What is customer lifetime value (CLV)?

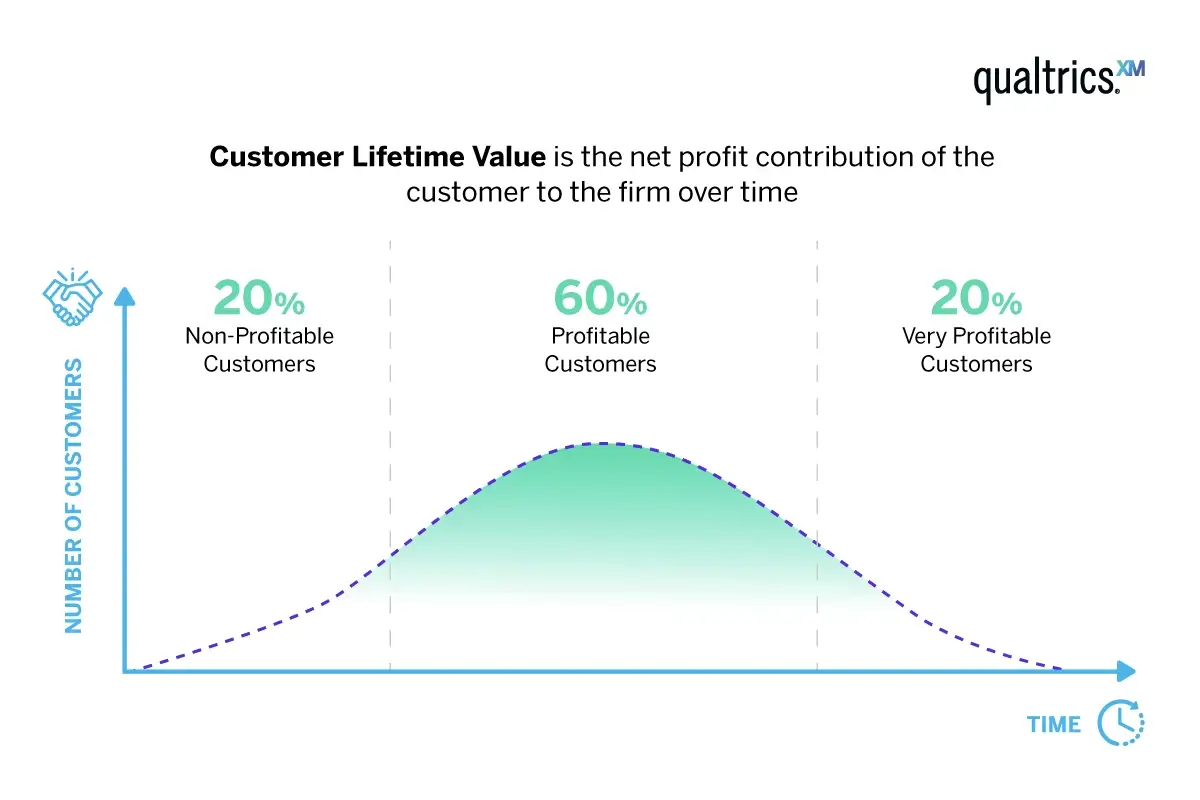

Customer lifetime value is the total worth to a business of a customer over the whole period of their relationship with the brand. Rather than looking at the value of individual transactions, this value takes into account all potential transactions to be made during a customer relationship timespan and calculates the specific revenue from that customer.

There are two ways of looking at customer lifetime value: historic customer lifetime value (how much each existing customer has already spent with your brand) and predictive customer lifetime value (how much customers could spend with your brand). Both measurements of customer lifetime value are useful for tracking business success.

Historic customer lifetime value

If you’ve bought a $40 Christmas tree from the same grower for the last 10 years, for example, your customer lifetime value has been $400 – pretty straightforward. This is an example of historic customer lifetime value– a measure that works by looking back at past events. It’s helpful to understand what an existing customer has brought to your brand and for building profiles of ideal customers, but it’s not as useful for predicting future revenue when considered alone.

