XM Solution Guided Program

Retail Banking Accelerator

Introducing our Retail Banking Accelerator - a comprehensive customer experience management platform for banks and credit unions that transforms customer feedback into actionable insights and recommendations.

Core Experience

Customer Experience

Created By

Qualtrics

COST

Contact for quote

This Retail Banking Accelerator Solution enables you to get your experience management initiatives up and running quickly and at a low fixed cost so that you can focus on generating insights into what your customers are experiencing. Benefits include:

- Increased speed-to-insight: Instead of building surveys and dashboards from scratch, the accelerator has pre-built surveys, dashboards and workflows to save from 20-100+ hours of build work. You don’t need to hire or invest your own limited resources in training to build surveys and dashboards.

- Best practices: Our XM Scientists built this accelerator using certified questions that have been tested over time and are consistently used in banking, together with an expert-backed platform configuration that follows Qualtrics’ best practices and methodologies.

- Implementation expertise: A Qualtrics certified partner will configure and implement the solution at a predetermined cost and timeframe.

- Benchmarks: A wide range of industry-based benchmarks (such as NPS and CSAT benchmarks) that allow you to measure your customers’ experiences against those of similar sized financial institutions.

- Fixed price: The packaged accelerator solution with no modifications is offered at a fixed price for the software and separately, a fixed price for the partner implementation.

Outcomes Delivered

- Focus on high-touch, high-value moments by streamlining omni-channel interactions and optimizing moments that matter

- Deepened customer relationships by measuring customer experience, identifying strategic drivers of loyalty and introducing products and services that resonate with customers

- A culture of systematic service recovery by improving customer interactions across all channels and touchpoints

Category Tags

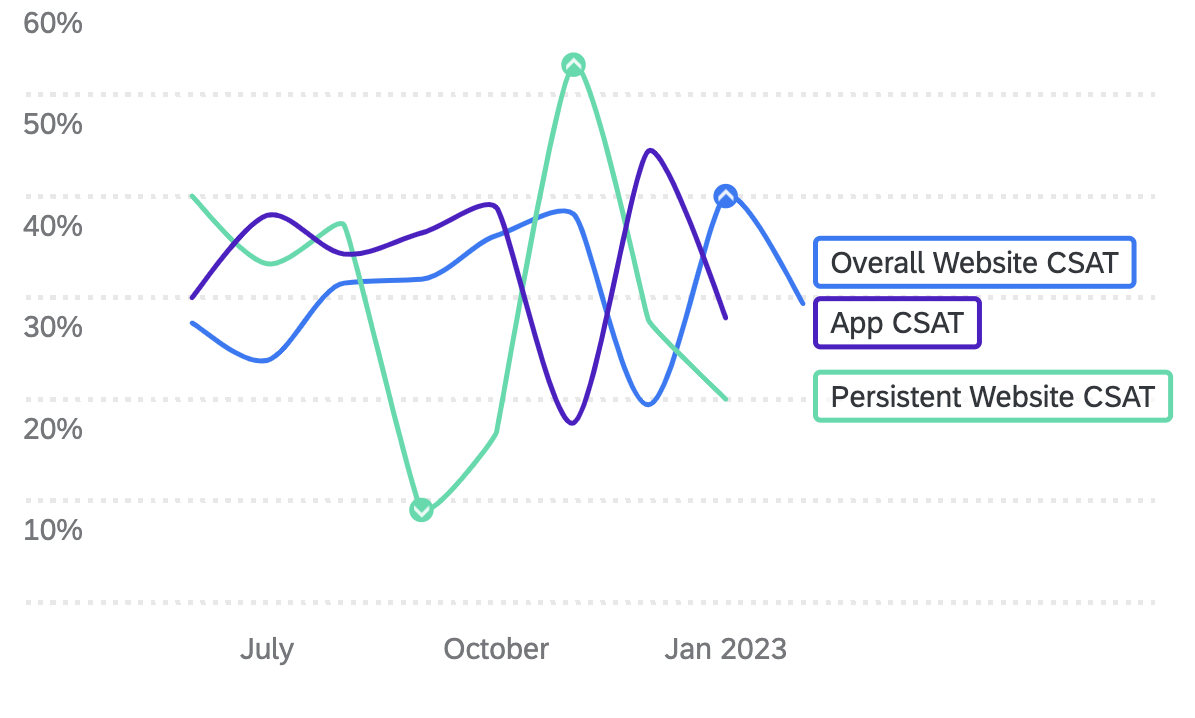

Real-time dashboards that monitor customer experiences

Monitor customer experiences in real time with expertly designed dashboards which include data analysis, text analysis and benchmarks to compare your customer experiences against those of similar sized financial institutions.

Industry-defining best practices

Our XM Scientists built the accelerator using industry certified questions that have been tested over time and are consistently used in banking.

