Government agencies are increasingly looking to best practices from customer experience in the private sector when it comes to gathering feedback, understanding people’s needs and then talking action to improve their experiences.

Government surveys are a great way to do that, and play a key role in helping agencies get closer to their taxpayers, constituents, end users, residents — or whoever else your ‘customer’ is (for the rest of this guide, we’ll simply refer to all end users as a ‘customer’).

Soliciting direct feedback from those you serve is the most effective way to boost satisfaction, address problems, and ensure your programs, policies, and services reflect community needs. Government surveys help include customers in decision-making processes that impact them, and help assure leaders that the decisions they make reflect the needs of the public.

Government agencies can benefit from utilizing surveys because they gather insights that can help:

- Understand community demographics, and their needs, preferences, and priorities

- Identify how experiences vary from group to group, and how to improve service equity and inclusion

- Create more relevant policies and services

- Search for and pinpoint experiences that cause friction or break trust

- Engage the workforce

Read on to learn about three types of government surveys, why they’re useful, and how you can structure a survey effectively to make tangible improvements in your community and workforce.

eBook Download: Your guide to experience management for government

3 types of government surveys

1. Transactional surveys

Transactional government surveys collect customers’ feedback on specific touchpoints with the government, such as navigating a federal government site or paying a fee. These are used to gather baseline data, identify the root cause of customer pain points, and benchmark progress over time.

A transactional survey can also be used to close the loop on single-instance issues, and help government agencies identify systemic improvements that will make the biggest difference for customers’ experience.

Results include:

- Established baseline and benchmark data

- Closed loop on single-instance issues

- Identification of general customer pain points

- Additions to respondent panel

2. Relational survey

Relational government surveys ask customers for input on their overall experience rather than a specific interaction. They are used to gather baseline data, provide an overall picture of perception, and benchmark progress over time.

A relational survey can also be used to understand how specific experiences impact overall perception, and help leaders prioritise areas of focus for improvement.

Results include:

- Established baseline and benchmark data

- Relationship between relational to transactional data

- Identification of focus areas

- Additions to respondent panel

3. Project and journey-based surveys

Project and journey-based government surveys seek feedback on the common things customers experience, think, and feel throughout their entire journey or specific parts of it. They are used to identify pain points in a specific journey, close the loop on systematic issues, and inform improvement initiatives.

Results include:

- Identification of general customer pain points

- Closed loop on systemic issues

- Informed improvement plans

- Additions to respondent panel

Best practices for implementing a government survey system

Cast the net wide

Make sure you get a representative view of the entire population you’re serving, and look to all the distribution methods available to ensure you hear every voice.

Why?

This is critical to designing policies and programs that are more relevant to the needs of the public. Only a small portion of the population tends to actively provide feedback, so it’s important to use your government surveys to seek out voices beyond those who are already vocal to ensure you reach a representative sample.

How?

Make it as easy as possible for people to respond by promoting your survey on multiple channels, such as text, email, and QR codes in popular public locations. For a more in-depth survey, consider incentivising responses by providing compensation – a gift card or financial incentive – for people who respond and offer their lived expertise. With feedback from all the channels your community members interact on, agencies can gain a deeper and more holistic understanding at every stage of the customer journey.

Remember

It’s not likely that a simple survey tool will have this capability. And, the most important piece of all is demonstrating to your community that you are committed to taking action based on the feedback they provide. It’s not “survey fatigue” it’s “lack of action fatigue” that causes people to disengage. Look for a comprehensive experience management or customer experience platform that enables you to take immediate action on your results.

Know what you want to measure

There’s plenty of underlining variables that could get in the way of your results. Understanding what you want to measure before writing your survey questions can greatly impact the results of your government survey.

Why?

Defining the concepts you need to measure in order to answer your research question(s) ensures your survey fulfils its purpose.

How?

Tie each survey question back to a specific objective you want to achieve, such as improving customer satisfaction during a certain process or creating more accessible service for a particular group. It’s helpful to come back to your vision – why are you asking questions, what actions will be taken with this feedback, and who will take them?

Remember

Learning how to write survey questions is both art and science. The wording you choose can make the difference between accurate, useful data and just the opposite. Qualtrics offers surveys and resources specific to government use cases, built by research experts and government industry leaders.

Focus on your people

When asking questions about your target audience you need to phrase and ask them in a manner that they will understand and relate to.

Why

Lots of organisations gather customer feedback but forget to check in with the people delivering the services they ask customers about. Not only are employees full of ideas on how to improve, it’s also important to check in on their well-being and satisfaction with their jobs.

