Customer segmentation is an effective tool for businesses to closely align their strategy and tactics with, and better target, their current and future customers. Every customer is different and every customer journey is different, so a single approach often isn’t going to work for all.

Don’t worry, though – you can effectively reach your target audience with the valuable process of customer segmentation analysis.

Let’s begin with understanding exactly what customer segmentation is before diving into customer segmentation analysis.

Free eBook: How to drive profits with customer segmentation

What is customer segmentation?

Customer segmentation is the process by which you divide your customers up based on common characteristics – such as demographics or behaviours, so your marketing team or sales team can reach out to those customers more effectively.

These customer segmentation groups can also be used to begin discussions of building a marketing persona or product user persona. This is because effective customer segmentation analysis is typically used to inform a brand’s messaging and positioning, helps organisations know what new products are services they might want to invest in, and uncovers ways to improve how the business sells. Because of this, marketing personas need to be closely aligned to those segments in order to be effective.

The “target persona” (or “marketing persona”) is, by definition, a personification of a specific customer segment so it’s not uncommon for businesses to create several personas to match the various customer segments they’ve created.

But for that to happen, a business needs a robust set of customer segments to form a customer segmentation model. This leads us to the next section, distinguishing the difference between customer segmentation and market segmentation, so that your segmentation is as accurate and specific to you as possible.

Customer segmentation vs market segmentation

In comparison to customer segmentation, market segmentation is more general and looks at the entire marketplace. Whereas market segmentation relates to the whole market, customer segmentation is your part of the market.

For example, if you’re in the business of selling vehicles and you typically sell directly to businesses, then your customer segment is B2B and you might compare customers that are likely to buy large commercial trucks, versus small business-owned vans. These two customers have different needs and, depending on the correlation you find, might then become two different customer segments for you to focus on.

However, if you’re considering the entire market, you might compare people that are in the market for a sedan versus a sports car, which is much broader. In this instance, most market producers aren’t going to cater to the whole market, so it is more effective to focus on the selling element. You’ll see a better payoff by targeting one or two focused customer segments rather than trying to attract the whole market with a broader, shotgun approach.

Types of customer segmentation

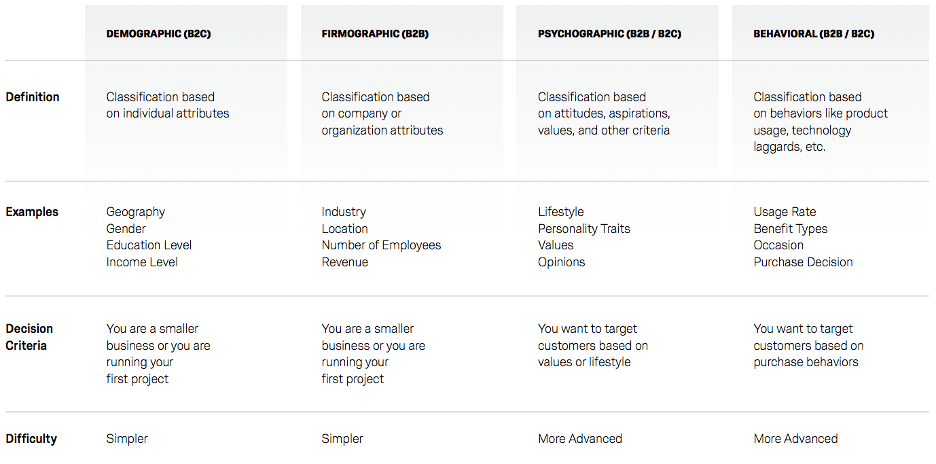

There are different segmentation variables that you should give careful consideration as you begin to build out your customer segmentation efforts. These are not one-size-fits-all, so you should do what is right for your business.

Customer segmentation can be broken down into two types:

Segmenting customers based on who they are

The process of understanding who customers are typically focused on psychographics, demographics and, in the case of B2B, firmographics. This will include factors such as:

- Age

- Geography

- Urbanisation – are they city or rural?

- Income

- Relationship status

- Family

- Job type

Segmenting customers based on what they do

You can also segment customers based on how much they spend (share of wallet), how often, and what products (this allows you to see how much you can increase spend). This is more focused on behaviours.

