Customers perceive the experiences they have with an organization across three dimensions:

- Success: Were they able to achieve their goals?

- Effort: How easy was the interaction?

- Emotion: How did the experience make them feel?

While all three are important, companies that excel at the emotion component outperform their industry peers by 36 percentage points in stock returns. However, in the 14 years that XM Institute has tracked these three dimensions, emotional scores have consistently lagged behind success and effort metrics by double digits.

These findings expose a widespread blind spot. Our analysis of 350+ brands shows emotion predicts customer loyalty better than success or effort across every metric we measure, including trust, NPS, and repurchase intent. Despite this clear relationship, customer emotions are deteriorating. Happiness, excitement, and relief have all declined by up to 9 percentage points since 2017, even as companies invest billions in functional experience improvements.

Why emotion dominates customer decisions

The answer lies in how our brains make decisions. The human brain processes emotions much faster than rational thought, with 95% of decisions occurring below conscious awareness. We feel before we think — and those feelings, not our rational analysis, ultimately drive our choices.

This biological reality explains why emotion dominates our findings. It's not that customers value feelings over function; it's that feelings determine how they perceive and remember functional experiences. Yet organizations continue to design experiences for the 5% of conscious processing, investing billions in operational excellence while leaving emotional impact to intuition and accident.

In this research, we draw from multiple longitudinal studies spanning nearly 15 years, hundreds of brands, and thousands of customers to examine the magnitude of this emotion gap and how to design experiences that emotionally resonate with customers. The data shows that organizations treating emotion as a 'soft' metric are missing the strongest driver of both customer loyalty and financial performance.

The financial stakes of emotional connection

The business case for emotional connection extends far beyond traditional CX metrics. Our research reveals that emotion drives superior financial performance, predicts customer loyalty more accurately than functional metrics, and represents the greatest opportunity gap in customer experience. Yet despite these advantages, organizations continue to underperform on emotion while customer feelings about their experiences steadily deteriorate.

To understand both the magnitude of emotion's impact and the scale of organizations' failure to deliver it, we conducted four complementary studies examining emotion through different lenses: stock performance, loyalty prediction, historical trends, and changing emotional composition.

