There’s clearly a disconnect between how large a brand looms in the minds of marketers and in the minds of consumers. How to harness what happens in those seven seconds of a consumer choosing a product is clearly critical to brand equity. Here are some ideas for approach, and questions to include in your brand equity research.

Out with the old…

Traditional brand surveys present a consumer with a long list of competitor brands that loom large in the minds of the marketers, but often don’t bother the consumer at all. Up until now, customers have had no way of going ‘off script’ with their answers – they’ve had to select what was given to them. Herein lies the problem with traditional check box surveys and brand tracking; marketers push their own biases, fears and beliefs onto consumers when they are surveyed, rather than letting the consumer say what’s on their mind, unprompted. This approach doesn’t represent the consumer world view, and misunderstanding what drives purchases affects a brand’s equity.

…in with the new

There is a new way. When trying to get as close to real-world purchasing behaviors as possible, just ask consumers ‘which brands matter to you?’ With open text questions, consumers can express their preferences in their own words, and you’ll be able to analyze their responses to reveal which brands they use or consider. You can also use this approach to learn what consumers think of other aspects of your brand equity: logo, imagery, or quality.

The right questions, at the right time, of the right people

Your brand is unique, so there’s no need to stick to every standard metric or question – cherry pick the ones that give you the most valuable data. There are some that we would recommend considering:

Awareness

The first step towards building brand equity, and often reported to the C-suite as a measure of brand performance. It’s a measure that matters to all brands.

Awareness can take three forms:

Top of mind: This is the first brand consumers recall when given a category cue, e.g. ‘Think about supermarkets in your area. Which one first comes to mind?’ [Consumer writes open text].

Spontaneous: Awareness of other brands, as well as the one top of mind, e.g. ‘What other supermarkets in your area come to mind? Please list up to 3 more supermarkets.’ [Consumer writes an open text list of three more supermarkets]

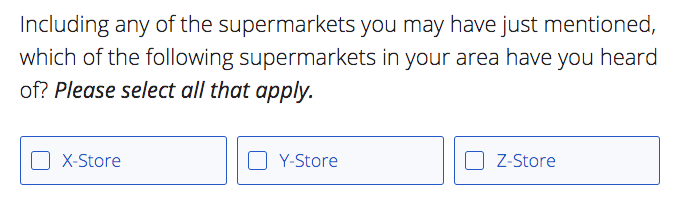

Aided: Recognition when prompted by a stimulus such as a brand name or logo. [Consumer selects] For example:

Consideration

This is a useful measurement as it asks about consumers’ future behavior. It measures in both absolute and relative terms:

Absolute consideration

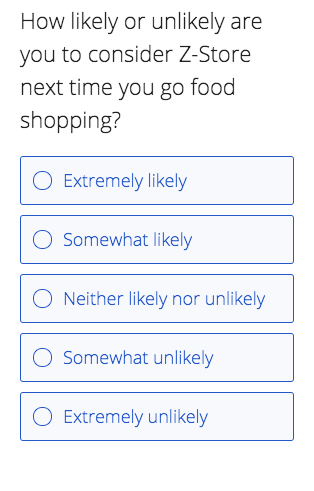

Measures the likelihood of choosing a brand in the future [Consumers select from a Likert Scale] For example:

Relative consideration

This measures how likely your brand is to be a consumer’s ‘back-up plan’, behind the one they use regularly, e.g. ‘if your favorite brand isn’t available, which other brands would you consider?’ [Consumers can write open text answers, mentioning, we hope, your brand].

- Loyalty and usage: Open text questions are particularly useful here, as consumers can both express their sentiments and reveal their buying habits, e.g. ‘How often do you buy this brand?’ Instead of ticking ‘weekly, monthly, yearly’ formulaic boxes, answers such as ‘when I run out’ [consumer has intention to rebuy] or ‘when I fancy a change’ [consumer is not particularly brand loyal] reveal far more about buying behavior.

- Brand perception: Because brand perception evolves day by day, and is closely tied in with sales and profits, it’s essential to know what the marketplace thinks. See our Brand Perception Survey Questions for examples of questions to include

- Brand relationship/attitude: To round off a survey, a strong indicator for brand equity comes from Net Promoter Score data. It asks the simple question ‘On a scale of 0-10, how likely are you to recommend [Brand X] to a friend or colleague?’ A high NPS score indicates high brand equity.

When your brand equity is gauged effectively through research, this informs brand positioning – where your brand is implanted into consumers’ minds and differentiated from rival brands in the marketplace. Whatever metrics you choose, keep them, and your questions, simple.

Get started with our free brand awareness survey template