There’s a lot that goes into deciding how much to charge customers for your product, and the price you go to market with can make or break the success of your launch.

Price it too high, and you could alienate your customers. Price too low, and you could jeopardise your revenue and fail to get a return on your product development process.

This is where price optimisation comes in.

In this guide, we take a closer look at price optimisation and how it fits into your pricing strategy.

What is price optimisation?

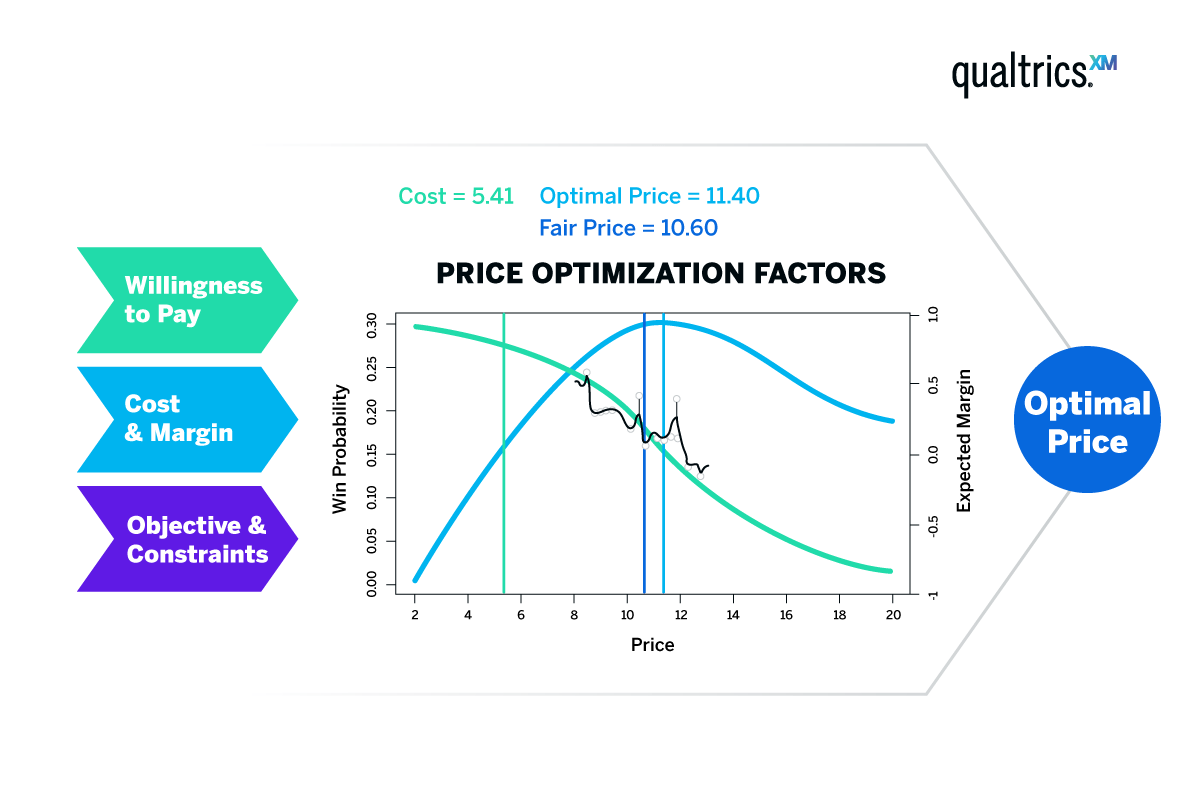

Price optimisation is the process of using market and customer data to find the optimal price point for a product or service.

Price optimisation is used to maximise sales when a product goes to market as well as maximising sales long-term by using different price strategies in line with the product life cycle or external factors like market conditions.

Pricing optimisation uses information like customer data, operating costs, churn data and product lifetime value, as well as historical data to find the optimal price.

The end goal of price optimisation is to find the long-term balance between profits, customer value and demand for your product or service.

Ultimately price optimisation is the process of using dynamic pricing, as the price of a product or service will likely change over time.

Optimise products and pricing with predictive insights

Why is price optimisation so difficult?

Price optimisation is such a difficult process because it requires a lot of effort and data analysis and an ongoing pricing strategy to ensure your product is priced correctly based on its market position and the customer segments you’re targeting.

From the initial price, to dealing with price fluctuations due to market conditions and competitor pricing, price optimisation is a long term strategy.

Which is why the fact that research suggests many companies only spend around 10 hours on average deciding on price optimisation is quite concerning.

To get price optimisation correct throughout the product’s life cycle you need a pricing model that’s flexible enough to deal with changes, while robust enough to maintain your revenue goals.

Why is it so important? What is the ROI?

