Author: Rosemin Anderson

Subject Matter Expert: Koren Stucki

What is customer experience?

Customer experience, often shortened to CX, is essentially the catchall term for someone’s perception of your organization, based on all their purchases and interactions with it – both direct and indirect. It’s one part of a group of experiential measures that describe how your company is being perceived:

CX – Customer Experience:

The feelings, reactions, and ideas that result from direct consumption, purchase, and use of a branded product or service

EX – Employee Experience:

The feelings, reactions, and ideas that result from direct engagement with a business as a current or former employee

BX – Brand Experience:

The feelings, reactions, and ideas that result from the direct or indirect exposure to any branded interaction influencing a future purchase decision.

What is customer experience management?

Customer experience management is the term used to describe a set of strategies that help nurture the relationships brands have with their customers.

It’s often confused with CRM, or customer relationship management, which is usually thought of within the context of software and what it helps businesses to achieve. This might be tracking communications and interactions and nurturing relationships with leads and customers or clients.

In contrast, customer experience management (CEM or CXM) is more holistic and customer centric, and deals with the people, processes, and systems required to deliver the desired customer experience.

The goal of customer experience management is to improve the customer experience at every single stage of the customer journey – whether that means during the act of purchasing, during customer support calls, or with interactions over social media. It’s all about turning every engagement – both passive and active – into positive ones. Do that, and you’ll build brand loyalty as a result.

What is customer experience management software?

Customer experience management software is technology that helps you streamline your organization’s customer journeys. With it, brands are able to plan out and deliver customer experiences across multiple channels, both online and offline. The system manages interactions across all your customer-facing touchpoints: organizing, automating, and synchronizing them so that you can service all your existing customers and respond quickly to issues and new business.

It should also enable you to take direct action in response to what your experience data is telling you about customer journeys. This might be through a ticketing and notifications system that alerts the relevant people about problems or questions, or by closing the loop with customers by contacting them directly, wherever they’ve fed back to you.

Ready to see the world’s most powerful CX platform in action?

