Market research definition

Market research is the practice of gathering information about the needs and preferences of your target audience – potential consumers of your product.

When you understand how your target consumer feels and behaves, you can then take steps to meet their needs and mitigate the risk of an experience gap – where there is a shortfall between what a consumer expects you to deliver and what you actually deliver. Market research can also help you keep abreast of what your competitors are offering, which in turn will affect what your customers expect from you.

Market research connects with every aspect of a business – including brand, product, customer service, marketing and sales.

Market research generally focuses on understanding:

- The consumer (current customers, past customers, non-customers, influencers))

- The company (product or service design, promotion, pricing, placement, service, sales)

- The competitors (and how their market offerings interact in the market environment)

- The industry overall (whether it’s growing or moving in a certain direction)

Free eBook: The 4 AI categories shaping market research

Why is market research important?

A successful business relies on understanding what like, what they dislike, what they need and what messaging they will respond to. Businesses also need to understand their competition to identify opportunities to differentiate their products and services from other companies.

Today’s business leaders face an endless stream of decisions around target markets, pricing, promotion, distribution channels, and product features and benefits. They must account for all the factors involved, and there are market research studies and methodologies strategically designed to capture meaningful data to inform every choice. It can be a daunting task.

Market research allows companies to make data-driven decisions to drive growth and innovation.

What happens when you don’t do market research?

Without market research, business decisions are based at best on past consumer behavior, economic indicators, or at worst, on gut feel. Decisions are made in a bubble without thought to what the competition is doing. An important aim of market research is to remove subjective opinions when making business decisions. As a brand you are there to serve your customers, not personal preferences within the company. You are far more likely to be successful if you know the difference, and market research will help make sure your decisions are insight-driven.

Market research – in-house or outsourced?

Traditionally there have been specialist market researchers who are very good at what they do, and businesses have been reliant on their ability to do it. Market research specialists will always be an important part of the industry, as most brands are limited by their internal capacity, expertise and budgets and need to outsource at least some aspects of the work.

However, the market research external agency model has meant that brands struggled to keep up with the pace of change. Their customers would suffer because their needs were not being wholly met with point-in-time market research.

Businesses looking to conduct market research have to tackle many questions –

- Who are my consumers, and how should I segment and prioritize them?

- What are they looking for within my category?

- How much are they buying, and what are their purchase triggers, barriers, and buying habits?

- Will my marketing and communications efforts resonate?

- Is my brand healthy?

- What product features matter most?

- Is my product or service ready for launch?

- Are my pricing and packaging plans optimized?

They all need to be answered, but many businesses have found the process of data collection daunting, time-consuming and expensive. The hardest battle is often knowing where to begin and short-term demands have often taken priority over longer-term projects that require patience to offer return on investment.

Today however, the industry is making huge strides, driven by quickening product cycles, tighter competition and business imperatives around more data-driven decision making. With the emergence of simple, easy to use tools, some degree of in-house market research is now seen as essential, with fewer excuses not to use data to inform your decisions. With greater accessibility to such software, everyone can be an expert regardless of level or experience.

How is this possible?

The art of research hasn’t gone away. It is still a complex job and the volume of data that needs to be analyzed is huge. However with the right tools and support, sophisticated research can look very simple – allowing you to focus on taking action on what matters.

If you’re not yet using technology to augment your in-house market research, now is the time to start.

Market research in the age of data

The most successful brands rely on multiple sources of data to inform their strategy and decision making, from their marketing segmentation to the product features they develop to comments on social media. In fact, there’s tools out there that use machine learning and AI to automate the tracking of what’s people are saying about your brand across all sites.

The emergence of newer and more sophisticated tools and platforms gives brands access to more data sources than ever and how the data is analyzed and used to make decisions. This also increases the speed at which they operate, with minimal lead time allowing brands to be responsive to business conditions and take an agile approach to improvements and opportunities.

Expert partners have an important role in getting the best data, particularly giving access to additional market research know-how, helping you find respondents, fielding surveys and reporting on results.

How do you measure success?

Business activities are usually measured on how well they deliver return on investment (ROI). Since market research doesn’t generate any revenue directly, its success has to be measured by looking at the positive outcomes it drives – happier customers, a healthier brand, and so on.

When changes to your products or your marketing strategy are made as a result of your market research findings, you can compare on a before-and-after basis to see if the knowledge you acted on has delivered value.

Regardless of the function you work within, understanding the consumer is the goal of any market research. To do this, we have to understand what their needs are in order to effectively meet them. If we do that, we are more likely to drive customer satisfaction, and in turn, increase customer retention.

