What is ESG (Environmental, social and governance?

ESG stands for Environmental, Social, and Governance. It encapsulates several standards that measure how an organization’s activities contribute to sustainable, viable development, and how that organization minimizes its negative impacts on the planet, its people, and itself.

It also measures an organization’s transparency and accountability, and is used as a framework to ascertain whether an organization is financially viable and stable.

ESG considerations are:

- How much does the organization care about environmental concerns?

- How well does it reflect and support society?

- How well run is the organization?

ESG covers a variety of topics within each category:

| Environmental | Social | Governance |

|---|---|---|

| Climate change | Working conditions | organization ethics |

| Direct and indirect greenhouse gas emissions (GHG) | Equal opportunities | Executive pay |

| Carbon emissions from fossil fuels | Fair wages | Board diversity and structure |

| Resource depletion | Employee relations | Management diversity and structure |

| Waste management and pollution | Employee diversity, equity and inclusion, and belonging (DEIB) | Bribery and corruption |

| Water and energy efficiency | Human rights | Political contributions and lobbying |

| Deforestation | Health and safety | Investment choices |

| Biodiversity loss | Modern slavery | Taxation strategy |

| Animal welfare | Child labor | Compliance and due diligence |

| Local community involvement | Data security | |

| Philanthropic initiatives |

ESG is also a step up from corporate social responsibility (CSR):

CSR is how individual organizations choose to run their organizations sustainably, e.g. via internal green initiatives and community participation.

ESG on the other hand, takes a deeper look at the above factors and assesses organizations to decide whether they’re worth investing in from growth, sustainability and risk perspectives.

But what do we mean by ESG investment?

What is ESG investing?

ESG investing is also known as:

- sustainable investing

- socially responsible investing

- impact investing and

- ethical investing

ESG funds are mutual funds graded using environmental, social, and governance principles. ESG funds are not individual stocks.

ESG is not new — Muslims, Quakers, and Methodists set up and have used investment funds that chime with their ethical and religious beliefs for years, but now it’s set to become the new normal.

