ESG stands for Environmental, Social and Governance. These make up a set of standards that measure an organization’s transparency and accountability, and its impact on the environment and society. It’s a framework that determines whether a company is financially viable and stable, it asks:

- How much does the business care for the environment?

- How well does it reflect and support society?

- How well run is the company?

In short, ESG is how your business operations contribute to sustainable, viable development, and how it minimises negative impacts:

Ready to see change? Check out the Qualtrics ESG solution

Environmental criteria

This covers the energy and resources your company uses, the waste it produces, and the impact of these on living things. Contribution to carbon emissions, climate change and environmental impact comes under this category.

Social criteria

Every company impinges upon communities, both near and far. This standard reflects your company’s relationship with the people, communities and organisations where you do business. It covers company reputation, diversity, equity and inclusion (DEI) and labor relations.

Corporate Governance

Every company is a legal entity. Governance is the business strategy for how your company is governed, to: comply with the law, serve stakeholders, make sound business decisions, and implement effective internal practices, systems, procedures and controls.

What’s the difference between ESG and CSR (corporate social responsibility)?

CSR is, in effect, a micro ESG. It’s how individual companies choose to run their businesses sustainably, with their own internal green initiatives and community participation.

ESG on the other hand, is the standard that investors use to assess companies and decide whether they’re worth investing in, from growth, sustainability and risk perspectives.

Why are ESG strategies so important for businesses?

The times when businesses could do as they wished without regard for consequences are fading. Now, a company is judged not only for what it does, but how it does it. And while investors and consumers expect a company to tread lightly on the world, employees, legislators and regulators demand it.

Without businesses’ commitment to change, achieving sustainability and prosperity is impossible. Many are deciding to opt for sustainability not just because it’s the right thing to do for the environment and community, but also because it makes good business sense.

One survey found:

- 83% of consumers believe companies should actively shape ESG best practices

- 91% of business leaders think their company has a responsibility to act on ESG issues

- 86% of employees prefer to work for or support companies that care about the same issues they do

