What is product research?

You’re in the process of developing a new product idea with a view to launch it on the market. Or maybe you’re reviewing and updating an existing product that’s already on the market in the hope of making it better.

It’s a risk – get it wrong and you could make an expensive mistake; get it right and you could have a successful, profitable product, service or experience delivering amazing returns on your investment. So how can you make sure you end up in the second category?

This is where product research comes in. It helps you:

- Evaluate and prioritize your ideas

- Test and validate concepts

- Assess names and packaging designs

- Check out the competition

- Set the right selling price

- Gauge customer satisfaction and monitor product-market fit post-launch

- Continually improve the product

Product research is the term most often used to describe this process, but it’s not just about physical products. The research process we’re describing here could apply equally to a physical product such as a smartphone, a service like cloud storage, or an experience like a tour or hotel stay.

Product research goes hand-in-hand with market research, which identifies a target customer, develops typical buyer personas, and analyses purchasing behavior. Together, the two help you make informed decisions about how to find the right fit between what people need or want, and what you can offer them.

Kick off your product research with our free Product Research Survey template

Why is product research important?

A product idea can be brilliant, but if nobody wants to buy it, there’s no market for it.

Product research will tell you that. Similarly, a product is only worth what people are willing to pay for it, and you’ll be able to set a product price accordingly.

And if your competitors are doing better than you, you need to find out why, identify any gaps that they’ve missed and uncover emerging trends so you can get ahead.

How to conduct product research

Sure, you can start your research online. Amazon, review sites, and social media, will give you an idea of what’s out there and how buyers react to products, but if you want to dig deeper and own your research — you need to invest in user experience (UX) research.

UX research focuses solely on the user of a particular product, covering the following areas:

Target demographic

Demographic targeting or segmentation helps you understand who your particular product or service is targeting. Demographic information includes everything from gender and age to education and income.

Needs

Uncovering a need is one of the main drivers for creating a winning product. For example, if you’re selling into a particular market, your UX research can help you identify flaws in particular products or services and what your potential customers might want from something new. Likewise, researching customer needs helps you to identify what you shouldn’t focus on.

Wants

When you research products and UX, you should also examine what your target market wants out of the product or service. Want differs from need as a product need is a requirement, whereas a want could specify certain features of capabilities. They can also differ in priority based on each customer.

For example, this could be improving how your product or service works, or the UX outcomes — e.g. does the product make their job easier or give them more time to focus on other activities?

This should all form part of your UX research and can give you a huge advantage if you get it right.

Thoughts

What do your customers think about you or your product? What do they think about your competitors, and how do you compare to those competitors?

What do your customers think about the problem they have? Or how can they solve it? Do you think about their problem the same way they do?

You need to understand how your customers think and what they think if you’re going to convince them to buy your product.

Behaviour

Understanding your customers’ behavior should form a big part of your product research process. Not just in terms of how they go about their lives or work — which can help you understand how your products fit in — but also how they do their product research when looking for a solution. Do they base their purchase decisions on word-of-mouth? Do they typically buy online, or are they more likely to want to visit a retailer to see, hear and touch their potential purchase?

Think about the use case for your product or service. If it’s a gadget, will they use it in the home or out and about? This consideration might inform whether you build in a battery power feature or rely on a wall socket. If it’s a shoe-shine service, would they prefer to be able to walk in off the street or is an appointment system more appealing?

Understanding their behavior can help with your product development to meet a need, and also with your marketing strategy and sales messaging.

Motivations

What drives your customers to find and buy products or services? This is something you need in your product research so you can create solutions that further their success.

Customer motivations are either conscious or subconscious, e.g. they’re aware of a problem and need a solution, or driven by changes or demand in the market (for example, a government requirement to implement certain technologies for business operations).

Product research can help you to understand these motivators, subsequently enabling you to tailor your market messaging and create amazing products.

