What is customer equity?

Customer equity is the sum total estimated value of all of your customer relationships, usually calculated for a specific period of time. It’s a way of describing the total potential financial profit that all of your customers can bring to you during their relationship with your brand.

It’s a useful way of seeing the value of your customers. The more customer equity you have, the higher the revenue your brand should receive and the more value you can potentially get out of customer relationships.

Free Download:2024 Global Consumer Trends Report

Why you need to understand customer equity for business success

Customer equity is a good indicator of value

Your customer equity is a vital business calculation that puts a monetary value on your company’s customers. It’s a good indicator of how valuable your customer relationships are and helps you to make more calculated financial decisions.

For example, if your brand planned to go public, knowing your customer equity helps you to determine a more accurate value of your brand’s shares.

Customer equity demonstrates brand prowess

Your ability to retain and increase customer equity is an indicator of your brand’s success. A company’s customer equity, if high, indicates that the brand is competitive and appealing to the market.

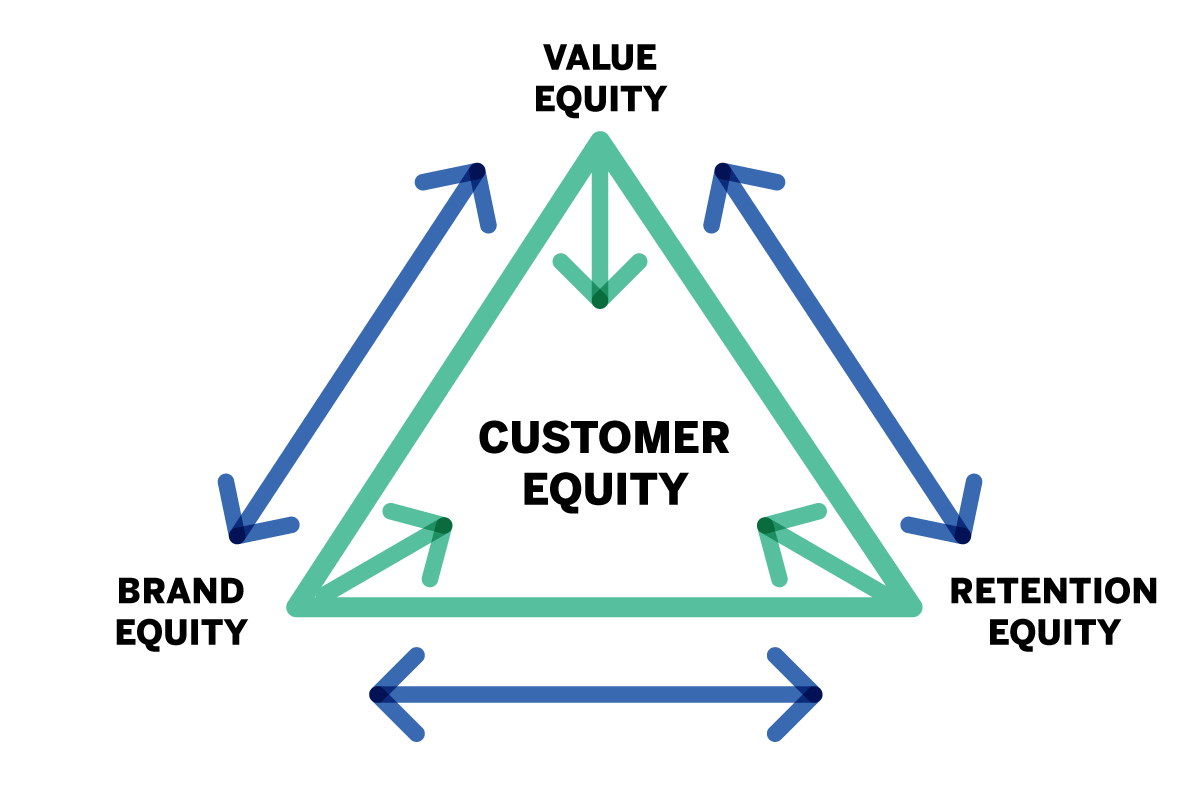

The relationship between customer equity, brand equity, value equity, and retention equity

Customer equity is driven by three factors: brand equity, value equity, and retention equity. Their relationship is shown below:

To understand the above, first we need to understand each type of equity.

What is brand equity?

Customer equity and brand equity describe the type of loyalty your customers have towards your brand and the value of your brand-customer relationship. However, there are key differences between the two.

Customer equity deals with the financial outcomes of your customer relationships. It’s an empirical view of the value of loyal customers.