Top customer experience management software

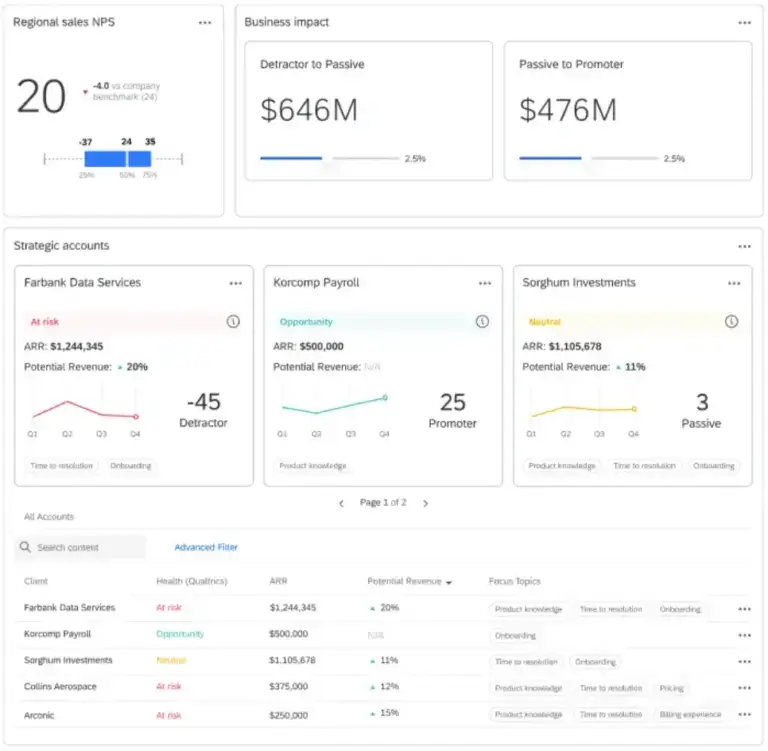

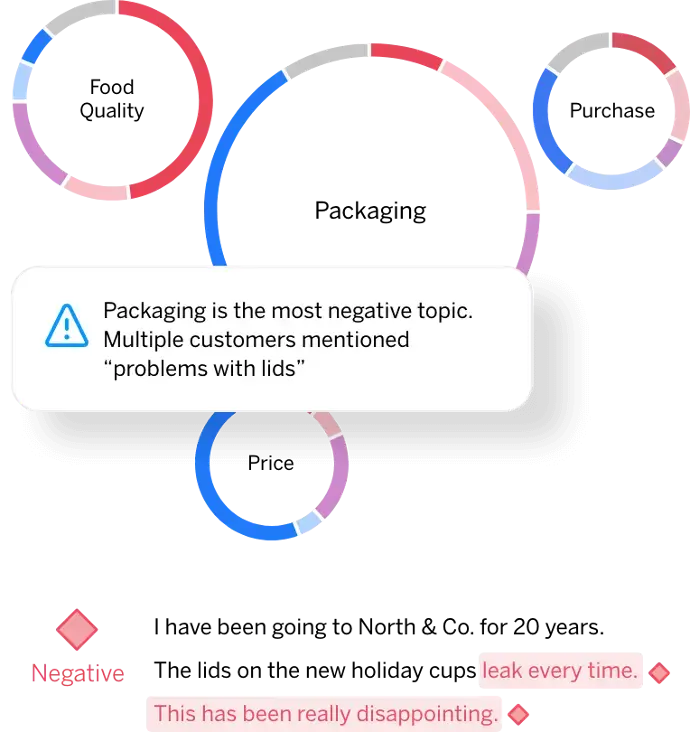

Qualtrics® XM®

With omnichannel customer experience management driven by AI-enabled real time analysis, Qualtrics XM gives you a complete overview of your customers’ interactions with your brand. Text analytics-based Insights into customer emotion, intent, sentiment and more blend with data gleaned from more than 128 sources, giving you an unrivaled view of customer pain points and areas of opportunity. Improved experiences are easily automated with integrations and real time suggested actions to help your team to provide the best experience possible.

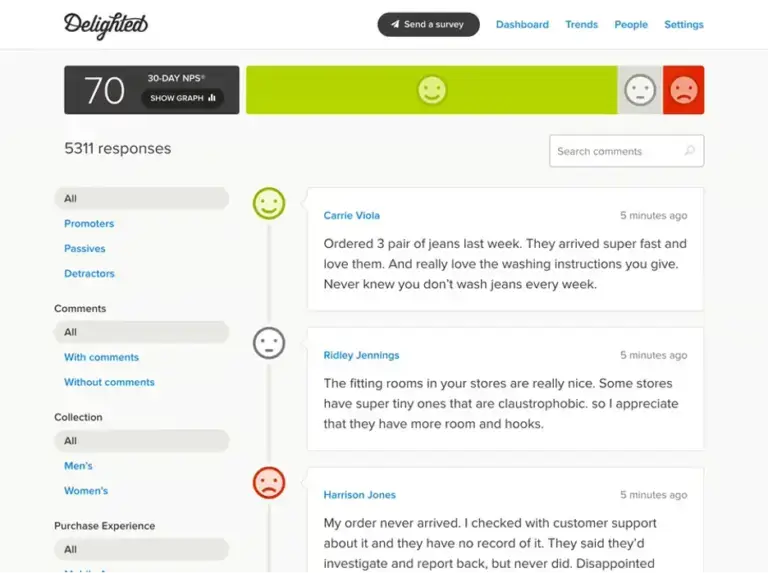

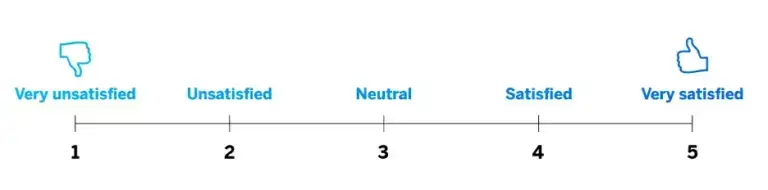

Delighted®

Image from delighted.com

Self-service customer experience management platform Delighted offers a quick and easy way to collect feedback from customers and employees. With in-depth survey management and data analysis, users can easily mine customer feedback for vital intelligence and automatically route insights to the right teams.

