What is customer lifetime value (CLV)?

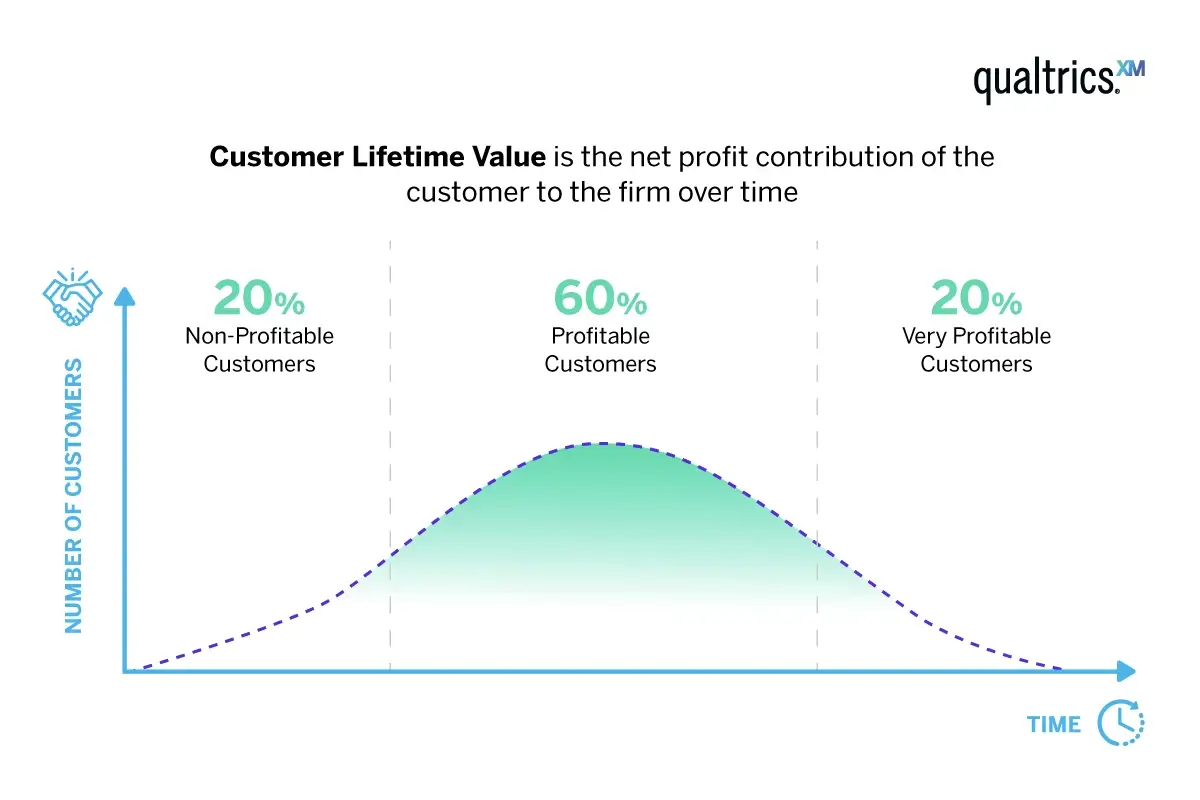

Customer lifetime value is the total worth to a business of a customer over the whole period of their relationship with the brand. Rather than looking at the value of individual transactions, this value takes into account all potential transactions to be made during a customer relationship timespan and calculates the specific revenue from that customer.

There are two ways of looking at customer lifetime value: historic customer lifetime value (how much each existing customer has already spent with your brand) and predictive customer lifetime value (how much customers could spend with your brand). Both measurements of customer lifetime value are useful for tracking business success.

Free eBook: The ultimate guide to improving customer loyalty

Historic customer lifetime value

If you’ve bought a $40 Christmas tree from the same grower for the last 10 years, for example, your customer lifetime value has been $400 – pretty straightforward. This is an example of historic customer lifetime value– a measure that works by looking back at past events. It’s helpful to understand what an existing customer has brought to your brand and for building profiles of ideal customers, but it’s not as useful for predicting future revenue when considered alone.

Predictive customer lifetime value

You can also calculate predictive customer lifetime value. This is an algorithmic process that takes historical data and uses it to make a smart prediction of how long a customer relationship is likely to last and what its value will be. It can take into account customer acquisition costs, average purchase frequency rate, business overheads and more to give you a more realistic customer lifetime value prediction. It can be a more complex way to calculate customer lifetime value, but it can help you to see when you need to invest in your customer loyalty.

How is customer lifetime value different from other customer metrics?

