What is competitor analysis?

A foundational part of crafting a brand strategy relies on market orientation, i.e. the process of identifying and meeting the stated or hidden needs or wants of customers.

However, a critical part of your strategy is also associated with choosing how you want to compete, which naturally requires an understanding of the competition as well as your overall market share.

Focusing attention on your current and potential competition will help zero in on specific claims that you believe distinguish your brand from its competitors. The more you can understand the brands that directly and indirectly compete in your area of business or industry, the better you’re equipped to capitalize on opportunities and mitigate the threats to your own business.

That way you can ensure you are one step ahead of the game and the competition.

Learn about our competitive benchmarking study

Category competitors vs. the wider market

While it is important to pay attention to your most relevant competitors, businesses can be at risk by only focusing on what they believe are their category competitors.

However, what can really impact your market share is not seeing a category disruptor or a business redefining the category itself. In recent years, we have seen numerous examples of this – from Facebook and Google becoming major advertising channels to Amazon and eBay disrupting retail.

The ability to redefine a category by shifting the offered benefits to differentiate in new and unexpected ways was the foundational idea developed in The Blue Ocean Strategy.

It’s critical for businesses and brands to attend to this challenge, periodically take a broader view of industry trends, and look beyond their own category. Talk to consumers who have left your category – that way, you can understand if the “category” is losing consumers and what categories, outside of your own, you might be competing with.

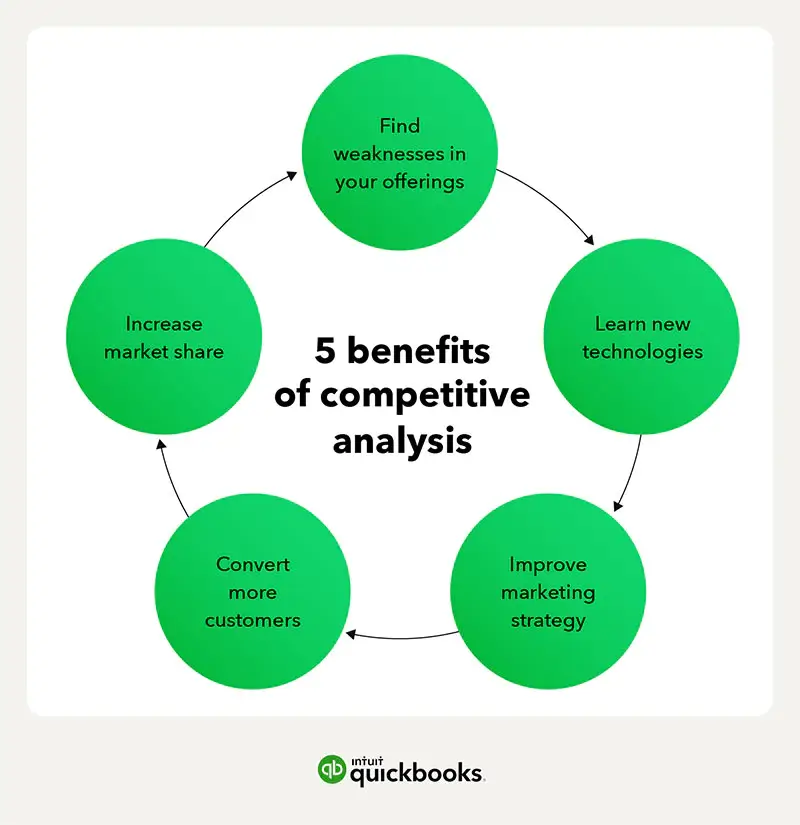

What are the benefits of competitor analysis?

Competitor analysis is used by the most successful businesses to remain forward-looking – it helps you revise strategy based on the insights you uncover and amplify what works.

Competitive analysis also helps businesses understand how they can improve by better serving their customers, based on customer feedback around other competing businesses in their market.

Businesses are better off if they know how they are faring when competing for market share, and why.

Businesses not executing regular competitive analysis risk not understanding when and why consumers prefer their competitors, not identifying their competitive vulnerabilities, and not seeing new threats and opportunities.

