What is brand research?

Brand research is the process of understanding how your brand is perceived in the market—by your customers, potential customers, and in comparison to your competitors. Sometimes called brand market research, it combines quantitative and qualitative methods to help you answer key questions like:

- Who knows about this brand?

- What do they think and feel about it?

- How does it compare to others in our space?

By collecting insights on factors like brand awareness, perception, and loyalty, you can spot gaps between how you want your brand to be seen and how it’s actually seen—then take action to close them. Whether you’re building a new brand or optimizing an existing one, brand research gives you the data to grow with confidence.

Take a tour of Qualtrics Brand & Communication Research software right in your browser

How does brand research work?

Brand research can be as simple or sophisticated as you need it to be, with the scope often depending on varying factors like your goals, the maturity of your brand, and the resources available. Some brands opt to run large-scale periodic studies involving multiple touchpoints and audience segments; others focus on a few key metrics, tracked continually.

Effort vs. insight: Finding the right balance

With brand research there’s always a trade-off between how much effort you invest and the depth of insights you gain.

A quick online survey might give you a snapshot of brand awareness, while in-depth interviews or focus groups can reveal the emotional drivers behind brand perception. The key is aligning your method with your objective—whether it’s fast feedback or foundational insight.

Leveraging AI in brand research

Brand research has traditionally been slow, reactive, and resource-intensive. But AI is changing that—giving teams the ability to analyze huge volumes of data, surface insights instantly, and adapt their strategies in real time.

Using Machine Learning and Natural Language Processing (NLP), AI branding can uncover meaning from unstructured data—like reviews, survey responses, or social posts—and detect the tone and context behind what people are saying. Today, it’s empowering brands to track sentiment, spot issues early, and personalize brand experiences with far greater precision and at scale.

Done well, AI makes brand research faster, deeper, and more responsive—helping brands turn a flood of feedback into competitive advantage.

Why leading brands invest in brand research

The world’s most successful brands know that a strong brand is one of the most powerful drivers of long-term growth—and therefore treat it as an asset worth understanding, measuring, and optimizing. That’s where brand research comes in.

Whether it’s Apple refining its positioning, Nike responding to cultural trends, or new, emerging startups finding their niche, companies use brand research to make smarter decisions, adapt faster, and stay relevant in increasingly busy and competitive markets.

Here’s why brand research is a crucial investment:

Make informed, strategic marketing decisions

Every brand wants to make bold, creative decisions—but the best ones are grounded in data. Brand research helps you understand how your brand is currently perceived and how your marketing efforts are shifting that perception over time.

With insights into what your audience values, where your message is landing (or falling flat), and how well you’re cutting through the noise, you can optimize your campaigns and spend your budget where it matters most. Concrete brand insights can also give you the confidence to test new directions, knowing you have benchmarks and tracking in place.

When resources are tight, brand research becomes even more valuable. It helps you focus on high-impact tactics, justify your spend to stakeholders, and avoid costly missteps.

Build stronger customer relationships and loyalty

Customers don’t just buy products—they buy brands, too.

Brand research helps you uncover what people really think and feel about your brand at every stage of their journey, from first impressions to long-term loyalty. It can help you identify gaps between customer expectations and brand experience, refine your messaging, improve touchpoints and experiences, and create brand value.

In return, you build a stronger emotional connection with your audience, strengthen trust, and ultimately increase the likelihood of repeat business and advocacy.

Gain a competitive advantage

Markets are hectic. Consumers have more choices than ever. And differentiation is getting harder.

In these noisy times, brand research gives you the competitive intelligence to understand where your brand stands relative to others—and how it can stand out before your target market.

It helps you track competitor activity, benchmark performance, and pinpoint areas where you have an edge or are falling behind. With these insights, you can fine-tune your positioning, clarify your value proposition, and build a deeper moat separating your business from the market.

Understand your brand’s real impact

Do you really know if your brand awareness is growing? Do people trust it more than they did six months ago? Are you becoming the brand of choice in your category?

Questions around brand performance are traditionally very hard to answer with confidence. But today brand research is making brand measurable. It allows you to track changes in awareness, loyalty, and other key brand health metrics over time—so you can see what’s working, what isn’t, and act fast when something’s off track.

