Everything in business has a cost, right? To run yours, you’ll be paying for:

- Employees (including marketing and sales teams)

- Inventory

- Capital equipment

And you need to make sure you generate enough revenue from your customers to cover these costs.

But attracting new customers comes with its own set of costs:

- Marketing

- Sales

- Technology

And plenty more besides!

This is called customer acquisition cost (CAC), and your goal should be to keep it as low as possible – to earn the maximum amount of revenue for the lowest expense.

In this article, we’ll show you why customer acquisition cost is so important for every business to understand, how to calculate it, and strategies to improve it.

But first, let’s give a detailed definition of customer acquisition cost…

What is customer acquisition cost (CAC)?

Customer acquisition cost (CAC) is the total expenses it takes to gain a new customer. It can also be used to calculate the cost of generating new leads and subscribers.

The lower the cost, the cheaper it is to acquire new customers, and the higher the opportunity for revenue and profit for your business.

You have to engage in a bunch of activities to acquire new customers, including:

- Content marketing

- Targeted advertising

- SEO on your website

- Social media marketing

- Customer success strategies

- Running promotions and giveaways

- Tracking the buyer’s journey

- Hosting events

- Testing landing pages

When you calculate customer acquisition cost, you better understand how to optimise your investments across everything listed above. Tracking customer acquisition costs can also reveal how effective your tactics or strategies are.

If you’re spending a lot of money on Google PPC ads, for example, but you’re not converting new customers, then perhaps you should spend more time on your social media and content marketing strategy instead, or put more effort into SEO.

Reducing the cost to attract new customers helps your company grow and increase its profit margins.

But customer acquisition cost doesn’t exist in a vacuum on its own…

It’s directly related to the lifetime value of your customers.

Free eBook: 2023 Global Consumer Trends Report

CAC Calculator

Need help calculating your customer acquisition cost? We’ve got you covered. Implement the necessary information below and discover how you compare in your industry.