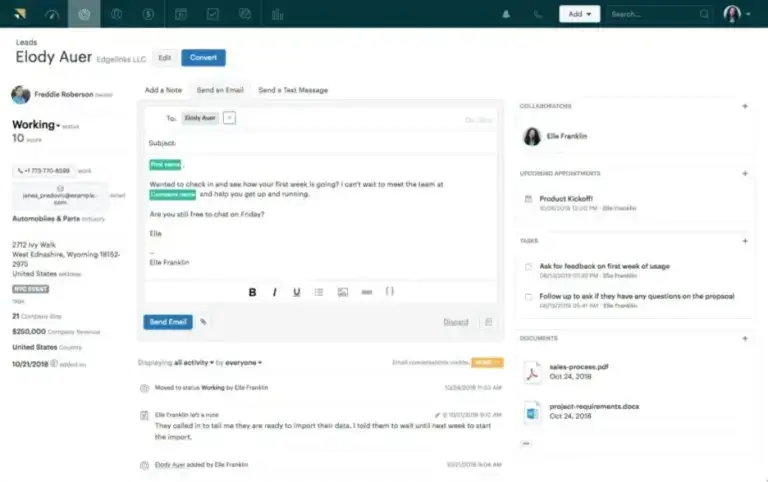

HubSpot Operations Hub

Image from hubspot.com

Though more of a customer relationship management tool than a customer experience platform, HubSpot’s CXM offering collects customer data for more efficient feedback and action processes. Users can optimize customer journeys and pinpoint loyalty drivers with automated data analysis.

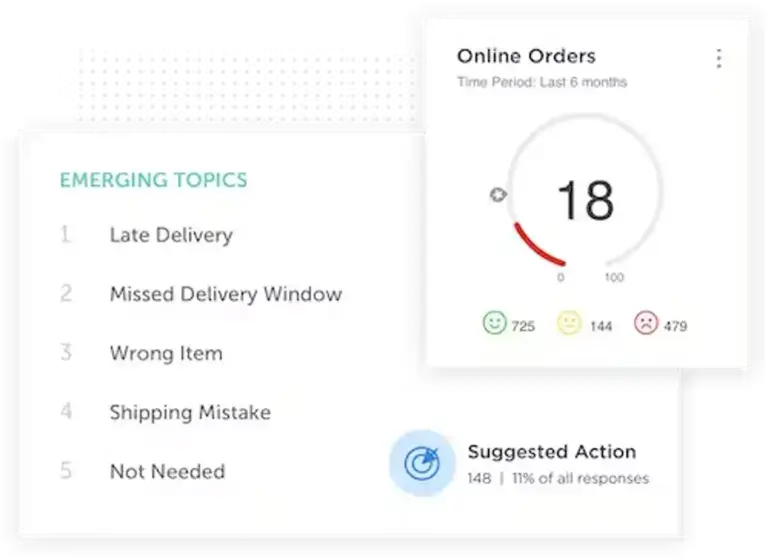

Medallia

Image from medallia.com

Medallia’s customer experience management platform utilizes AI and machine learning to pinpoint missed opportunities and optimize customer journeys. With real time insights delivered automatically to your teams, the software offers predictive analytics to discover trends in customer needs.

