You’ve spent weeks, months, or even years developing the perfect product. How do you ensure that your investment pays off? Pricing research. Getting your pricing dialled in has more influence on profitability than any other factor including market share, fixed costs, or variable costs.

What is pricing research?

Pricing studies aim to discover what customers are willing to pay for a product or a service. This enables you to determine the optimal price point to maximise profit, revenue, or market share. You’re aiming to find the price point that is low enough that customers are willing to part with their money without feeling overcharged, and high enough to make sure your profit level is high enough to sustain and grow your business. It also helps you to avoid cheap prices that, while sustainable for you, may make the customer question the product’s quality.

Pricing research guides organisations on how they can increase revenues and profit margin by increasing or decreasing prices over time, for example by adopting price-skimming or another pricing model.

Pricing research offers the following key benefits:

- Understand the market’s willingness to purchase

- Capture the highest return on our product investment

- Preserve the value of your brand

- Make strategic decisions on how to change pricing over time

Free eBook: How to Price Products for Maximum Profitability

ROI of pricing research

Make no mistake, getting pricing right is crucial. Price is the most important factor in profitability, according to Bain & Company. And according to a study by McKinsey, if the Global 1200 raised prices just 1%, profits would increase on average 11%.

In spite of this, many organisations still fail to price effectively. Most companies state that pricing is a top priority, but 85% say they have significant room to improve, according to Bain.

With meaningful margin upside at stake, managers cannot afford to continue pricing by guesswork or rules of thumb.”

– Ron Kermisch & David Burns, Bain & Company

Companies that fail to price correctly can leave thousands or even millions on the table. In the 1990s, hard-disk drive manufacturers invested $6.5 billion in research and development. These innovations resulted in significant innovation as storage capacity improved 1,000 percent. However, manufacturers failed to price these innovations correctly, resulting in net losses of $800M, according to McKinsey analysis.

But the right pricing approach can lead to market growth. Of the top-performing companies, Bain found that 76 percent strongly agreed that their pricing strategies maximized returns at the customer and product levels.

Common pricing methodologies

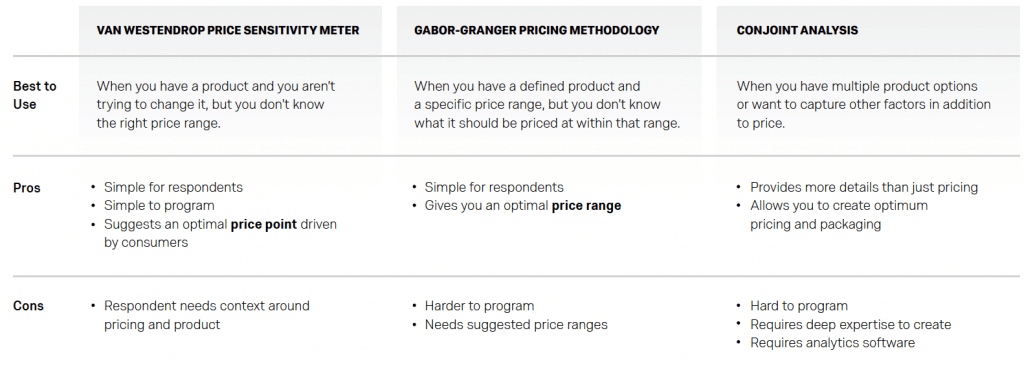

While there are many approaches to pricing strategy, a few leading methodologies generally emerge:

- Van Westendrop Price Sensitivity Meter

- Gabor-Granger technique

- Conjoint analysis

- Cost-plus pricing

- BPTO (Brand price trade off)

- Monadic price testing

Each option is best applied in specific situations and each comes with certain tradeoffs.