Customer lifetime value is distinct from the Net Promoter Score (NPS) that measures customer loyalty, and CSAT that measures customer satisfaction because it is tangibly linked to revenue rather than a somewhat intangible promise of loyalty and satisfaction.

It’s a confirmed understanding of how much loyal customers bring to your business financially, or in the case of predictive customer lifetime value, how much they are likely to bring based on past data.

Knowing existing customers’ lifetime values helps businesses to develop targeted strategies to acquire new customers and retain existing ones while maintaining profit margins. Read on to understand why customer lifetime value is a key metric to track, and how to calculate and improve on it.

Why is customer lifetime value important to your business?

It helps you save money

Customer lifetime value is an important metric to track, as it costs less to keep existing, loyal customers than it does to acquire new ones. Recent research has found that even in sectors with potentially easier customer acquisition, such as e-commerce, there’s been a 222% increase in costs for new customers over the last eight years.

Focusing on increasing the current customer lifetime value of your existing customers is a great way to drive growth. Rather than relying on new customers (and spending lots to get them), you can figure out what keeps your customer base loyal and replicate your actions for increased value with existing customers.

It helps you spot and stop attrition

Customer lifetime value is a great metric to use to spot early signs of attrition and combat them. Let’s say you notice that customer lifetime value is dropping, and pinpoint that customers are neglecting to sign up for a continuation of an ongoing subscription of your product or service. You might decide to launch or improve a loyalty program to tempt customers back, or provide better customer support or marketing efforts around renewal times to help encourage customers to sign up again. This will help to increase customer lifetime value and business revenue again.

It helps you find your best customers and replicate them

Your best customers will have a higher customer lifetime value, and through careful analysis you’ll be able to understand the commonalities between these individuals. What drives them to buy into your brand again and again? Is it a common need, a particular income bracket, a specific geographical location? You can define a whole customer segment based on these higher value existing customers alone.

Once you’ve analyzed the drivers for high customer lifetime value and created a buyer persona specifically for this type of customer, you can seek out new customers using this information. Once you’ve got them on board, you have your predictive customer lifetime value to rely on for future revenue.

How much are your existing customers costing you?

Customer lifetime value goes hand in hand with another important metric – CAC (customer acquisition cost). That’s the money you invest in attracting a new customer, including advertising, marketing, special offers and so on. Customer lifetime value only really makes sense if you also take the customer acquisition cost into account.

For example, if the customer lifetime value of an average coffee shop customer is $1,000 and the customer acquisition cost is more than $1,000 (using advertising, marketing, offers, etc.) the coffee chain could be losing money unless it pares back its customer acquisition costs.

Another factor in the equation is Cost to Serve. This is part of the cost of doing business, and it involves everything you do to get the product or service into the customer’s hands and doing what they need it to do. For example, logistics, overheads in your physical location, contact center costs and so on.

Breaking this down by customer can help you understand these costs on a granular level, and dig into details like whether your customers with a higher customer lifetime value cost the same as the low ones, and whether some customers are more expensive than others. If the cost of serving existing customers becomes too high, you may be making a loss despite their seemingly high customer lifetime value.

Cost to serve may vary across the customer lifetime, unlike customer acquisition which is a one-off expense. To use a paid TV subscription as an example, your cost to serve might be higher in the first year of a contract but gradually drop off the longer the customer stays with you. Thus, if your renewal rates drop, your average cost to serve is likely to rise and cause a drop in profitability.

Understanding these numbers over time and being able to track them side by side is the only way to get a true understanding not only of what’s driving customer spend and loyalty but also what it’s delivering back to the business’s bottom line.

Start your customer experience journey with Qualtrics today

How do you calculate customer lifetime value (CLV)?

There are a couple of factors that go into how you calculate customer lifetime value – we’ve laid them out below.

A simple customer lifetime value formula

The simplest formula for measuring customer lifetime value is:

Customer revenue per year * Duration of the relationship in years – Total costs of acquiring and serving the customer = customer lifetime value

This formula is suitable for situations where the figures are likely to remain relatively flat year-on-year.

There are other useful formulas that can help you to calculate customer lifetime value. Read our helpful guide to calculating customer lifetime value to understand what these formulas are and how to apply them.

Other important factors for your customer lifetime value calculation

As you can imagine, in bigger companies with more complex products and business models, customer lifetime value gets more complicated to calculate.

Some companies don’t attempt to measure customer lifetime value, citing the challenges of segregated teams, inadequate systems, and untargeted marketing.