Using quantitative and qualitative product research

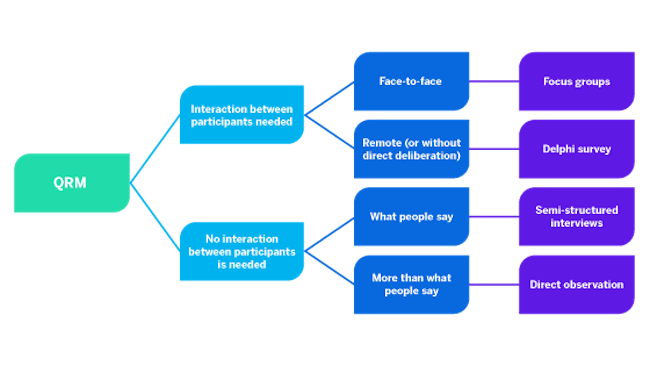

Product research relies heavily upon qualitative and quantitative research methods — this includes capturing feedback, observing how people use products, and analysing existing data (or new data) to uncover trends or opportunities.

Combining both qualitative and quantitative research methods will help you to identify the most pivotal market trends, as well as understand the specific thoughts and beliefs of customers. Here’s a quick breakdown of how each product research method works:

Quantitative UX research

Quantitative research is a starting point. It’s all about crunching the numbers that translate into informative statistics. Surveys and polls (online, mobile, paper, telephone) are the most commonly used methods, although you can add data from analytics platforms to the mix.

Qualitative UX research

Qualitative research joins the dots of the quantitative data by revealing what people think, believe, and feel about a product. Rather than ticking boxes, people say or write what they think either in open text boxes on surveys, or during interviews and focus groups. Qualitative UX research provides context, painting a picture using the data.

Areas of product research

Breaking product research down into manageable stages will increase its effectiveness. These stages are:

Market research

Understanding the current marketplace can help you not only identify any trends in particular buying habits or fads that are attracting short-term attention. It can also help you identify areas of opportunity that you could exploit.

Market research helps with pricing decisions based on whether your market is stable or growing. From the research, you’ll uncover market size and competition, as well as answers to the following questions:

- What are the best-selling products already in your market and where do you fit in compared to them?

- Is there low competition in your market, or is it saturated?

- Are you selling a product that’s got high demand? And how long does that high demand last?

- Is your product something that can be sold year-round? Or is your product seasonal?

Customer research

We’ve already touched on this, but your product research should include your customers.

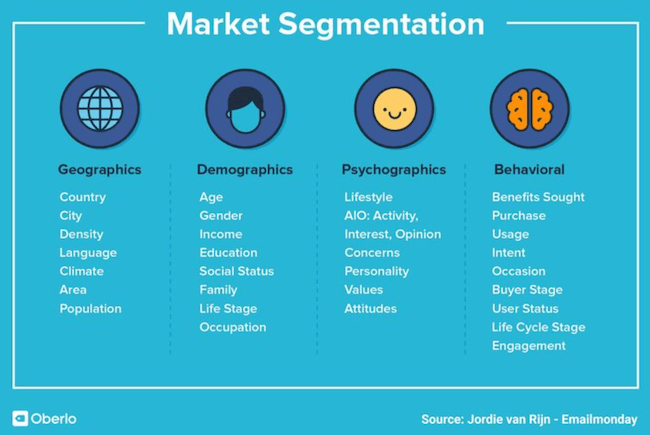

For example, research demographics to understand who they are, use psychographic information to understand their wants and needs, and leverage specific customer segmentation to ensure you’re targeting the right section of the market with your product or services. All of this will help you to build a better picture of your audience.

Your customer research should also include where you plan to sell your products based on your customers’ preferences. Will you need to sell online? Or is your product something your customers will want to see in person first?

If you plan to sell online, you’ll need to factor in other elements of your selling and marketing strategy. This will be everything from keyword research for marketing and understanding the search volume for your products, to shipping costs if you’re going to sell nationally, or internationally.

New product development

Finally, you should examine your specific product idea. This includes whether there’s a demand for it, what the pricing landscape is like and where you should position yourself, minute product details like the size and weight, or whether you’re selling perishable goods or consumables.