Van Westendorp’s Price Sensitivity Meter

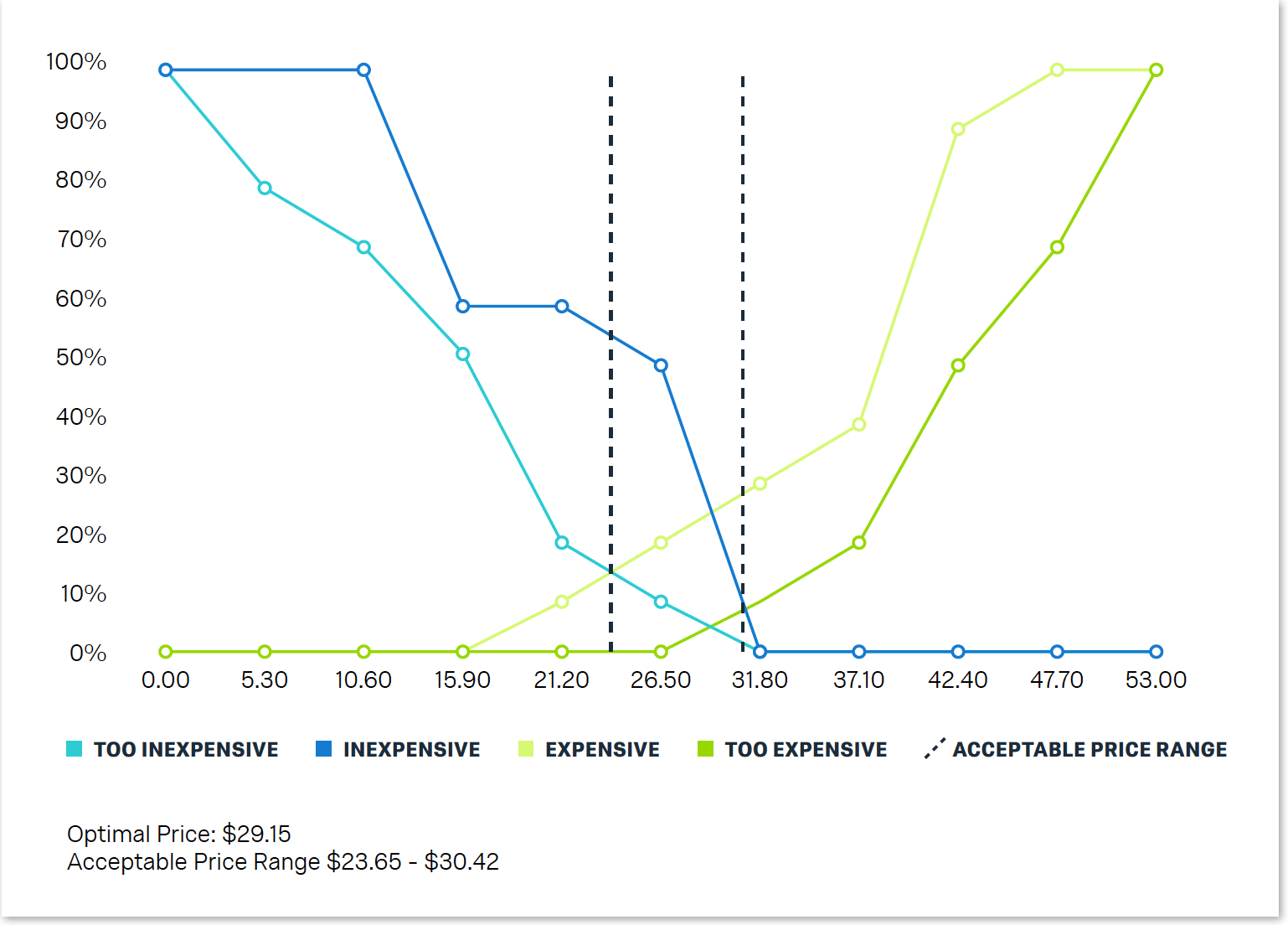

Developed by economist Peter Van Westendorp, the price sensitivity meter is a type of direct pricing research that constructs a range of acceptable prices for a given product. By asking the following four questions, Van Westendorp’s Price Sensitivity Meter creates a range of acceptable prices for a given product:

- At what price would you begin to think the product is too expensive to consider?

- At what price would you begin to think the product is so inexpensive that you would question the quality and not consider it?

- At what price would you begin to think the product is getting expensive, but you still might consider it?

- At what price would you think the product is a bargain – a great buy for the money?

Van Westendorp will give you a set of ranges as well as an optimal price.

