The energy at TMRE this year is unmistakable. AI isn't a future trend for market research anymore, it's reshaping how teams work right now, and every session, hallway conversation, and booth demo reflects that shift. An overwhelming 94% of senior marketing and insights leaders say AI gives them a competitive advantage, and 95% say they are already using or plan to use synthetic data within the next 12 months to generate new customer insights, fill data gaps, replace or augment traditional surveys, and simulate audience segments. The reasons: improved speed to insights (84%) and better depth of insights (79%).

At Qualtrics, we're seeing this momentum firsthand. In addition to early testing of Qualtrics synthetic research panels, thousands of XM for Strategy and Research customers are embracing AI-powered solutions like Insights Explorer and adaptive surveys to gain a competitive edge by turning customer insights into faster, smarter decisions that increase loyalty and growth. Already these customers collect more than 1.8 million responses monthly through AI-powered conversational feedback alone. That number jumped 38% from August to September, signaling accelerating adoption.

However, the promise of AI-powered research has faced its share of skepticism, and for good reason. Early attempts to use general-purpose large language models (LLMs) for synthetic research revealed significant limitations: responses were too agreeable, lacked demographic variation, and failed to capture the nuance of real human attitudes and behaviors.

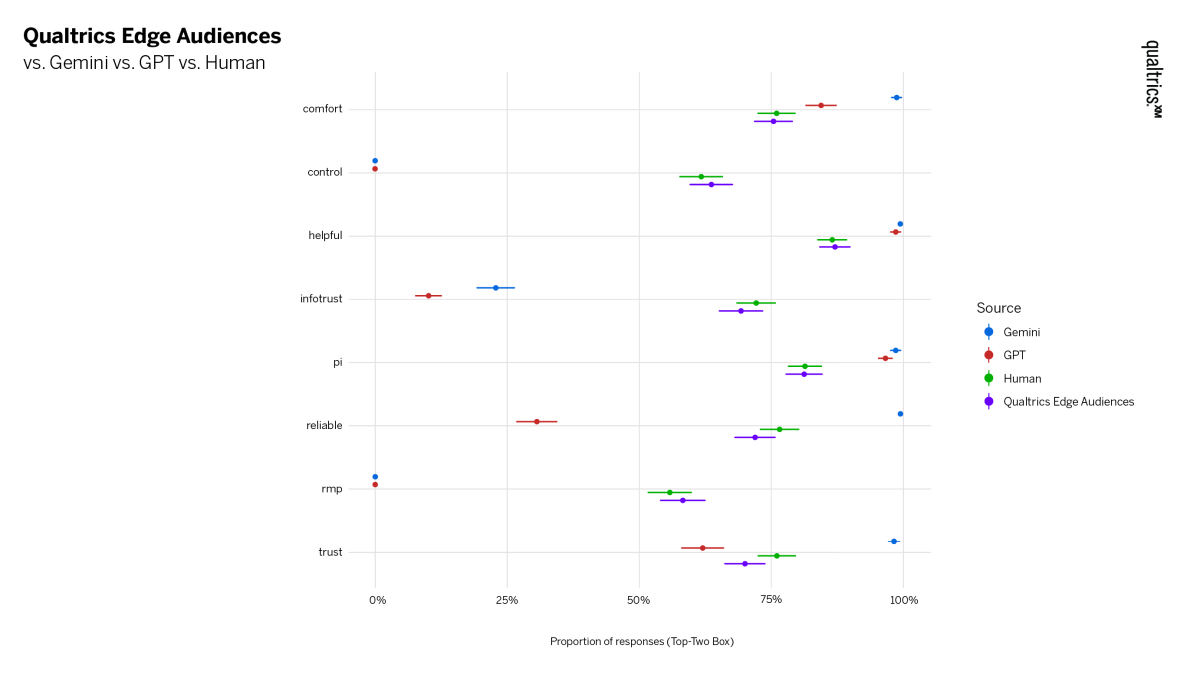

Industry research over the past year has found that general-purpose LLMs simply aren't suitable for survey research because the synthetic responses did not align with the patterns of human responses. However, these studies did not test the performance of fine-tuned LLMs powered with massive, context-specific datasets.

That's exactly what Qualtrics has built.

The Qualtrics Difference: Purpose-Built AI for Market Research

Edge Audiences, our flexible research panel offering both human and synthetic responses, is already being used by hundreds of organizations including Loop Earplugs, Zip, Booking.com and Google Labs within months of launch.