Several metrics and KPIs are used to gauge the success of decisions made from market research results, including

- Brand awareness within the target market

- New users

- Share of wallet

- CSAT (customer satisfaction)

- NPS (Net Promoter Score)

When to use market research

You can use market research for almost anything related to your current customers, potential customer base or target market. If you want to find something out from your target audience, it’s likely market research is the answer.

Here are a few of the most common uses:

Buyer segmentation and profiling

Segmentation is a popular technique that separates your target market according to key characteristics, such as behavior, demographic information and social attitudes. Segmentation allows you to create relevant content for your different segments, ideally helping you to better connect with all of them.

Buyer personas are profiles of fictional customers – with real attributes. Buyer personas help you develop products and communications that are right for your different audiences, and can also guide your decision-making process. Buyer personas capture the key characteristics of your customer segments, along with meaningful insights about what they want or need from you. They provide a powerful reminder of consumer attitudes when developing a product or service, a marketing campaign or a new brand direction.

By understanding your buyers and potential customers, including their motivations, needs, and pain points, you can optimize everything from your marketing communications to your products to make sure the right people get the relevant content, at the right time, and via the right channel.

Attitudes and Usage surveys

Attitude & Usage research helps you to grow your brand by providing a detailed understanding of consumers. It helps you understand how consumers use certain products and why, what their needs are, what their preferences are, and what their pain points are. It helps you to find gaps in the market, anticipate future category needs, identify barriers to entry and build accurate go-to-market strategies and business plans.

Marketing strategy

Effective market research is a crucial tool for developing an effective marketing strategy – a company’s plan for how they will promote their products.

It helps marketers look like rock stars by helping them understand the target market to avoid mistakes, stay on message, and predict customer needs. It’s marketing’s job to leverage relevant data to reach the best possible solution based on the research available. Then, they can implement the solution, modify the solution, and successfully deliver that solution to the market.

Product development

You can conduct market research into how a select group of consumers use and perceive your product – from how they use it through to what they like and dislike about it. Evaluating your strengths and weaknesses early on allows you to focus resources on ideas with the most potential and to gear your product or service design to a specific market.

Chobani’s yogurt pouches are a product optimized through great market research. Using product concept testing – a form of market research – Chobani identified that packaging could negatively impact consumer purchase decisions. The brand made a subtle change, ensuring the item satisfied the needs of consumers. This ability to constantly refine its products for customer needs and preferences has helped Chobani become Australia’s #1 yogurt brand and increase market share.

Pricing decisions

Market research provides businesses with insights to guide pricing decisions too. One of the most powerful tools available to market researchers is conjoint analysis, a form of market research study that uses choice modeling to help brands identify the perfect set of features and price for customers. Another useful tool is the Gabor-Granger method, which helps you identify the highest price consumers are willing to pay for a given product or service.

Brand tracking studies

A company’s brand is one of its most important assets. But unlike other metrics like product sales, it’s not a tangible measure you can simply pull from your system. Regular market research that tracks consumer perceptions of your brand allows you to monitor and optimize your brand strategy in real time, then respond to consumer feedback to help maintain or build your brand with your target customers.

Advertising and communications testing

Advertising campaigns can be expensive, and without pre-testing, they carry risk of falling flat with your target audience. By testing your campaigns, whether it’s the message or the creative, you can understand how consumers respond to your communications before you deploy them so you can make changes in response to consumer feedback before you go live.

Finder, which is one of the world’s fastest-growing online comparison websites, is an example of a brand using market research to inject some analytical rigor into the business. Fueled by great market research, the business lifted brand awareness by 23 percent, boosted NPS by 8 points, and scored record profits – all within 10 weeks.

Competitive analysis

Another key part of developing the right product and communications is understanding your main competitors and how consumers perceive them. You may have looked at their websites and tried out their product or service, but unless you know how consumers perceive them, you won’t have an accurate view of where you stack up in comparison. Understanding their position in the market allows you to identify the strengths you can exploit, as well as any weaknesses you can address to help you compete better.

Types of market research

Although there are many types market research, all methods can be sorted into one of two categories: primary and secondary.

Primary research

Primary research is market research data that you collect yourself. This is raw data collected through a range of different means – surveys, focus groups, , observation and interviews being among the most popular.

Pros

Primary information is fresh, unused data, giving you a perspective that is current or perhaps extra confidence when confirming hypotheses you already had. It can also be very targeted to your exact needs. Primary information can be extremely valuable. Tools for collecting primary information are increasingly sophisticated and the market is growing rapidly.