When marketers have a strong knowledge of their brand, it can be tempting to think that competitor analysis is an unnecessary exercise, but this is a common misconception.

Customer decision-making isn’t always straightforward or rational, but by asking your customers about their beliefs, attitudes, behaviors, and experiences toward you and your competitors, you can build an accurate picture of how to become a more significant part of their everyday lives.

Most importantly: you can find actionable insights that lead to practical, positive changes to your marketing strategies, product or service, or business as a whole. This, ultimately, means that competitor analysis is a vital tool in cultivating a competitive edge.

Image credit: QuickBooks

Who are your competitors?

Direct, indirect, aspirational – all your competitors matter, and it’s important you understand their significance to what you’re trying to achieve, and where and how you will decide to compete. First, let’s look at how to find yours:

Ask your customers

The reason for this is that what we assume isn’t always true. People don’t stick to categories the way we often think they do – sometimes they think of alternatives that we might miss.

Only by talking to existing or potential customers can you reflect their point of view and understand their behaviors, your business’ role within that, and the wider competitive landscape.

Desk research

Read feature articles and industry trend reports and get a gauge for what’s here and now, and also on the horizon. That way you can stay one step ahead of your competitors and lead the market.

Online tools

There are a host of digital tools to help you hone in on a list of your competitors. Google Trends, for example, lets you see search results for various terms. Maps is a simple way to find locally-based rivals, while, SocialMention scours social media channels for brand mentions based on any search query.

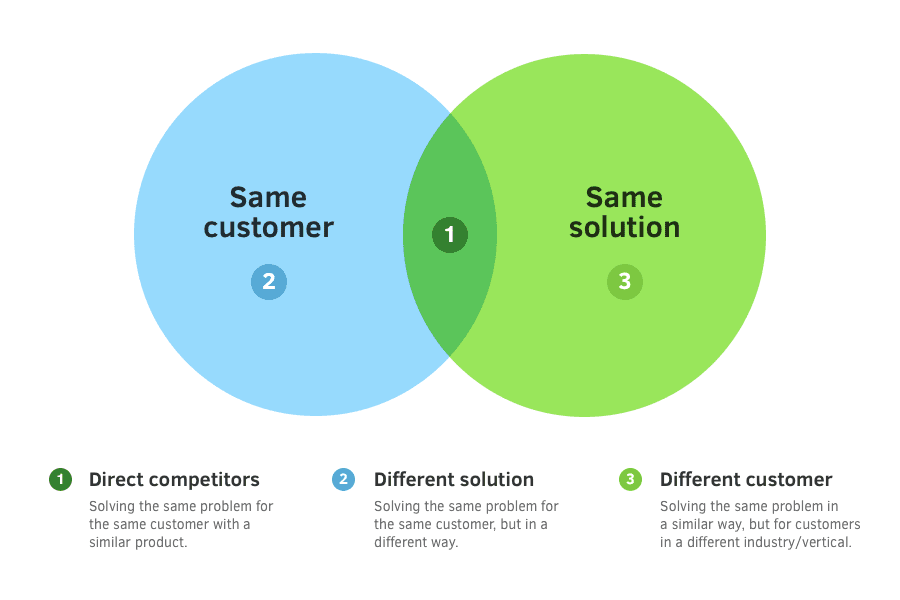

The next thing you need to do is classify the competitors you’ve found into one of four groups:

1. Direct competitors

The brands that first come to mind when you think about your competition. They’re in your sector or neighborhood, marketing products and services that do the same like-for-like job as yours.

2. Indirect competitors

They address the same customer needs as your business does, but they do it differently. Your target audience will overlap with theirs but won’t be an exact match.

3. Substitute competitors

These don’t sell the same products but compete for consumer spending, e.g. bars, cafés, restaurants, delis, and supermarkets all compete for lunchtime trade on a main street.

4. New entrants

Competitors who have recently entered a market offering the same products or services.