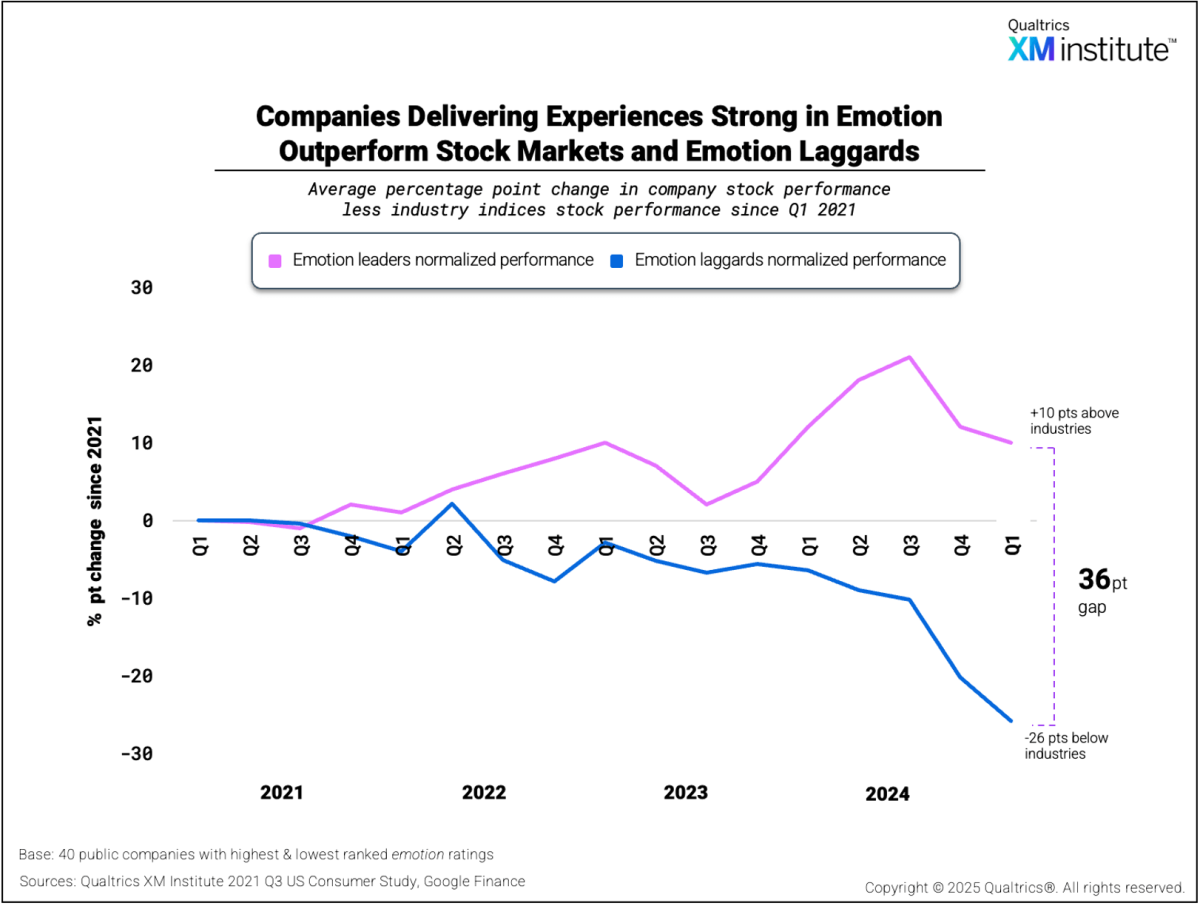

Study #1: Emotion leaders outperform the market

Our four-year longitudinal study of 40 publicly traded companies found that emotion leaders consistently outperformed the stock market while emotion laggards increasingly fell behind (Methodology #1).

As part of this analysis, we found:

- Emotion leaders outperformed their industries by 10 percentage points. Companies with the highest emotion ratings started 2021 at parity with their industry indices but steadily pulled ahead, finishing 10 points above industry averages by the end of 2024.

- Emotion laggards fell 26 points behind their industries. The 20 companies with the lowest emotion ratings saw accelerating declines, particularly after 2023, ending the period 26 percentage points below their industry benchmarks.

- The gap between leaders and laggards has widened dramatically. Starting from near-zero in 2021, the gap between emotion leaders and laggards expanded each year through market volatility. This emotion-driven spread is 12 points larger than the 23-point market performance gap we measured between overall CX leaders and laggards using composite success, effort, and emotion ratings.

