Getting your pricing strategy right affects every part of your business.

From sales, to profits to market position, the selling price of your product or service isn’t something to take lightly — and can ultimately make or break your success.

But in a highly competitive market, how do you develop a pricing strategy that results in a positive profit margin, and doesn’t put you out of reach of your target customers?

In this guide, we’ll look at the key factors you need to consider when pricing a product to help you make the right decision for your business, and your customers.

Capture product pricing insights with our pricing survey templates

How to price a product

There’s a lot that goes into a pricing strategy, from business goals and competitor pricing analysis to your marketing strategy and reaching new customer segments. There are also unpredictable elements, such as the economy and the health of your target market.

But before considering these factors, you have to look at your processes and the costs associated with your service or product — after all, without knowing these details, you’ll never turn as much profit as you could.

Here are the main things to consider when it comes to pricing strategies:

Add up your variable costs

Variable costs are expenses that increase or decrease based on your level of production, in other words, the higher the production level, the higher the costs.

The price of your raw materials can also influence your variable costs and fluctuates depending on availability. For example, if a company spends $1 to produce their product, it will cost them $1,000 to produce 1,000 units, but if the company increases production to 2,000 units, their variable costs will rise to $2,000.

Monitoring production costs is vital as an increase could mean selling a product at a higher price to cover additional overhead costs.

Add up your fixed costs

Fixed costs are expenses that aren’t impacted by the volume of production, such as business insurance, lease fees for property, or equipment and machinery.

For example, if the company above leases machinery for $5,000 a month to produce 1,000 units of their product, they’ll pay $5,000 in leasing costs. Even if they increase production to 2,000 units, the leasing costs remain the same.

Costs are particularly important when conducting a break-even analysis — the process of looking at fixed costs relative to the profit earned by each product produced and sold. In general, a company with lower fixed costs will have a lower break-even point of sale, e.g. a company with $0 of fixed costs will automatically have broken even upon the first sale of their product (assuming variable costs do not exceed sales revenue). Profit is anything above and beyond the break-even point — which we’ll cover next.

Add an ideal profit margin

Your profit margin gauges the degree to which your company makes money. Expressed as a percentage, it measures the amount of profit obtained per dollar of revenue gained. A simple formula to remember is: Profit = Income – Expenses.

When it comes to selling your product, you’ll want an ideal profit margin — something to aim for. In theory, you can add as much profit margin onto your product as you want, but you have to be realistic and ensure you have a competitive price once taking your desired profit into account.

While margins do vary greatly, according to one study by NYU, a 10% profit margin is considered healthy, 20% is high, and 5% is low. Before determining your final price, however, there’s a lot more to consider.

Other factors that influence product pricing

Who is your target customer?

Understanding your target customer not only helps you focus your marketing messages, but it also helps you to determine the price of your product to ensure you aren’t pricing yourself out of the market or reducing your cash flow unnecessarily.

As well as this, a thorough understanding of your target customer, such as their preferences and propensity to buy, will help you to devise more effective product selling strategies, such as using multipack deals to attract customers who love bargains or bundles. This allows you to sell more of your product at a lower price, potentially increasing your profit in certain markets.

What are the market prices?

While using your competitors’ pricing as a basis for your own can be a good way to establish where you sit in the market, competition-based pricing can be a dangerous pricing strategy.

The reason for this is that you’re basing your price on nothing other than publicly available information: what your competitors charge for their products or services.

So rather than pricing your products based on your competitors, price them based on the value to the customer, e.g. what they get and why it’s beneficial to them. Taking a value-based approach to pricing will demonstrate your commitment to your customers, and set you apart from the competition.

Setting a revenue target

This is a simple pricing method that estimates the number of units you expect or plan to sell in the next year and divides the revenue you want to achieve by the number of units. And it’s a great starting point for pricing products.

But you should be careful using this method in isolation. Here are two things to consider:

Firstly, is your revenue target realistic? Secondly, can you sell the required number of units to reach that goal? There’ll be a lot of factors that determine your sales — like seasonality, market trends or simply reducing sales by setting a higher price.

What’s your market’s trajectory?

One thing you can’t under or overestimate is market demand for your product and how market trajectory can influence price.

If your market is retracting, for example, you may have to set lower product prices to generate interest so you can maximise profits.

If your market is growing, you could price your product higher as the demand already exists and doesn’t need an additional push from competitive pricing or lower pricing.

How will you sell the product?

How you sell a product, e.g. online, offline, as part of a bundle, on a subscription basis, as a freemium offer, or otherwise, can affect your pricing, especially when it comes to the product’s positioning.