With all this in mind, keep the lens wide and try to maintain an open mind. Try to take as broad a view of the competitive landscape as you can. Not only will you understand the context in which you operate better, but you will learn more too. Some of the best businesses take ideas that are working well in other markets and replicate them in their sphere.

For example, rather than looking to understand a beer brand’s market share, think of the competition as ‘share of throat.’ Why? Because not everyone likes beer, but they might like wine or gin – and these are often in competition with beer as someone’s drink of choice.

Image credit: Buffer

What are the different aspects of competitive analysis?

Marketing research, as applied to competitive analysis, is key to helping us understand consumer sentiment toward brands and products, as well as those of our competitors and how they influence the market.

This is because you’re asking the people that actually use them, or those who choose not to, and gaining valuable insight into why.

But this can be broken down into specific topics:

- Who is the target audience of your competitors?

- What do people like/dislike about the product/service/brand sentiment?

- Why do people like/dislike the product/service/brand? And why do they use/not use the brand?

- When do people use them? Are there particular circumstances or occasions of use?

- How much would a customer spend, and why?

- Are they front of mind for the customer when it comes to buying or using a product/service?

- But most importantly, how does this stand up against you?

An effective way of conducting a competitor analysis is to break it down into stages, using the questions above as your framework.

Firstly, ask yourself – What do I already know?

Begin by conducting stakeholder interviews and tap into their vision and experience of the brand. See the market landscape from their perspective – it might be different from yours or your colleagues’. Then undertake desk research to get more insight into any broader trends that may be emerging, as well as review recent marketing research that may contain information about your competitors. It is key to begin any new marketing research efforts with some clear ideas about what you might find.

Secondly, ask yourself – what don’t I know?

But how do I know what I don’t know? – you might ask. Begin by casting your net wide, and then bring it in as you hone in on the information important to your business.

Steps to performing competitive analysis

Any thorough competitor analysis will want to absorb and compare as much information as possible – but it’s crucial that you look at the right information that’s relevant for your business.

In essence, though, competitor analysis is all about information gathering. Generally, there are four business areas to concentrate on, which we’ll cover below. Some of them will require specialized competitor analysis tools, while others rely more on desk research and a bit of digging.

1. Company

These metrics are the core numbers and details associated with your competitor as a business. And within that sphere, you can group those into sections like revenue, customers, funding, and basic info.

Whereas the latter might be a simple case of filling out details on your competitors’ number of employees, the name of their C-suite executives, locations, etc. via sources like LinkedIn or CrunchBase, metrics like revenue are harder to figure out.

Start by googling their names alongside ‘revenue’ or ‘customers’ to see what you can uncover from their website, press releases, and investor keynotes. If that doesn’t work, you can also try a business directory like Dun & Bradstreet.

2. Products and services

Understanding the products or services that your competitors offer is the key to finding market differentiation for your brand. The first thing you’ll need to do is answer a few basic qualitative questions:

- What are your competitors selling?

- What is their USP

- What key features are offered?

- What technology are they using?

Most of this information can likely be found on their website, but you should also consult their LinkedIn posts, job ads, and tools like BuiltWith to fill in any gaps.

After that, you can move on to more quantitative details around price. Questions to answer here include:

- How much does their product cost?

- Is that more or less than your closest equivalent?

- Is it a subscription or a one-off fee?

- Do your competitors offer more packages than you?

3. Target market and customer awareness

Whom are your competitors trying to sell to? Is it the same kind of customer your own company wants to attract? And, importantly, is it working? You can get a decent handle on that last question by monitoring both share of voice and sentiment. Most social listening and competitor analysis tools (more on those in a bit) will be able to track this for you.

The crucial part with both is: how does your competitor’s share of voice or sentiment rankings stack up to yours? It’s only really by tracking a range of competitors that you can apply meaning and context to the results your brand sees.

Social listening can also help you learn what customers are saying about your competitors and whether they’re listening. It’s also useful to see what kind of things your competitors are saying on their social channels – and on which ones.

For instance, if your competitor is posting more on say, TikTok than LinkedIn, then you can make an educated assumption that they’re probably looking to attract a younger audience.