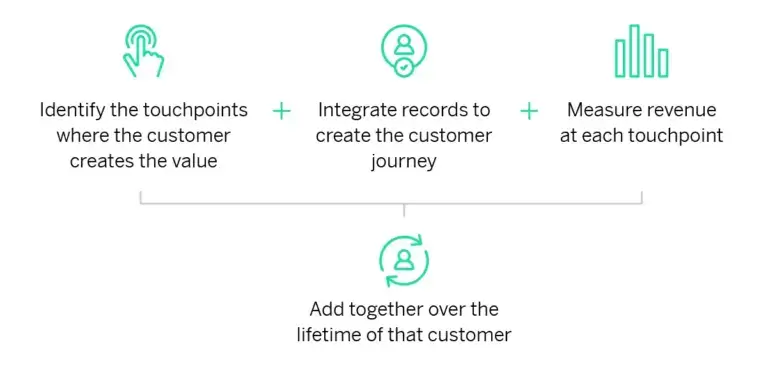

When data from all areas of an organization is integrated, however, it becomes easier to calculate customer lifetime value more accurately.

Customer lifetime value can be measured in the following way:

- Identify the touchpoints where the customer creates the value

- Integrate records to create the customer journey

- Measure revenue at each touchpoint

- Add together over the lifetime of that customer

How to improve customer lifetime value (CLV)

Customer lifetime value is all about forming a lasting positive connection with your customers. So it naturally follows that the way to boost your customer lifetime value figures is to nurture those customer relationships. Here are a few ways of doing that.

Invest in customer experience

Customer experience is made up of every instance of connection between a customer and a brand, including store visits, contact center queries, purchases, product use and even their exposure to advertising and social media. Improving the experience is a business-wide endeavor that’s often addressed using a customer experience management program. This is a process of monitoring, listening and making changes that add up to a lasting improvement in how customers feel and their tendency to be loyal over the long-term.

Ensure your onboarding process is seamless

Customer experience starts the moment a potential customer encounters your brand, but often companies can forget that customers need care after the purchase. Make sure your onboarding process is optimized for your customers’ needs, and it’s as simple and easy as possible for minimal customer effort. Personalization and communicating the extra value you provide to your customers should be a priority. You should also remember that how you treat your customers during the onboarding process is how they expect to be treated ongoing, so make sure your customer experience reflects this.

Start a loyalty program

A loyalty program incentivizes repeat business by offering discounts or benefits in return. A loyalty program might take the form of a loyalty card or app, or a points system that customers accrue when they make a purchase. Although it’s not a silver bullet for customer retention, a loyalty program can yield great results when it’s planned and executed well.

Recognize and reward your best customers

With your customer experience management program up and running, you’ll already have some ideas about which customers are likely to have the best customer lifetime value. You can nurture your relationships with these individuals or groups using targeted marketing and special offers that recognise their loyalty. This could include free expedited shipping, top-tier benefits in your loyalty program, or access to exclusive or pre-release products and services.

Provide omnichannel support

Your customers will have a variety of preferences for how they engage with you, so your support channels need to reflect this. Do your research to find out which channels your particular customer base prefers, rather than just offering what you think they’ll want to use. Get customer feedback on self-service options and frontline interactions to provide a great customer experience with omnichannel support.

Remember the power of social media

Social media is increasingly important not only for customer communication, but for customers to gather information on your brand and public image. If customers feel as though your social media responses to a query or issue aren’t fast enough, thorough enough, or empathetic, this will affect the opinion the customer has of your brand moving forward. Make sure you factor in social media – mentions, and responses into your customer experience strategy.

Close the loop with unhappy customers

Closed-loop feedback is a powerful way to reduce unwanted churn and turn dissatisfied customers into newly loyal ones. In this model, businesses proactively reach out to detractors or complainants and intervene before issues can escalate and lead to a breakdown of the customer relationship. In many cases, this targeted effort and active listening on the part of the business actually makes the relationship stronger than it was originally. It’s a valuable extension of your customer experience management program.

Making customer experience a vital driver of customer lifetime value

Ultimately, you don’t need to get bogged down in complex calculations – you just need to be mindful of the value that a customer provides over their lifetime relationship with you. By understanding the customer experience and measuring feedback at all key touchpoints, you can start to improve on the key drivers of customer lifetime value.

At Qualtrics, we believe that customer experience is a vital reason why customers return to a brand again and again. By focusing on customer experience, you’re able to easily increase customer lifetime value – we’ve found that customers who rate an experience 5/5 stars are more than twice as likely to buy again, and 80% of satisfied consumers will spend more.

Make accurate predictions for future revenue based on a holistic view of your customers’ relationship with your brand. See customer acquisition costs and more data alongside the results of customer satisfaction surveys and more on one integrated dashboard.

Free eBook: The ultimate guide to improving customer loyalty