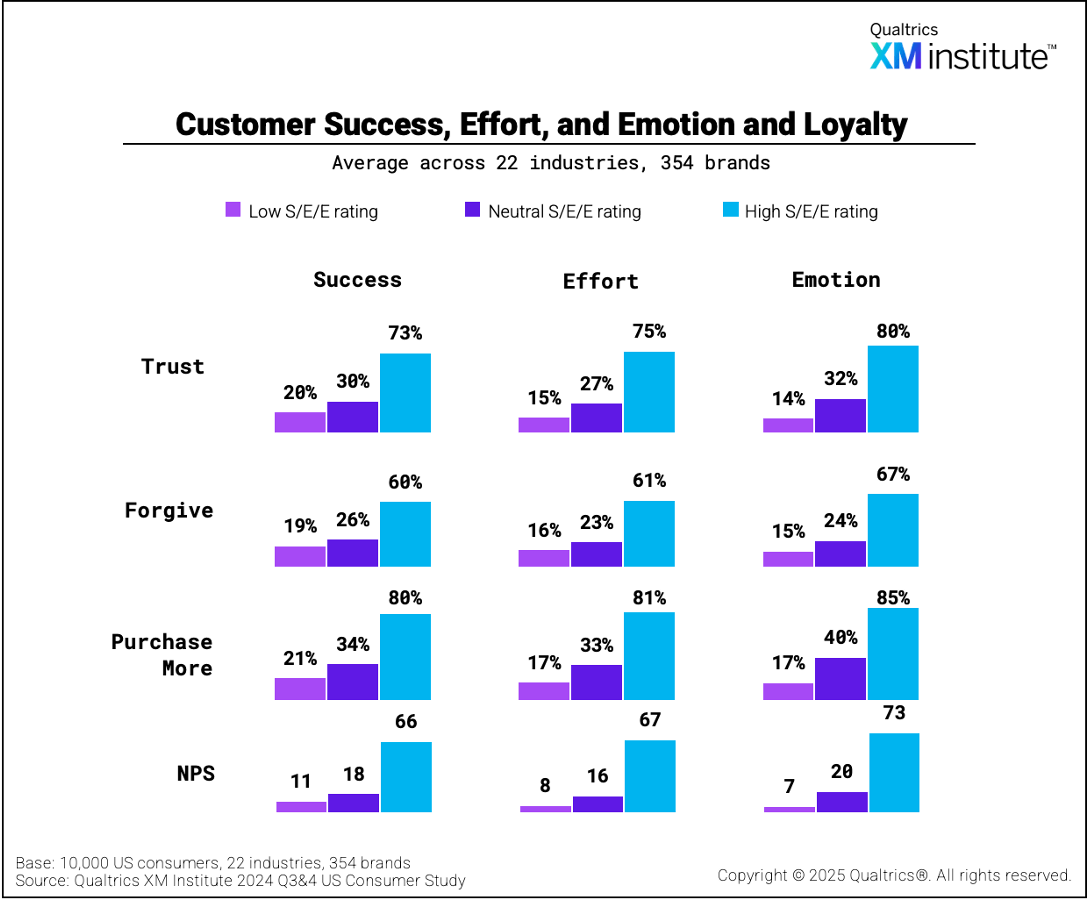

Study #2: Emotion predicts loyalty better than functional metrics

Our analysis of 354 brands across 22 industries found that – compared to success and effort – emotion is the most strongly correlated with customers’ likelihood to trust, forgive, repurchase, and recommend an organization (Methodology #2). This finding has remained consistent across 14 years of research since 2011 — emotion has been the superior predictor of loyalty in every annual study we've conducted.

In our most recent consumer study, we found:

- Emotionally connected customers are 5.7x more likely to trust the brand. When customers give high emotion ratings, 80% trust the brand compared to just 14% with low emotion ratings — a 5.7x multiplier. This exceeds the predictive implications of both effort (5.0x) and success (3.7x), demonstrating that how customers feel matters more than just functional delivery.

- Emotion drives forgiveness and repurchase intent. High emotion ratings correlate with a 4.6x increase in forgiveness (67% vs. 15%), exceeding both success (3.1x) and effort (3.8x). For purchase intent, 85% of those with high emotion ratings say they will buy more — a 5.1x multiplier that again outpaces success (3.8x) and effort (4.8x).

- Emotion predicts strong advocacy. Customers giving high emotion ratings generate an NPS of 73 versus just 7 for low ratings — a 11.1x multiplier that far exceeds the implications of success (5.8x) and effort (8.7x). This dramatic difference means emotionally connected customers don't just stay loyal, they could become active advocates, amplifying growth through word-of-mouth.