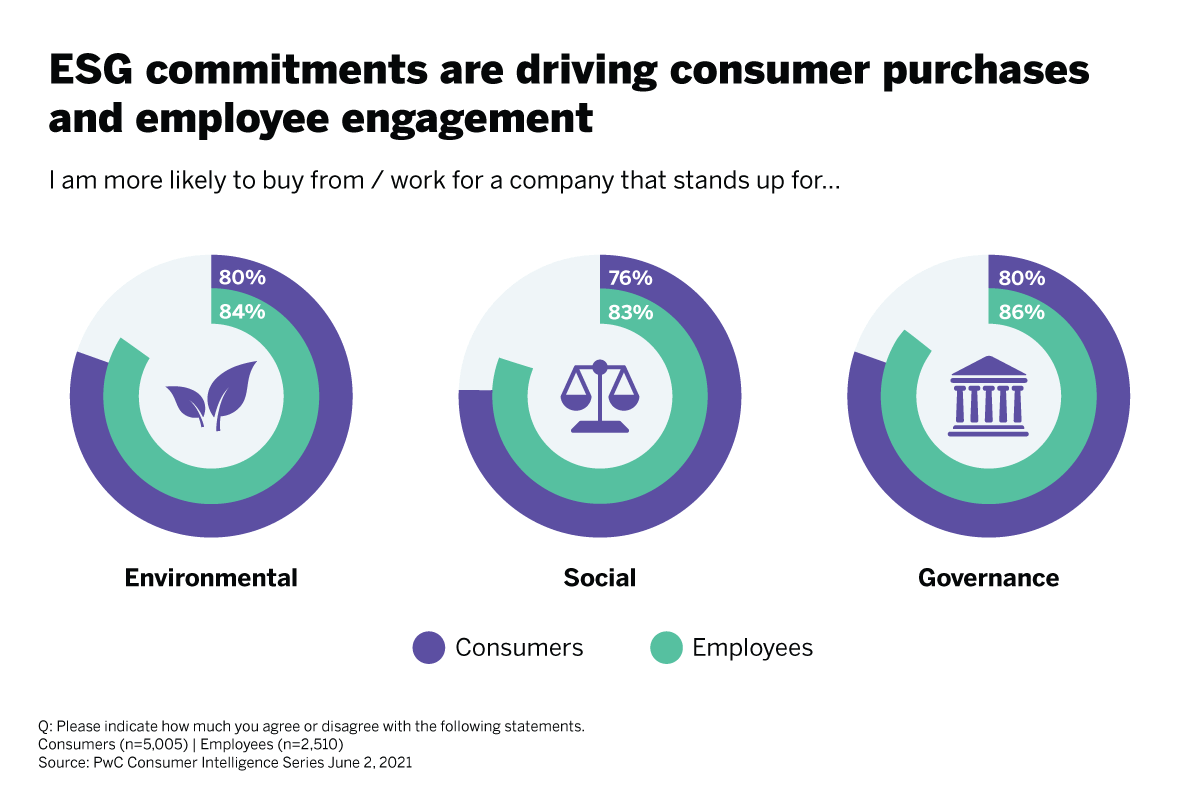

The same survey found that ESG commitments are drivers of consumer purchase and employee engagement:

What is the return on ESG investment (ROI)?

More sustainability and cost-effectiveness

Implementing ESG strategies can help companies cut energy, water and waste expenses, reducing operating expenses.

Attract customers

Consumers are being more selective, choosing to spend their money with more environmentally and socially responsible companies. For example, 62% of Gen Z customers prefer to buy from sustainable brands, and 76% of consumers said they would ‘discontinue relations with companies that treat employees, communities and the environment poorly’. Closer ties with the local community help you engage with potential customers, and suppliers.

Attract investors

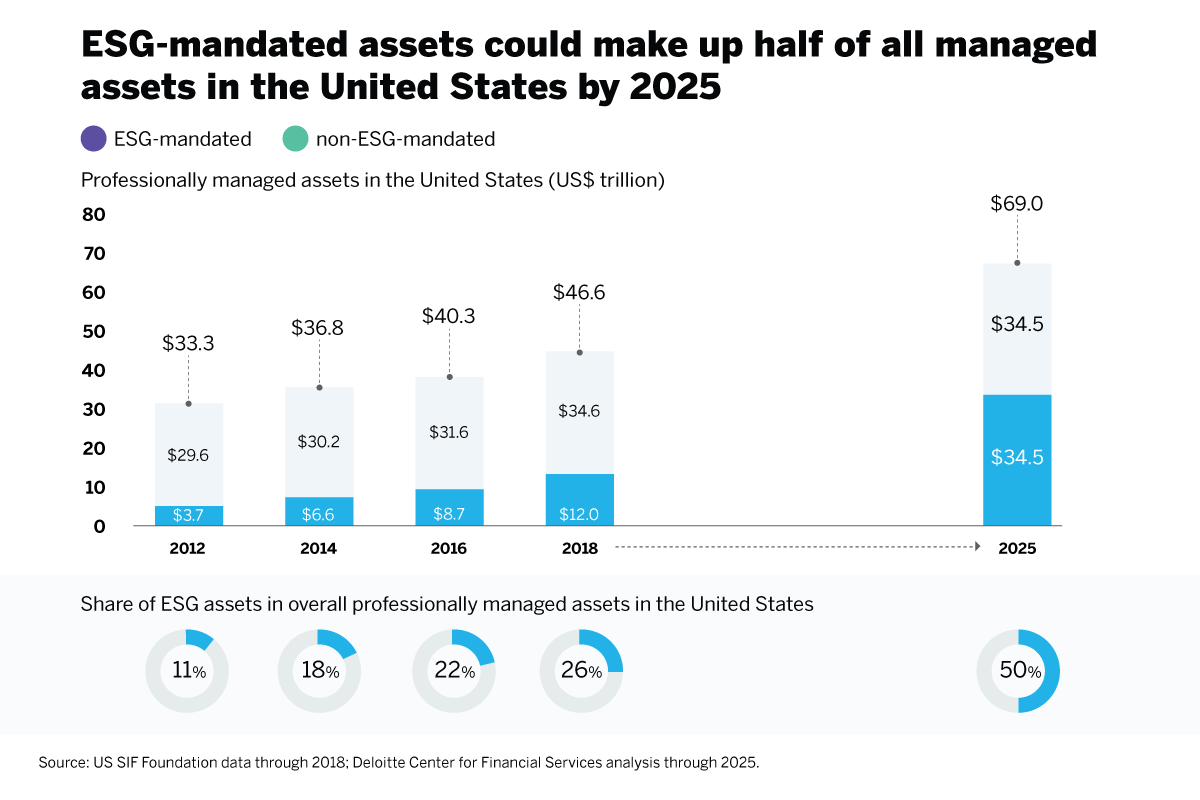

ESG is moving from ‘nice to have’ to a strategic imperative as investors are increasingly looking at companies’ ESG risks when considering investment products. It’s estimated that ESG assets could continue to grow at a 16% compound annual growth rate (CAGR),

otaling almost $35 trillion by 2025:

