Market research services

Design new experiences with expert-led research

Design world-class research studies, get high-quality feedback from any target audience, and quickly surface the insights that drive your business.

The world’s best brands power insights with Qualtrics

Global market research at your fingertips

We’ve executed over 28,000 projects and worked with 3,000 different brands around the world

MARKET OPPORTUNITIES

Find the white space in your market with everything from market positioning and benchmarking studies to attitudes, habits, and usage studies

PRODUCT LAUNCHES

From testing initial concepts to honing in on the perfect name and pricing strategy, we’ll do the market research to help your next launch go perfectly.

BRAND STUDIES

From advertising and message testing to understanding the secret sauce that will generate loyalty with your target customers, we’ll design the brand research you need to grow.

Start your research project now

Get to insights faster

Do more research, more efficiently and take action in real-time as the needs of your business, and your consumers, change.

- Build and deploy research faster with dedicated research project managers

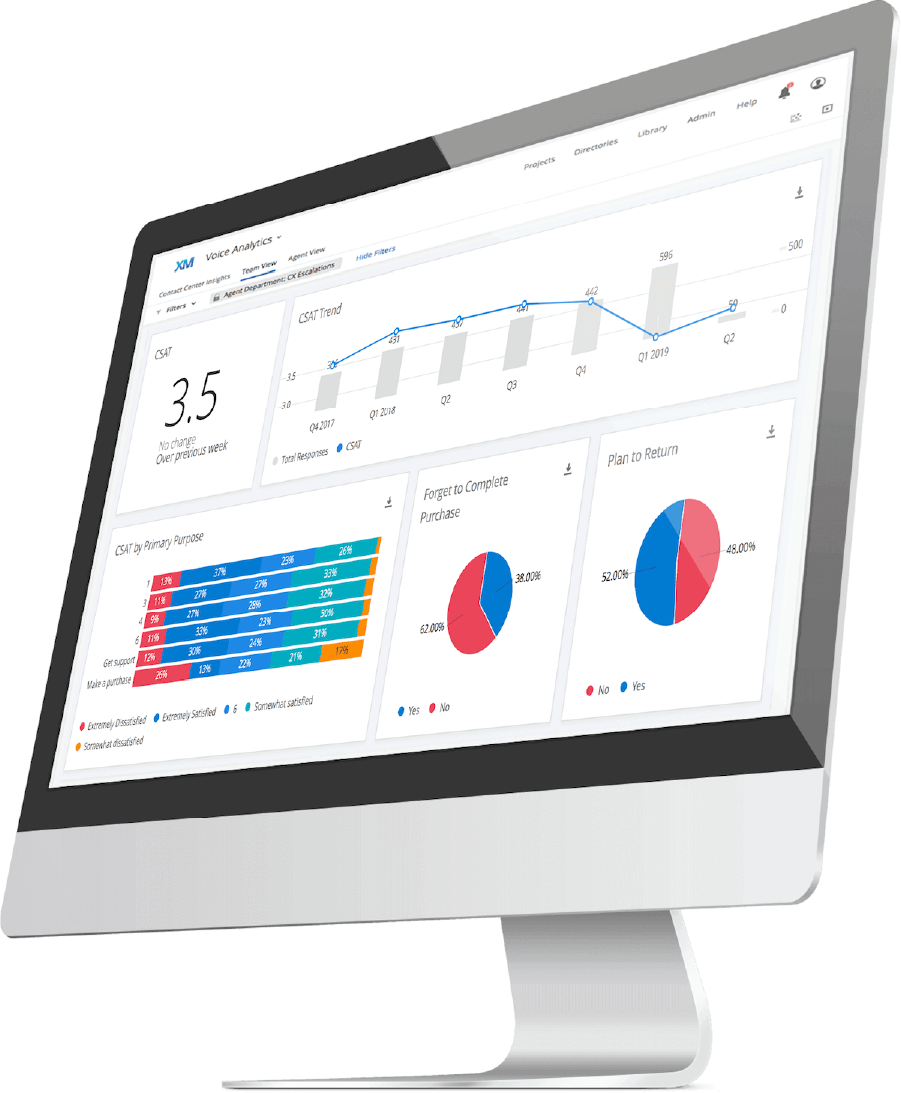

- Streamline data collection, analysis, and reporting through dynamically updated dashboards

- Track research progress in real-time and make adjustments on the fly

Make decisions with confidence

Get high-quality data that’s backed by research expertise and trusted by stakeholders

across the organization to help drive action.

