Author: Leonie Brown

What is customer experience?

Customer Experience (CX) is the measurement of your customers’ perception of their interactions with your organization.

It should reflect their expectations compared to your brand promise. This measurement spans the full customer journey – every interaction, from what they first see on your advertising materials to how they feel about the conversation with your customer support team post-purchase. By delivering a consistently remarkable customer experience, your CX metrics will reflect this positive sentiment from customers.

Unlike customer service or customer relationship management, customer experience does not map neatly to a single area of your business. Essentially, customer experience (CX) refers to how a customer perceives your brand based on their exposure to it.

Customer experience management is now an established business discipline, especially when it comes to long-term strategy and planning. You set the overall context of a customer’s experience: your product or service, messaging, and interactions at the sale and post-sale stage. But the perception of how these touchpoints are experienced is the customer’s. It is not something you control (although you can certainly influence it). Instead, it is defined by your customers and their journey.

We see our customers as invited guests to a party. And we are the hosts. It’s our job every day to make every important aspect of the customer experience a little bit better.

– Jeff Bezos, Amazon

Understanding AI: Your real-world CX playbook

The importance of customer experience

Most organizations recognise the importance of customer experience at its core: by delivering consistently on your brand promise, and providing customers an optimized experience, brings financial rewards. But that represents a shift from previous years, where brands chased after higher sentiment scores of satisfaction or recommendation, without connecting those scores to financial or operational performance.

As organizations evolve their CX mindset, they’ve recognised that CX is a means to an end. High CX metrics mean little without an associated uplift in financial performance.

5 benefits of improving CX:

- Drive revenue and customer lifetime value

- Increase brand value

- Boost customer loyalty and advocacy

- Understand changing behaviors and expectations

- Derisk and accurately prioritize investments by understanding customer impact

What is a good customer experience?

We’ve touched on the fact that a customer’s experience isn’t totally within a brand’s control. There are a few reasons for this:

- Customer experience is made up of a wide range of factors, some of which are outside of the company’s direct influence (for example user-generated social media content, third party reviews).

- Customers create their own journeys, rather than following a prescribed process. They stop and start, move from one platform or channel to another, and sometimes retrace their steps. Customer experience derives from the journey as a whole, not the quality of each touchpoint.

- Customer expectations are not just set by your company but also by the actions of your competitors – if they change their offering they may reset customer expectations for that type of product or service in general.

So with this in mind, what does a positive customer experience look like, and how can you as an entire company know when you’ve met your goals for customer experience management?

As is often the case, the answer to understanding your customer experience is to ask your audience. In the following sections we provide a range of customer experience metrics and a starter-list of foundational elements of a good customer experience management program.

In addition to tracking quantitative metrics like customer effort score (CES), customer satisfaction score (CSAT) and net promoter score (NPS), make sure you are set up to gather and act on qualitative experience data from customers, as this can be a valuable source of insights and can offer you a deeper understanding of what customers want and expect from you. As a result, you can better avoid a poor customer experience by understanding the drivers of customers’ perceptions.

Successful customer experience management

A successful customer experience management strategy will put customers at the heart of its strategy and day to day decisions. This benefits your business as well as your customers, with improved customer satisfaction leading to brand loyalty and reduced cost to serve.

Below are some best practice methods for building a framework for a customer experience program, as well as the necessary steps for making CX management a business priority.

Build an experience management framework

Customer experience management (CXM) is your strategy for controlling customers’ perceptions of your brand, and understanding where and how to invest in improvement.

