What is employee financial wellness?

Employee financial wellness is the confidence and empowerment that employees feel when they know they can pay their bills, finance unexpected costs, and look forward to a healthy financial future.

Employees who enjoy financial wellness have few money worries, and they know how to deal with them. They’re paid a fair salary, are able to make sound financial decisions, can manage any debt and savings, and don’t experience stress when they think about money.

Employees who have financial wellness don’t bring money stress and worries into work: they can concentrate fully on their jobs instead.

Learn more: Improve employee financial wellness with benefits surveys

Why is financial wellness important?

Worrying about money and finances is miserable for anyone, and for employees, it impacts negatively on both their personal and their professional lives.

For a company, this really matters because poor financial wellness affects your business. Ways in which financial stress affects a company include:

Absenteeism and lateness

One study found that employee financial stress caused a 34% increase in being late to or absent from work. Employees with money worries also miss 3.5 work days a year, almost double that of people with financial wellness.

Presenteeism

The other side of the unhealthy work attendance coin, presenteeism – employees coming to work when physically or mentally unwell, or working excessively long hours – is harmful to the overall health of your workforce.

Drop in productivity

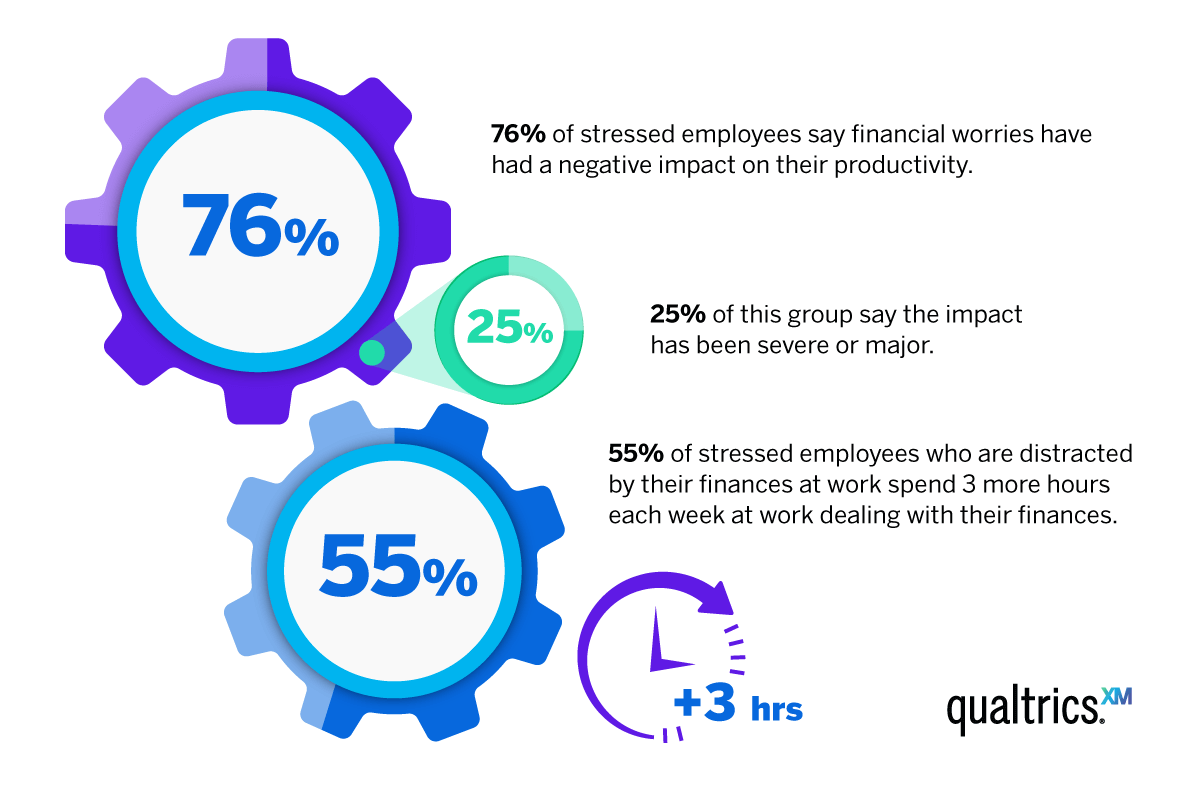

According to a report by PwC, there’s more distraction and less productivity when you have financially stressed employees:

- 76% of employees experiencing stress said financial worries negatively impact their productivity, with 25% of those saying the impact was severe

- 55% of stressed employees were distracted by their money worries and spent more than 3 work hours per week dealing with their personal finances.

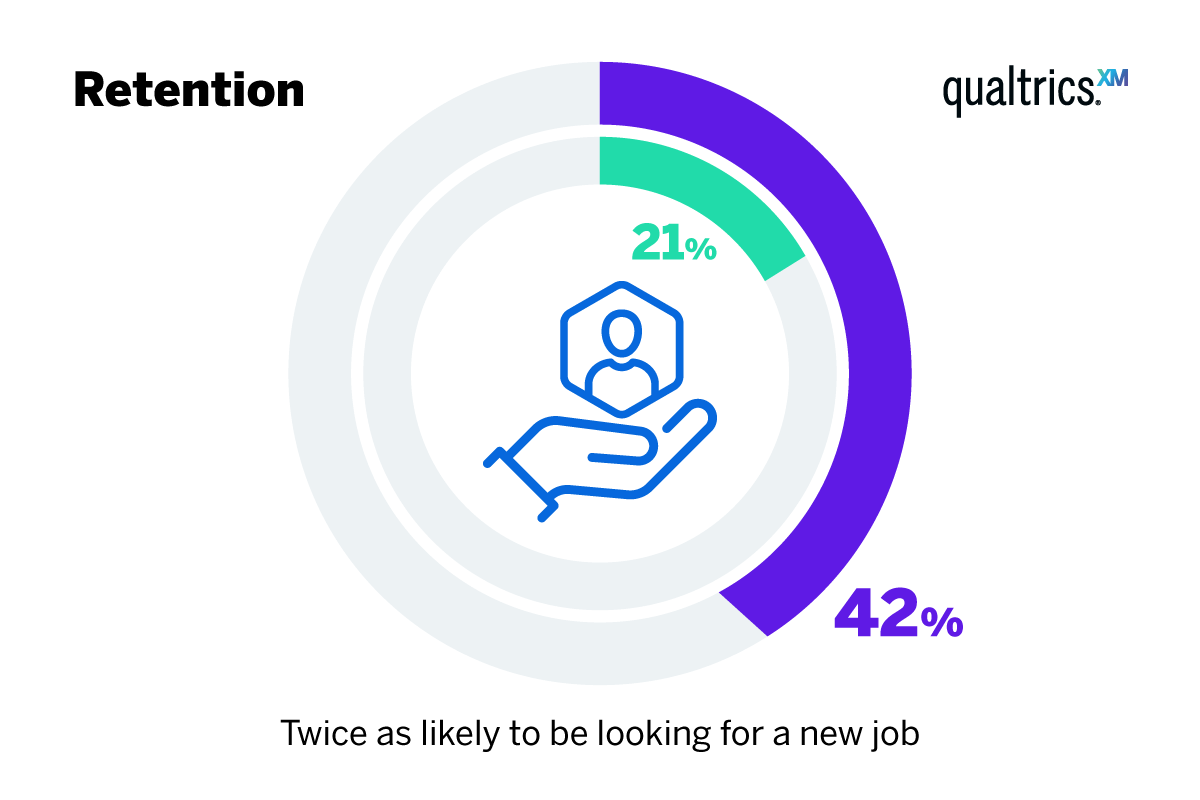

Higher turnover

Employees with financial stress are twice as likely (42%) to be looking for a new job than those without. When people fear that they cannot afford their financial commitments (retirement saving, school loan repayments, mortgages) on the salary your company offers, they will actively consider leaving their jobs, even their industry sector.