Take Spotify, for example. Spotify uses a freemium model, offering a free version that allows users to listen to music, but if they want to download files to listen to offline, skip songs or adjust their audio quality, they have to upgrade to a paid subscription.

On the other hand, luxury brands like Rolex and Mercedes-Benz have deliberately high price points to give the perception of value and attract certain customers. Of course, they produce high-quality products, but the fact is that with this strategy they can generate huge profits from fewer sales.

Much of the above comes down to the perceived value of your product, e.g. the actual price versus the amount a customer is willing to pay for it. Having a reputable brand often allows companies a bit of flexibility in their pricing, while lower prices and certain pricing models (e.g. freemium models) allow more customer accessibility.

However, just because a product is priced highly, that doesn’t mean it’s of high quality. Likewise, more affordable products can exhibit high quality.

If you sell based on product price alone, you could have less success if a customer perceived the value of a competitor’s product as higher than yours, even if it’s more expensive.

According to research published by Forbes, more than 50% of customers who earn less than $75k a year are willing to pay more for a product if they believe it’s a better service. This is one reason why value-based pricing is important to your overall pricing strategy.

Overpricing vs underpricing

“You get what you pay for” is a well-known phrase around the world, and it can play a big role in the success of your product when it comes to setting a price.

It can be tempting, especially if you’re new to a market, to set your prices lower than the competition to tempt customers to you.

But this does present challenges.

If you underprice your product, you risk positioning your brand as cheaper than the competition, and as we’ve mentioned already — customers are happy to pay more for a better product or service.

Plus, once you’ve set your prices low, it’s much harder to raise them later.

One option is to overprice your products and differentiate yourself based on value. This does run the risk of pricing some of your customers out, and you might lose some sales you otherwise would have won with a lower price, but in the long term, it can position you as a better option.

Alternatively, if you can achieve an economy of scale (and produce products or services that are superior to the competition at a fraction of the cost), you can potentially undercut other market players and seize market share. Over time, you can adjust your product pricing in accordance with demand and the perceived value of your offering.

Testing price points

Product prices aren’t static and you should constantly test what the market and your customers are willing to tolerate to improve your profit margins.

Knowing when to set higher prices, and when to use lower prices, is difficult, and simple A/B testing (offering the same product for different prices) isn’t recommended.

One way to test price increases is to offer monthly incentives or additional offers with your key products, for an increased price. You can then use the immediate rise or fall in sales to judge the reaction to the change.

If sales drop dramatically in the wake of a price increase, you know that customers view your product as too expensive compared to its value. If sales stay the same, your new pricing structure should be tested again with another increase and a new offer next month.

Lowering prices, on the other hand, is a risky tactic. You might see an immediate rise in sales volume, but that’s expected when customers see a product’s price reduce — it’s why seasonal sales and discounts are so successful.

Over time, however, you end up conditioning customers to wait for sales, making it much harder to justify a price increase for the same product later on. This ultimately forces you to add new features or capabilities to a product or provide offers for it.

Monitor your product pricing strategy

As we’ve mentioned, the pricing process isn’t static and you should periodically review your product pricing strategy in line with market and competitor activity.

Constantly monitoring your pricing model can mitigate the risk of losing customers to the competition, maintain your market position, and prevent your products from becoming overpriced or underpriced in comparison to the wider market.

For example, if you use value-based pricing and position yourself as more expensive, but higher value, then you may need to increase your prices if the competition does, to retain your market position.

Let’s take a look at some of the pricing models you can use for your products and services.

Essential pricing models for businesses

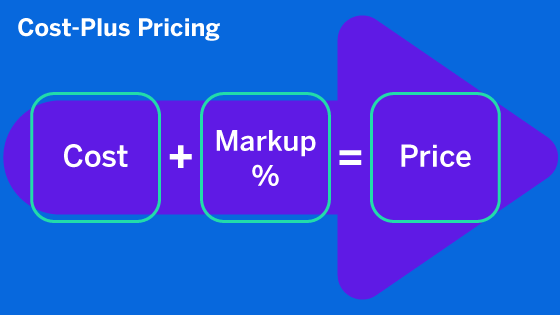

Cost-plus pricing

Cost-plus pricing is one of the most common pricing models used.

Using this model, the retail price is determined simply by adding a fixed percentage (or a markup) on top of the cost of producing the product.

For example, if a product costs $5 to make and you added a 10% markup the product would be sold for $5.50.

While cost-plus product pricing is a common and simple pricing model, it’s not always the best fit for every business.

This is because the final selling price usually doesn’t take external factors into account, such as market conditions or competitor prices, and is instead judged on an internal number.

Cost-plus pricing is more common in industries like retail where margins can be added to a wide range of products and the perceived value of a product isn’t as big a factor.