Cons

Historically, conducting market research in-house has been a daunting concept for brands because they don’t quite know where to begin, or how to handle vast volumes of data. Now, the emergence of technology has meant that brands have access to simple, easy to use tools to help with exactly that problem. As a result, brands are more confident about their own projects and data with the added benefit of seeing the insights emerge in real-time.

Secondary research

Secondary research is the use of data that has already been collected, analyzed and published – typically it’s data you don’t own and that hasn’t been conducted with your business specifically in mind, although there are forms of internal secondary data like old reports or figures from past financial years that come from within your business. Secondary research can be used to support the use of primary research.

Pros

Secondary research can be beneficial to small businesses because it is sometimes easier to obtain, often through research companies. Although the rise of primary research tools are challenging this trend by allowing businesses to conduct their own market research more cheaply, secondary research is often a cheaper alternative for businesses who need to spend money carefully. Some forms of secondary research have been described as ‘lean market research’ because they are fast and pragmatic, building on what’s already there.

Cons

Because it’s not specific to your business, secondary research may be less relevant, and you’ll need to be careful to make sure it applies to your exact research question. It may also not be owned, which means your competitors and other parties also have access to it.

Primary or secondary research – which to choose?

Both primary and secondary research have their advantages, but they are often best used when paired together, giving you the confidence to act knowing that the hypothesis you have is robust.

Secondary research is sometimes preferred because there is a misunderstanding of the feasibility of primary research. Thanks to advances in technology, brands have far greater accessibility to primary research, but this isn’t always known.

Different types of primary research

If you’ve decided to gather your own primary information, there are many different data collection methods that you may consider. For example:

- Customer surveys

- Focus groups

- Observation

- Interview

Think carefully about what you’re trying to accomplish before picking the data collection method(s) you’re going to use. Each one has its pros and cons. Asking someone a simple, multiple-choice survey question will generate a different type of data than you might obtain with an in-depth interview. Determine if your primary research is exploratory or specific, and if you’ll need qualitative research, quantitative research, or both.

Qualitative vs quantitative

Another way of categorizing different types of market research is according to whether they are qualitative or quantitative.

Qualitative research

Qualitative research is the collection of data that is non-numerical in nature. It summarizes and infers, rather than pin-points an exact truth. It is exploratory and can lead to the generation of a hypothesis.

Market research techniques that would gather qualitative data include:

- Interviews (face to face / telephone)

- Focus groups

- Open-ended survey questions

Researchers use these types of market research technique because they can add more depth to the data. So for example, in focus groups or interviews, rather than being limited to ‘yes’ or ‘no’ for a certain question, you can start to understand why someone might feel a certain way.

Quantitative research

Quantitative research is the collection of data that is numerical in nature. It is much more black and white in comparison to qualitative data, although you need to make sure there is a representative sample if you want the results to be reflective of reality.

Quantitative researchers often start with a hypothesis and then collect data which can be used to determine whether empirical evidence to support that hypothesis exists.

Quantitative research methods include:

- Polls

- Questionnaires

- Surveys

- Review scores

Exploratory and specific research

Exploratory research is the approach to take if you don’t know what you don’t know. It can give you broad insights about your customers, product, brand, and market. If you want to answer a specific question, then you’ll be conducting specific research.

- Exploratory. This research is general and open-ended, and typically involves lengthy interviews with an individual or small focus group.

- Specific. This research is often used to solve a problem identified in exploratory research. It involves more structured, formal interviews.

Exploratory primary research is generally conducted by collecting qualitative data. Specific research usually finds its insights through quantitative data.

How to do market research (primary data)

Primary research can be qualitative or quantitative, large-scale or focused and specific. You’ll carry it out using methods like surveys – which can be used for both qualitative and quantitative studies – focus groups, observation of consumer behavior, interviews, or online tools.

Step 1: Identify your research topic

Research topics could include:

- Product features

- Product or service launch

- Understanding a new target audience (or updating an existing audience)

- Brand identity

- Marketing campaign concepts

- Customer experience

Step 2: Draft a research hypothesis

A hypothesis is the assumption you’re starting out with. Since you can disprove a negative much more easily than prove a positive, a hypothesis is a negative statement such as ‘price has no effect on brand perception’.

Step 3: Determine which research methods are most effective

Your choice of methods depends on budget, time constraints, and the type of question you’re trying to answer. You could combine surveys, interviews and focus groups to get a mix of qualitative and quantitative data.

Step 4: Determine how you will collect and analyze your data.