Salesforce

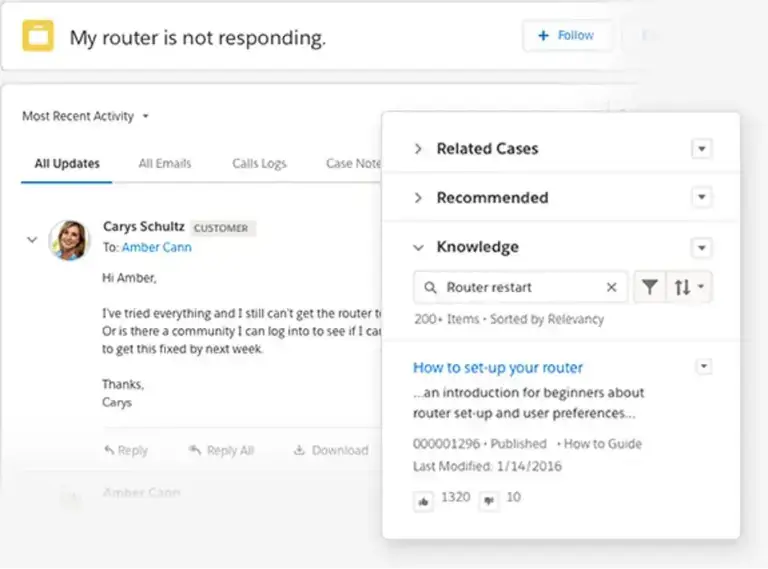

Image from salesforce.com

Cloud-based CRM platform Salesforce enables better customer experiences through tailored customer relationships. Feedback and reviews are integrated into the customer relationship management platform with outcomes and actions provided to your teams automatically.

Zendesk Sunshine

Image from zendesk.com

Another cloud-based customer relationship management tool is Zendesk, focusing on providing targeted on-demand assistance and improved customer support. Interactions with customers are tracked and monitored for better customer engagement and easier customer service management, with options for personalizing customer experiences and tailoring marketing and sales messaging on a wide scale.

Why invest in customer experience management software?

Aside from naturally sitting at the core of your customer experience strategy, there are three key reasons why business customers should think about using CXM software: volume, speed, and complexity. If you want to manage customer experiences well, you need to be able to master all three at the same time, and the right software can get you there.

Customer experience management involves a huge quantity of information that must be managed and acted on 24/7. What you learn from your CX program must be turned into action and used to make positive change, often in a very short timeframe. In addition, doing CX well means working across a broad range of business areas, from customer service to logistics to marketing.

Customer experience isn’t an expense. Managing customer experience bolsters your brand.

– Stan Phelps, Author, Instructor at the ANA School of Marketing

Having a dedicated customer experience management solution in place gives you the means to bridge across those silos and connect the right people to the right information at the right time in a strategic manner, leading to increased revenue and happier customers in a few key ways:

Increase customer loyalty

More personalized, better-attuned interactions with your customers will help close the experience gaps that leave you open to criticism and the risk of customers churning and going to the competition. The more you’re listening to your customers through the lens of effort, emotion, and intent, the more you can fine-tune the customer experience, and the higher your overall customer satisfaction scores will become.

It’s important to include omnichannel feedback across different channels in this listening exercise. Customer communication often differs cross-channel, meaning it’s important to capture all types of feedback. The potential conversational data gathered can provide valuable information to be used in optimizing the contact center. Not only that, but it can be used to reduce customers’ need to reach out in the first place by providing all that they require for a great experience in the first instance.

Consumers are 5.1x more likely to recommend an organization after a positive customer experience and are 3.3x more likely to trust a brand after a positive experience. Recommendation and trust are the building blocks of customer loyalty, so you’ll naturally develop more loyal customers – and build brand loyalty – as you make strides to improve things across the entire customer journey.

Enhance customer experience

It should go without saying, but this is the ultimate goal of successful customer experience management: an overall customer experience that vastly outstrips your competition, with customer journeys free of pain points and friction. Get every step of every journey firing on all cylinders and you’ll see a host of customer-related metrics move in the right direction.

5 things to look for in a customer experience management solution

A CXM platform is an important investment for any business, with the potential to transform every aspect of your operation.

Here are some features and capabilities to look for when choosing one:

1. Omnichannel customer experience data collection

Wherever customer experiences are happening, that’s where you need to be listening.