Harder recruitment and hiring

A company that offers generous employee financial wellness solutions, from coaching to employee assistance programs, will find it easier to recruit top talent. Having an employee financial wellness program distinguishes you from other companies that may not offer this benefit.

More expensive healthcare costs

Financial worries as part of job stress can be associated with increased rates of heart attack, hypertension, and other disorders, according to the American Institute of Stress.

20% of Americans have said that they have either considered skipping or skipped going to the doctor in the past year when they needed health care because of financial concerns, which may result in higher health care costs for your company later.

What is the return on investment (ROI) for businesses focusing on a financial wellness program?

The ROI of any sort of wellness is difficult to measure at the best of times. Productivity, absenteeism and sickness fluctuate all the time and these fluctuations may be completely unrelated to employee financial stress. The Consumer Financial Protection Bureau said employers typically see a return of $3 for every $1 spent on financial wellness programs.

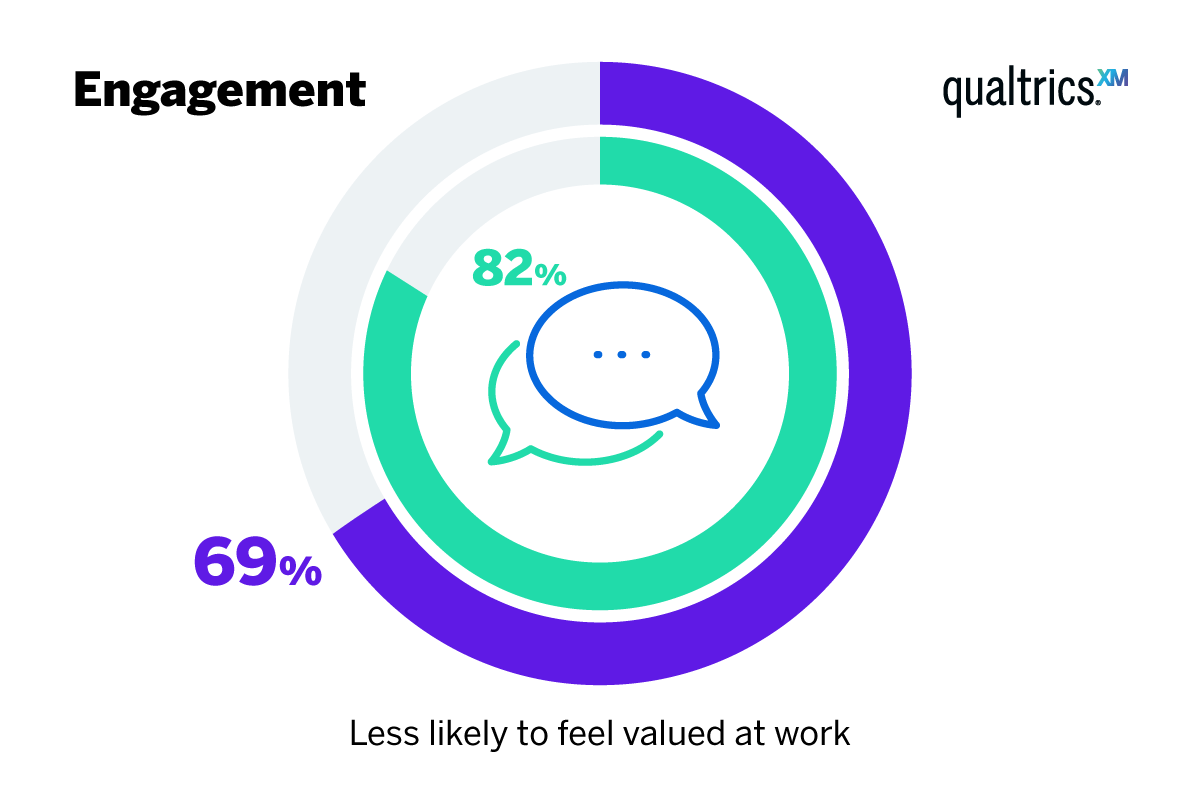

However, a more reliable way to prove a financial wellness program’s value is by measuring employee engagement. Employees who say they have financial stress are less likely to feel valued at work.