Price optimisation is important because it allows businesses to make informed decisions based on historical data, customer behaviour and market conditions to set the most effective and competitive prices for their products.

It’s an essential part of revenue optimisation because it takes the guess work out of pricing, ensuring your price points are always within a reasonable measure of the market as a whole.

The ROI from price optimisation can be huge, provided you’ve done the right research to arrive at the right price for your product.

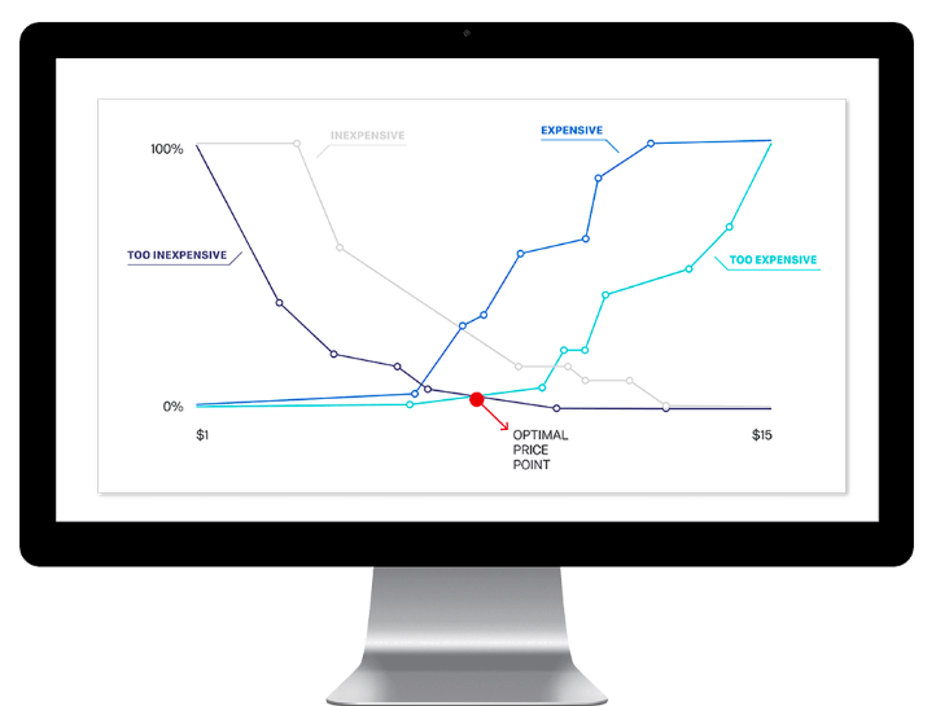

Price optimisation also allows you to accurately measure price elasticity, which is the change in demand for a product with every 1% increase from the initial price..

This is important for pricing optimisation because it allows you to accurately view how price changes affect demand within different customer segments and allow you to maximise revenue.

And getting it right with price optimisation can have significantly good results for revenue.

According to some studies, using price optimisation tools to set the right price on a product to between a 5% and 19% increase in profits.

The pricing process

As we’ve mentioned, the pricing process can be a long and research heavy one.

This is because you’ll be building price optimisation models using a number of historical and current sources including historical pricing and current market data.

Price optimisation typically uses a type of data analysis called conjoint analysis.

This is effective for pricing strategy because it’s used to measure the value your customers place on a particular product or feature.

Conjoint analysis allows you to uncover and understand key pricing variables to predict the demand for your product at a certain price, predict price sensitivity based on internal factors like cost of production, as well as external factors like market conditions, competitor prices and how customers respond to certain product updates or new products on the market.

Your analysis could be as simple as asking customers how likely they would be to buy your product at different prices, and using the one that’s viewed most favourably.

Or you could ask whether customers would be likely to pay more for a product if it had additional features.

Using customer and market data for price optimisation

Two key data points you’ll need to align prices with demand, is customer data and market data.

Market data can be anything from competitors prices to comparisons of products and the wider economic situation you’re operating in. For example you may have price changes based on seasonal promotions, or during recessions.

Your customer data could be based on customer satisfaction with the market’s current product offering, and whether they think it’s value for money to how price has affected customer loyalty in the past.

Price optimisation models

There are lots of price optimisation models to choose from (which are different to pricing strategy – which we’ll discuss later).

Price optimisation models are often dictated by industry and how prices are set within certain types of business.

For example, some price models are better suited for physical products, while others are more suited to digital products (which don’t incur the same hard costs of production).

Below are a few examples of models you can use for pricing based on industry:

Product pricing

With a physical product there are usually higher production costs of manufacturing (along with shipping and other costs) that will impact your pricing decisions. All these costs must be factored in.