The right software will provide you with tools to set up listening posts for tapping into conversational sources such as calls and chats, social media, forums and reviews, and digital feedback.

Ideally, you’ll be able to collect both solicited and unsolicited data, from both structured and unstructured sources of customer feedback. In this way, you’ll be able to analyze both what customers are saying explicitly to you (e.g. in customer feedback surveys) and what they’re saying on platforms you don’t control (such as on social media or on third party review sites).

When captured on a centralized system, your teams will be able to surface meaningful insights that give you a fuller picture of what customers really think of your customer experiences.

2. Customer data captured at each stage of the customer journey

Any customer experience management (CXM) software suite worth its salt will help you understand customer journeys like never before, by bringing together every facet of all customer experiences into one centralized hub. That includes:

Customer lifecycle and customer segmentation

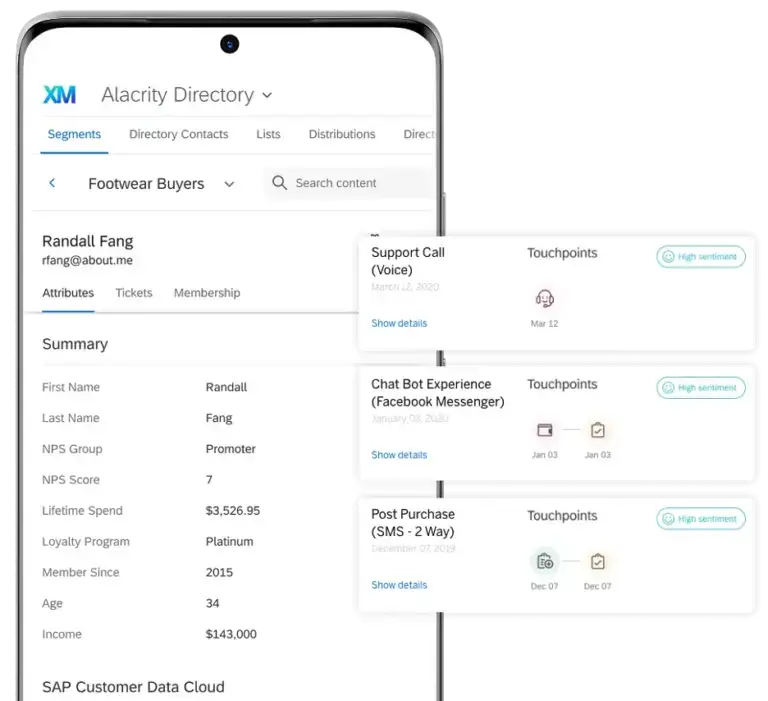

Is the customer at the start of their buying journey? Or are they a longtime, loyal customer of yours already? Customer experience management is all about building up profiles that differ depending on where in the buying journey customers are. The resulting segmentation and customer data will help you deliver personalized experiences, and to nurture each stage of the customer journey.

Next-generation listening and understanding of customer feedback

It’s essential to be able to analyze your customer’s feedback at scale and understand what they are saying to you. Modern CXM software applies sophisticated AI, machine learning, and natural language processing to alert you to what’s happening, and recommend the actions to take next.

Understanding signals such as emotions and emotional intensity, effort, sentiment and intent with AI-driven tools can help your team to make definitive predictions, allowing your business to anticipate customers’ next steps.

Customer engagement and customer touchpoints

You need to be able to see how and where customers are talking about (and with) you. That means collecting engagement data with an omnichannel approach. In today’s business environment, a review on a third-party website, an off-hand tweet, an email, and a customer support call should all be given the same weight in terms of importance.

Centralized, intuitive data storage

A good customer experience management solution stores all your customer information in one place, with real-time updates that are easy to share with your various teams.

You should be able to see a history of your interactions with customers from their behavior (such as purchase or contact) to how it made them feel (customer feedback), revealing where you got customer service right, and where you maybe got it wrong.

Your customer experience management solution is a repository of interaction and experience data about each of your customers that makes future interactions smoother, easier, and more personalized.