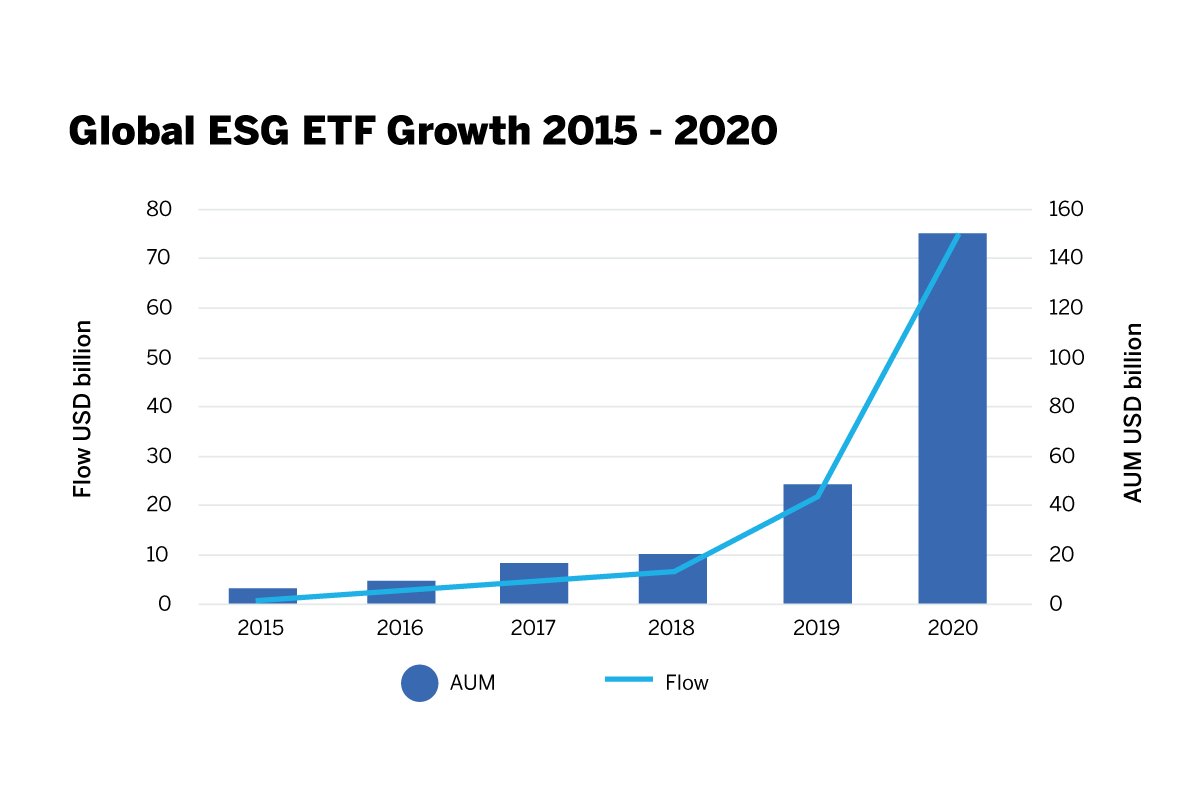

In the capital markets, institutional investors realize the value of socially responsible investing, and in recent years, consumers have changed their behavior to embrace sustainability. They want to make greener choices, recycle more and waste less. They are increasingly interested in social and environmental criteria.

ESG investing focuses on choosing organizations that are committed to these sustainable, responsible, and transparent practices and adding them to the investment portfolio. As such, ESG investing has seen huge growth as investors in mutual funds rush to include organizations that tick all the environmental, social, and governance boxes.

Learn about Qualtrics ESG Solution

Why does ESG investing matter?

The times when organizations could do as they wanted while disregarding environmental, social, and governance consequences are fading. Now, a organization is judged not only for what it does but how it does it. And while the investment industry and consumers expect a organization to tread lightly on the world, employees, customers, consumers, legislators, and regulators demand it.

The hard, cold fact that climate change-related weather events are expected to cost organizations $1.3 trillion by 2026 has jolted many investors into taking notice of ESG factors.

Without organizations’ commitment to change, achieving sustainability and prosperity is impossible. Many are deciding to opt for sustainability not just because it’s the right thing to do for the environment and community, but also because it makes good organization sense. If organizations want to stay ahead of the competition as well as contribute to the common good, they’ll need to adopt ESG criteria.

The good news is that ESG is being taken seriously. In 2020, the following organizations had ESG initiatives in place:

- 88% of publicly traded organizations

- 79% of venture and private equity-backed organizations

- 67% of privately owned organizations

ESG funds are different from traditional funds because they:

- Constantly monitor performance to assess organization sustainability

- Measure financial performance and stability in the market

- Invest in industries and organizations that meet all the ESG criteria

How does ESG work?

No longer do modern investors rely on an organization’s balance sheet to appreciate organization value. ESG considerations provide a much broader view of non-financial factors, such as risks and opportunities that the balance sheet cannot show. Because every organization is unique, it would be impossible to create comparable ESG profiles across all organizations and industries. This is where ESG scores come in.

What are ESG scores?