Breaking this down even further, customer behaviour can vary so you may want to look to separate your data analysis as follows:

- Basket size

- Share of wallet

- Tenure (how long they stay with you)

- Long-term loyalty (a combination of share of wallet and tenure)

As mentioned above, there is no single approach to use here as part of your customer segmentation process. It varies depending on your industry and size. For example, in supermarkets it’s very unusual to get 100% share of wallet, so you might focus on customer behaviour – such as what products they buy – so you can implement a strategy to get customers to buy a greater quantity, or to buy a more premium product.

However, in insurance 100% share of wallet is common and many companies incentivise customers to achieve this (such as discounts to add car insurance to their existing house and pet insurance). If you have three pets, it’s easier to have them all on the same policy rather than taking three different policies.

In financial services, it’s common to have nuances too. Generally, most people have one current account, but they might have multiple providers for savings accounts or credit cards.

Different approaches should be used to target different people or companies, based on what is appropriate for that customer segment — e.g. loss leading on an offer to get customers in-store, knowing the customer might buy more once they’re there in person.

Why segment customers at all?

Customer segmentation is popular because it helps you identify new products and services to create next, as well as how to market and sell existing offerings more effectively. This is because you can develop a better understanding of your customers’ needs and desires. Here are some reasons why customer segmentation and customer segmentation analysis are critical for businesses:

Improve brand loyalty and customer lifetime value

The business impact of doing this is even more important, as effective customer segmentation will help you to increase customer lifetime value, which means they will stay longer, and spend more.

By better understanding your customer, and therefore being able to target them more effectively, you can drive greater loyalty. Instead of customers visiting Sephora.com two times a year to get skincare products (with a big basket size), segmentation can give you insights that will help you get customers returning 5x a year with smaller basket sizes. Although each basket is smaller, customer loyalty has increased because they’re interacting with the business more frequently.

Smaller, more frequent purchases are disproportionately more effective than one large one-off purchase. It’s a more predictive indicator of behaviour too, which will help inform business decisions in the future. Not only will it improve loyalty but it will increase the lifetime value of the customer.

Deliver 1:1 experiences at scale

As global consumer trends in 2022 indicated, customers are seeking one-on-one experiences at scale. Over two-thirds of customers want to feel cared for, and will spend more as a result — and with 9.5% of your revenue at risk, it’s critical to understand exactly what each customer wants through customer segmentation.

Whether it’s at a brand level or for a smaller marketing strategy, you need to understand each customer base’s wants and needs in order to target them most effectively. What do your high value shoppers value? What are the common denominators between target groups, and how can you group similar customers for better personalisation during the customer journey? With customer segmentation analysis, you can understand your current customers better, making developing a strategy easier on your marketing team.

You can also uncover segments that you could be focusing on, and understand how and when customers are moving between segments. Customers don’t stay in a particular segment, they shift and move. For example, consider how a person might move between segments when they’re a new college grad getting their first job, then getting promoted (and moving into a higher income bracket), then going from renting an apartment to owning a home, and from being single to getting married to becoming a parent.

Stay on top of changing customer needs

Customer behaviours and needs aren’t static, and the customer journey and experience has to adapt over time to reflect this. For example, the dramatic shifts within the last few years have created new needs as human experiences have changed. From office work to remote working, from eating out to dining in, from new artificial intelligence-driven technology to a return to the basics, your market knowledge needs to evolve as each of your customer segments do.

Developing customer segmentation models that can incorporate new information and segment data, and then adapt accordingly, is key. The most successful segments for one season might be completely different the next — and what existing customers are looking for might not be the same, as society and technology evolve. Understanding the why behind your ideal customers’ choices will help you to weather external storms and reach new segments more effectively.

How to segment customers and target them effectively

Wondering how to go about your segment analysis and develop a few strategies to target particular segments? Look no further.

First up, your customer segmentation analysis should look at industry-wide data on the marketplace, and then dig deeper and look at data on your own customer population. Now, look at subsets within your customer population. This is where you begin to segment, so look to see what similarities tie certain customers together. What correlations do you find? How do you know if there is a correlation? Or how do you even find a correlation? Then how do you know which engagement strategy will have the greatest influence over that customer segment? Use this as a structure when looking at the data and try to see how they tie together.