Furthermore, if you’re selling the same product as the competition, how are you planning to compete? Are you going to compete on price and if so, what will your selling price need to be to gain an advantage while generating a profit margin?

Segmentation Research

Image from Oberlo

Segmentation is the strategic lens through which you view your market landscape. It’s used to identify who to target so that you can develop, maintain, or adjust branding and marketing tactics and identify product optimization and innovation opportunities. The most profitable products are those that are targeted at specific segments of a market and tackle a particular need or problem.

Ask yourself the following:

- What segment of your customers are you going to target with this new offering?

- How large is that segment?

- Are your customers early adopters or more traditional? Are they open to new ways to do things or will they need to be convinced?

How people perceive your brand speaks volumes about what they are prepared to buy from you. Just as you wouldn’t buy a computer from a supermarket, you wouldn’t buy your groceries from a technology store (more importantly, it’s highly likely that neither would sell either of those products).

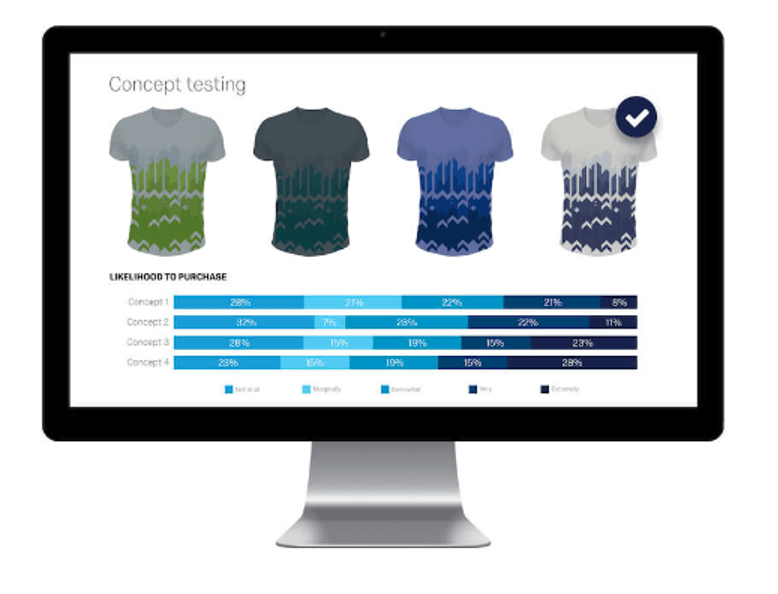

Concept testing

Concept testing should be conducted in an agile environment.

Begin early in the process with an MVP to test on existing and potential customers. A series of small studies done throughout the product innovation cycle will ensure that your new product is refined by customer input.

It is always more cost-effective to refine a new offering as it is being developed than to have to drop or make significant changes to a product that has already consumed a great deal of investment.

This continues as you roll out your new product. You must stay in touch with your target audience as they use the product, and take on board comments and suggestions for improvement. There are many benefits to concept testing:

- It’s cost-effective and flexible: You can send out simple, quick surveys if you want high-level rapid feedback, or longer ones if you want to dig deeper into the detail

- You’ll be able to optimise your product: You’ll gather useful information on things like branding, pricing, and market status that will make a real impact on your development decisions

- Continuous quality assurance: You can use the same audience to give feedback on your improvements, or survey a new audience to get fresh insights on your product development.

- Great brand loyalty: You’ll build up good customer relationships and increase your brand equity by including potential customers in your product’s design and development.

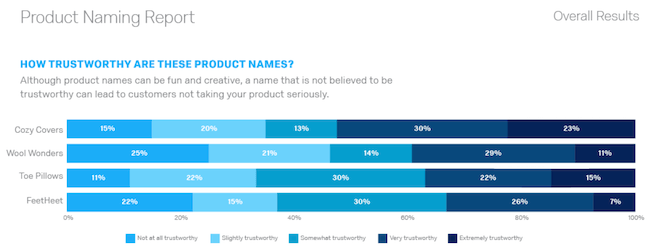

Naming research

What’s in a name? A best selling product, we hope.