Customer Acquisition Cost (CAC) Calculator

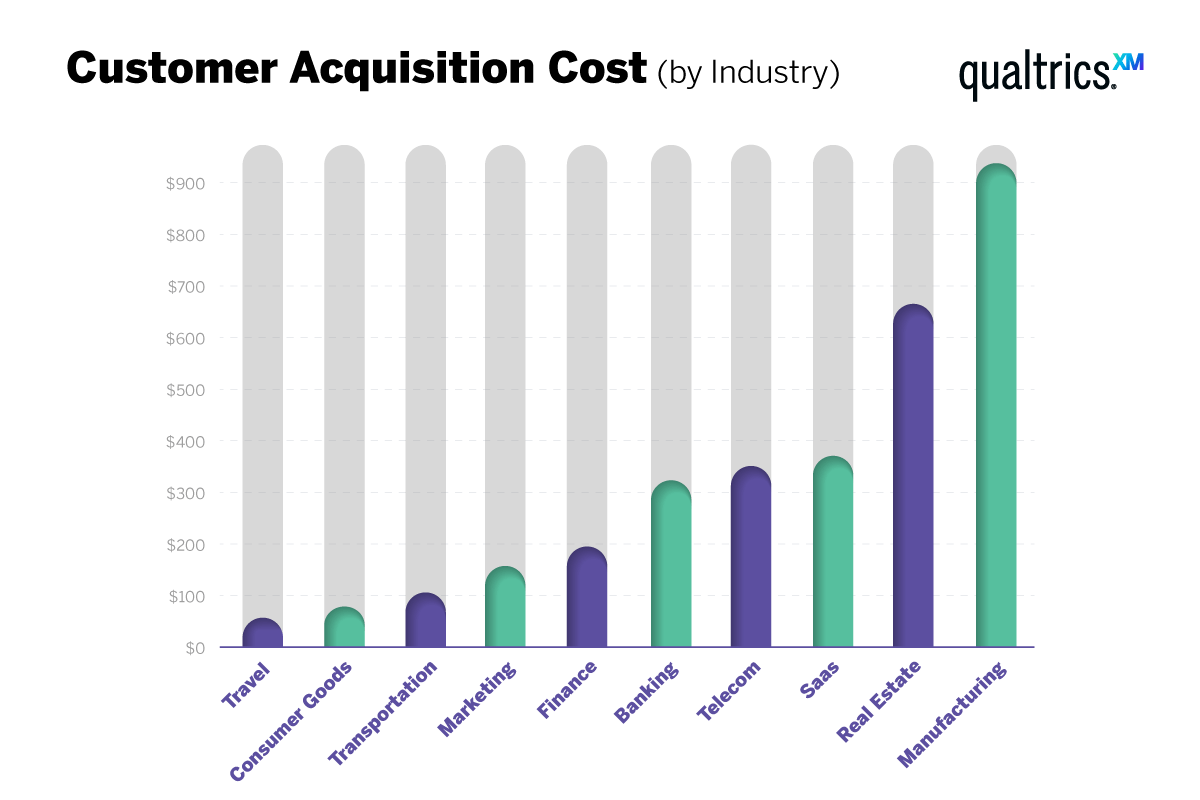

What is a good CAC overall? How does your cost compare? According to Entrepreneur this is how it’s broken up by industry.

Industry Standard CAC

Travel: $7

Retail: $10

Consumer Goods: $22

Manufacturing: $83

Transportation: $98

Marketing Agency: $141

Financial: $175

Technology (Hardware): $182

Real Estate: $213

Banking/Insurance: $303

Telecom: $315

Technology (Software): $395

How CAC is tied to another important metric: Customer lifetime value (CLV)

Customer lifetime value is a calculation of how much total revenue you can reasonably expect to gain from a single customer. It’s a combination of a customer’s revenue value and their anticipated lifespan as an active customer.

One of the benefits of calculating CLV is being able to identify the most significant customer segments in your audience – the ones who are the most valuable to your company. In terms of the Pareto Principle, it helps you see the 20% of high-value customers responsible for 80% of revenue.

The longer a customer continues to purchase your products and services, the greater their lifetime value becomes.