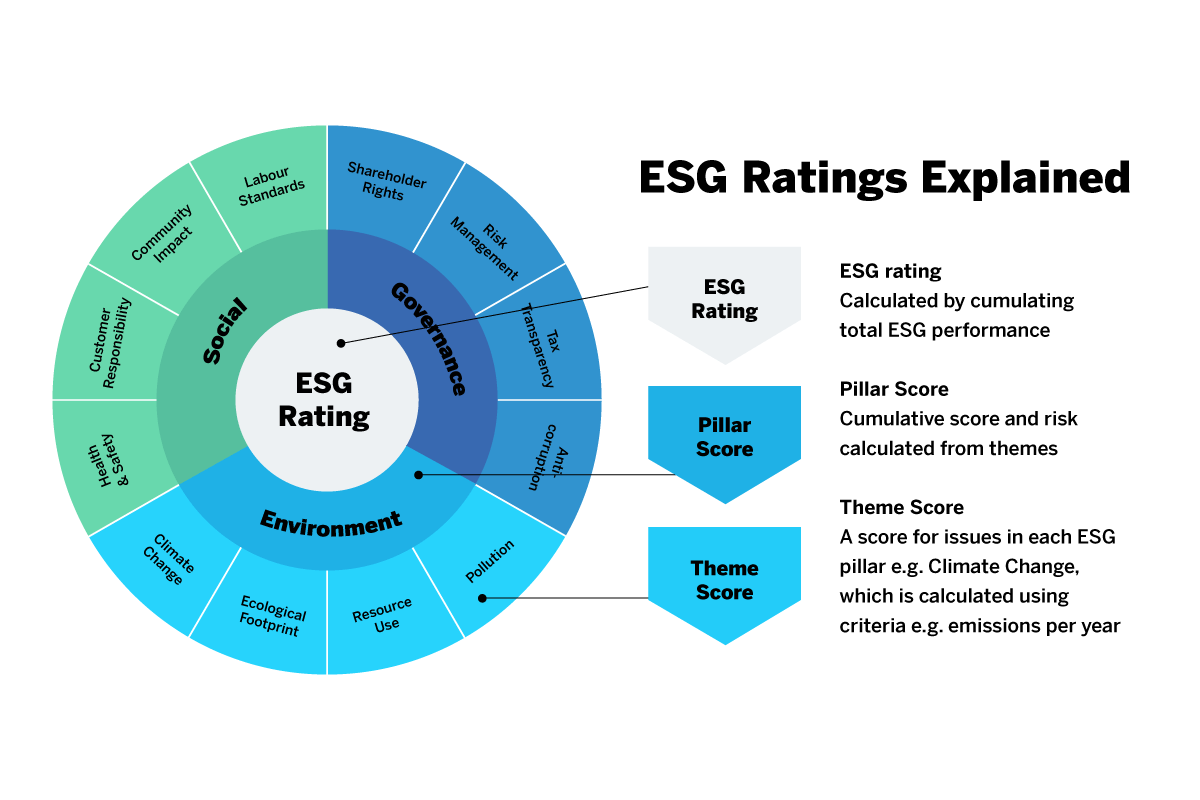

In the same way that a person’s credit score shows how financially solvent they are, ESG scores rate how robust an organization is when exposed to ESG risks.

ESG analytics take into account those environmental, social, and governance risks that don’t feature in traditional financial analysis: health and safety, DEI, energy consumption, and so on. Although these carry significant financial consequences, traditionally they were disregarded in favor of the profit and loss account.

Not anymore. It’s now possible to evaluate all the environmental, social, and governance factors together and produce one rating that ESG investors can use, along with financial analysis, for making investment decisions.

What is a good ESG score?

While there are several ESG rating systems, two of the most prominent are the Bloomberg ESG Scores, which rates organizations from 1 (worst) to 100 (best), and the MSCI ESG Rating, which uses a rules-based methodology to identify industry leaders and laggards.

The MSCI ESG Rating measures an organization’s exposure to ESG risks and how well they manage those risks. Their ratings range from AAA, AA (leaders) to average (A, BBB, BB), to laggards (B, CCC). They also rate equity and fixed income securities, loans, mutual funds, ETFs and countries.

As for third-party options, according to InfoGrid, most ESG scoring methodologies range from 1 (worst) to 100 (best), with organizations scoring 70 and above considered “good”. Others use a letter-based scoring mechanism.

A breakdown of ESG scoring could be as follows:

- Excellent: a score of 70+ – the organization is following all ESG best practices and the organization has few, if any, internal or external risks.

- Good: the organization is following ESG best practices and has a low impact on people or the environment.

- Average: the organization is unlikely to meet ESG benchmarks or meaningful ESG targets.