At the same time, it’s a macro-level data source that helps you see trends and patterns in your business as a whole, across large numbers of customer interactions.

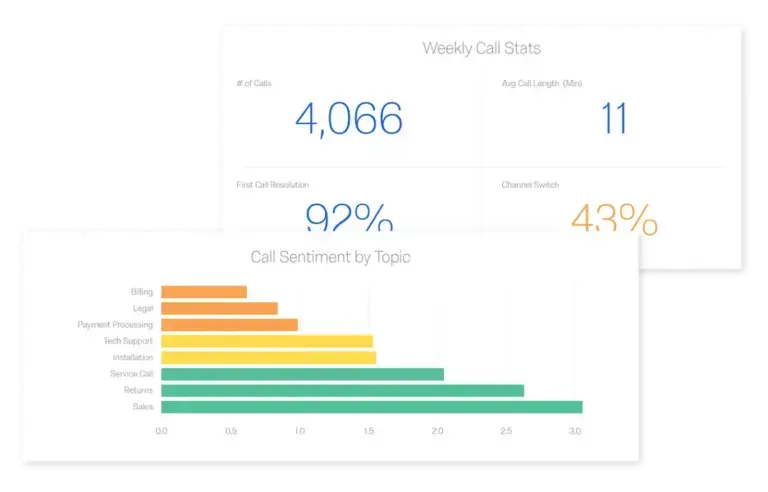

3. Real time and detailed dashboards

Customer experience management software will usually show your customer feedback and CX data in the form of dashboards. These provide a single view of what’s happening whether it’s your NPS score or a real-time view of the key trends in customer feedback.

The most advanced systems offer customizable, role-based dashboards. Not everyone in the organization needs the same customer data, so it’s helpful to be able to control who sees what. For example, your logistics team can’t make use of the latest comments from your website satisfaction survey, while call center agents won’t be interested in the NPS score for your retail stores.

By customizing which data is available to people in different roles, you’re able to show people the metrics that matter most to them, so they know where they can make an impact.

By the same token, leaders and high-level staff can use the dashboard system to take a high-level view of organizational activity and make connections and discoveries about how activity across different roles and systems are interacting with one another.

Analysis tools for customer experience data

Most platforms will include some level of analytics capability – after all, few organizations have a team of data scientists that can help the company understand what the data means.

When choosing your software, think carefully about how you’ll use analytics tools and what kinds of benefits they offer your business. Are they simply crunching the numbers to tell you what’s happening, or do they go a step further and offer predictive and deductive insights to help you plan and take action?

Here are some analytic capabilities to add to your wish list:

Statistical analysis

From simply relating one variable to another (e.g., how is NPS affected by call waiting time?) to a multivariate regression that takes hundreds of competing variables and models to understand the precise impact of each one, statistical analysis can help you turn hunches into known facts backed by statistical significance.

Text analysis

Natural language data is time-consuming in small quantities and impenetrable in large ones. AI-powered text analysis technology takes open-text responses and automatically sorts and analyzes them so you don’t have to wade through them all. There are different levels of sophistication here, from those that identify topics to those that analyze sentiment so you can see which topics are spoken of in positive or negative terms.

Key driver analysis

Key driver analysis identifies underlying relationships to uncover the most important drivers of a particular metric, such as NPS or revenue, so you can see which areas to focus on. It can also help you understand customer motivation and pinpoint the most important factors leading a customer to convert.