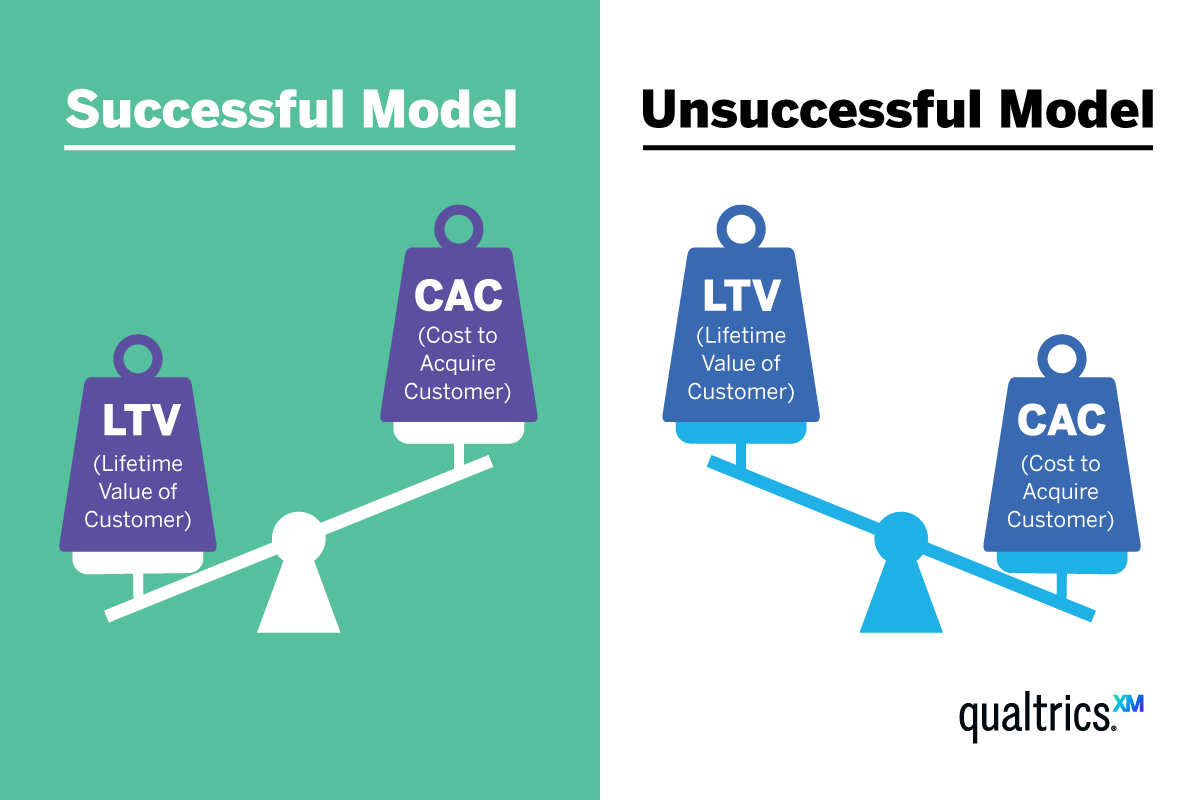

But customer lifetime value really only makes sense when you factor in customer acquisition cost.

For example, if the customer lifetime value of your average customer is only $500 and it costs close to $1,000 to acquire them (via advertising, marketing, special offers, labor, etc.), then they’re losing you money, and you’ll need to pare back your acquisition costs and/or increase CLV through other products and services.

Another factor to keep in mind is the cost to serve.

The cost to serve represents all the expenses needed to get the product or service delivered to the customer. It’s what we mentioned in the introduction to this article:

● Paying employees

● Buying and maintaining capital equipment

● Stocking inventory

These and so many other expenses are the costs of operating your business.

Understanding CAC, CLV, and the cost to serve together gives you a full picture of what’s driving customer spend how much it delivers to your business’s bottom line.

But, for the purposes of this article, let’s continue diving deeper into CAC.

Why is customer acquisition cost so important for your business?

Customer acquisition costs highlight your return on every investment, and that will matter more and more as your business grows and becomes profitable.

Here are three reasons why customer acquisition cost is so important to calculate (and reduce):

Optimises your CLV

As we pointed out in the last section, your customer acquisition cost informs your CLV and vice versa. So the more you reduce your CAC, the higher your potential CLV becomes.

And the higher you increase your CLV, the more it offsets your CAC.

When you first start tracking customer acquisition cost as a business metric, create a benchmark of where you’re at currently. Then, on a quarterly basis, reevaluate your CAC and find ways to improve it. By doing so, you’ll automatically be improving your CLV.

Again: If your CAC is lower than the lifetime value of your customers, you’re in good shape. This means that you’re spending less to acquire a new customer than you’re likely to make from that customer in the long run. On the other hand, if your CAC is higher than the lifetime value of your customers, you’re losing money on each new customer you acquire.

Optimises your payback period

Payback period in capital budgeting refers to the time required to recoup the funds expended in an investment or to reach the break-even point.

In the case of customer acquisition cost and your business, this is the period of time it takes to make back the money spent on acquiring a customer. Recouping lost funds should be your top priority when gaining a new customer.

Knowing exactly what your CAC is will tell you precisely how much revenue you need to generate from each customer to break even and move toward profitability.

Optimises decision-making

CAC can give you a shortcut to making sound decisions in your business, helping you save on things like marketing costs.

Let’s assume you operate a SaaS business and are testing three different ads this quarter. Each ad receives 100 clicks and generates 10 new customers.

If that’s the only metric you measure with your ads, then you might as well keep running all of them next quarter.

But let’s dig a little deeper into those marketing expenses and look at the cost per click (CPC) for each ad.