Crucially, consistently tracking brand performance creates an invaluable feedback loop. Each round of research gives you clearer insight into the changes you’re making, whether they’re driving growth or holding it back—setting you on a path to build a brand that can be consistent, trusted, and increasingly valuable, all at once.

Brand research terms to understand

Brand research is made up by a collection of core concepts and metrics that combine to create a clear picture of brand performance.

By understanding them as a first port of call, you will be far better equipped to make sense of your results—and know what to measure in the first place.

Here are the core concepts to get familiar with as you assess your brand’s health and impact:

Brand awareness

Brand awareness measures how familiar people are with your brand, either through recognition (seeing your logo or brand name) or recall (remembering your brand unprompted).

It’s essential to track because awareness is considered the first step in the customer journey—people can’t choose to buy from a brand if they don’t know it exists.

Brand awareness is mainly influenced by factors such as marketing reach, media exposure, and word of mouth—and how consistently your brand shows up across channels.

Brand association

Brand associations are the qualities and ideas people link to your brand, such as reliability, innovation, or social responsibility.

Built over time through your messaging, customer experience, design choices, and even partnerships, brand associations influence whether customers feel aligned with your business and define your brand identity in the market.

Brand equity

Brand equity refers to the added value your brand brings compared to similar alternatives. It’s what determines why a customer chooses a branded painkiller over a generic one with the same ingredients.

Built on a foundation of brand awareness, trust, consistency, and positive experience, strong equity allows brands to command higher prices, win preference, and drive loyalty.

Brand loyalty

Brand loyalty reflects how likely people are to keep choosing your brand—and recommend it to others.

It’s one of the most powerful signals of brand health, showing that your products, experiences, and values resonate enough to create repeat customers. Its biggest drivers are a great product or service, consistent delivery, and emotional connection.

Brand perception

Brand perception is the overall impression people hold about your brand, from loyal customers to unlikely buyers, based on every touchpoint—from ads to customer service to word of mouth.

It matters because perception shapes reality: what people believe about your brand drives how they behave toward it.

Brand positioning

Brand positioning is how your brand is perceived relative to competitors, be it premium, best value, challenger, sustainable, or more. It’s how you carve out space in the customer’s mind and differentiate in a crowded market.

Effective positioning is influenced by your pricing, tone, visual identity, and other strategic choices you make about who you’re for and why you’re different.

Brand preference

Brand preference measures how many people would choose your brand over another—even if they haven’t bought from you before.

Influenced by brand perception, reputation, emotional appeal, and how well your offer fits customer needs, preference is a strong sign that your branding and marketing are resonating, helping you win at the all-important moment of choice.

Brand tracking

Brand tracking is the cornerstone of brand research best practice. It’s the ongoing process of measuring your brand’s performance over time and across metrics.

Unlike one-off studies, brand tracking creates a continuous feedback loop—helping you spot trends early, assess the impact of campaigns, and respond to change.

The most effective brand tracking programs don’t just monitor awareness or sentiment—they link brand metrics to key business outcomes like revenue, retention, and return on investment (ROI). With the right system, you can understand not just what’s changing, but what’s driving that change—and how to respond.

Want to see how it works in action? Request a demo of Qualtrics Brand Tracking Software and see how leading brands keep their edge.

![]()

Brand research methods

Once you know what you want to understand about your brand, the next step is choosing how to get those insights. Different methods offer different strengths—some help you quantify what’s happening, others help you explore why.

Most brand research falls into one of two categories: quantitative and qualitative. The most effective brand strategies use a mix of both to build a complete picture of awareness, perception, loyalty, and more.

Here are three of the most widely used methods—and how to use them well.

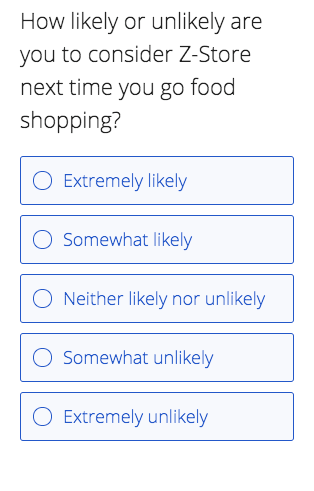

Survey research

Surveys remain a great way to solicit feedback on your brand, whether it’s via email, over the phone, or in its most effective design, an online form.

Results are often instantaneous, there’s no limit to the kinds of questions you can ask, and you can collect feedback at any stage of the customer journey if you include a survey as part of your onboarding, marketing, or purchase process.