By paying close attention to governance, compliance and regulatory requirements and other ESG factors, your business avoids the penalties and reputational damage that results from breaches, and attracts investors.

Boost employee productivity, engagement, retention, loyalty, and recruitment

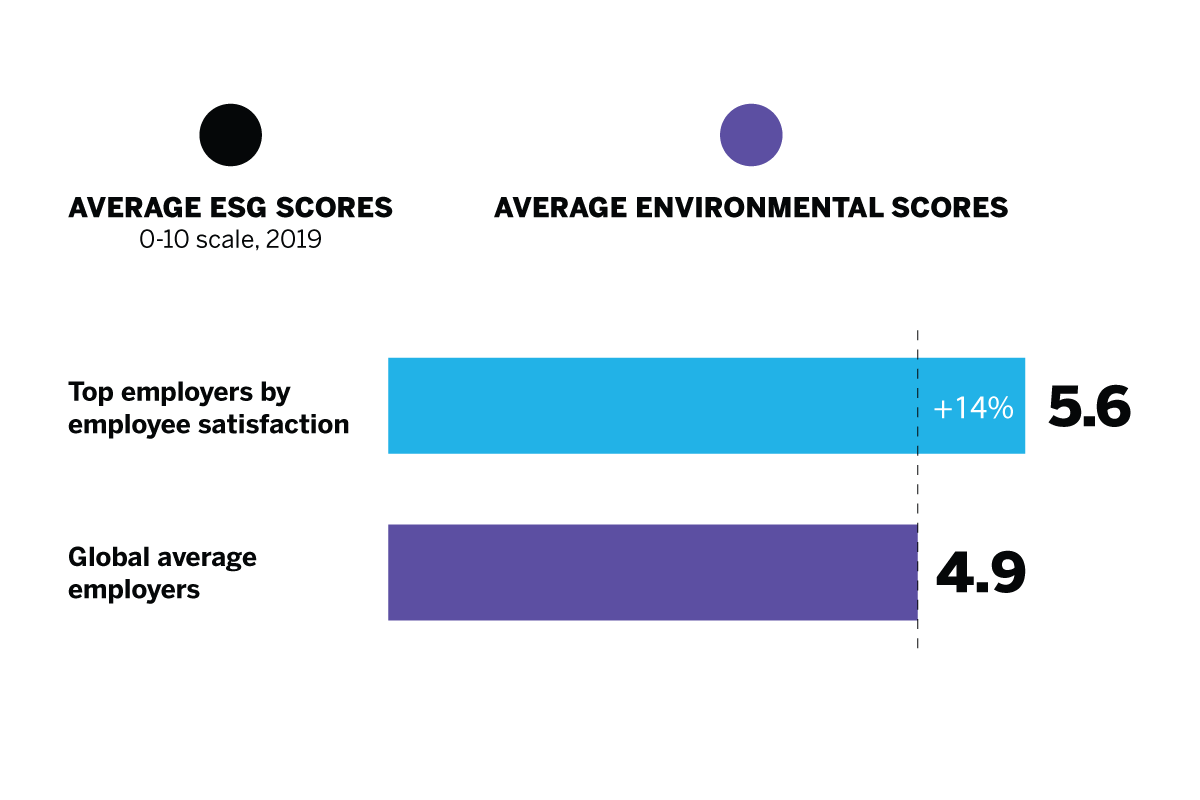

ESG reaches into every area of employee experience, and as we know, a happy workforce delivers a healthy bottom line. Employers recording the highest employee satisfaction had ESG scores 14% higher than the global average, and the reason is that all of us — particularly the younger generation — are placing a greater emphasis on environmental and social concerns.

All of us want to work for organisations that understand the importance of protecting and improving the world we live in, and are far more vocal when employers

ail to meet the standards we set.