Digital product pricing

Particularly prevalent in SaaS businesses, there are significantly lower production costs to consider for a digital product. So your pricing will be dictated more by its perceived value and how much customers put on the benefits you offer.

Service price modelling

Similar to a digital product, there is no tangible production cost to a service based offering (like a marketing consultancy that will charge by the hour, but has no physical product to offer).

The value metrics for pricing a service based business will again come down to the perceived value the customer has in the benefits they’ll get from your expertise, rather than the benefits of buying an actual product.

There are, of course, many more pricing models and which one you choose can directly impact the sales strategies you use.

Of course there are ways to combine these models (in some instances) so you can better use these models to your advantage.

For example if you have a digital product, but can also marry that with service based pricing, you can create additional perceived value to your product, and charge a higher premium.

Pricing strategies

Just like price modelling, there are various pricing strategies you can use to improve price optimisation.

Below are just a few examples:

Value-based pricing

Value pricing is based on whatever customers are prepared to pay for the product. Using supply data you can accurately judge what the market perceives your product to be worth and if you monitor prices properly, you can make good returns on value pricing.

It’s possible to drastically increase customer loyalty with value based pricing if you price your product or service below what customers would be willing to pay, but still at a level that makes a profit.

Competitive pricing

Sometimes called competitor based pricing, this is when you use the market rate of a similar product (yours competitors pricing) as a benchmark for the price of your product. In this model there is no consideration for the cost of manufacturing or shopping etc within this price strategy.

Price skimming

A skimming pricing strategy involves launching a product for the highest possible starting price your customer segment will tolerate, and then gradually lowering the price over time as demand falls.

Retail companies can often deploy this method, particularly in the technology retailers, who will set the price of a new piece of equipment higher at launch (when more people are interested) and then reduce the price as the old technology becomes less relevant.

Cost-plus pricing

Cost plus pricing uses the production costs of making the product and adds a fixed percentage (a markup) to the selling price based on the profits you want to make. This can be an effective way of optimising pricing when you want to create a perception of a higher quality product if you’ll be charging more than your competitors.

Penetration pricing

Penetration pricing involves introducing your product or service to the market at a lower cost than your competitors in order to try and win new customers who are simply looking for the best price.

This could then lead to competitors lowering their prices in order to match yours. In terms of price optimisation, this can be a risky strategy as you could start a race to the bottom, where customers simply come to expect lower and lower price changes, without attaching any value to your product.

Understanding the long-term effects of your decision is what makes price optimisation important.

Economy pricing

This involves pricing products lower because they have lower production costs attached to them. Economy pricing is a type of price optimisation based on generating revenue and profits from the volume of goods you can sell at a lower price, rather than attaching value to it.

Cheap department stores are prime examples of economy pricing in action.