Perhaps the most common survey type for brand-based research is the Net Promoter Score (NPS), which asks how likely someone is to recommend your brand to others. But email and online surveys can go far deeper—also assessing brand awareness, perception, preference, and associations.

Designing effective online surveys for customer feedback

To get high-quality insights, your survey needs to strike a balance between being comprehensive and easy to complete.

Start by clearly defining your objective—are you testing brand recall, gauging sentiment, measuring loyalty, or something else? Keep your questions focused and avoid leading or ambiguous language. Use a mix of question types, such as Likert scales, multiple choice, and open text boxes to gather both quantitative and qualitative insights.

Consider personalizing the survey experience based on who the respondent is—for example, an existing customer should receive different questions than someone who has little awareness of your brand.

Example survey questions

Here are a few sample questions to help guide your brand research:

- How familiar are you with [Brand Name]?

- Which brands come to mind when you think about [product category]?

- What three words would you use to describe [Brand Name]?

- How did you first hear about [Brand Name]?

- How likely are you to recommend [Brand Name] to a friend or colleague? (NPS)

- Which of the following brands would you consider when purchasing [product/service]?

- What do you associate most with [Brand Name]?

- What could [Brand Name] do to improve your experience?

By gaining answers to questions like these, you can uncover how your brand is perceived, how it compares to competitors, and where to focus your efforts for improvement.

Focus groups

Focus groups—whether conducted in person or online—are a powerful way to gather deeper, more nuanced insights into how people perceive your brand. Unlike surveys, which focus on breadth and quantitative data, focus groups allow you to explore the why behind customer attitudes, emotions, and behaviors.

They’re especially useful for exploring themes like brand perception, brand associations, and emotional connection—giving you an invaluable opportunity to test how your messaging resonates, get feedback on brand visuals or campaigns, and uncover what drives brand loyalty, or what’s getting in the way.

Choosing a focus group provider

Brands either run focus groups by engaging participants themselves, or by leveraging online platforms. The latter has made it significantly easier for businesses to collect insights from more diverse groups, and across geographies and time zones.

If you’re looking to work with a third-party provider, here’s what to look for:

1. A broad and relevant respondent pool

Look for providers with access to a large, diverse panel—covering the demographics, behaviors, and markets most relevant to your brand. Remember, only with the right respondent pool will you gain insights that are truly representative of your target audience.

2. Support throughout the process

Good providers offer more than just participants: they help you design your session, moderate the discussion, and interpret the findings—so you walk away with clear, actionable insights.

Digital listening

Digital listening—also known as social listening or conversational analytics—is the process of monitoring and analyzing online discourse about your brand across channels like social media, forums, review sites, blogs, and even your own customer service touchpoints.

Unlike surveys or focus groups, digital listening captures unfiltered, unsolicited opinions—giving unique insight into how your brand is being discussed and perceived in the wild. It’s a powerful way to uncover trends in real time, identify risks early, and discover opportunities you might otherwise miss.

Digital listening technologies have rapidly grown in sophistication, applying natural language processing (NLP) and sentiment analysis to not only filter through content but now also determine emotion, uncover key themes, and deliver actionable insights. It’s no longer about seeing what’s being said—digital listening is now also about understanding what it means and what to do next.

With platforms like Qualtrics Brand & Communication Research, brands can connect insights from 100+ structured and unstructured data sources to get a complete, real-time view of brand sentiment. Using AI-powered text analytics and industry-tuned models, our platform helps businesses surface critical insights from across their customer journey—empowering them to track perception, spot reputational risks, and optimize messaging with confidence.

When to use digital listening

Digital listening is especially useful when:

- You want to track brand sentiment in real time

- You need early warning signs of reputational risk or emerging issues

- You’re launching a new campaign or product and want to monitor reactions

- You’re benchmarking your brand against competitors in public discourse

- You want to supplement structured feedback (like surveys) with unsolicited opinions

By combining digital listening with survey research and focus groups, you can build a richer, more complete picture of your brand—one that reflects both what people tell you and what they say when no one’s asking.

Brand research FAQs

Brand research can cover a lot of ground—especially if you’re new to it or trying to scale your approach.

Below, we’ve answered some of the most common questions to help you better understand how brand research works, why it matters, and how to use it effectively.