From aligning with employees’ green principles to delivering sound health and safety policies, ESG contributes to productivity, attracts top talent – and retains them.

Increase brand awareness and value

There’s a clear link between brand strength and a company’s sustainability practices — customers are increasingly seeking out brands and businesses that uphold good environmental and social practices. According to data from Bain & Company, the brands that scored highest on sustainability generated five times the revenue growth of companies scoring lowest.

Drive top-line growth

By offering more sustainable products and establishing a stronger ESG reputation — as above — businesses can attract more B2B and B2C customers. The reality is that people want to work for and buy from organisations that have sustainability and social responsibility (and needs) at the heart of what they do.

Minimise regulatory and legal interventions

When organisations operate sustainably, they not only reduce the risk of being fined for not adhering to legislation, but they also gain more support from governments and subsidiaries, while having the opportunity to exercise more strategic freedom (as more avenues open).

What is an ESG strategy?

An ESG strategy is the plan you have as a company to meet ESG goals. You may already have ESG procedures in place, particularly if you embraced CSR. But you want to take ESG performance much further. ESG goals could include reducing energy consumption (and associated costs), making your workforce and boardroom more diverse, and making customers aware of the sustainability of your goods and services.

A good ESG strategy demonstrates those environmental, social, and governance factors that your business leaders believe to be important for your company operations – both now and in the future. Done well, your ESG strategy will give you a competitive advantage by fulfilling pre-tender and contractual obligations. It will also highlight your responsible approach to stakeholder wellbeing, governance requirements and environmental issues such as greenhouse gas emissions and climate change.

Ten steps to develop an ESG strategy for success

1. Audit what you already do

A company that has nothing in place regarding ESG strategy is so outdated that it really cannot exist in today’s world. Chances are, you already have ESG procedures in place, but there may be gaps, and it’s these you need to address. From something as simple as fixing dripping taps in restrooms to questioning a supplier about factory standards where your products are made, you can begin to fill these gaps in using operational data such as energy bills, and experience data from pulse surveys.

2. Get stakeholder engagement

Stakeholders are no longer just the C-suite and your investors; they are employees and customers too. This is where employee surveys and customer surveys come into their own. What do people value? What can they see is wrong? What is working well? What is performing badly? What is the change they would like to see? Data from surveys will highlight areas for ESG improvement you probably didn’t even know about.

3. Know what best practice looks like

Your business is unique, and your ESG strategy will be bespoke to its unique needs. But there will be ESG-leading businesses that you can look to for inspiration. Maybe you cannot contribute millions of hours of community service like Starbucks does, but you could use this as a model at your scale.

4. ESG team: assemble!

Implementing your ESG strategy will need a team drawn from the whole of your organisation, from senior executives to the shop floor. Make this team of champions as diverse as you can – their different perspectives and experiences are your lenses to focus on ESG issues, spread the word, and meet targets. Make sure every team member is clear on what they are doing and owns accountability.

And get employees involved with ESG initiatives such as volunteering, empowering them to come up with some of their own, once data has confirmed the need.

5. Gather your ESG data and evidence

Clearly, being able to measure ESG data in the same way that you measure employee engagement or customer satisfaction is the ideal, but it’s often more challenging when you don’t have centralized metrics to track from a baseline.

The HR department will hold some data: for example, ESG metrics such as volunteering records, workforce demographics, DEI, training investments, hiring, retention, and supplier diversity.

Operational (O) data will give you an environmental picture around energy (renewable/non-renewable) and water use, waste, packaging, recycling, turnover and profit.

For governance, look at the policies currently in place, what’s missing, and whether they chime with sector expectations. Maybe you are a clothing company with an environmental policy, but none on modern slavery or human rights. Maybe you’re in the fast-food industry but have no policies on animal welfare or sustainable farming. It’s the gaps in the supply chain you are looking for.

As well as this, gather feedback from your employees on how they perceive the organisation’s performance against key ESG factors. Then, use this feedback to inform your strategy, as well as understand how your ESG efforts are influencing the overall employee experience.

This kind of approach is crucial as we know that ESG is an increasingly important area (and priority) for employees, customers and the market alike.

Finally, gather all your ESG data points and feed them into your ESG system as a baseline to measure improvement. Use this data to benchmark your organisation against others in the market and support new initiatives to help support ESG goals.