Employee financial wellness programs examples

The most common employee financial well being benefits that companies offer include:

Retirement savings plan aka 401(k) plan

Employees choose to defer some of their salary. Instead of receiving that sum in their paycheck, the employee delays getting that money, and instead, it goes into a 401(k) plan sponsored by their employer.

‘Safety net’ insurance

Various insurances, including disability insurance and life insurance in case the worst happens.

Education benefits

Tuition fee reimbursement, 529 plans and student loan support from the employer are highly sought-after employer benefits, particularly among younger employees burdened with student debt.

Emergency fund

45% of unemployed Americans and 16% of working Americans feel that emergency funds are one of the most important of the financial wellness resources offered by employers. These take the form of payroll advances, or short term employee loans which are gradually paid back through payroll deductions.

Financial coaching

This initiative can help reduce financial worries before they even begin by educating employees. Not everyone has access to information and education about financial issues in their day to day life, so such a program is tremendously valuable for employees’ financial wellness.

As there is a connection between financial wellness and mental health, consider offering financial coaching alongside your employee mental health resources.

Specific topics can include:

- Personal finance

- Household budgeting and living expenses

- Managing credit and debt

- Saving

- Taxation

- Investing

- Renting or home ownership

Financial planning

For a longer term view, financial planning may include meetings with a specialist financial advisor to discuss:

- Retirement planning

- Investments

- Stock options

- Wealth management

- Estate planning

Creating your own employee financial wellness program

As we’ve shown above, the negative impact of employee financial stress can run deep within an organization. Addressing those financial challenges, and thereby improving the self esteem and work atmosphere for your employees can:

- Reduce absenteeism

- Avoid lost productivity

- Provide education

- Improve work performance

- Avoid health issues

Here’s how to get started:

1. Set your goals

There are two main goals of any financial wellness program:

- To help your employees enjoy a better state of financial wellbeing

- To achieve employer goals such as improving productivity, raising employee morale, reducing turnover rate

Your financial wellness program will most likely be part of your human resources department, and as such it is an HR strategy. HR departments tend to have access to a company’s operational (O) data and experience (X) data, which gives a holistic view of the whole organization.

When you combine O-data X-data, you’ll be able to pick up signs of a decline in employee financial wellness with metrics such as absenteeism, employee turnover, customer satisfaction, and employee engagement. With this information, you can step in and remedy problems before your employees burn out with financial stress.

2. Identify internal challenges

Financial wellness services and an employee assistance program don’t come cheaply, especially when offered by an employer. You’ll need to look at:

- Costs – you’ll need to have sufficient capital to offer loans and financial wellness solutions, although certain non-profit organizations, financial institutions and brokers may offer free resources

- Leadership buy-in – Management will need to see evidence of an ROI for any proposed financial wellness program

- Quantifying results – you’ll need to set up financial wellness solutions to gather data, analyze it and present it in an engaging visual way so that you can take action

- Opt-ins: Not everybody will need to, or want to, take part in employee financial wellness programs, so it’s best to offer the programs as optional, for those who need them most.

3. Listen to assess employees’ financial health

A simple way to find out what your employees are facing financially is to ask them. Surveys are your ally here; either include financial wellbeing questions in your employee engagement survey or send round pulse surveys that cover aspects of financial literacy.

When you use surveys, bear the following important points in mind:

- Understand that personal finances, and how employees feel about them, is a sensitive and stressful topic

- Use surveys to have employees opt into the program

- The survey must be anonymous, and you must let employees know that

- Communicate with your employees and actively engage them with your program

Example questions for your surveys:

Using a Likert scale of ‘Strongly Agree/Agree/Neither agree nor disagree/Disagree/Strongly Disagree’ and a follow-up open text box for each one, ask questions such as:

Are financial worries currently affecting your mental wellbeing?