A segmentation variable might include:

- Who they are

- What they do

- What they want

Some products will have a stronger tie to demographics (like music), whereas products like food, for example, are for all. So bear this in mind when you’re digging into the data because it may or not be helpful to get very specific; it depends on your circumstances and objectives. Still not sure? We cover a few questions below which you can ask yourself so you know when to be specific with your segmentation or when it might be more appropriate to keep it broad.

Using experience data is essential if you hope to ascertain how these three factors correlate to one another.

Access customer data for customer segmentation analysis

There are multiple ways to go about experience data collection, and these are separated into direct or indirect streams. See below for a full list. Direct streams can typically involve customer surveys that elicit a direct response. Indirect streams will involve insights derived from data that wasn’t directly obtained, but can still point to important trends that will help understand any correlation in behaviour within the customer base.

Direct

- Relationship surveys

- After-store visit surveys

- Post-purchase surveys

- Product satisfaction surveys

- Video Feedback

- Brand Tracking

Indirect

Qualtrics can help you understand both of these approaches, by using DesignXM and CustomerXM to consider key trends and drivers of behaviour.

Once you’ve created your customer segments based on the correlations you found, they should be used to determine your brand positioning, messaging, and your go-to-market strategy. These segments give you valuable insight into how to effectively meet your business objectives, because you know who to target and how to effectively target them in a way that will grow your bottom line.

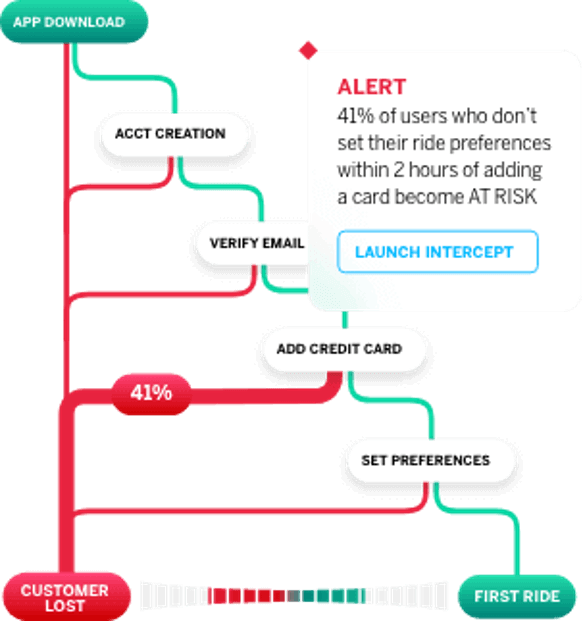

Customers do the customer journey in different ways, so a better understanding of how different segments behave will allow you to create journeys that cater to different segments and make it as easy as possible for customers to complete the journey.

Aligning your customer segments to your objectives will help to guide you about how specific these customer segments should be. For example, a global brand, such as eBay, who’s attempting to launch a new service offering that targets everyone will have a very different customer segment than a brand that’s only targeting small, independent businesses.

When undertaking your customer segmentation and aligning these to your objectives, ask yourself what you want to achieve:

- Is it a competitive reaction?

- Is it a new product offering?

- Do you want to expand the market?

These will help to determine how specific your segmentation should be.

Create rich customer segments

Your customer segmentation strategy should focus on your customers’ actual experiences, rather than demographic factors alone. Effective customer segmentation analysis should be able to use direct feedback, such as a post-transaction survey, as well as indirect signals from online reviews or social posts. This allows you to develop rich, dynamic customer segments that help you target not only your product or service, but drive better experiences across your customer base.