Product naming is the process of coming up with compelling, unique names for your new products.

We would always recommend using qualitative research, with its emphasis on verbal expression, to test product names with your prospective customers, and using a text analytics tool to categorise text responses by both topic and sentiment automatically.

When deciding on product names (we recommend between 3 and 15 options) to run past your respondents, remember these six golden rules:

- It should be easy to remember: consumers must be able to recall the name easily

- It should be memorable: There’s a lot of product ‘noise’, and your name needs to be heard above it

- It must be easy to pronounce: Word of mouth is important, and if your customers can’t say it, they won’t mention it to others

- It must be easily understood: It helps if the name hints at what the product does unless you have a colossal marketing budget to explain a more left-field name

- It must translate well with international audiences: We’ve all heard the apocryphal story that Coca Cola originally transliterated as ‘bite the wax tadpole’ in Chinese. Whatever the truth, make sure audiences around the world can pronounce your product name and it doesn’t mean anything problematic.

- It has to be a name you can own. No one wants to discover after a comprehensive research program that the name everyone loves is not available for use.

Provide your respondents with a product description, and ideally images of the product. Break your testing between:

- Overall name questions: How does each name compare with the others? Rank the names in order of preference, or against criteria such as trustworthiness, appeal or creativity. Do respondents have any names of their own? The results of this testing will give you the top names overall and in every category.

- Individual name questions: Would respondents buy this product with this specific name? How does this name make them feel? Individual name analysis should reveal name sentiment, as well as data about a consumer’s likelihood to purchase or consider your product.

Feature research

You use this to identify which product features your customer’s value so that you can add or improve them.

But you always need to keep in the back of your mind that a product is more than just the sum of its features – it’s how they work together to give a seamless experience that’s important. Research will help you do that.

There are three areas of feature research that you’ll need to undertake:

- Identifying customers’ wants and needs: Customer needs analysis will give you insights into personal values, purchasing decisions, and pricing tolerance. Conjoint analysis, with its multiple product attribute comparison/trade-off scenarios, will inform which features customers consider most valuable.

- Internal development: Once you’ve analysed what customers want, you need to bring your feature back in-house and seek the expert opinion of your product managers, business analysts, marketers, designers, engineers, and customer experience teams.

- Test with customers: You’ve created a feature that customers want, and your in-house teams have approved them. Now you can use product feature prioritisation to understand the features your customers’ value (and don’t). Survey: usage (where and how the customer uses the feature); ‘top of mind’ negative and positive associations with the feature; product categorisation (comparing with the competition to see which features make a product more or less ‘swappable’).

Pricing research

A product is only worth what people are prepared to pay for it. You need to ensure that its price is low enough for people to feel they’ve got good value, and you also make sufficient profit, but not so cheap that its quality is questioned.

You also need to consider how many units you’ll need to sell based on your product prices to have a good profit margin.

When you conduct pricing research, you’ll discover:

- How willing the market is to buy your product

- The highest return on your development investment

- How to maintain your brand’s value

- When and how to alter your pricing effectively

- The costs involved in producing your product

Pricing research is done through a combination of market research, competitor research, market analysis, and testing in the marketplace.

Use product pricing research tools. These use one or more of the following methodologies to ask survey respondents:

- Van Westendorp price sensitivity meter is a type of direct pricing research that asks survey respondents four simple questions to gauge whether your product is too expensive or a bargain

- Gabor-Granger pricing methodology uses predefined price points to determine the highest price a respondent would pay for your product

- Conjoint analysis gives respondents a choice between product packages and then asks them to choose one of the feature/price configurations to create the ideal option. Each option comes with trade-offs and the best time for use

Top new product development tips

You could come up with an amazing product or service, but without product research, you’ll never know if there’s a market for it. Furthermore, you might price it wrong and/or target the wrong customers, severely limiting (or preventing entirely) your sales.

The good news is that there are a lot of product research tips and product research tools we can share with you:

Research existing products on the market

The easiest way to do product research is to examine what products are already available in your marketplace and identify the top-selling products on the market that you’re competing with.