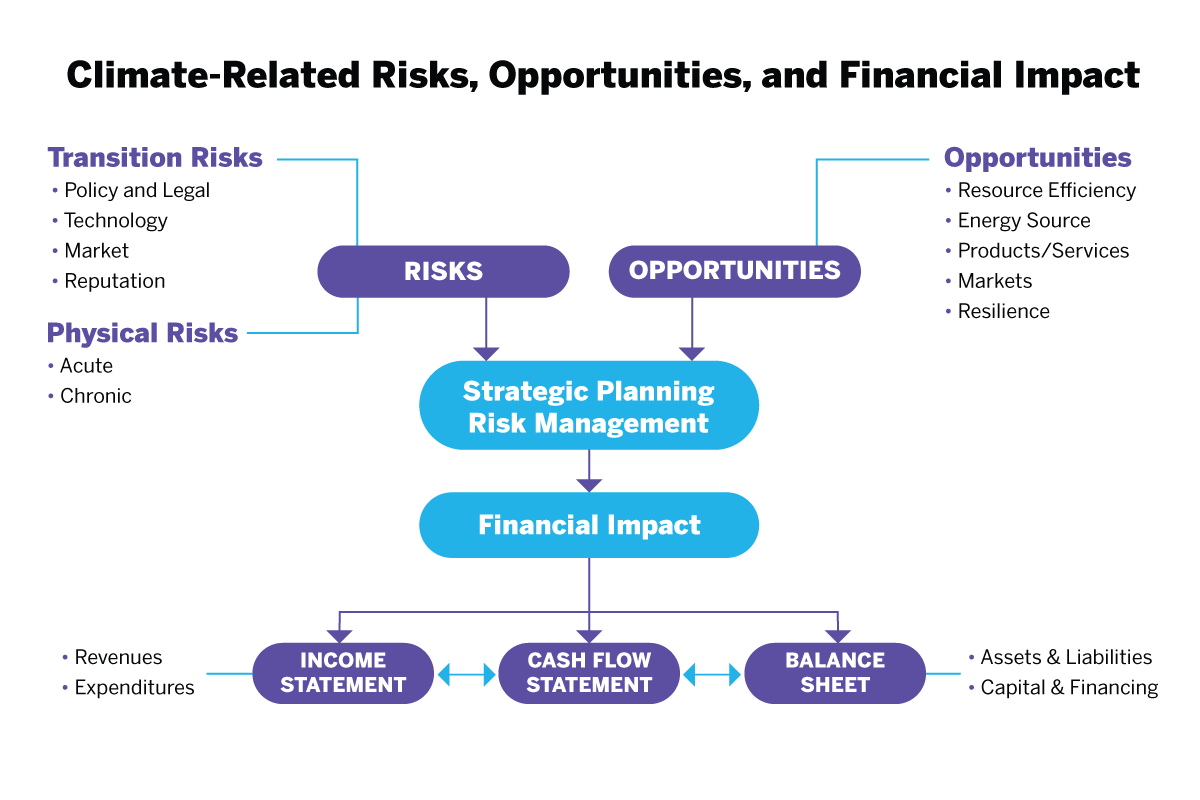

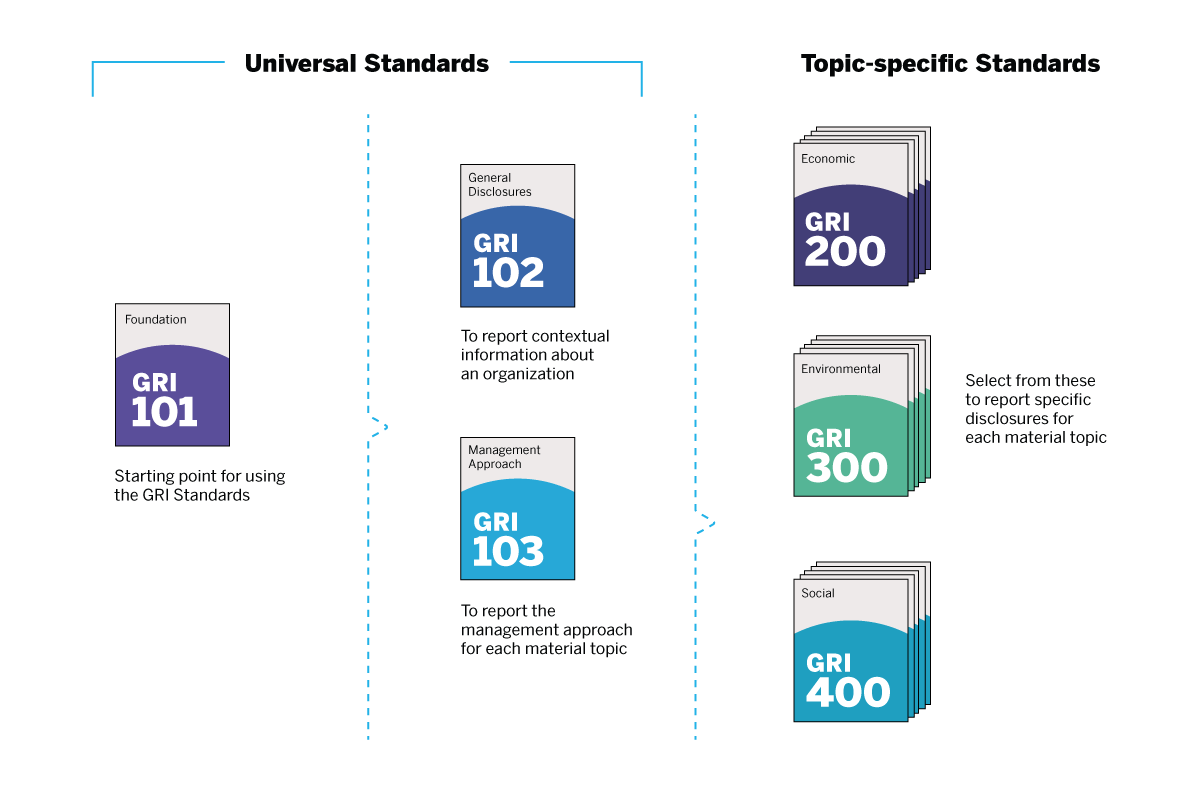

6. Align your business with international frameworks

Here are some key ESG standards, metrics and a global reporting initiative to get you started:

7. Continually measure and act

ESG is constantly shifting as the world throws up more challenges and considerations. Your ESG strategy needs to be as agile as possible to stay relevant in turbulent times, shifting concerns of stakeholders, and new rules and regulations. Keep measuring ESG metrics and keep taking action.

8. Share your ESG story

Data is just a load of numbers until it tells a story, with a beginning, a middle and an end. ESG reporting, with its human, triumph-in-adversity themes is perfect for storifying and sharing on the company websites, social media, and other channels of communication. The more people hear about ESG successes, the more they will buy into them to make a difference in the world.

9. Associate with equally ethical companies

“A person is known by the company they keep” so the saying goes, and even the shiniest ESG strategy can be tarnished if your clients or suppliers all along your supply chain are not aligned with the same standards. Who are their clients? More tellingly, who aren’t their clients? Are they living their mission statement? Are they accredited for their ESG efforts by the likes of Investors in People, or the Rainforest Alliance? If not, why not? What do their employees really think?

10. Create a company culture with embedded ESG principles

A company website can have glossy pictures of volunteering and a whole page of accreditations, but if employees don’t feel the company is genuinely socially or environmentally

responsible, word will get out, often harmfully, on employee or client review sites. When you create a culture of belonging, are honest with your ESG performance and efforts, and are transparent with your achievements, your stakeholders will be your best ambassadors – and that can only be good for business.

Building an organisation for the future

No matter the industry you operate in, you have to prioritise ESG — and understand what your employees, prospects, customers, investors and market want — to build an organisation that’s fit for the future.

As our investment in sustainable practices and social responsibility increases, it’s no longer enough to do the bare minimum. Organisations must set an example and meet the expectations of the people that they want to work for them.

And it all starts with listening. With the right employee experience solution and listening tools, organisations can understand and act on the key drivers of ESG, diversity, inclusion, wellbeing, equity, professional development and more.

With the Qualtrics Employee Experience management platform, you have a system of action that takes you from listening to breakthrough results. You can continuously listen and improve experiences across the board, fix problems before they become part of your culture, and go beyond measurement to drive immediate, meaningful change.

Pursuing sustainable practices is increasingly important, yes — but many organisations are confused by conflicting information and recommendations.