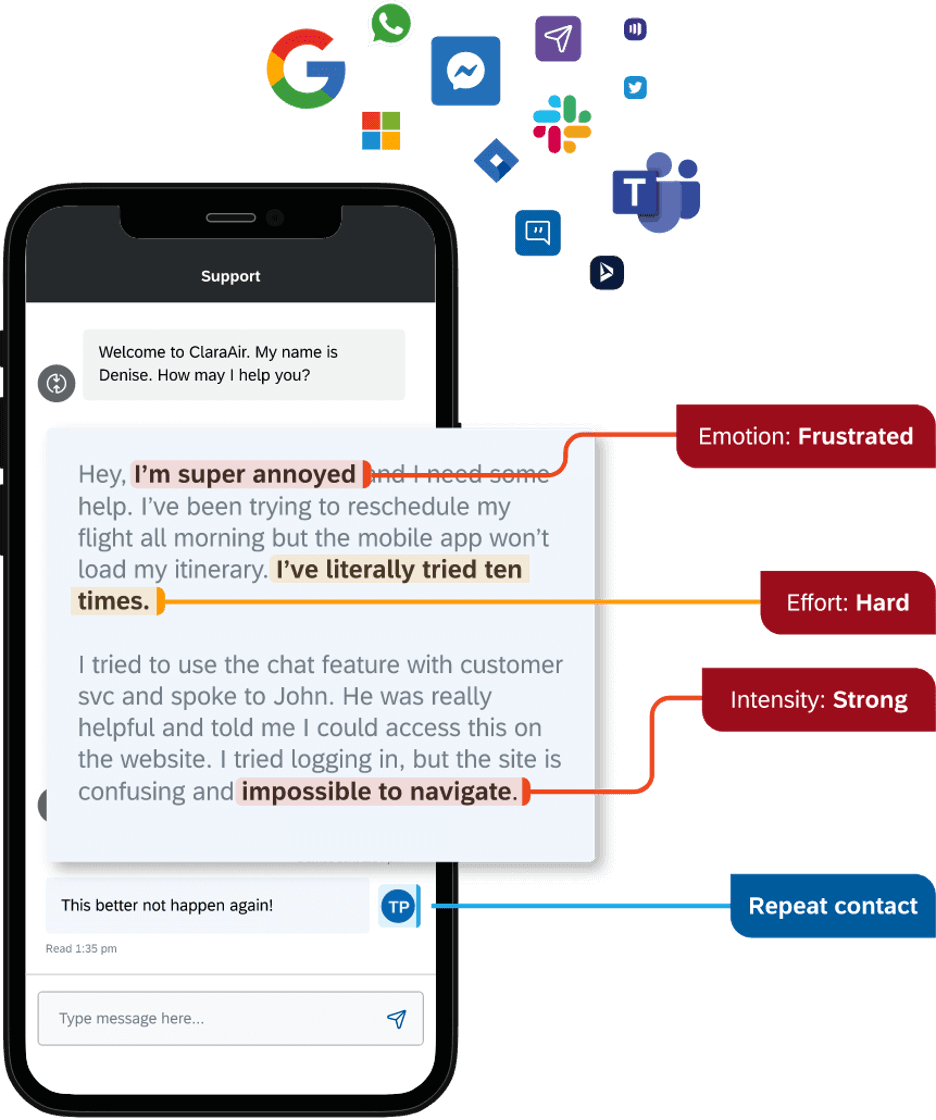

For example, with Qualtrics Experience iD, you can capture every signal across every channel to help group customers intelligently. Rather than limit your segments to listing demographics and customer needs, you can base your potential customer profiles on more granular data that includes emotion, intent and sentiment.

Close experience gaps and personalise every interaction

Effective customer segmentation analysis is only the beginning. A deep understanding of your customer base in all its different segments will help you to create personalised experiences at scale, while fixing experience gaps you find along the way.

Automatically detect where experiences diverge and break down, sending target segments on a personalised and smooth experience that exceeds their customer needs. Improve business outcomes by offering defined segments the experience that best suits them at every stage of their journey.

Drive profits with customer segmentation analysis

If you’ve never sold to a customer base before…

First, you should understand what the addressable market is.

Then, you’ll need to determine how much of the market you can reasonably expect to get.

Finally, you’ll want to implement effective customer segmentation to make sure that your messaging and positioning is meaningful for both your new and existing customers.

Fortunately, Qualtrics offers a full suite of services to help you with all your customer segmentation analysis needs.

Identify distinct groups with customer segmentation: With our segmentation research service, you can determine which groups of customers are the key targets for your needs, based on customer data on needs, attitudes, behaviours and demographics.

Profile and prioritise the segments that matter most: Understand which are the successful segments based on customer data and drive higher value with a targeted strategy.

Send surveys and get response recommendations: Use our built-in survey function to gather customer data and utilise our Ph.D.-designed methodology to get the most out of your answers.

Use prebuilt reports to save time and get detailed insights: Increase your sample size with our successful response system, designed to help you gather meaningful customer data.

Work with Qualtrics Research Services to get the most out of your customer segmentation analysis: We offer you a dedicated Qualtrics Research Services representative to help you design a successful customer segmentation project.

Free eBook: How to Drive Profits with Customer Segmentation