If you’re not already offering this product, you can create your own version, and with the right research, you can identify areas of improvement to differentiate your offering.

Look at product descriptions to see how existing products are being sold and use this to create products that fill a gap.

The easiest way to do product research is to get out and act as a customer. Go to popular online marketplaces like eBay and Amazon to see what people are looking at. Get out onto the high street and visit brick and mortar stores to see what product categories are already on the market.

All of the above will help you understand the current landscape and how you can fit in or disrupt it.

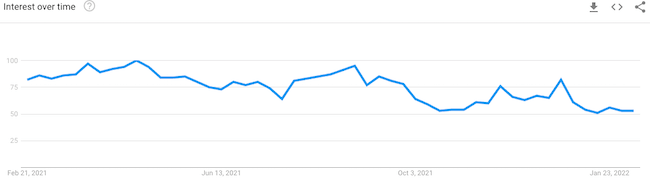

You can also look online at Google Trends and queries for particular products in your marketplace. Understanding these trends and the search volume for a particular keyword related to your products can help with your launch, as well as the optimisation of product pages.

These trends can be particularly useful if you’re selling a seasonal product, as you can use real-time search data to see trending products, or changes to your market size when there might be more people looking for your product at certain times of the year.

Look at online reviews

The best feedback on products will always come from customers. And the best place to find honest feedback is by looking at online reviews — whether they’re on Google or Amazon.

Especially if you’re an online business, these Amazon and online reviews are a trove of ideas that can help you with your product research.

For example, paying particular attention to poor reviews can help you identify gaps in a competitor’s offering that you can take advantage of.

Identify gaps in the market

You don’t have to reinvent the wheel with your product ideas, often you can simply take an existing product and improve on it.

Online reviews are incredibly useful for product research because customers will typically share their ideas for improvement as part of the submission.

Quantitative product research

Using quantitative research with online polls or product research tools can help you reach a large portion of your potential marketplace in a cost-effective way.

You can use this as a starting point to understand the market as a whole before drilling down into specifics.

Qualitative product research

As well as analysing the wider market, you should get specific reviews and opinions of your products from customers using qualitative research.

Through focus groups or individual interviews, you can start to understand the sentiment towards your products and identify opportunities to capitalise on.

In the long run, this data can help you to develop new product ideas, especially if you uncover downsides or holes in your product development.

Ongoing product research

While research can help test and optimise your product idea before launch, it shouldn’t stop once the product is on the market.

You should continue to do your research as an ongoing project.

This will give you more information about how your product or service is perceived and can also help you identify ongoing room for improvement for your products to help you make more sales in the future.

Conducting thorough product research is key to more sales

Researching your products can make the difference between success and failure when it comes to launching winning products and having success in the long term.

It should produce a complete picture of your market, product, and customers and will produce the roadmap for your launch and ongoing sales.

Your research will help with everything from product development, to your marketing campaigns, to selling prices and ongoing development.

By doing in-depth research you’ll be able to make better, more informed decisions about your product ideas and help you create and sell more profitable products.

Find success with Qualtrics’ product research tools

By bringing customers into your product development process, you can identify and solve problems while uncovering new opportunities. And Qualtrics makes it easier than ever.

With Qualtrics ProductXM, you can accelerate your product development cycle using real insights from your customers and easily identify gaps in the market. This enables you to launch new, customer-oriented products, services, and solutions, or disrupt existing categories with offerings that have new or improved features.

Using Qualtrics, you can get instant access to feedback from 27 channels and more than 125 data sources like Google Search and other search engines and social media sites.

Then, use smart analysis at every step of the product development lifecycle to launch products you know your customers will love. Concept testing enables you to validate every aspect of your offering, from features and branding to messaging and price, to set it up for success. You can also use conjoint analysis to find your customers’ ideal product configurations, e.g. packing, pricing, design and features.

Finally, close the product experience gap, instantly gather real-time feedback that you can use, and automate the process using XM automated actions. With Qualtrics, everyone has the power to drive change.

Download our free product research survey