Customer data is never used to train Qualtrics' synthetic model. Instead, Qualtrics proprietary foundational large language model (LLM) is built on 25+ years of experience expertise, comprising thousands of aggregated research studies and millions of unique responses. This ensures responses are accurate, secure, and reflect changing consumer sentiment, behavior, and expectations.

To validate our approach, we conducted our own study testing Qualtrics' synthetic model against general-purpose LLMs using the same methodology as similar studies conducted over the past year. Our purpose-built model produced results nearly identical to human responses without any special tuning or adjustments. This out-of-the-box performance proves that fine-tuned models trained on domain-specific data not only accurately reflect consumer sentiment, they significantly outperform general-use LLMs for research applications.

As we work with more clients and test more data, our model keeps getting better at representing diverse consumer groups. We validate this through a rigorous four-step framework that covers data generalization, data shape, diversity, and transferability. We're committed to transparency through regular methodology reports, and we continuously refine the model by training it with fresh, proprietary datasets as consumer behavior and markets evolve.

In partnership with human research, Qualtrics’ synthetic models are not only able to help scale and fill quotas, but our early pilots show that the differences between synthetic and human responses to the same questions often reveal insights that human research alone would miss.

The business value to research teams is obvious. Qualtrics synthetic models produce insights proven to reduce fielding costs by up to 50%, accelerate time to insights from weeks to as little as minutes, and allow teams to significantly expand audience reach.

Dollar Shave Club: From Single Segment to Market Growth

Dollar Shave Club wanted to validate whether their brand could expand into a new consumer segment they'd never served before. Using Qualtrics' synthetic panel, Dollar Shave Club rapidly tested assumptions about shopping behaviors, brand perceptions, and product preferences, getting directional insights in days.

The synthetic data correctly identified that the target segment shops primarily at accessible retailers and through direct-to-consumer websites, mirrored human data on routine-based attitudes, and produced identical thematic segmentation around "Experience" versus "Necessity"—compressing their research timeline from over a month to just a few weeks.

“We were surprised by how closely the synthetic responses mirror human data and insights we have for the category. We saw a lot of overlap for synthetic responses as they related to behavioral, brand and shopping insights that we have previously done in the category and gave promise to being able to apply learnings confidently.”

– Nikki Frisz, Senior Director of Marketing, Dollar Shave Club

Gabb: Stress-Testing Brand Messaging at Scale

Gabb, a leader in safe tech for kids, needed faster, more cost-effective insights to support brand and product strategy without sacrificing quality. They partnered with Qualtrics to compare AI-powered synthetic data against human panel responses on parents' perspectives about children's tech use. The program focused on key areas including device ownership, parental control triggers, and attitudes toward social connection and screen time.

The results validated Qualtrics synthetic data as a reliable, directional tool. The rank order of what triggers parents to tighten controls was aligned across both synthetic and human responses. The synthetic data served as a "cultural radar," accurately mirroring public discourse on topics like the "anxious generation," providing a valuable baseline for stress-testing messages. Gabb uses a blended approach: synthetic data to quickly narrow down ideas and triage concepts, then human panels to validate high-stakes decisions.

"Synthetic data became our “cultural radar”—cutting research timelines from a week to hours while giving us confidence to test messaging against emerging trends. The blended approach lets us move faster on early-stage testing, then validate high-stakes decisions with human panels."

– Garred Sheppard, Marketing Research Director, Gabb

Alongside strong customer adoption of Qualtrics’ AI capabilities for market research, they are receiving support from Qualtrics partners including PureSpectrum, Deloitte, commonFont, SOM, Mercer, Acceleration Strategy, Farlinium, ROI Rocket and Walker.

Blending Human and Synthetic Intelligence is the Future of Market Research

AI and synthetic research isn't about replacing human research. It's about giving researchers a powerful new tool to accelerate insights, expand reach, and optimize research budgets so that companies can operate at the speed and scale that today’s markets demand.

Organizations using AI and Edge Audiences can now move faster, test more hypotheses, and make more confident decisions by combining the speed and cost-efficiency of synthetic panels with the validation and insights from human research where it matters most. Because Edge Audiences delivers reliable insight almost instantly, it fundamentally reshapes the business design process. Organizations can test and refine ideas continuously, capture opportunities sooner, and realize greater value at every stage of innovation.

Ready to explore how purpose-built synthetic research can transform your market intelligence? Learn more and request a demo today.