Primary research can generate a huge amount of data, and when the goal is to uncover actionable insight, it can be difficult to know where to begin or what to pay attention to.

The rise in brands taking their market research and data analysis in-house has coincided with the rise of technology simplifying the process. These tools pull through large volumes of data and outline significant information that will help you make the most important decisions.

Step 5: Conduct your research!

This is how you can run your research using Qualtrics CoreXM

- Pre-launch – Here you want to ensure that the survey/ other research methods conform to the project specifications (what you want to achieve/research)

- Soft launch – Collect a small fraction of the total data before you fully launch. This means you can check that everything is working as it should and you can correct any data quality issues.

- Full launch – You’ve done the hard work to get to this point. If you’re using a tool, you can sit back and relax, or if you get curious you can check on the data in your account.

- Review – review your data for any issues or low-quality responses. You may need to remove this in order not to impact the analysis of the data.

A helping hand

If you are missing the skills, capacity or inclination to manage your research internally, Qualtrics Research Services can help. From design, to writing the survey based on your needs, to help with survey programming, to handling the reporting, Research Services acts as an extension of the team and can help wherever necessary.

How to do secondary market research

Secondary market research can be taken from a variety of places. Some data is completely free to access – other information could end up costing hundreds of thousands of dollars. There are three broad categories of secondary research sources:

- Public sources – these sources are accessible to anyone who asks for them. They include census data, market statistics, library catalogs, university libraries and more. Other organizations may also put out free data from time to time with the goal of advancing a cause, or catching people’s attention.

- Internal sources – sometimes the most valuable sources of data already exist somewhere within your organization. Internal sources can be preferable for secondary research on account of their price (free) and unique findings. Since internal sources are not accessible by competitors, using them can provide a distinct competitive advantage.

- Commercial sources – if you have money for it, the easiest way to acquire secondary market research is to simply buy it from private companies. Many organizations exist for the sole purpose of doing market research and can provide reliable, in-depth, industry-specific reports.

No matter where your research is coming from, it is important to ensure that the source is reputable and reliable so you can be confident in the conclusions you draw from it.

How do you know if a source is reliable?

Use established and well-known research publishers, such as the XM Institute, Forrester and McKinsey. Government websites also publish research and this is free of charge. By taking the information directly from the source (rather than a third party) you are minimizing the risk of the data being misinterpreted and the message or insights being acted on out of context.

How to apply secondary research

The purpose and application of secondary research will vary depending on your circumstances. Often, secondary research is used to support primary research and therefore give you greater confidence in your conclusions. However, there may be circumstances that prevent this – such as the timeframe and budget of the project.

Keep an open mind when collecting all the relevant research so that there isn’t any collection bias. Then begin analyzing the conclusions formed to see if any trends start to appear. This will help you to draw a consensus from the secondary research overall.

Communicating your market research findings

Market research success is defined by the impact it has on your business’s success. Make sure it’s not discarded or ignored by communicating your findings effectively. Here are some tips on how to do it.

- Less is more – Preface your market research report with executive summaries that highlight your key discoveries and their implications

- Lead with the basic information – Share the top 4-5 recommendations in bullet-point form, rather than requiring your readers to go through pages of analysis and data

- Model the impact – Provide examples and model the impact of any changes you put in place based on your findings

- Show, don’t tell – Add illustrative examples that relate directly to the research findings and emphasize specific points

- Speed is of the essence – Make data available in real-time so it can be rapidly incorporated into strategies and acted upon to maximize value

- Work with experts – Make sure you’ve access to a dedicated team of experts ready to help you design and launch successful projects

Choose the right platform for your market research

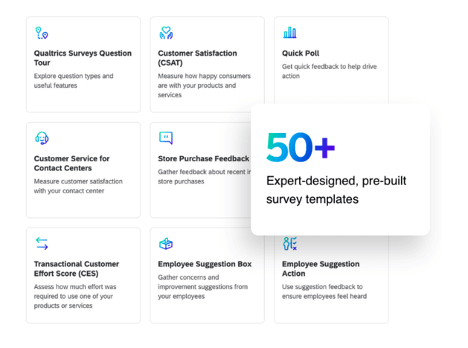

Trusted by 8,500 brands for everything from product testing to competitor analysis, Our Strategic Research software is the world’s most powerful and flexible research platform. With over 100 question types and advanced logic, you can build out your surveys and see real-time data you can share across the organization. Plus, you’ll be able to turn data into insights with iQ, our predictive intelligence engine that runs complicated analysis at the click of a button.

Free eBook: The 4 AI categories shaping market research