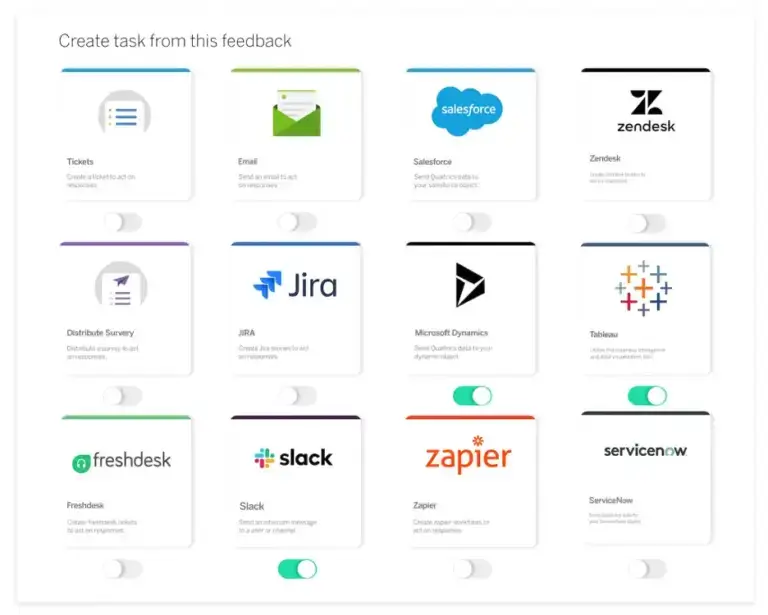

4. Suggestions for actions based on your data

Having data is one thing, but doing something about it is quite another. What if your customer experience solution not only turned data into insights but gave you the ability to automate actions based on them?

The most successful organizations go a step further than simply collecting and analyzing customer feedback and using it as a basis for action. A state-of-the-art CX management platform enables businesses to respond to customers directly, right from within the system, without having to lift a finger.

Ticketing, alerts, and automated actions take the effort out of your hands. Rather than having to think about who needs to do what, and when, you can set the parameters in advance so that your CXM system carries out tasks like following up with dissatisfied customers, or checking in with customers at moments that matter.

All of this can happen within the same platform where you’re collecting feedback and managing customer contacts, so you can track customer feedback from survey response through to resolution, combining the efficiency of automation with the personal care and attention that makes for a great customer experience.

5. Integration with other tech

Customer feedback isn’t the only data your organization has – you probably also have access to website analytics, CRM systems like Salesforce, and even HR and finance data. Most of these platforms have APIs which allow you to send the data to other systems.

Being able to integrate them into your CX platform can be a huge benefit, as you get better visibility of the customer experience and its impact on your business.

Take website analytics for example – you may be seeing an increase in people abandoning their cart, but it’s hard to identify why when you’re looking only at the analytics data. But combine it with customer feedback and you can drill down to see what customers are saying, so you can quickly and easily see the impact.

Integrating your data is a great way to get a ‘one customer’ view – you can tie feedback to contact records and start to tie your CX metrics into operational metrics like win-rate and revenue to really understand the impact of your customer experience on the bottom line.

Customer experience software that helps you to exceed customer expectations

Ultimately, customer experience management software should enable you to better do what its name implies: manage the customer experience. If that sounds obvious, it’s worth remembering why it’s our goal: to streamline the customer journey in ways that older technology just couldn’t enable, and in ways that customers didn’t previously expect.

But here’s the thing: in today’s business environment, they do expect it. Modern customers expect to be listened to, understood, and treated like an individual, rather than members of a market segment. We know that 63% of consumers think brands need to do a better job of listening. And in this space, listening really means capturing qualitative customer data of every kind and acting upon it.

By utilizing customer experience management (CXM) software to its fullest, you’ll gain a much deeper understanding of what your customer interactions mean. That deeper understanding will help you build more personalized experiences, and those personalized experiences will help customers feel listened to.

Remember: 94% of consumers who rate a company as very good in CX are more likely to purchase again and recommend it to a friend. So it’s never been more, while McKinsey & Company research shows that maximizing satisfaction along the customer journey could lift revenues by up to 15%.

All told? It’s never been more important to manage the workflows that enable you to give the customer exactly what they want.

Qualtrics’ customer experience management platform allows you to listen to and analyze every interaction, no matter where it occurs, for more effective action enabled through unrivaled analytics. Workflows are designed to easily prompt personalized customer service from your teams, with data-driven guidance for exceeding customer experiences based on detailed insights.

Ready to see the world's most powerful CX platform in action?