What’s the difference between brand research and brand analysis?

Brand research is the process of gathering data on how people perceive your brand through methods like surveys, focus groups, or social listening. It’s the investigative stage, where you ask questions to understand brand awareness, perception, loyalty, and more.

Brand analysis is what comes next. It’s the process of interpreting that data to uncover insights, identify patterns, and make decisions that shape your brand strategy.

Research gives you the raw information; analysis turns it into action.

How often should you conduct brand research?

It depends on your goals, market dynamics, and business size—but the short answer is: more often than you think. While it’s not possible for lots of businesses, there’s a good reason—or really, lots of good reasons—why the world’s leading brands make continuous brand research a priority, year in, year out.

In fast-moving markets or during brand shifts—like a rebrand, new product launch or marketing strategy, or a crisis—deeper research is crucial. The same applies when a major new competitor enters your market: Red Bull’s US market entry would have been an excellent time for incumbents to commission fresh brand research.

What’s the difference between qualitative and quantitative brand research?

Like in any form of research, quantitative brand research focuses on numbers—it’s about measurable data collected at scale, often via surveys. This helps you answer questions like “How many people are aware of our brand?” or “How does our Net Promoter Score compare over time?”

Qualitative research, on the other hand, digs into the why. Through interviews, focus groups, or open-ended feedback, you can explore the attitudes, perceptions, and emotions people hold when it comes to your brand.

Both methods offer unique value: quantitative gives you the numbers; qualitative gives you the story behind the numbers.

How can brand research help in a crisis?

Assumptions are always risky within any business—especially in crisis mode. You need facts in a crisis, which is why brand research becomes even more valuable.

Done well, brand research can help soften the blows of a crisis situation—helping you understand consumer perception has been impacted, where trust has been lost, and what concerns need to be addressed.

By listening to customers, you can tailor your messaging, rebuild credibility, and avoid further reputational damage.

Why continuous brand research matters

Brand research should never be seen as a one-and-done—especially in today’s fast-moving markets, where customer expectations, competitor activity, and cultural context can shift quickly.

Only with an always-on approach to brand tracking can you truly know how your brand is performing. It will help you respond faster, track the impact of campaigns in real time, and adapt before small issues become bigger problems.

With continuous brand research, you can:

- Detect changes early: Spot shifts in sentiment, awareness, or preference as they happen, not months later

- Track long-term progress: Understand how brand equity builds—or erodes—over time with consistent metrics and benchmarks

- React in real time: Adjust your messaging, media spend, or customer experience based on live data

- Validate actions quickly: See whether a new campaign, rebrand, or product launch is landing as intended—without waiting for a quarterly review

Most importantly, continuous brand research gives you confidence. It removes guesswork, validates decisions, and helps you build a brand that’s not just consistent but consistently improving.

Generate brand insights and turn them into action with Qualtrics

The most successful brands don’t just measure—they act. With Qualtrics Brand & Communication Research, you can move beyond static reports and transform your brand data into fast, confident decisions.

Whether you’re building a brand from scratch or evolving one already in market, Qualtrics gives you the tools to uncover what matters, act at speed, and stay ahead of change.

Identify untapped opportunities

Qualtrics connects data from every source—structured and unstructured, from surveys to social—to help you see the full picture of your brand’s health.

By analyzing patterns in real-time customer feedback, Qualtrics Brand & Communication Research highlights emerging trends and unmet customer needs, so you can capitalize on white space before your competitors do.

Make faster, data-driven decisions

With built-in analytics, dynamic dashboards, and automated feedback flows, our platform equips you to move at the speed of business.

Instead of waiting for quarterly reports, you get continuous insights that help you fine-tune messaging, test new ideas, and respond to shifts in consumer sentiment as they happen.

Simulate scenarios and predict impact

Use predictive analytics to test brand strategies before launch. Model how changes to your messaging, creative, or experience influence key brand metrics—like awareness, equity, or consideration—and optimize for impact before you go live.

Understand and replicate success

By linking brand metrics to business outcomes, Qualtrics helps you pinpoint what’s working and why. Whether it’s a campaign that’s driving recall or a message that’s boosting trust, you’ll be able to identify the levers behind high performance and apply them consistently across regions, products, or channels.

See for yourself and take a tour of Qualtrics Brand & Communication Research today