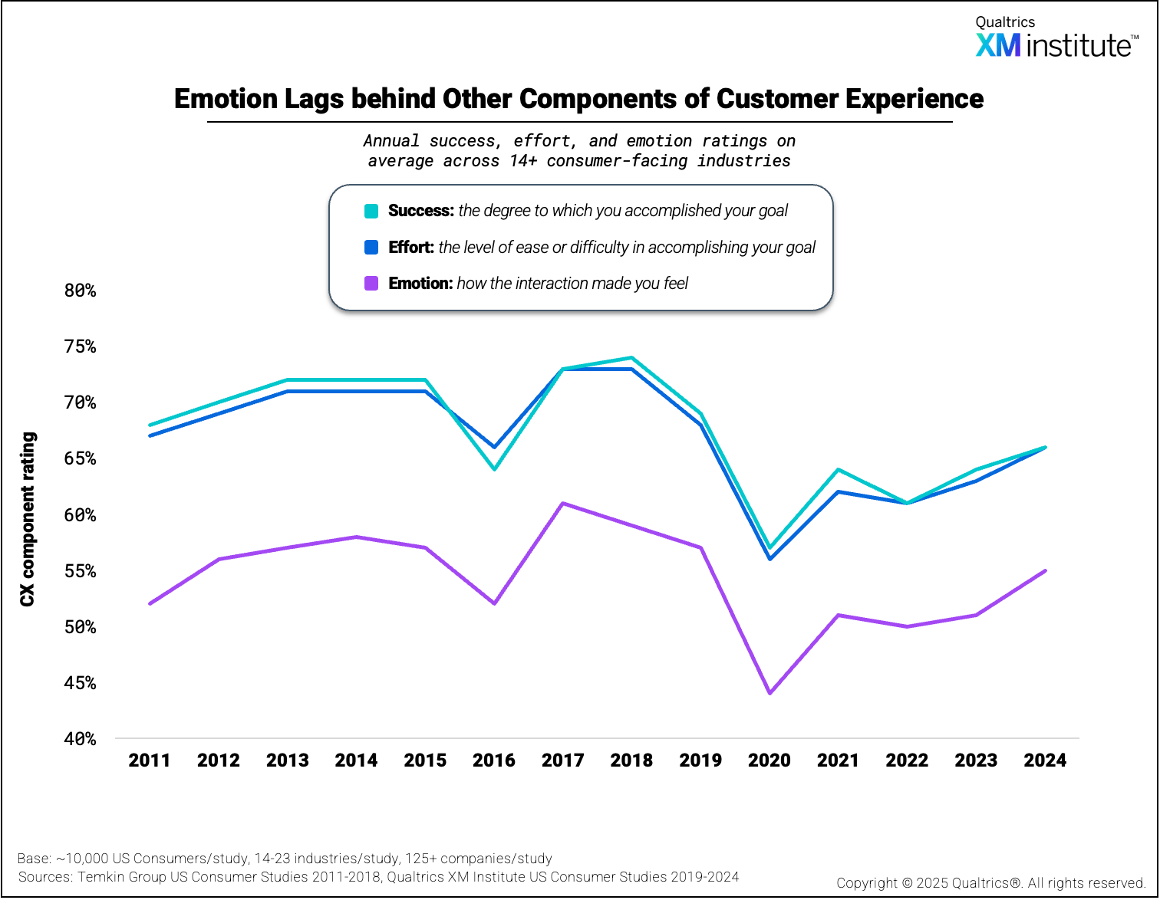

Study #3: The persistent emotion gap

Despite emotion's clear value in driving loyalty and financial performance, organizations have consistently underperformed on this dimension for 14 years — a gap that shows no signs of closing (Methodology #3).

Our longitudinal analysis shows:

- Emotion is always the lowest-scoring CX dimension. Over this entire period, consumers rated emotion no less than an average of 11 points behind success and effort.

- The 2020 pandemic affected all dimensions equally. While all three metrics crashed in 2020 — with emotion hitting a low of 44% — the relative performance gap remained unchanged, demonstrating this is a structural issue that persists regardless of external conditions.

- Organizations continue to leave value on the table. With emotion scores at just 55% in 2024 – versus 66% for success and 65% for effort – companies are systematically underdelivering on the dimension that most strongly predicts loyalty and financial performance.