- Poor: a score of less than 50 – the organization is following no best ESG practices, it’s probably negatively impacting the planet, and is not treating its employees or suppliers well.

Why do ESG scores matter?

Clearly, an organization that achieves an Excellent ESG score is an attractive proposition for investors. It will have:

- Fewer liabilities and ESG issues

- A great brand reputation

- Good stakeholder relations

- Engaged employees

- Low turnover

- Satisfied customers

Conversely, a Poor ESG score is indicative of an organization with:

- Potential environmental, social, and governance liabilities

- A questionable brand reputation

- Disengaged employees, with poor mental health and low diversity, equity and inclusion

- High employee turnover

- Customer churn

- Potentially rising poverty levels in the organization’s locale

What is the return on ESG investing (ROI) for organizations?

When investment professionals choose socially responsible ESG investing, they soon discover that ESG funds deliver a healthy financial return on investment in many different ways:

More customers

In the 21st century, consumers are being more selective about where they choose to spend their money — and it’s often with more environmentally and socially responsible organizations. According to research from Forbes, 62% of Gen Z customers prefer to buy from sustainable brands, and 87% of consumers said they will buy a product because an organization advocated for an issue they cared about. Closer ties with the local community help you engage with potential customers and suppliers.

Increased brand awareness and value

There’s a clear link between brand strength and an organization’s sustainability practices, and customers are increasingly seeking out those that uphold good environmental, social, and governance initiatives. According to data from Bain & organization, the brands that scored highest on sustainability generated five times the revenue growth of those scoring lowest — great news for ESG investors.

More top-line growth

By offering more sustainable products and establishing a stronger ESG reputation — as above — organizations can attract more B2B and B2C customers. The reality is that people want to work for and buy from organizations that have sustainability, good corporate governance, and social responsibility (and needs) at the heart of what they do. These organizations are good investments.

Fewer expensive regulatory and legal problems

When organizations operate sustainably, they not only have fewer governance issues and reduce the risk of being fined for not adhering to legislation, but they also gain more support from governments and subsidiaries, while having the opportunity to exercise more strategic freedom (as more avenues open).

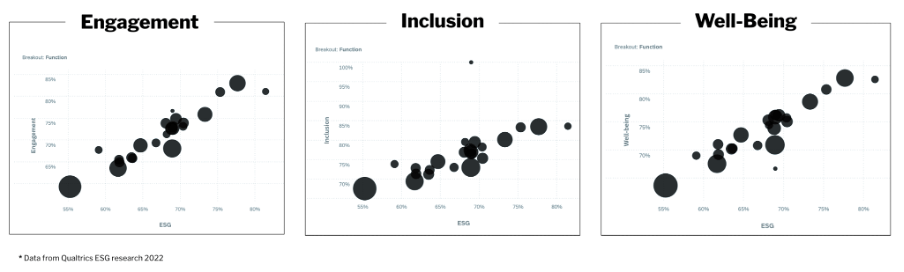

Better employee experiences

Anecdotally, during the pandemic and with the rise in demand for social justice, we have seen a shift in employees wanting to work for more purpose and value-driven organizations. They want to work for outfits that not just reflect their values, but demonstrate them. However, this is no longer just anecdotal evidence — our research shows the same, too.

We found that there were significantly higher levels of engagement, inclusion and well-being where there were positive perceptions of the organization’s performance on ESG factors.

When organizations care about the world around them, they naturally work to improve the employee experience, too. To be sustainable, organizations must ensure that employees not only feel safe and secure in their roles, but also proud of the organization they work for.

More and more employees ar dedicating themselves to the cause of ensuring the well-being of communities and societies across the globe, and they’re holding their organizations accountable for their contributions towards these efforts.