4. Marketing strategy

The meta-information around the above line of inquiry can help you fill in a few more blanks, too. For example, you’ll learn the geographical markets your competitor is focussed on alongside which ones they aren’t, and you’ll soon develop a full picture of their online presence as it relates to their target market.

But beyond that, a vital part of competitor analysis is in examining direct and indirect competitors’ marketing strategies as a whole. And there are many areas to dive into:

Advertising

Alongside TV and other traditional ATL advertising, it’s helpful to use competitor analysis tools to find out how (and how often) other brands are running ads online. You’ll want to see how your advertising output matches up against your rivals’ Google, YouTube, Display, Facebook, and Twitter ads.

Social media and influencer marketing

As mentioned in the section above, it’s important to know where your direct competitors are focussing their efforts when it comes to social posting. Moreover, if you monitor engagement levels per platform, you’ll learn which channels it’s best for you to prioritize.

Content marketing

Are your competitors blogging? Do they publish thought-leadership pieces on LinkedIn? Do they make regular videos on their YouTube channel? Do they own or sponsor a podcast? And is any of it working? Learning what others are publishing and tracking engagement can be a useful benchmarking exercise, or – again – it can highlight potential gaps in the market.

SEO performance

Tracking content marketing will likely lead to monitoring the SEO performance of your direct competitors. There are several online tools (like PowerSuite, Ahrefs, Rank Tracker, and SimilarWeb) that can help you find out what keywords other brands are ranking for, and how you stack up in comparison.

Understanding this is crucial for adjusting your marketing strategy, to win a greater share of common search results in your industry.

Lead handling

Familiarize yourself with your competitors’ lead and sales process by venturing down it yourself. Watch a tutorial, book a demo, or make contact with their sales teams to see how much of the process is gated, how seamless things are, and how long responses take.

Similarly, competitors’ customer service is also something to keep an eye on: how do your rivals handle it? Take a look at Twitter complaints and note down their response times, or you could even email them with a ‘query’ of your own.

Learn about our competitive benchmarking study

Using competitor research to understand the wider picture

At this point, it’s also useful to gather insight on your designated topics from the point of view of the consumer. Marketers have various tools available to them to do this – surveys, social media listening, and purchasing panel data (E.g. Nielsen Panel, IRI), each serving a particular purpose.

Brands can leverage surveys to assess attitudes; passive data can be used to understand behavior; and panels for market penetration and share. All of these, when used together, help to understand the sentiment and opinion about particular topics and competitors and give a broader view of the market.

You may want to segment this research too, so you can see how different audiences behave differently from competitors in the market. This will help you to establish where you are performing strongly, and how you can improve in relation to your competitors. Whilst knowing this information is great, it’s just as important to listen and act on the insights that arise from it.

There are tools to help with this. For example, the Qualtrics BrandXM platform can help you focus on the important points of action recommended in the platform.

Qualitative collection methods also play an important role. For example, social media listening tools are great at helping understand the share of voice and can help you set key metric benchmarks.

These can be used in partnership with more traditional qualitative collection methods too, like focus groups and interviews. Use these methods to dig deeper and talk to people to understand what drives their attitudes and behaviors.

At Qualtrics, we work with partners to help you facilitate this qualitative research. By pulling this qualitative data into BrandXM, you can quantify it and pull out trends and valuable insights in your dashboard. This will help you with your strategy moving forward.

How often should I do competitor analysis?

Research only reflects a certain point in time, so if you want to stay ahead of the competition then you need to make sure that this data is maintained for accuracy. Many businesses find themselves wrong-footed, not because they did something wrong, but because they failed to anticipate changes in the market.

This is why keeping a pulse on how the business competes is important. Maintain an awareness of who’s gaining attention and who’s losing traction, amongst who too.

Do so by updating this research periodically, be it once a year, bi-annually, or every quarter. That way, whenever a change in strategy is taking place you can draw on the most recent data to establish this foundation for the change.

What tools can I use to do competitor analysis?

