Optimize growth and efficiency while minimizing risk

In today’s competitive financial services landscape, delivering exceptional customer experiences is key to long-term success. At Qualtrics, we leverage the world’s leading experience management platform to help our financial services customers solve their most pressing business challenges while maintaining the resilience, security, and compliance they require. From revenue growth to operational efficiencies and risk management, the Qualtrics platform enables you to gather, analyze, and act on feedback across every channel that matters, turning insights into action that drives your business forward.

Today's reality—sound familiar?

Investing in experience management drives business performance

- For property and casualty (P&C) insurers, customers who had a positive claims experience are almost 50% more likely to renew their policy

- For banks that are top quartile for customer experience experience both 1.8x faster deposit growth and deliver 1.7x higher returns to their shareholders than those in the lower quartile

Create experiences that propel your business forward

Create experiences that propel your business forward

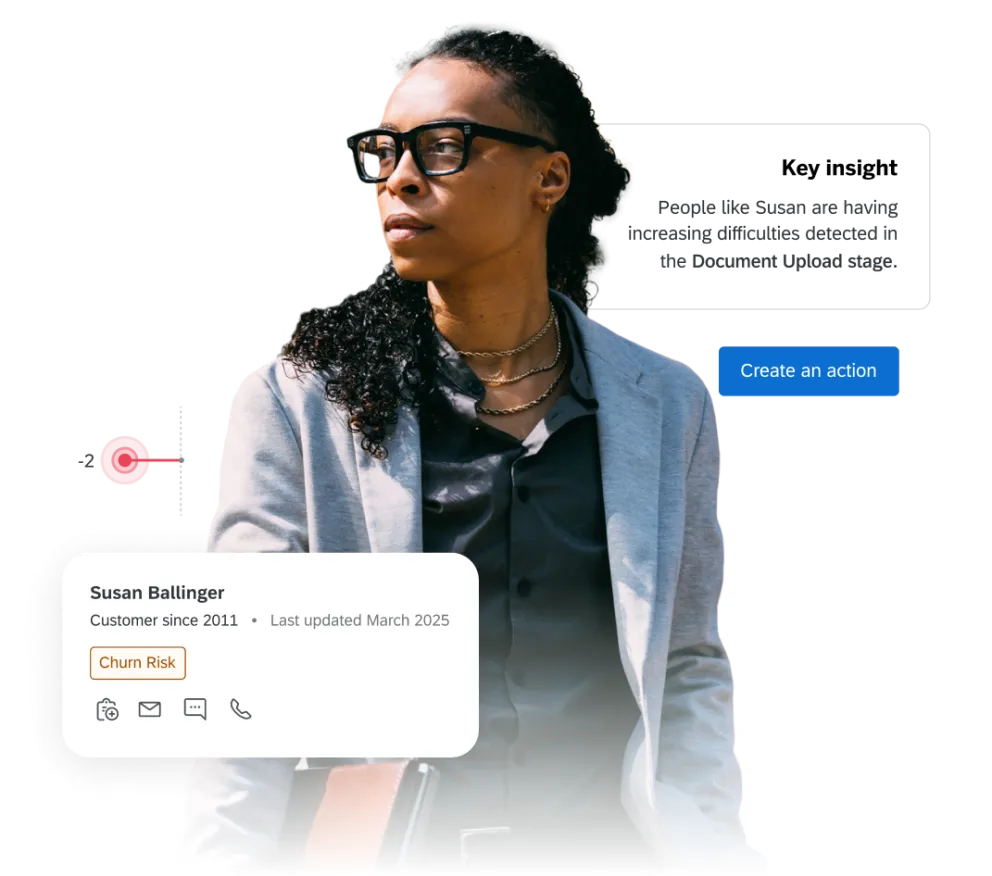

Elevate your customer and employee journeys with Qualtrics AI-powered XM platform. Get instant clarity into every touchpoint—so you can design exceptional experiences, pinpoint root causes, and take swift action to boost satisfaction, engagement, loyalty, and retention. We partner with firms across the financial services landscape to turn insights into real business impact. Discover how experience management can set you apart and drive results that matter.

Experience management isn’t just a feel-good initiative—it’s a proven driver of real, measurable growth in financial services.

Whether you’re driving cross-sell through digital or working to increase the productivity of your advisors, capturing customer and employee insights in real-time allows you to quickly address pain points, refine product offerings, and build loyalty through more personalized interactions. Every streamlined process and resolved issue fuels cross-sell opportunities, retention, and brand advocacy.

The result? Tangible gains in revenue, market share, and customer satisfaction—powered by experiences that set you apart.

Browse our solutions

Browse our solutions

Real-time omnichannel feedback can help meaningfully reduce operating costs for financial institutions.

Signal from experience management programs help pinpoint areas of friction - which tends to drive operational expense. Doing this in real-time can help quickly spot and resolve issues at scale, delivering a better experience to customers and employees alike. This proactive approach minimizes the escalation of issues and helps improve customer satisfaction across channels.

Finally, omnichannel insights can help streamline and optimize contact center operations through:

(a) Using the insights to improve digital channels and deflect simple inquiries away from contact centers

(b) Improving average handle times and first call resolution

(c) Delivering data-rich, targeted, and actionable training to your front line contact center teams

Browse our solutions

Browse our solutions

Real-time omnichannel experience management provides financial institutions with an integrated view of customer interactions, enabling early detection and prompt resolution of potential compliance breaches. By capturing feedback and complaints across all channels, organizations can more effectively respond to regulatory obligations, facilitate transparent reporting, and minimize the risk of penalties.

Furthermore, robust analytics and monitoring tools help assess adherence to quality standards and script protocols, ensuring consistent messaging and proper service delivery. This comprehensive approach enhances both compliance readiness and reputational resilience.

Browse our solutions

Browse our solutions

Results that speak for themselves

Results that speak for themselves

We integrate

seamlessly with

your mission-

critical systems

Safe, secure, and compliant for financial services

- Keep your data safe and secure on the enterprise-grade Qualtrics platform, and have complete trust with tight privacy, monitoring, and data access controls.

- We work with some of the most security-conscious financial institutions in the world. We’re FedRAMP certified and GDPR compliant, so you can rest assured the XM Platform™ gives you the tools you need to comply with all relevant financial services regulations in the countries where you operate. You can find more information at the Qualtrics Trust Center

You're in good company

Ready to see how Qualtrics can improve experiences at your institution?

Ready to see how Qualtrics can improve experiences at your institution?