+

200+

expert consultants and practitioners

+

30+

global panel partners

+

48M+

global research responses collected

+

200M

total respondent pool

+

200+

global markets covered

On hand, wherever you need support

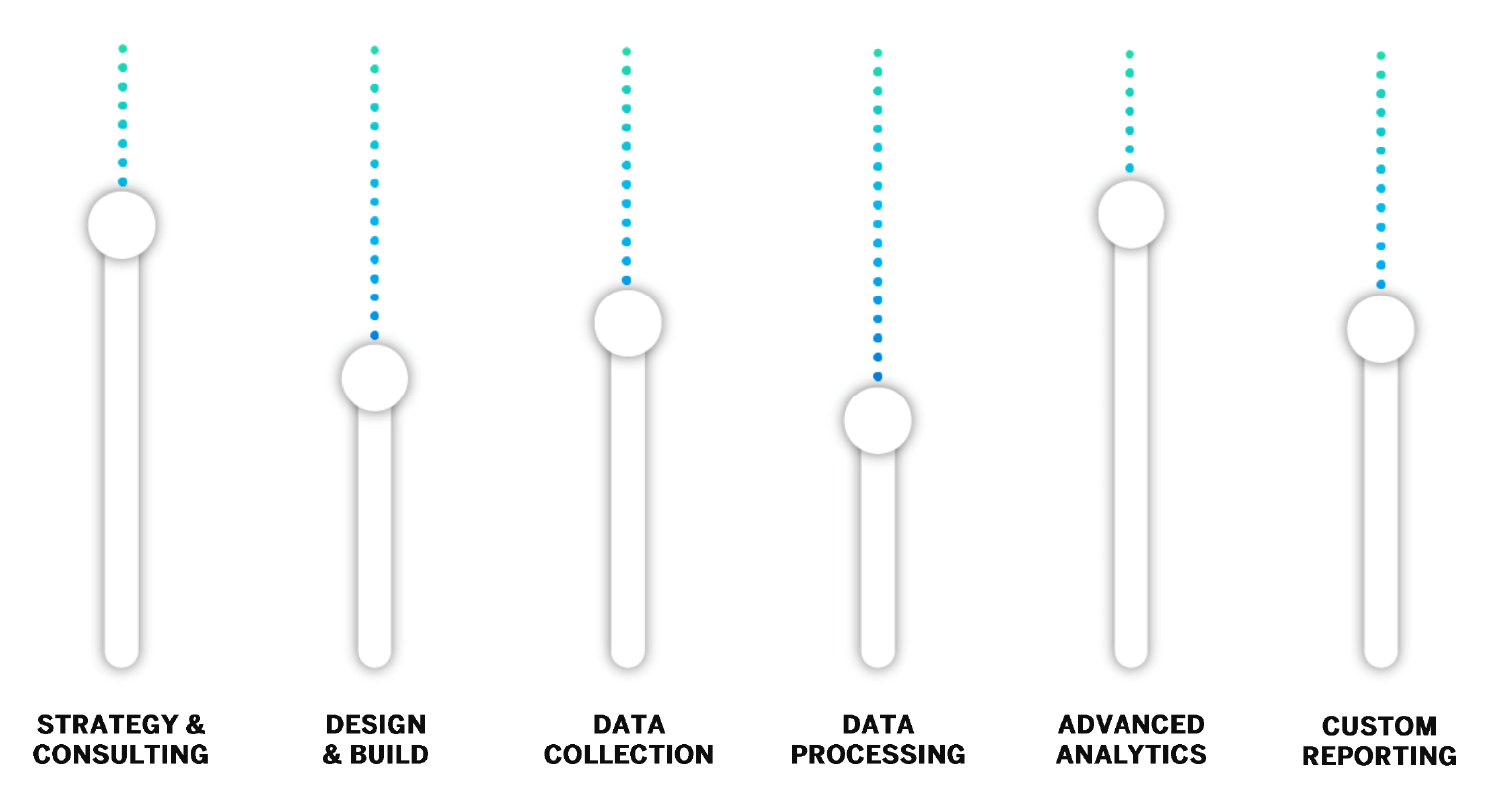

Need a team to take a project on from end to end? Or looking to bring in expertise for specific stages, or to provide additional capacity? Our flexible services model lets you adjust the dial and get the support you need, whenever you need it.

Online samples

Your next breakthrough needs a market research panel designed for faster, more consistent, and higher quality insights. With our proprietary online samples, you can get insights from any audience around the world and accurately track trends and shifts in your market over time

- Choose any target audience and we’ll give you access to a representative sample

- Boost the accuracy of your tracking studies with a sample methodology that’s 47% more consistent than standard sampling methods

- Launch best-in-class studies with support from your dedicated team at every stage, from launching your survey to reporting on the results

Measurable intelligence for every

part of your business

Whatever type of research project you’re running we can take care of some or all of it through our flexible services model. Just let us know where you need support, and we’ll step in and take care of the rest.

Design & Programming

- Survey methodology

- Survey design

- Programming

- Translations

Sample and Fielding

- Panel/sample recruitment

- Project Management

- List distribution

- Incentive distribution

- IHUT Studies

- Focus Groups

- Computer Moderation

Data Processing

- Data Weighting

- Open-ended Coding

- Data Cleaning

- Tabulations (stats testing)

Analysis & Reporting

- Conjoint / MaxDiff

- Regression Analysis

- Segmentation Analysis

- TURF Analysis

- Pricing Analysis

- Key Driver Analysis

- Perceptual Mapping

- Reporting