What You Get

A fully developed, ready-to-implement XM program based on the Qualtrics CX Foundational program that consisting of the following:

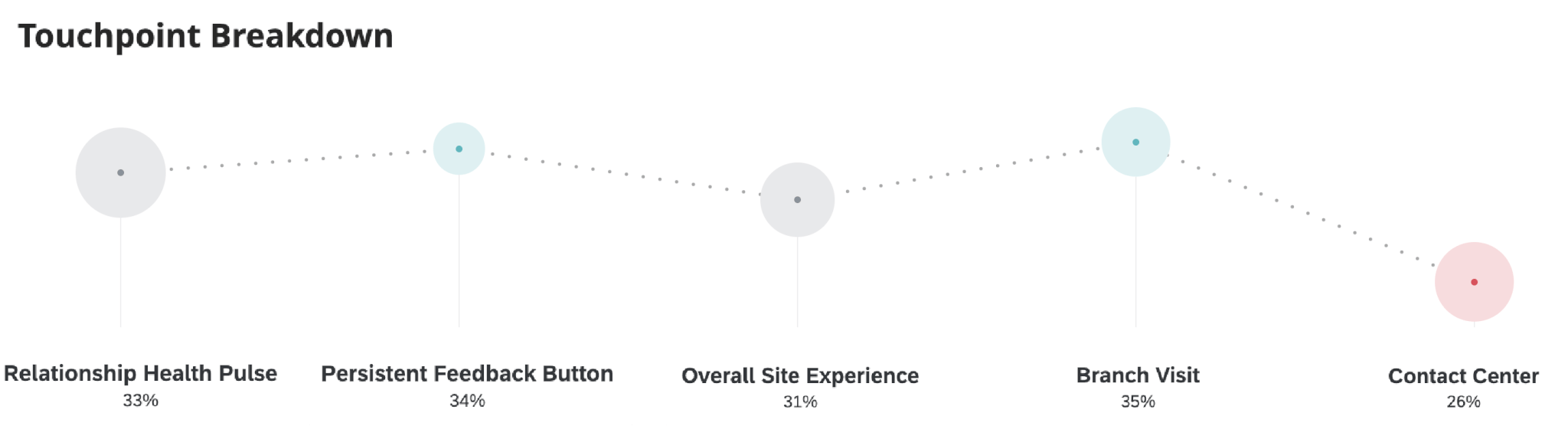

- Executive summary dashboard with relationship survey and channel survey outcomes

- Relationship survey and dashboard

- Contact center survey and dashboard

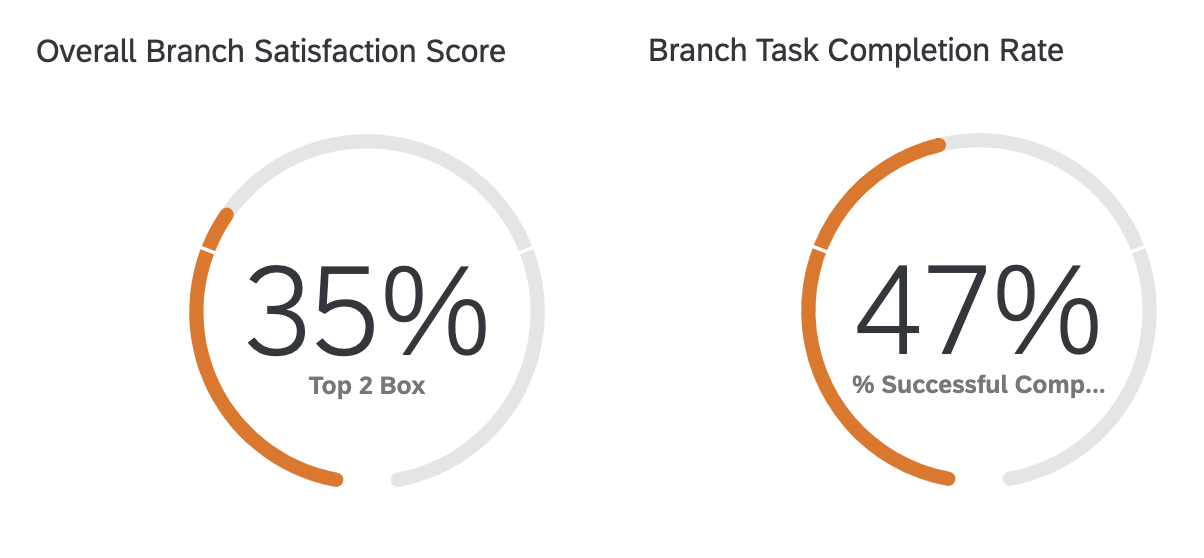

- Branch survey and dashboard

- Web survey and dashboard

- Web persistence survey and dashboard

Prebuilt surveys and dashboards

The CX Accelerator Solution is powered by pre-built survey templates, dashboards, benchmarks and analytics that are specifically tailored for banks and credit unions. Implement programs faster and at lower costs, all while demonstrating quick return on investment.

Expertise and best practices

Surveys and templates designed by Qualtrics XM Scientists using certified questions that have been tested over time and are consistently used in banking, implemented by a Qualtrics certified partner who will configure and implement the solution at a predetermined cost and timeframe.

Languages

English

Category Tags

Featured Solutions

Not a Qualtrics XM Customer?

Qualtrics Experience Management Platform™ is used by the world’s most iconic brands to

optimize the four core experiences of business.