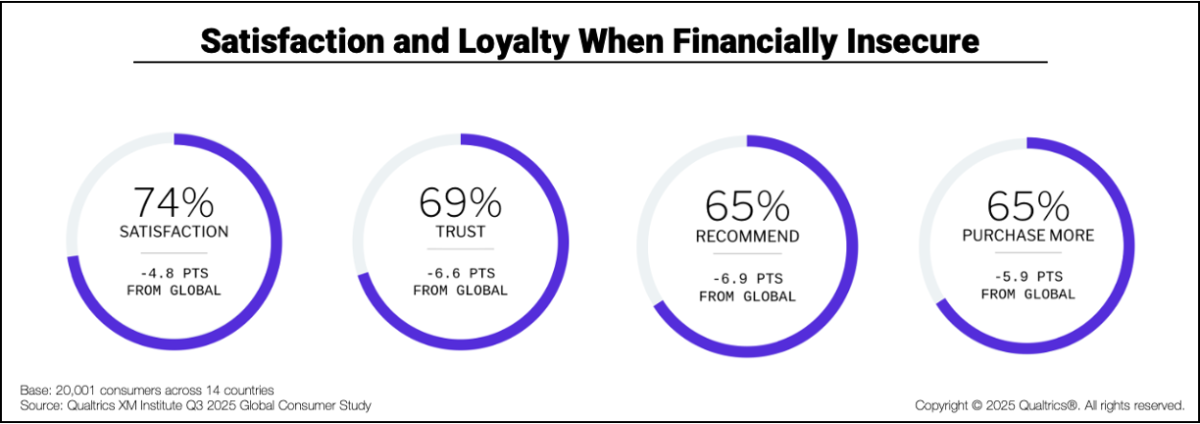

Financial insecurity correlates with lower CX Ratings

Qualtrics’ 2026 consumer trends found that both consumer satisfaction and loyalty saw increases over the past year – but not all types of consumers painted the same rosy picture of their recent experiences.

Financially insecure consumers’ satisfaction and loyalty ratings lag behind global averages. Most notably, their willingness to recommend and trust organizations falls well below global norms, highlighting how financial stress shapes consumer sentiment.

Advice for professionals

To account for these big-picture well-being trends in their own context, CX teams should:

- Interpret CX metrics through a well-being lens. Your CX scores don't just measure service quality. They also reflect your customer base's economic conditions and baseline well-being. Financially insecure customers rate their experiences worse across all CX metrics. Similarly, women and middle-aged consumers report systematically lower well-being, meaning customer bases skewing toward these demographics will generate lower scores independent of service quality. This affects both benchmarking (companies serving affluent segments naturally score higher than those serving stressed populations) and trend analysis (year-over-year changes may reflect shifting economic conditions rather than operational performance). Before comparing your performance to historical trends or competitors, investigate whether you're comparing populations facing similar circumstances. This prevents misallocating resources to fix problems that are macroeconomic, not operational.

- Identify which segments are under economic stress. While demographic composition is already captured in your segmentation, economic conditions change rapidly. To account for these shifts, overlay economic indicators onto your existing customer segments. You don't need sophisticated modeling; start with publicly available data matched to your customer profiles, like local unemployment rates, wage growth data, and regional inflation. This diagnostic work reveals whether CX score declines in specific segments correlate with deteriorating economic conditions or signal actual service failures you can address. It also shows you which parts of your customer base may need fundamentally different service approaches. Understanding where economic stress concentrates in your customer segments informs both near-term resource allocation and longer-term decisions about product design, pricing strategy, and channel investment.

- Focus on eliminating friction for stressed customers. Research shows that financial insecurity significantly reduces cognitive bandwidth, consuming mental resources and leaving less capacity for complex decisions or multi-step processes. This means financially insecure customers are more likely to prioritize price transparency over surprise-and-delight, simple processes over feature-rich experiences, and flexible payment options over traditional loyalty rewards. CX teams should reallocate resources accordingly. Instead of investing in "delight" features customers might not appreciate under stress, focus on friction reduction, cost predictability, and radically simplified interactions. Self-service tools requiring sustained attention, opt-in programs, and multi-step choices may trigger abandonment or decision paralysis. Instead, design for constrained capacity by offering clear default options, proactive communication about costs, and high-frequency interactions that require minimal cognitive load.