Ad two has a CPC of $8.

And ad three has a CPC of $10.

If ad one was able to generate the same number of customers as ads two and three at a substantially reduced cost, then it would be financially prudent to discontinue ads two and three and focus on improving the results you get from Ad one.

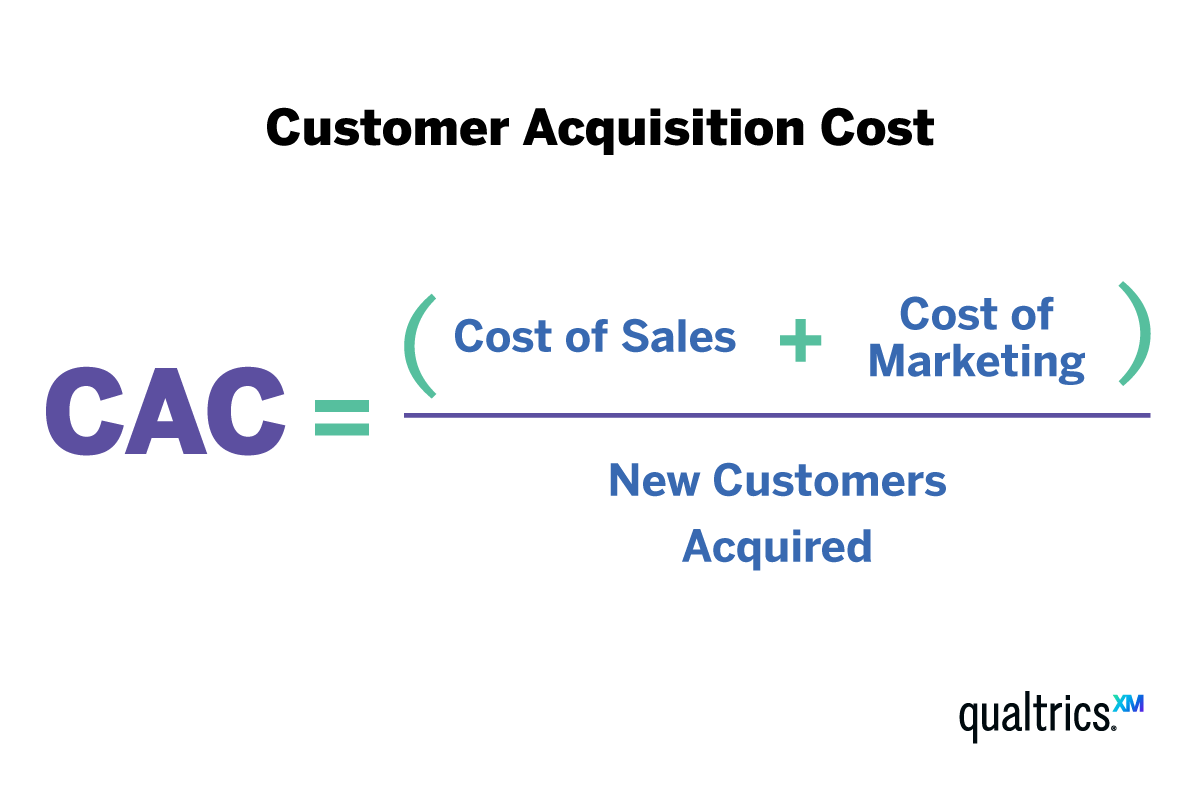

How to calculate customer acquisition cost

The most basic way to calculate customer acquisition cost is by dividing all the costs spent on acquiring new paying customers by the number of customers acquired in the same period as the money was spent.

For example, if you spend $1,000 on marketing costs (and any other necessary expenses) in one year and acquired 100 new customers, then your CAC is $10.

Accurately calculating customer acquisition costs requires you to know the specific financials of your expenditures on all activities and tools to acquire customers.

Some businesses tally up all their expenses and divide them by the number of new customers acquired. While others calculate CAC for each specific expense for an even more detailed view.