Brand equity outlines the amount of influence your brand has with customers. It’s more about the value and trusts a customer places in your brand, its name, and its reputation. With great brand equity, your brand is easily recognised, with better customer loyalty, and retention. You’re able to charge higher premiums for your products and services as a result.

You can have customer equity without brand equity, and vice versa – they are independent of one another. However, getting an understanding of both can help you to develop deep customer loyalty.

What is value equity?

Value equity describes the value your customers place on the products and services you provide. If customers believe your offering has a high value, it will increase the prices you can charge and encourage new customers to try out your brand.

What is retention equity/relationship equity?

Retention equity (or relationship equity) is the strength of your customers’ relationships with your brand. It describes customer loyalty to a preferred brand over competitors.

The connection with customer equity

Going back to our diagram, we can see that each type of equity has a connection with generating customer equity. In short:

- Better brand equity means higher customer equity because you’re able to attract new customers and retain your existing customers with your reputation

- Better value equity means increased customer equity because your customers are willing to pay more for your products and services

- Better retention equity means better customer equity because your customers are loyal to your business

How to calculate customer equity

Calculating customer equity is usually performed with a customer equity formula, shown below. It’s best to calculate this for a specific period, say a year, to see progress over time.

Your viral coefficient is the number of customer referrals a customer can make for your brand.

Your LTV, or customer lifetime value, is the total value of money that each customer can make you. This might be through initial sales, upselling, cross-selling, and more over the course of a customer relationship.

Acquisition refers to the cost of attracting customers.

Retention refers to the cost of retaining customers.

For example, if we were to calculate customer equity for Brand X for a year, it might have:

10 x $100,00 – ($50,000 + $50,000) = a customer lifetime value of $900,000.

How to increase customer equity and customer lifetime value

To increase your customer equity and improve your overall customer lifetime value, you’ll need to strategise for better customer relationship management. With better, more profitable relationships, you’ll decrease the amount you need to spend on acquisition and retention and improve your overall customer equity.

Create high-quality products and services

It isn’t necessarily how much your company spends on the marketing strategies that will help you to develop your customer equity – it’s the quality of the products and services you provide that will keep customers coming back for more.

You can try:

- Focusing on what customers actually come to you for – is it to solve a problem, for fun, out of necessity? Address this in the product/service design and ensure your offering meets and exceeds expectations

- Implementing customer feedback on product/service quality

Show customers that you care and that you value their relationship

To build customer equity and maintain loyalty, you’ll need to invest in the relationships your customer base has with your brand.

You can try:

- Creating loyalty programs to reward customers for their engagement and show future customers that you appreciate them

- Informing customers that their feedback has been implemented, demonstrating that your relationship is two-way

Listen to what they’re saying

In 2022, we found that 63% of consumers said that companies needed to do a better job of listening to feedback. With this level of dissatisfaction, it becomes easier to stand out – and to develop customer equity – by making it clear customer feedback is welcomed and actioned.

You can try:

- Using feedback surveys, personal interviews, and focus groups to get each customer’s unbiased assessment of their experiences with your brand

- Using natural language understanding (NLU) and other machine learning techniques to hear what your customers aren’t saying overtly in open text feedback, such as social media commentary

Solve pain points

No matter why your audience is coming to you, the way to retain customers and develop customer equity is to consistently detect and solve problems. Pain points can be the problems that your average customer comes to you to resolve, or issues with your customer experience that need fixing.

You can try:

- Evaluating your customer journey. Are there any unnecessary points of friction? What are the roadblocks to retention in your customer experience?

- Implementing feedback to ensure that when customers flag issues, you’re able to demonstrate that those problems won’t occur again or can be handled quickly. This helps to improve customer retention and reduce churn

Personalise their experience

Increasing customer equity is easier when customers believe they’re getting an unrivalled personal experience with your brand. Around 80% of consumers are more likely to buy when a brand provides a personalised experience, meaning customer experience is worth the investment.

You can try:

- Using loyal customers’ data insights to inform future strategy – customer acquisition is easier when you understand what customers want from their experiences

- Investing in a CX management platform to ensure customer experience opportunities are surfaced and actioned

Predict what they’ll need

Optimise your marketing strategy to ensure that you’re delivering customers information on current and future products they’d like. Using customer data, you’re able to examine behaviour and understand what to offer to build a loyal customer base. In turn, loyal customers will increase customer equity with more purchases.

You can try:

- Leveraging data for insights into customer behaviour and popular trends

- Delivering insights to the right people in real-time to ensure that actions are taken quickly, following the flow of customer behaviour

Make it easy for customers to recommend you

When you calculate customer equity you’re inputting a viral coefficient, or a numerical value for how many customers an existing customer can generate on your behalf. To increase this number, you’ll need to make it simple for customers to refer you to the people they know. It’s worth it to do so – consumer word of mouth referrals are estimated to be worth around $6 trillion per year. In fact, the value of a word-of-mouth impression can be 5 to 100+ times more valuable than a paid media impression, meaning it’s worth your time to make this process easier for your customers.