Study #4: The deteriorating emotional landscape

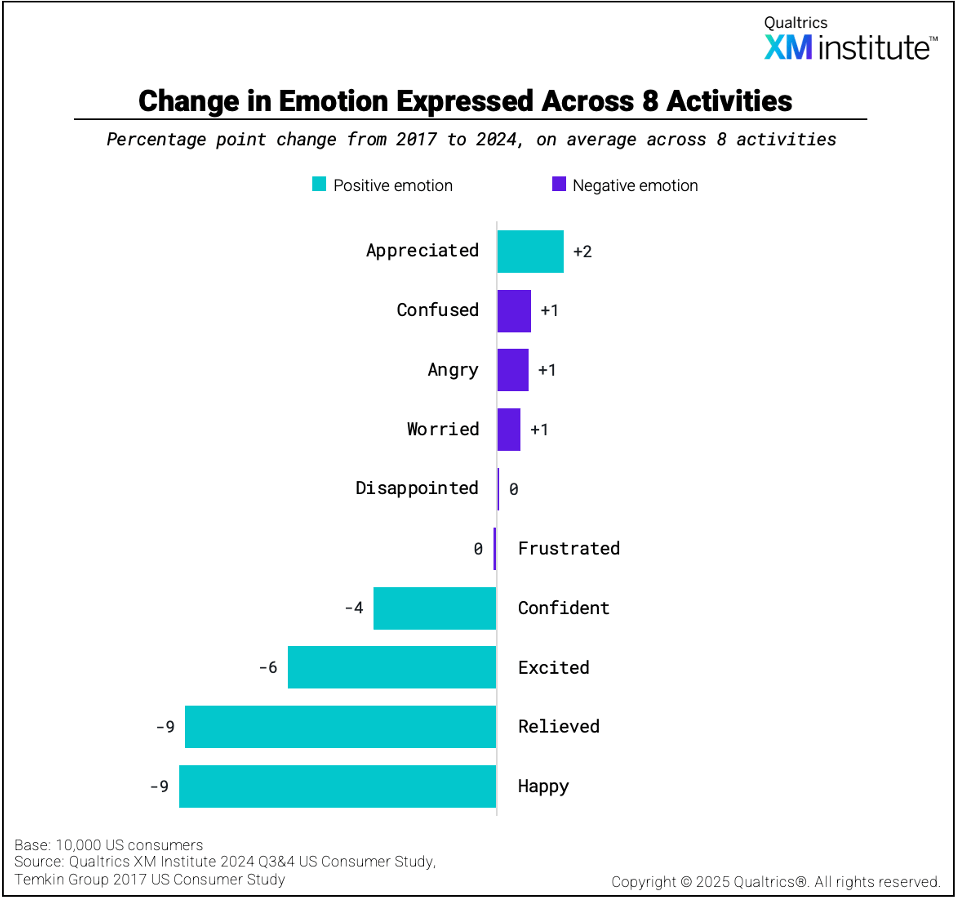

While overall emotion scores have recovered from pandemic lows, the specific emotions customers experience are shifting in troubling ways. Comparing 2024 to 2017 across eight common customer interactions reveals systematic decline in positive emotions while negative emotions persist (Methodology #4).

When we analyzed the prevalence of specific emotions, we found that:

- Most positive emotions are declining. Since 2017, happiness and relief both dropped 9 percentage points, excitement fell 6 points, and confidence dropped 4 points – indicating a systematic erosion of the types of positive feelings that build customer loyalty.

- Negative emotions remain stubbornly persistent. While positive emotions largely declined, confusion (+1 point), anger (+1 point), and worry (+1 point) have all increased slightly, suggesting that organizations aren't just failing to delight — they're actively creating more friction and anxiety.

- Appreciation is the sole bright spot. Rising 2 percentage points, appreciation is the only positive emotion trending upward, providing a small counterpoint to the otherwise negative trajectory of customer emotions.

Five practices for building emotional connection

The gap between emotion's proven value and organizational performance represents both a crisis and an opportunity. Companies that continue to treat emotion as a soft metric will watch competitors capture the loyalty and financial returns they're leaving on the table. But those willing to systematically build emotional connection into their experiences can unlock substantial competitive advantage.

To bridge this gap between current practice and emotionally resonant experiences, we've identified five evidence-based practices that leading organizations use to systematically build emotional connection:

- Measure specific emotions, not generic satisfaction. Generic satisfaction scores mask the emotional nuances that drive behavior. Research shows that measuring discrete customer emotions – like gratitude, confidence, and anxiety – predicts customer behavior more accurately than traditional CSAT. Start by identifying specific emotions tied to your brand promise and critical journey moments, then embed them into existing measurement programs. For instance, if your brand promises "peace of mind," explicitly measure that promise in relationship surveys, then track the underlying emotions of relief and confidence after support interactions. These emotion scores will monitor how well you're living up to your brand and serve as powerful inputs for predictive models and personalization strategies.