We recommend trying to do both for a well-rounded picture.

Looking for some customer acquisition cost examples? Here’s a list of expenses to consider using in your customer acquisition cost formula:

Advertising costs

Ad spend is the amount of money spent on all forms of paid advertising. Google PPC ads, Facebook ads, native ads, and any others. In other words, customers acquired through specific advertising channels have a CAC that correlates with that channel’s cost.

Employee salaries and labor

In-house marketers and salespeople are oftentimes the ones driving new customer acquisition. Their salaries, bonuses, commissions, and other labor costs have to be factored into the total costs of acquiring customers through their efforts.

Content marketing

Content marketing costs are numerous. Paying for employees to create the content, tools for distributing the content, tools for monitoring content performance, and so much more. Gather these costs together to understand all your content marketing expenses in order to get an accurate calculation.

Technology

Technology is used to produce content, track customer progress (CRMs), build and maintain websites and landing pages, improve your SEO, handle customer support, and perform many other jobs within your organisation. When this technology is used to acquire customers, the support costs should be factored into your CAC.

Inventory upkeep

If you’re a SaaS business, you have to pay software engineers to update and maintain your product, deploy patches, locate bugs, and improve the user experience. Rolling out a quality product has a direct effect on how well you’re able to acquire new customers.

Customer acquisition cost FAQs

1. How does CAC work day-to-day in business?

In your day-to-day, CAC becomes a good indicator of the efficiency of your marketing efforts; it can help you identify areas where you might be able to cut costs or increase revenue.

In other words, by analysing your CAC, you can figure out where the problem is and take active steps to fix it. This kind of customer acquisition strategy is how you can keep an eye on advertising costs, sales, and marketing costs, and the total cost of each customer in relation to their overall value to your business.

2. How to track customer acquisition cost across marketing channels?

In addition to helping you identify problems, CAC can also be a useful tool for planning and executing your marketing efforts. That’s because customers acquired through marketing spend can be divided up across different channels and campaigns, letting you can see which ones are the most effective.

For example, let’s say that you’re running a marketing campaign and you notice that your CAC for some assets or activations is higher than for others. This could be a sign that you’re spending too much on one specific kind of advertising, or that your sales team isn’t closing deals effectively.

For example, let’s say that you’re running a Facebook ad campaign and a Google AdWords campaign at the same time. By tracking your CAC for each campaign, you can see which one is bringing in new customers at a lower cost. This information can help you decide where to allocate your marketing costs and make sure you’re getting the most bang for your buck.

3. Is customer acquisition cost a long-term or short-term metric?

It’s important to consider both short-term and long-term costs and their benefits. While the initial costs of acquiring a customer – like advertising and employee salaries – might be significant, that customer’s potential lifetime value should also be considered.

Any kind of business is a long game. It may be the case, for instance, that your marketing costs are higher when you’re starting out than they are over the long term. In fact, your customer acquisition costs as a whole may be front-ended in this way.

If your customer relationship management is up to scratch, however, your CAC should lower over time, as customer lifetime value increases. In the long run, customers who stick around are often worth the initial pain of a high CAC.

How to reduce CAC by improving customer experience

Now that you know what CAC is and how to calculate it, the question you’re probably asking yourself is, “How do I improve customer acquisition cost?”

This is especially important in tough economic climates. When people become less inclined to spend, they become choosier, which makes your customer relationship management more important than ever.

The famous business stat goes that it’s much cheaper to keep an existing customer than it is to acquire a new one. And that’s because keeping a customer improves their CLV.

The answer is to deliver a better customer experience.

By delivering a positive experience to existing customers, you can encourage them to spread the word about your business to their friends and family, which can help to attract new customers without the need for costly advertising or other forms of promotion.

That all starts with how you market your product, the touchpoints on the customer journey to buying your product, and the interactions customers have with your content and team. The better the experience, the more you’ll benefit from people recommending you (which is free!).