Predictive customer lifetime value

You can also calculate predictive customer lifetime value. This is an algorithmic process that takes historical data and uses it to make a smart prediction of how long a customer relationship is likely to last and what its value will be. It can take into account customer acquisition costs, average purchase frequency rate, business overheads and more to give you a more realistic customer lifetime value prediction. It can be a more complex way to calculate customer lifetime value, but it can help you to see when you need to invest in your customer loyalty.

How is customer lifetime value different from other customer metrics?

Customer lifetime value is distinct from the Net Promoter Score (NPS) that measures customer loyalty, and CSAT that measures customer satisfaction because it is tangibly linked to revenue rather than a somewhat intangible promise of loyalty and satisfaction.

It’s a confirmed understanding of how much loyal customers bring to your business financially, or in the case of predictive customer lifetime value, how much they are likely to bring based on past data.

Knowing existing customers’ lifetime values helps businesses to develop targeted strategies to acquire new customers and retain existing ones while maintaining profit margins. Read on to understand why customer lifetime value is a key metric to track, and how to calculate and improve on it.

Free guide: Reimagining omnichannel CX in the age of AI

Why is customer lifetime value important to your business?

It helps you save money

Customer lifetime value is an important metric to track, as it costs less to keep existing, loyal customers than it does to acquire new ones. Recent research has found that even in sectors with potentially easier customer acquisition, such as e-commerce, there’s been a 222% increase in costs for new customers over the last eight years.

Focusing on increasing the current customer lifetime value of your existing customers is a great way to drive growth. Rather than relying on new customers (and spending lots to get them), you can figure out what keeps your customer base loyal and replicate your actions for increased value with existing customers.

It helps you spot and stop attrition

Customer lifetime value is a great metric to use to spot early signs of attrition and combat them. Let’s say you notice that customer lifetime value is dropping, and pinpoint that customers are neglecting to sign up for a continuation of an ongoing subscription of your product or service. You might decide to launch or improve a loyalty program to tempt customers back, or provide better customer support or marketing efforts around renewal times to help encourage customers to sign up again. This will help to increase customer lifetime value and business revenue again.

It helps you find your best customers and replicate them

Your best customers will have a higher customer lifetime value, and through careful analysis you’ll be able to understand the commonalities between these individuals. What drives them to buy into your brand again and again? Is it a common need, a particular income bracket, a specific geographical location? You can define a whole customer segment based on these higher value existing customers alone.

Once you’ve analyzed the drivers for high customer lifetime value and created a buyer persona specifically for this type of customer, you can seek out new customers using this information. Once you’ve got them on board, you have your predictive customer lifetime value to rely on for future revenue.

How much are your customers costing you?

CLV goes hand in hand with another important metric – CAC (customer acquisition cost). That’s the money you invest in attracting a new customer, including advertising, marketing, special offers and so on. Customer lifetime value only really makes sense if you also take the CAC into account.

For example, if the CLV of an average coffee shop customer is $1,000 and it costs more than £1,000 to acquire them (via advertising, marketing, offers, etc.) the coffee chain could be losing money unless it pares back its acquisition costs. Another thing to keep a close eye on is the cost of that customer to your business.

Another factor in the equation is Cost to Serve. This is part of the cost of doing business, and it involves everything you do to get the product or service into the customer’s hands and doing what they need it to do. For example, logistics, overheads in your physical location, contact center costs and so on.

Breaking this down by customer can help you understand these costs on a granular level, and dig into details like whether your high CLV customers cost the same as the low ones, and whether some customers are more expensive than others. If the cost of serving an existing customer becomes too high, you may be making a loss despite their seemingly high CLV.

Cost to serve may vary across the customer lifetime, unlike customer acquisition which is a one-off expense. To go back to our paid TV subscription, your cost to serve might be higher in the first year of a contract but gradually drop off the longer the customer stays with you. Thus, if your renewal rates drop, your average cost to serve is likely to rise and cause a drop in profitability.

Understanding these numbers over time and being able to track them side by side is the only way to get a true understanding not only of what’s driving customer spend and loyalty but also what it’s delivering back to the business’s bottom line.

Start your customer experience journey with Qualtrics today

Free AccountDeprecated: str_replace(): Passing null to parameter #3 ($subject) of type array|string is deprecated in /var/www/www.qualtrics.com/en-gb/wp-includes/formatting.php on line 578

Start your customer experience journey with Qualtrics today