Customer Experience

CX leaders consistently outperform the stock market

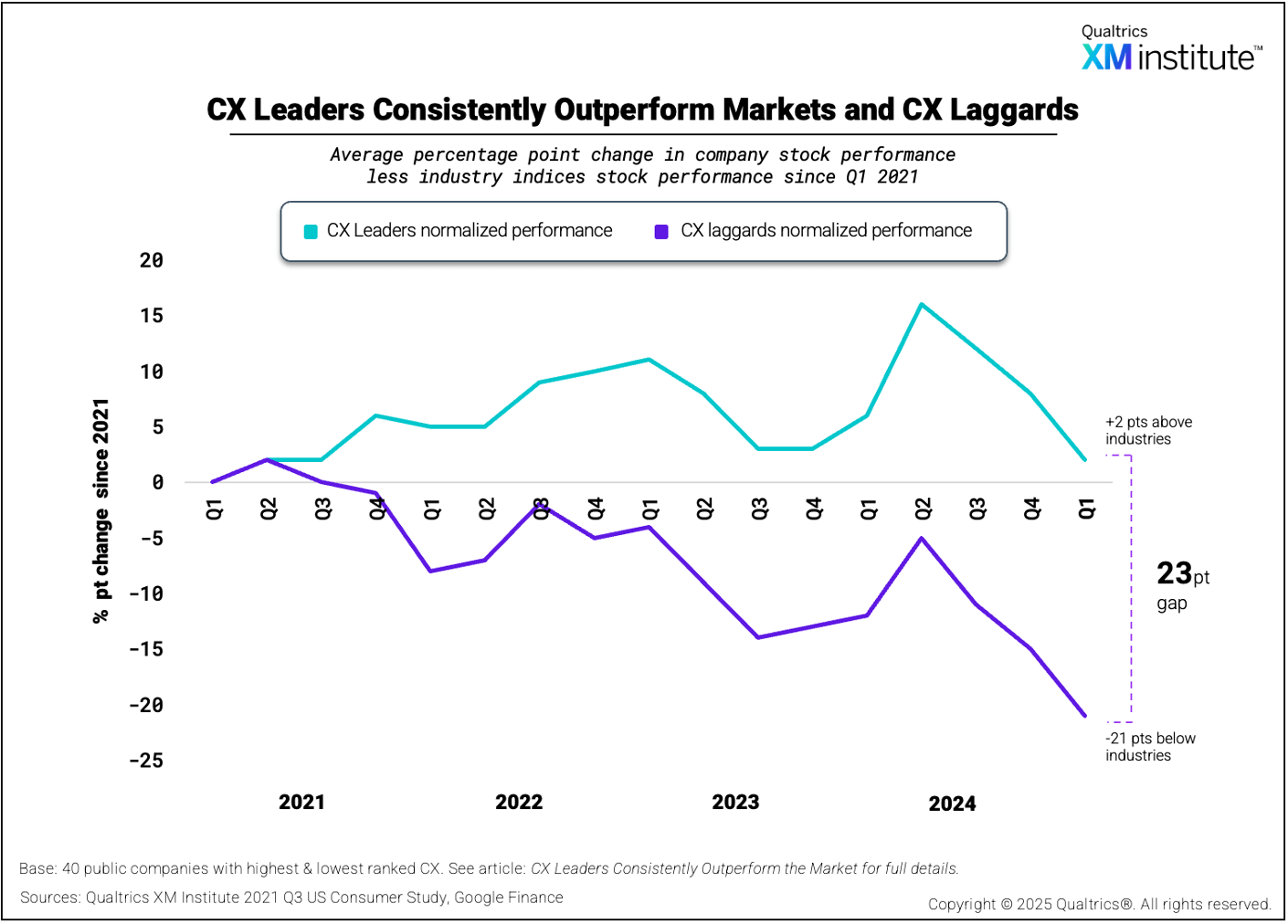

A four-year longitudinal study by the Qualtrics XM Institute found that companies rated highest by consumers for customer experience in 2021 consistently outperform their industry averages in stock market returns, while the lowest-rated companies fell 21 percentage points behind their respective industries. The performance gap between CX leaders and laggards in stock returns widened to 23 percentage points by the end of 2024.

These findings reflect how systematic customer experience management creates business value that extends beyond isolated improvements and individual KPIs. When organizations embed CX into their everyday decisions and operations, it generates emergent value that shows up not only in improved metrics, but in aggregate business outcomes.