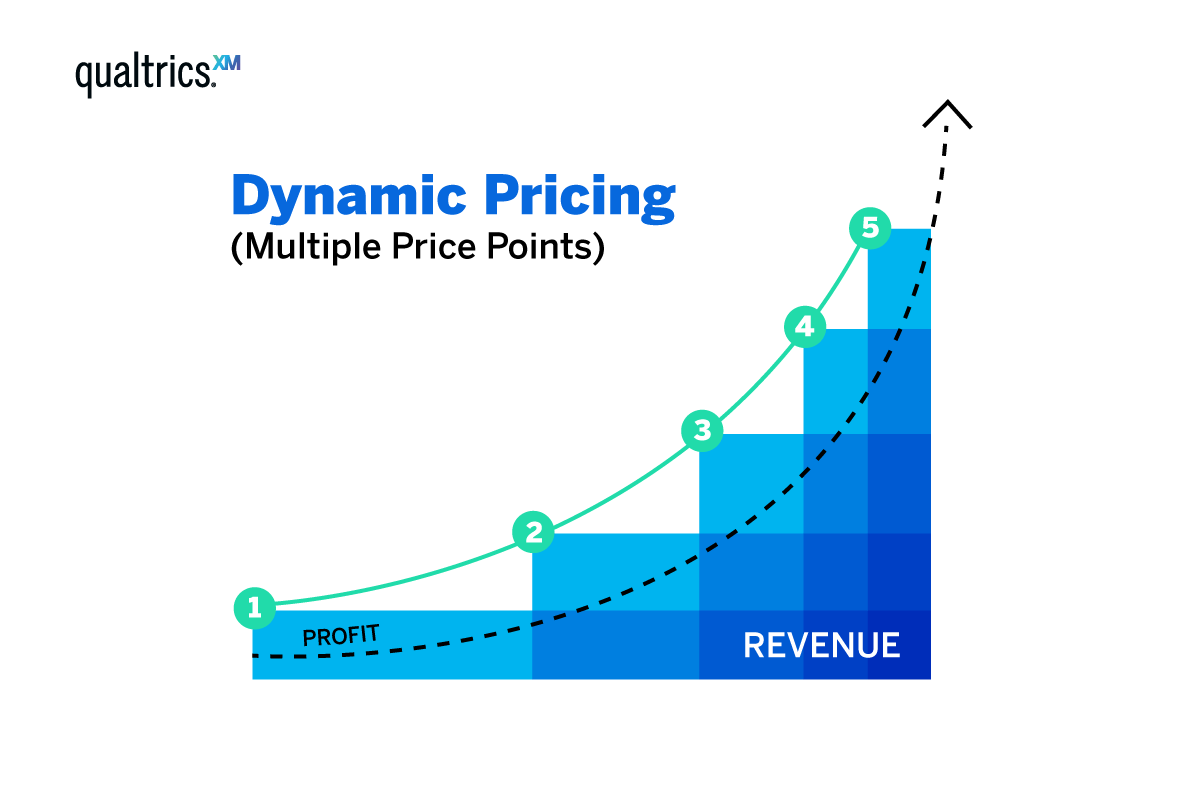

Dynamic pricing

As the name suggests, dynamic pricing is a model that dictates price based on customer and market demand data. Hotels and airlines typically employ dynamic pricing, in which they’ll optimise prices to be higher when the demand is higher (particularly during seasonal peaks) and then manage prices at a lower level to generate additional demand during off-peak seasons.

Clearance Pricing

Clearance pricing is typically used after a longer period of time, after a product has been on the market for a long time and interest has waned, or just before the launch of an improved product.

This can often be referred to as promotional prices, or discount price and is typically used to create final demand before a product is taken away,

Price optimisation solutions

While there is a lot of work and analysis needed to optimise pricing, you can make the process a lot easier by using pricing optimisation software, like that provided by Qualtrics.

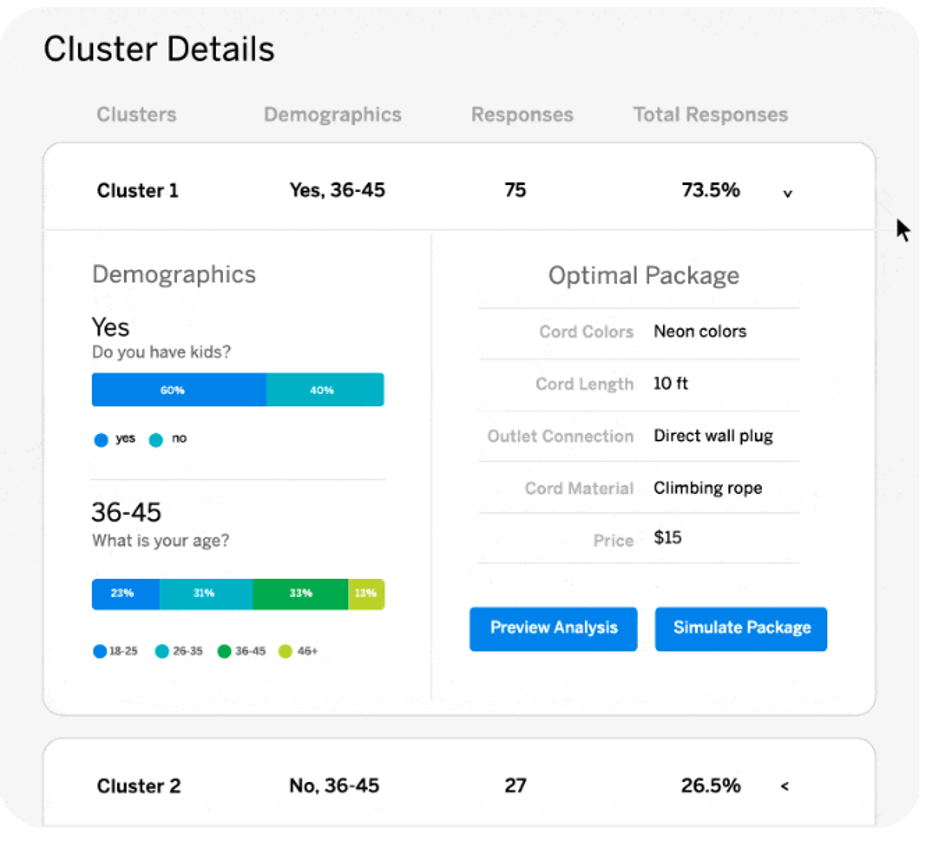

With the right price optimisation solution, you can compile all your data into one platform, making it easier to analyse the competitive landscape and assess where to price your product.

With data that is easily displayed in a visual way, you can more easily set pricing that will generate the kinds of revenue and profit you need.

Optimise products and pricing with predictive insights