But you can’t haphazardly track this stuff.

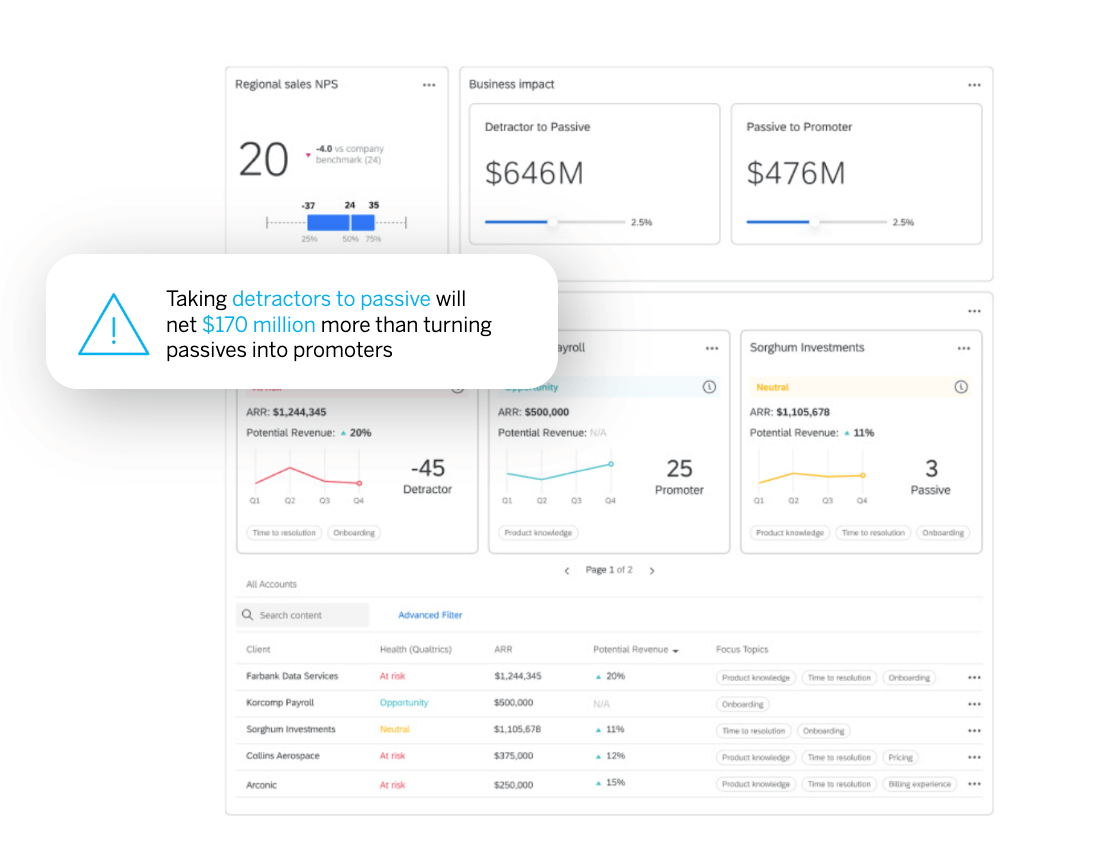

If you’re serious about reducing costs and maximising the number of customers you can acquire, then you need a technology platform that lets you see all your expenses and efforts while allowing you to drill into the details for data-driven decision-making.

This is exactly what Qualtrics offers.

Qualtrics can help you monitor and improve every key moment along the customer journey – uncovering areas of opportunity, automating actions, and driving critical organisational outcomes. And, crucially, it helps make customers feel listened to and understood – which fuels satisfaction and loyalty.

Qualtrics also provides real-time, actionable, customer intelligence that’s accessible at every level of the organisation – from executives to the frontline.

By monitoring all the most important data about your customers, you can reduce your customer acquisition cost while increasing your CLV.

Win-win.

Free eBook: 2023 Global Consumer Trends Report