The pros and cons of ESG

| Pros of ESG | Cons of ESG |

|---|---|

| Sustainable funds achieve returns as good as, if not better than traditional funds. | It has to be tailored to fit your organization. You’ll have to decide where to focus your initiatives – there’s no ESG manual |

| Rapid growth: customers are attracted by the more sustainable products and services offered by organizations with high ESG ratings | It has to be authentic. You must embrace ESG and mean it – it cannot be used as a marketing ploy or dipped in and out of. |

| ESG investing drives further investment into ethical practices | No organization has 100% perfect ESG. You have to choose which issues are most important to you and align with those funds. |

| ESG-driven organizations often perform better on the stock market. They take more calculated risks, over longer terms, and are safer for investors | While ESG organizations are often strong performers on the stock market, this is not always guaranteed |

| Cost-cutting. Good ESG practices reduce operating expenses, waste, and recruitment costs for organizations invested in. | ESG fund fees are higher than traditional funds because managers need to do more ESG research to keep the fund on track with your values |

ESG strategies

An ESG strategy is your plan to meet your ESG goals and make your organization investable. A good ESG strategy demonstrates those environmental, social, and governance factors that your organization leaders believe to be important for your organization operations – both now and in the future.

Done well, your ESG strategy will give you a competitive advantage by fulfilling pre-tender and contractual obligations. It will also highlight your responsible approach to stakeholder well-being, governance requirements, and environmental issues such as greenhouse gas emissions and climate change.

The key to ESG success

It all starts with listening. When organizations have the right experience management platforms and listening tools in place, they can understand the perspectives of all key stakeholders — their employees, customers and consumers. Understanding these perspectives and what motivates people — as well as having that information in one place — enables organizations to take targeted actions that can improve the overall experiences of key stakeholders.

From the key drivers of ESG: diversity, inclusion, well-being to equity, professional development, and more, employee experience management and listening tools are the foundation of future ESG success.

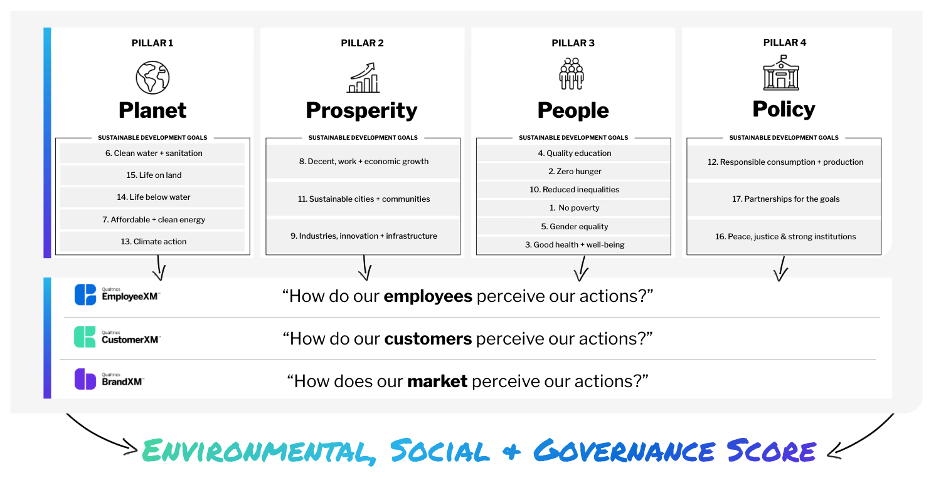

The Qualtrics ESG solution provides the standards for a data-driven approach to meeting ESG objectives. We use the World Economic Forum’s four pillars as core metrics, aligning the SDG goals and targets to each one:

Using the Qualtrics ESG solution, you will:

Understand — in one place — how your organization is performing on each of the key targets from the perspective of your employees, customers, and consumers

Learn what drives ESG perception and what matters most to your employees, customers, and consumers

Find out how you stack up against other organizations

Identify the most significant actions that will help bring about genuine change and contribute towards sustainability and overall improvements.

If you want to find out more about the Qualtrics ESG solution, as well as how you can use it to gather the perspectives of key stakeholders to make data-driven decisions on ESG objectives, check it out using the link below.

Learn about Qualtrics ESG Solution