You can try:

- Offering easy ways to complete third-party reviews post-transaction, such as pop-up surveys

- Providing social share buttons for products to encourage new customer acquisition across social media platforms

- Including post-transaction outreach through your marketing strategy to encourage reviews

Offer great customer experience at every interaction

Overall, the best way to improve customer equity is to show time and time again that you offer high-quality, high-value interactions and a brilliant customer experience. Customer satisfaction is a great way to estimate whether you’re providing this type of experience, and specifically improving customer experience pays dividends; customers who rate an experience 5/5 stars are more than twice as likely to purchase again, with 80% of satisfied consumers spending more.

You can try:

- Making sure you’re getting regular customer feedback on your performance to know where you can improve

- Making customer experience one of your unique value propositions – when customers see you as a preferred brand for experience, they’ll keep coming back

Improve customer retention and equity with Qualtrics

The importance of customer equity in a brand’s evaluation of its customer relationships can’t be understated. Putting a financial value on customer lifetime helps you to invest in the right actions for customer retention, developing your company’s customer equity over time as you take guided steps to improvement.

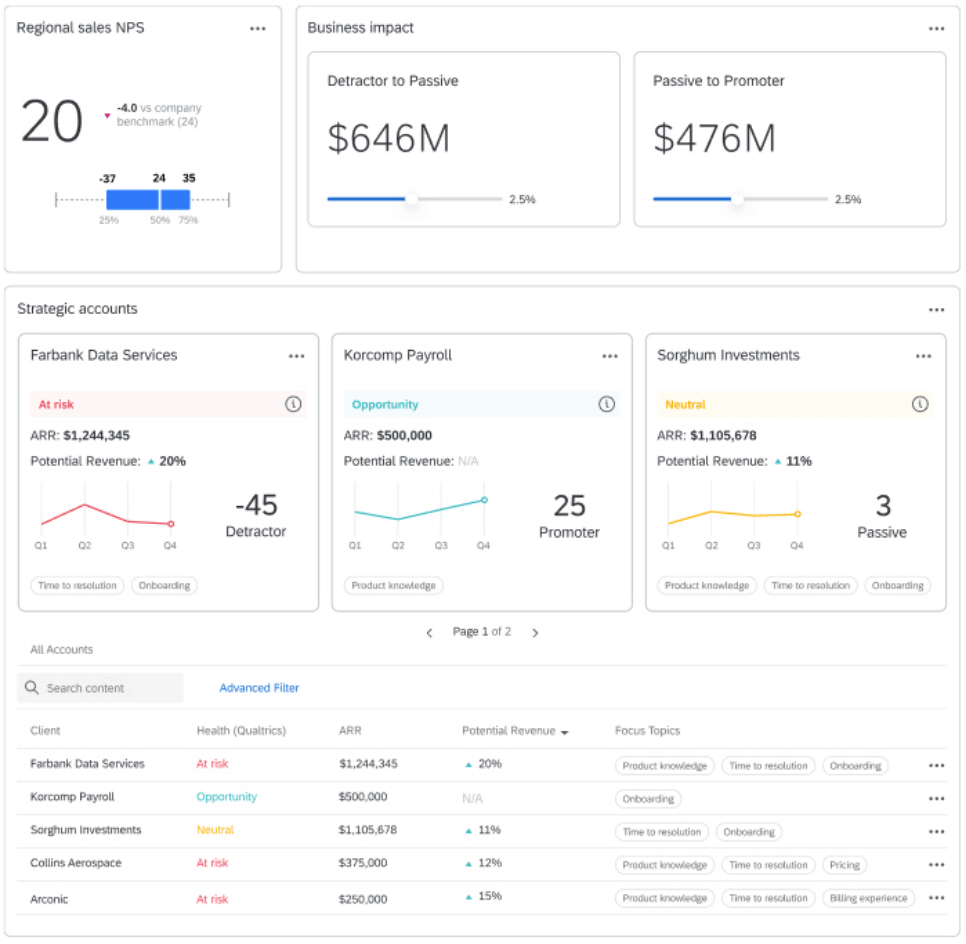

Develop your customer equity with Qualtrics CustomerXM™. Hear all your customers’ feedback, no matter where they’re sharing it. Increase customer equity by developing loyalty and designing brilliant experiences. Improve customer retention with predictive intelligence and analytics to stop customer churn and exceed expectations.

Improve customer retention and equity with Qualtrics