For industries where perceived value is a bigger consideration for customers, like software or services, cost-plus pricing can be a bad fit.

Again, whether cost-plus pricing will work for your business depends on the pricing strategy and market position you’re aiming for.

Some businesses build a brand position around their cost-plus pricing and aim to increase their market share as a company by offering price value and transparency overpricing.

This can be particularly effective in industries where price markups are deemed excessive and only in the interests of driving higher profits. That said, as popular pricing strategies go, it does have a lot of risks.

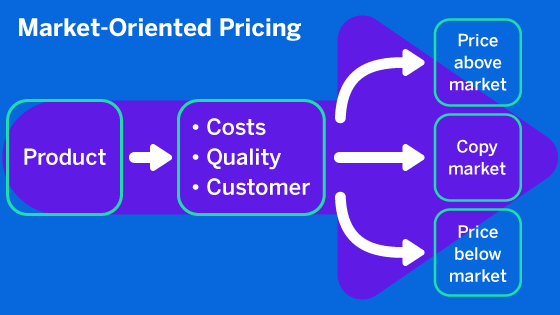

Market-oriented pricing

This is common for businesses looking to use a competition-based pricing strategy, where pricing is set in comparison to the wider market.

This pricing strategy is typically used by newer businesses that are still trying to work out their market position.

A simple competitive pricing strategy formula is to take the prices of the top three products or services you’re competing against, find the average, and that’s the final price.

It should be noted that this isn’t an ‘optimised’ pricing strategy as it doesn’t take perceived value or market conditions into account. It simply bases product and service price on the competition.

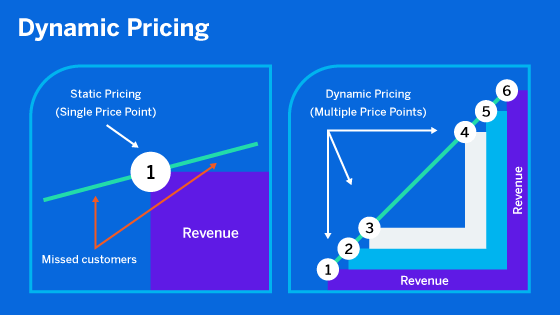

Dynamic pricing

Dynamic pricing, often referred to as demand pricing, is used for pricing decisions that are flexible and based on changing market demands.

It uses formulas to judge a series of factors that will impact the final price. These factors include competitor pricing, supply and demand in the market, and other external factors like seasonality.

Dynamic pricing is used in industries like hospitality and utilities, where the variable costs of the product (such as raw materials) or the demand for the product (like seasonal peaks) can impact sales.

In hospitality, for example, prices will rise during peak periods when demand for holidays and leisure activities is high, and then prices will fall when demand drops as a way to entice potential customers back.

In the utility industry, on the other hand, costs to the consumer will often rise in line with increased prices for the raw materials.

Dynamic pricing can be a good way to maintain a business’ desired profit margin in the face of changing market conditions.

Using Qualtrics to find the perfect price point

Several factors go into determining the final price of your product or service. Whether you base it on competitive pricing and positioning yourself against your competitors, or if you plan to remain flexible and adaptable with dynamic pricing, the options are seemingly endless.

And a great place to start when it comes to researching your pricing is to start with Qualtrics.

Understanding what your potential customers are willing to pay for your products before it launches can take a lot of the guesswork out of your pricing strategy, or help put some context into your wider research.

Using Qualtrics’ concept testing, market research, and segmentation software, you can determine exactly what will, what does, and what doesn’t work for every customer segment, no matter how complex.

With the Qualtrics Concept Testing tool, you can identify your most promising product concepts well before you think about pricing. Trusted by more than 13,000 brands, the Concept Testing Tool enables you to validate ideas, highlight the best product and/or service offers with the most lucrative market opportunities, and ultimately focus your research and development efforts.

Once you’ve agreed on a product concept, leverage Qualtrics’ pricing research software to run data-driven pricing studies, such as Van Westendorp price sensitivity analysis, Gabor-Granger analysis, and powerful conjoint optimisation projects — all from one platform. You can use powerful survey design and conjoint analysis studies (made simple so that anyone can use them) to find the product features your respondents will love and set ideal price points.

Then, after your products are out there in the world, use automated action to empower the right people to take action in real-time. If there are product experience gaps, from your pricing to the features you provide, you can collect, route, and prioritise product feedback.

Finally, Qualtrics Research Services can support you in simulating real-world pricing scenarios by targeting your specific audience and running comprehensive studies. No matter what you need, Qualtrics can deliver.

Get started with our free product pricing survey template