Tell us which aspects of your finances affect your mental wellbeing the most

I feel confident I could handle a major unforeseen expense.

Please add more detail.

I am satisfied with my salary and benefits.

How else could we offer you support?

Our company supports your financial wellbeing. Please give details to help us understand your response.

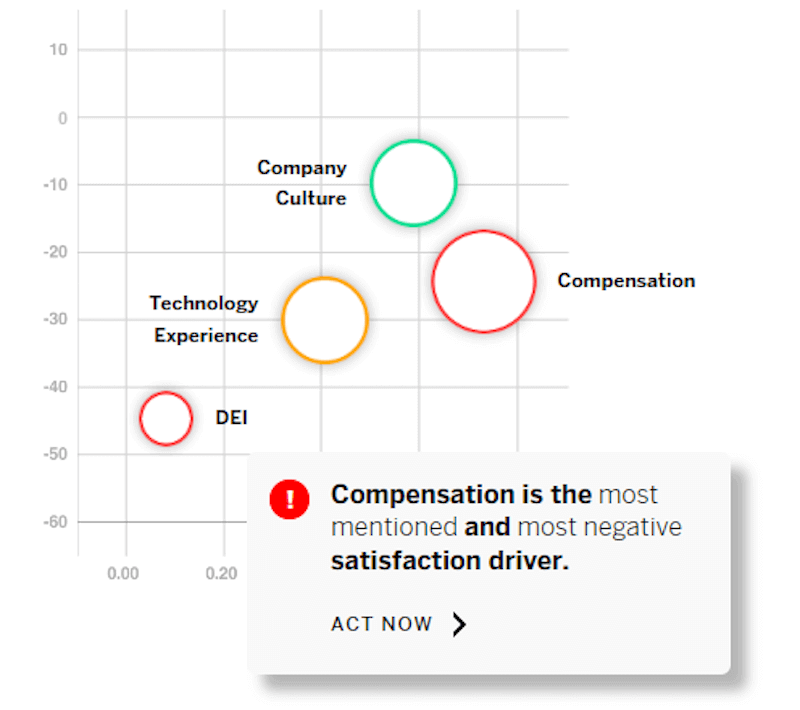

4. Conversational Intelligence and analytics software

This can help you to understand what employees are saying about financial wellness, whatever platform they’re saying it. From the contact center to social media to online reviews—and everywhere in between.

With Qualtrics’ Employee Listening solution, you’ll hear every voice, even the quiet ones. The software combs through every platform to understand how employees feel about your company. Using natural language processing, conversational intelligence and analytics software knows the difference in

the subtleties of human language (even emojis), to reveal the emotion, intent, and effort of each interaction.

5. Establish metrics to measure the success of your employees’ financial wellness

Employee financial wellbeing needs to be a core metric of your employee engagement model as disruption continues into 2023. Employees cannot thrive or do their best work when they are stressed about money, so active listening and acting to alleviate them is essential for employee happiness.

A successful employee financial wellness program will deliver tangible results. You should find positive changes in the following metrics:

- Employee satisfaction

- Employee engagement

- Productivity

- Retention

- ROI (cost savings, employee retention, turnover)

- Retirement offering participation

- Number of program participants

It’s important to find out where your employees are at, financial healthwise, and what company wellness programs are already in place so you can identify the gaps and risks.

6. Act on the findings of your employee financial wellness data

Once you know which areas you are lacking, or need to improve, you can set up employee resource groups and programs to support your workforce.

Every company is different, and employees will ask for different things. With Qualtrics Employee Listening software, you’ll be able to listen to every voice in your organization, take the right actions to enhance financial wellness, and look after your valuable people whatever the economic climate.

Improve employee financial wellness with benefits surveys