Traditionally, competitor analysis and other similar studies have been outsourced to agencies. However, these studies were often expensive, were slow to complete, and only reflected one point in time and you didn’t have access to real-time data. With advancements in technology, brands have far greater accessibility to tools that mean they can take this discipline in-house.

Complex processes and data have now been greatly simplified, so now everyone can be an expert with access to vital insights in real-time.

Qualtrics (quantitative and qualitative)

From usage & attitude studies to segmentation, brand perception, or awareness and perception tracking, Qualtrics BrandXM can get you up and running in no time. With all data in one platform, you can spend less time collating and cleaning survey responses, and more time listening and acting on your insights.

Qualtrics can also pull in all of your qualitative data at scale, giving you a holistic view of your competitors so you know how you compare. We also work with partners to give you the most comprehensive tool for competitor research. The partners listed below can be used to collect customer feedback about the competitive landscape in qualitative and quantitative formats.

Using Qualtrics, you’ll be able to see a holistic, unified snapshot of your place in the market, alongside a host of suggested actions for how to improve.

Qualtrics Research Services

If you don’t have an in-house team available to manage your data, Qualtrics research services can help. Our expert team oversees everything for you, from designing your studies, finding the right respondents, launching your surveys, and reporting on the results – so you can focus on taking action to improve your business. We’re with you every step of the way.

External partners:

LivingLens (qualitative)

LivingLens captures & analyses video content via speech, actions & sentiment, translating human behavior into insights. This makes working with video efficient and scalable, turning it into a usable data asset that you can gather insights from quickly.

Voxpopme (qualitative)

Whilst focus groups are still valuable, new approaches are being developed at scale that are changing the way we do market research. One example is Voxpopme, which “helps connect brands with consumers through real-time video feedback.” If you want to do in-store/shelf testing vs. interviews, digital usability testing, or tracking studies, Voxpopme gives access to qualitative insight at speed and scale for various use cases. Make the most of

Voxpopme’s on-demand community, or access your audience and capture, analyze and share insights from your customers all over the world.

BrandWatch (qualitative – social listening)

Various tools can help with social listening, and Qualtrics has an integration with a few partners – such as Brandwatch. Brandwatch gives “structure and meaning to the voices of billions of people, so you can make decisions that truly fit with consumer and buyer needs.” If you are just beginning to analyze your competitors and the market, social listening is your ally.

The reason for this is because it may (helpfully) challenge your perceptions of what you think is true by learning what your customers are saying about you and your competitors in their context. Brandwatch can also do scene analysis from sources such as pictures to help businesses understand the context in which they, and their competitors, are being consumed.

Taking action on your competitor analysis

If you’ve used the right tools and completed all the steps above, you should have a robust view of the competitor landscape. And that means it’s time to take your learnings and use them to form a competitive advantage.

Exactly how you do that will depend on what you learn about industry trends, your market share, what your target audience thinks, and how your major competitors behave, but you should be able to spot areas for improvement in your offering.

But here are a few ideas of how to turn competitor analysis into actionable points:

1. Market your brand where they don’t

If you know that your competitors have left a gap for you to fill, it’s time to adjust your online marketing strategy to do just that. That might mean executing a new content marketing push on platforms that are being underserved by the competition. It could mean responding to people on social media who are currently being ignored. Or it could be working to ensure that your SEO performance puts you at the top of SERPs for more keywords.

2. Adjust pricing or features

If your competitor analysis shows that a direct or indirect competitor offers better value than you, then it’s time to make some adjustments. See if you can identify superfluous parts of the supply chain or other processes that allow you to carve out a stronger value proposition. That could even mean a change in how your products or services are offered – for instance adding a monthly subscription tier instead of just an annual one.

3. Act on known pain points

As mentioned, a truly comprehensive competitive analysis should include collating feedback from new and potential customers. With their responses, you might find experience gaps that nobody in the industry is helping to close. That then provides an opportunity to evolve your offering in such a way as to give people what they currently can’t get – and in an easier way.

And remember: Qualtrics can help you take action on your findings, and stay in the loop with where your brand sits in relation to your competitors.

Find out more about our competitive benchmarking study