This creates a fundamental challenge where many organisations are trying to understand how they’re perceived by employees, customers, investors and the wider market. Building this insight and acquiring the right information will help organisations to determine if current perceptions accurately reflect their actions, and help identify what matters most to their people, customers and prospects.

And for that, they require the right framework and solution.

The Qualtrics ESG solution provides the standards for taking a data-driven approach to meeting ESG objectives.

This includes:

- Understanding — in one place — how your business is performing on each of the key targets from the perspective of your employees, customers and market

- Learning what drives ESG perception and what matters most to your employees, customers and market

- Finding out how you stack up against other organisations

- Identifying the most significant actions that will help bring about genuine change and contribute towards sustainability and overall improvements

How we created the ESG XM model

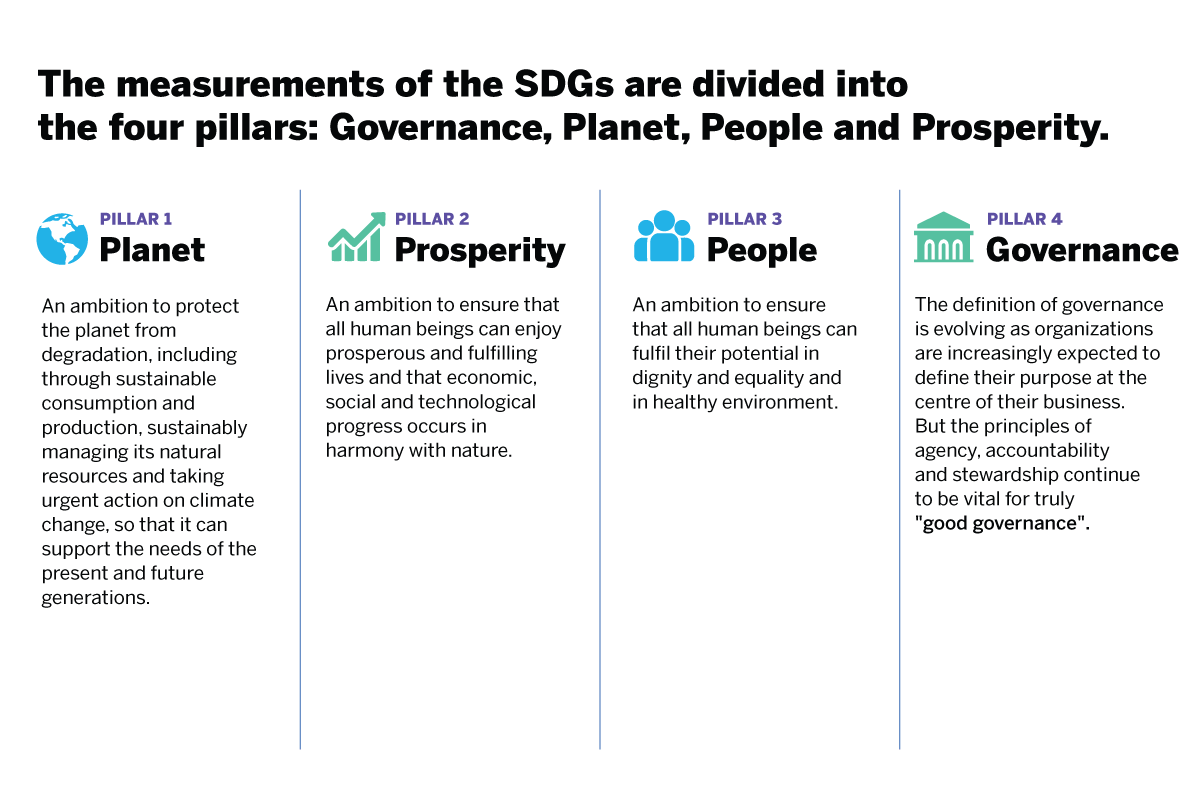

The Qualtrics ESG Solutions uses the World Economic Forum’s four pillars as core metrics, aligning the SDG goals and targets to each one.

The solution uses statistically proven indicators to collect employee, customer and market perceptions across the main four pillars of sustainability: governance, people, planet and prosperity. Through the data collected, it can then determine the most important social, environmental and governance measures and top drivers influencing employee, brand and customer experience.

Ready to see change? Check out the Qualtrics ESG Solution