+ Example: One global healthcare provider made "love" its core emotional metric, defining it as "loyalty beyond reason." Before implementing this approach, the company researched attributes of brands that customers genuinely love, identifying patterns they could adapt to healthcare. They now ask customers to categorize brands as loved, friend, acquaintance, or dislike — treating organizations as people to reveal deeper emotional connections. This measurement approach not only tracks progress toward their emotional goal but also helps identify specific attributes of loved brands to incorporate into their experience design. - Use behavioral signals to detect and respond to changing emotional states. While customers can reliably report conscious feelings, behavioral signals capture emotional responses in real-time across your entire customer base. These signals reveal immediate emotional reactions as they occur (e.g., rage-clicking shows frustration, all-caps typing indicates anger, backtracking suggests confusion), enabling intervention at the moment of emotional distress rather than after damage is done. Identify some behavioral indicators that correlate with certain emotional states in your critical journeys, like session duration and authentication failures for digital channels or rising pitch and increased interruptions for contact center calls. Once you identify these patterns, you can trigger targeted emotional interventions – launching proactive chat when confusion patterns emerge, coaching agents to shift approach when voice stress peaks, or simplifying processes where anxiety consistently spikes.

+ Example: One global fintech provider improved churn prevention by combining customer feedback with operational and behavioral signals to detect emotional risk states before they escalate. The company built predictive models that identify specific behavioral sequences — such as increased support tickets, delayed payments, and reduced product usage — that signal growing frustration or disengagement. When their system detects early warning patterns (for instance, when four of six high-risk indicators occur), it automatically triggers personalized outreach. The AI generates tailored outreach guidance for account teams based on successful retention patterns from similar situations. - Design for emotional peaks and endings, not averages. According to the peak-end rule, a cognitive heuristic, customers judge experiences based on their most intense moments and how they conclude, not their overall quality. A mostly pleasant journey with a terrible ending creates worse memories — and thus lower loyalty — than a difficult journey with a positive conclusion. Yet most organizations distribute improvement efforts evenly across touchpoints, missing the moments that actually shape memory. To design for this heuristic, map your critical customer journeys to identify emotional highs and lows, and then disproportionately invest in these memory-making moments. You should also get painful but necessary experiences (verification, payment) over with early, and create positive emotional peaks through unexpected moments of care. Most critically, ensure every interaction ends on a high note.

+ Example: One global payments company validated the peak-end rule through sentiment analysis of customer service calls. After modeling sentiment across thousands of call recordings, the company divided calls into four segments and found the final segment was most predictive of overall satisfaction. This insight transformed their coaching approach — instead of trying to optimize entire conversations, team leaders now focus agents on creating positive moments in critical segments and ensuring strong call closures. The company has begun identifying specific words and phrases that create emotional inflection points, allowing agents to consciously design for memorable peaks and positive endings rather than just resolving issues efficiently. - Choose channels based on emotional needs, not just efficiency. Not all customer interactions require the same emotional capability. While automation might reduce costs and excel at routine tasks, applying it everywhere removes the human moments that build lasting loyalty. The most successful organizations deliberately match channel capabilities to emotional requirements. Start by categorizing interactions by emotional intensity. Automate low-emotion tasks like password resets where speed matters most. Reserve human agents for emotionally charged situations — service failures, life events, first purchases — where human connection matters most. For the middle ground, develop hybrid approaches like AI that detects emotional escalation and smoothly transfers to trained agents or agents supported by real-time emotion coaching tools.

+ Example: One major bank's virtual assistant demonstrates sophisticated emotion-based channel routing by processing over 700 different customer intents and automatically directing interactions based on emotional context. When customers inquire about routine matters like routing numbers or bill payments, the AI handles these within its interface in an average of 48 seconds. However, when the system detects emotionally sensitive situations — such as a customer mentioning the death of a loved one while asking about estate management — it immediately recognizes the emotional weight of the conversation and seamlessly connects the customer to specialized human agents in the estate services team. This "high tech, high touch" approach has helped the bank achieve 98% first-contact resolution while maintaining the highest customer satisfaction scores among national banks. The system's ability to distinguish between functional and emotional needs ensures efficiency for the 50% of routine interactions while preserving human empathy for moments that matter most. - Use emotional insights to identify innovation opportunities. Customers can't request solutions they can't imagine, but their emotional patterns can illuminate unmet needs. The emotional data you collect provides a systematic way to spot these innovation opportunities across your entire customer base. Build regular practices to mine these insights. For example, hold monthly reviews of emotional data to identify recurring patterns. When you spot consistent emotional responses — whether negative (anxiety, frustration) or positive (delight, relief) — dig deeper to understand what's driving them. Reframe these patterns as innovation challenges: "How might we eliminate payment anxiety?" yields different solutions than "How might we speed up payments." Enrich your journey maps and design sprints with emotional data showing how customers actually feel at each touchpoint. This combination of emotional measurement and design thinking helps transform feelings into focused innovation priorities.