- Lower threshold – intersection of too inexpensive and expensive

- Upper threshold – intersection of too expensive and not expensive

- Optimal price point – intersection of too expensive and too inexpensive

Gabor-Granger Direct Pricing Technique

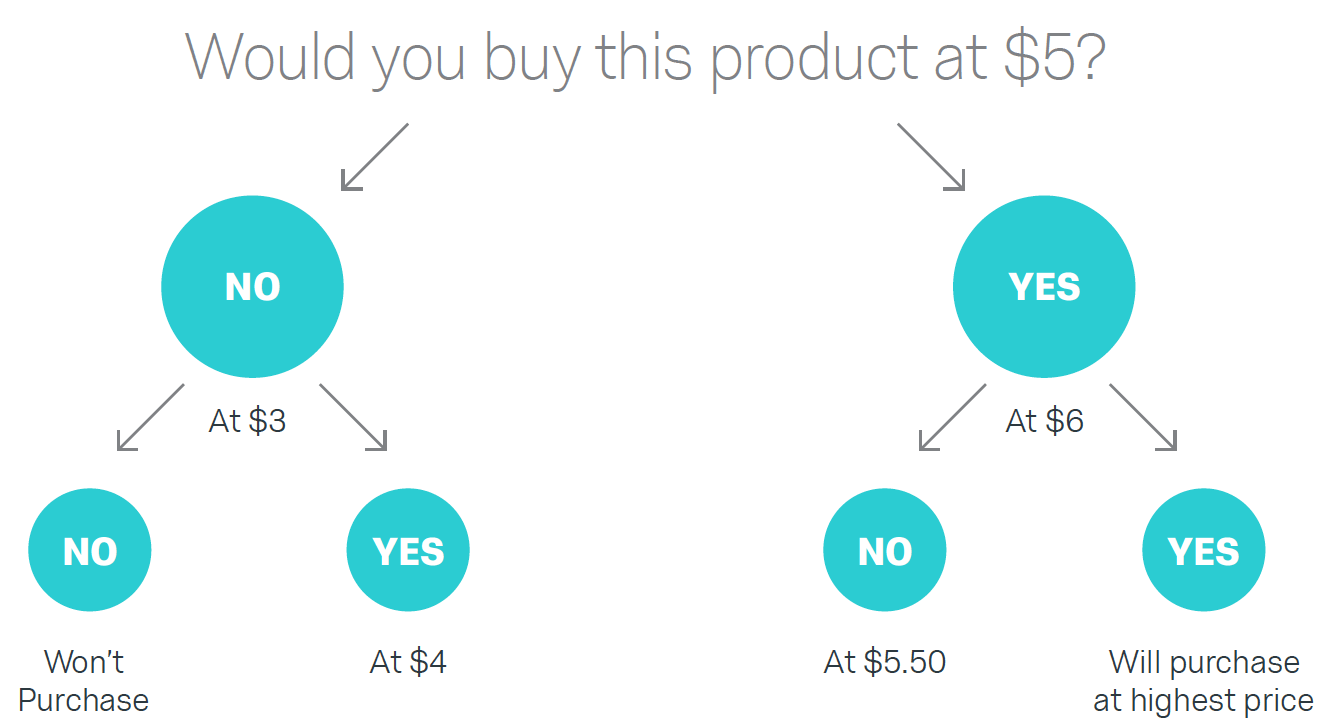

The Gabor-Granger technique is a type of direct pricing that asks respondents if they would purchase a product or service at a specific price. Researchers then change the price and ask respondents again if they would purchase the product or service. For example, researchers might ask respondents to respond to likelihood-of-purchase questions given the price would increase by an extra $5, $10, $15, $20, and so forth.

This direct pricing technique uses the results to determine demand at certain expected price points, which can then be used to determine an optimal price point within the market.

Keep in mind that because direct pricing measurement asks about pricing directly, researchers assume that survey respondents have a certain level of familiarity with the product or service. Additionally, the Gabor-Granger technique does not take competitive pricing into effect.

Conjoint analysis

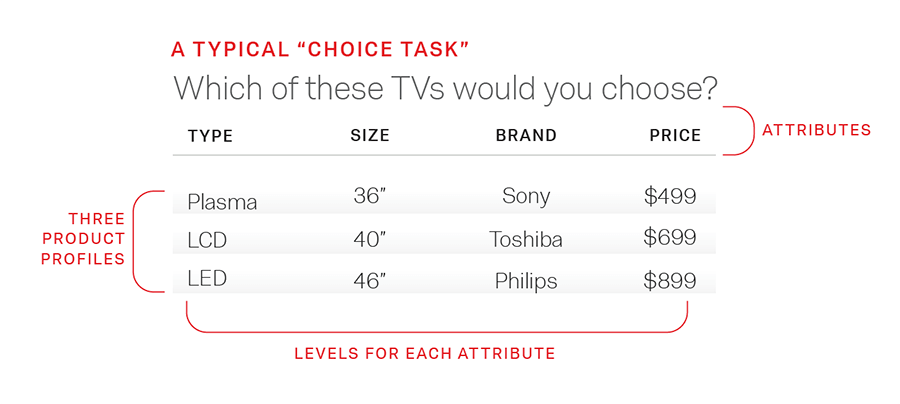

Conjoint analysis is often considered the most reliable way to determine pricing. Through discrete-choice modelling, a specific type of conjoint analysis, researchers can determine the influence that both price and product features have on customers’ willingness to pay.

Discrete choice modelling gives respondents a choice of two to five product configurations and then asks them to choose one of the configurations to help researchers determine packaging and pricing models. Ideally, a respondent’s choice reflects the value or utility he/she assigns to each attribute.

Cost-plus pricing

Cost-plus pricing means working out your price according to how much it cost you to produce the product, and then adding a markup, which is usually a percentage of the cost. It’s considered a very basic way to price products by some, but it does have a useful function in setting a floor for your pricing, under which you’d be making an outright loss.

To work out a price using this method, you would add together the cost of manufacturing (including materials), the cost of labor (what you pay for your employees), and a share of the cost of overheads (including things like lighting and heating).

Cost-plus methods may be appealing to customers, especially in B2B, because of their transparency. However they don’t take into account changes in the market, and may leave you open to losses if your costs increase unexpectedly.

BPTO (Brand-price tradeoff)

Brand-price tradeoff helps you understand how your brand value factors into the price you can charge. It’s a statistical technique in market research that helps you understand how your brand equity influences the price you can charge. It effectively puts a dollar value on your brand.

Another benefit is that it places your brand in context with the rest of the market, helping you understand how much market share you could achieve at different price points relative to your competitors.

Monadic price testing

Monadic pricing research works by splitting your testing participant into different groups and showing them all the same concept or product, but with different prices. These responses can then be analysed as a whole to see which prices were most acceptable. It’s a popular method of pricing market research.

The great strength of monadic testing is that it’s unbiased – each group sees only one price and product combination, so their answer isn’t influenced by other possibilities they have previously been shown.

Tools for pricing research

Free eBook: How to Price Products for Maximum Profitability