Mature CX capabilities create strategic agility

The sustained outperformance we observed for CX leaders reflects more than the sum of individual CX improvements. It demonstrates how systematic customer experience management builds strategic agility – a key differentiator in today’s market, where customer loyalty is declining and the pace of change continues to accelerate.

Organizations develop this agility through three core capabilities that transform customer insights into faster, more effective actions:

-

- Continuously learn. Organizations with mature CX capabilities continuously uncover and interpret customer signals, enabling them to detect market shifts, emerging needs, and competitive threats faster than competitors.

- Propagate insights. CX leaders systematically convert customer signals into actionable insights shared with appropriate stakeholders across the organization, driving faster, better-informed decisions at every level.

- Rapidly adapt. Mature CX organizations turn customer insights into operational improvements at scale by equipping employees with skills and authority to act and embedding insights directly into core business processes. This builds the operational agility needed to thrive in uncertain markets.

Our stock return analysis shows that organizations with mature CX capabilities consistently outperform the market. These organizations don't just improve individual metrics – they build systematic ways to understand and respond to customers that create lasting advantages. The widening performance gap between CX leaders and laggards demonstrates how these capabilities compound over time.

| CAPABILITY | EARLY CX | MATURE CX | TIPS TO ADVANCE |

|---|---|---|---|

| Continuously Learn |

|

|

|

| Propagate Insights |

|

|

|

| Rapidly Adapt |

|

|

|

How to turn these findings into executive conversations

This research provides CX leaders with powerful evidence to elevate customer experience from operational function to strategic priority. Here’s how to use it effectively:

- Secure time with executives. Look for opportunities in planning sessions, quarterly business reviews, or competitive discussions where executives are already thinking about market positioning. These forums provide natural openings to share competitive intelligence about what drives market outperformance.

- Present the data as competitive intelligence. Open with the executive-facing chart (downloadable here) showing the 23-point performance gap between CX leaders and laggards. Frame it as a market insight about what separates high-performing competitors rather than a CX program update. Let the widening performance gap tell the story of how these advantages compound over time.

- Position systematic CX as strategic capability. Explain how leading companies build systematic capabilities to continuously learn from customers, effectively distribute insights, and quickly adapt operations. These capabilities create lasting competitive advantages that show up in stock performance.

- Facilitate strategic conversation. Guide discussion toward competitive positioning by asking questions like "Where do we stand relative to these high-performers?" and "Which capabilities could give us an edge?" Focus on how better customer understanding could accelerate current strategic initiatives rather than requiring new ones.

- Propose concrete next steps. Suggest using the CX Maturity Assessment to evaluate where your organization stands on key CX capabilities, identify specific gaps and opportunities, and prioritize which foundational capabilities to build first, ensuring you sequence investments strategically rather than pursuing ad-hoc improvements.

- Follow up to maintain momentum. Meet individually with key stakeholders to understand their business priorities and explore how systematic customer insights could help achieve their goals. Use these conversations to build a CX roadmap that prioritizes capability investments based on stakeholder priorities, CX vision, and business impact.

The methodology

We conducted a four-year longitudinal study to understand how customer experience performance relates to market outcomes. Here's our step-by-step approach:

- Identified CX leaders and laggards. We selected the 20 publicly traded companies with the highest customer experience scores and the 20 with the lowest scores from our 2021 XMI Customer Ratings - Overall benchmark. This cross-industry benchmark measures customer experience across three dimensions (success, effort, and emotion) using data from the Qualtrics XM Institute Q3 2021 US Consumer Study. For the latest benchmark results, Qualtrics CX customers can check out the Benchmark Editor.

- Tracked stock performance. We monitored quarterly opening stock prices for all 40 companies from Q1 2021 through Q1 2025.

- Normalized against industry performance. To isolate company-specific performance from broader market trends, we compared each company's stock performance against the most relevant S&P 1500 or S&P 500 industry index. For example, we measured a hotel company's performance against the S&P 500 Hotels Restaurants & Leisure index.

- Calculated relative performance. We subtracted the percent growth in each company’s respective industry index price from that company’s stock growth percentage. For example, if a company’s stock grew by 20% over a quarter while its industry index grew 5%, its normalized performance would be +15 points.

- Created portfolio averages. We averaged the normalized growth rates across all 20 companies in each group, creating separate portfolios for CX leaders and CX laggards.

- Compared long-term performance. We tracked both portfolios over the full four-year period.

The bottom line: Organizations with strong CX capabilities consistently outperform the market.

Turn your CX program into a systematic advantage for your organization