As agencies struggle to attract and retain their workforce, it’s important to understand what it takes to not only retain them but keep them engaged and fulfilled.

How

Pulse employees regularly to learn what they place the most value and importance on, and turn findings into an action plan.

Remember

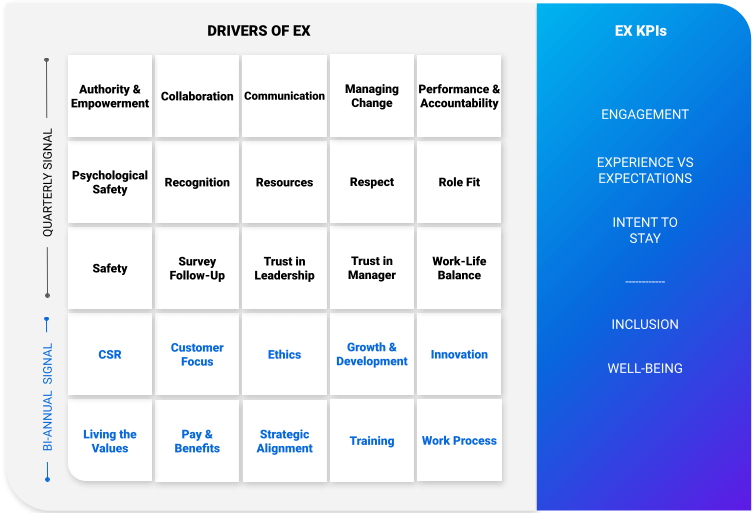

Just like community engagement, it’s critical to show your employees that you’re committed to taking action on their feedback. To help identify where to focus efforts, Qualtrics has identified 25 top drivers for employee engagement:

How to structure your government survey for the best results

Make a list of potential questions and think about:

- Question type

- Question wording

- Questionnaire organisation

- Questionnaire format

Read more on designing survey questions.

Tips for getting the most out of your survey:

- Although sometimes a lengthier survey is necessary, the shorter the survey the better. Use display logic to ensure respondents only see questions intended for them.

- Look for a platform that helps you optimise the look, feel and accessibility of the survey structure (like Qualtrics).

- Leverage strategically placed open-text responses for highly impactful insights (typically no more than one).

- Because experience data is dynamic, consider frequent review and action. Leverage role-based dashboards to make this a part of regular operations.

- Manage contacts to keep a close eye on survey frequency, preferences, and historical knowledge.

- Include a survey panel opt-in question to build your list of future survey participants.

Maximise the ROI of your government survey

Government surveys are valuable because they help agencies make confident, data-driven decisions that impact customers’ lives, experience and perception.

Listening to stakeholders at scale, summarising their needs, and measuring the actions you take to address them is a powerful way to optimise improvements.

Surveys are great resources for forming better connections with your customers and employees, and the right survey tool can help you cultivate an environment of transparency.

But the value of this tool extends well beyond the survey itself. Agencies which have adopted a true experience management program are able to build a system of action that captures feedback at all the moments that matter with customers, employees, and other stakeholders, measure key drivers and patterns through natural language processing and AI, and close the loop with automated workflows that pass feedback to the right teams for follow up.

Let’s look at an example. A one-time evaluation survey may help you assess the overall experience of getting a marriage license at the time responses were collected.

An agency leveraging experience management would know exactly how the public wants to complete a marriage license application (online, in person, by mail, etc.) because they gathered this insight in advance. They would gather post-transactional feedback to continuously improve the process, and they may even use feedback as a tool to coach customer service representatives, program owners, and more.

Some agencies with strong interagency collaboration may be able to ping the department of motor vehicles to prompt a customer to begin the name change process, if applicable. This moves an agency from a reactive to proactive position, improving the likelihood that customers can complete the process quickly and easily, from the beginning.

Using experience management, governments can easily understand and prioritise what’s working and what’s not, and what actions to take to continuously improve.

Ready to get your local or federal government survey system started?

More than 350 state and local government organisations and 90 federal offices – including every federal cabinet-level department – trust Qualtrics to help them design and improve the community experience.

Qualtrics can support your agency by helping you:

- Capture feedback across every touchpoint and journey, streamline workflows, and automate actions to continuously improve the experience for your communities and your employees.

- Design more inclusive and effective services, programs, and policies by sharing trends and insights through automated features like text analysis and key driver analysis. experience management.

- Design better experiences that build public trust, foster community engagement, and create caring workplaces by putting people at the heart of every public sector experience.

Your guide to experience management for government