+ Example: One non-profit organization used emotional insights to transform their member onboarding through design thinking. Journey mapping revealed that new members felt confused and anxious as benefits information arrived piecemeal across multiple channels over weeks, triggering unnecessary support calls about membership status. The CX team reframed this emotional pattern as an innovation challenge: "How might we transform onboarding confusion into an inspiring first impression?" Guided by their experience principles (Gets Me, Effortless, Inspiring), they prototyped a consolidated welcome box bundling all materials — cards, magazines, benefits guide, and premium gift — into one cohesive arrival moment. This emotion-driven innovation decreased new member support calls while increasing satisfaction scores.

Emotion as a differentiator

Emotion isn't a soft metric — it's your strongest predictor of both customer loyalty and financial performance. Companies that excel at emotional connection outperform their industries by 36 percentage points in stock returns and generate customers who are 5.7x more likely to trust, 4.6x more likely to forgive, and 11.1x more likely to advocate.

Yet across 14 years of research, organizations have consistently underperformed on emotion while positive customer feelings steadily deteriorate. This gap represents the largest untapped opportunity in customer experience today. The five practices outlined above provide a systematic path forward: measure discrete emotions tied to your brand promise, use behavioral signals for real-time emotional detection, design for memory-making peaks and endings, match channel capabilities to emotional intensity, and mine emotional patterns for innovation opportunities.

The question isn't whether emotion matters — the data makes that irrefutable. The question is whether your organization will continue leaving this value on the table while competitors capture the loyalty and financial returns that emotionally connected experiences deliver.

Study Methodology

Stock performance analysis

To understand how the emotion component of customer experience relates to market outcomes, we first identified emotion leaders and laggards by selecting the 20 publicly traded companies with the highest emotion scores and the 20 with the lowest scores from our 2021 XMI Customer Ratings - Overall benchmark. We then tracked, normalized, and determined portfolio stock performance using a methodology as defined in CX Leaders Consistently Outperform the Stock Market.

Loyalty metrics analysis

Using data from the 2024 Qualtrics XM Institute US Consumer Survey, we identified the number of low, neutral, and high ratings in each industry that also had high loyalty ratings and divided it by the total number of low, neutral, and high component ratings. We then averaged these calculations across all 22 industries included in this study. Check out the full methodology and breakdown by industry in How Success, Effort, and Emotion Predict Customer Loyalty, 2025.

Emotion over 14 years analysis

Using data from Temkin Group and Qualtrics XM Institute US Consumer studies from 2011 through 2024, we determined the cross-industry average success, effort, and emotion ratings for each year. Due to the expansion of industries included in these over time, between 14 and 23 industries are included in each year’s analysis.

7 year change in emotions analysis

Using data from the Temkin Group 2017 US Consumer Study and Qualtrics XM Institute 2024 US Consumer Study, we found the percentage of consumers who experienced each emotion during 8 common interactions: Researching a hotel or rental car for a trip, researching a health insurance plan, purchasing a new pair of shoes or sneakers, purchasing a new or used car, using a new phone or tablet for the first time, filing a claim with a home or auto insurer, investigating a mistake in a monthly bill, and reaching out for technical support for their computer. We then found the change in each emotion from 2017 to 2024 on average across all 8 interactions.

Each US Consumer Study includes a demographically representative sample of 9,055-10,000 US consumers according to the age, gender, regional, ethnic, and household income makeup of the population using the most recent US Census available at the time of the analysis.