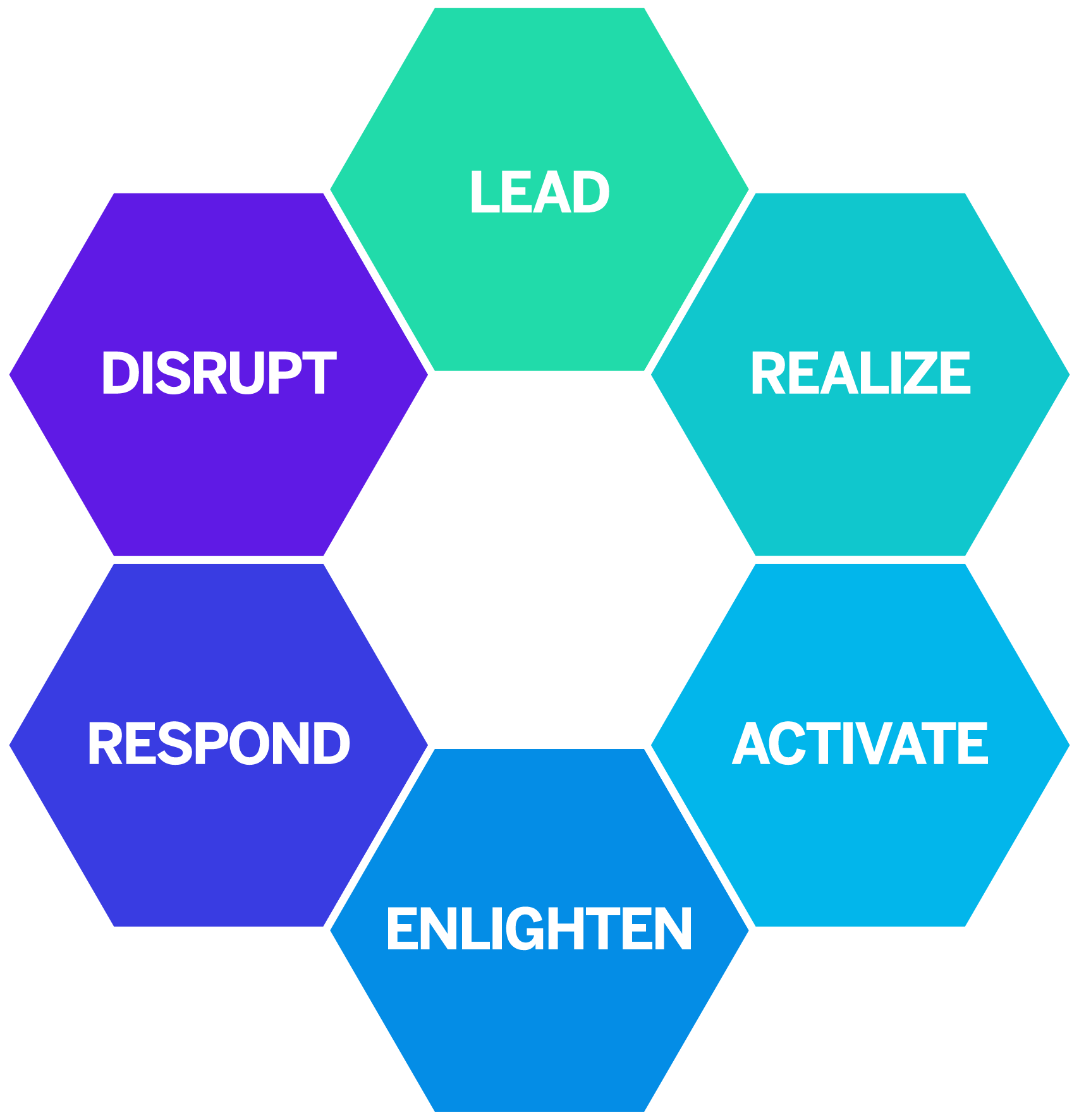

To be successful, companies should adopt the experience management Operating Framework, which is built on a combination of technology, culture, and the following six competencies.

- Lead – Architecting, aligning, and sustaining successful customer experience efforts across different people and projects over multiple years

- Realize – Identifying and tracing the right metrics to ensure customer experience efforts achieve well-defined business objectives

- Activate – Making sure your organization has the appropriate skills, support, and motivation to achieve the desired customer experience results

- Enlighten – Capturing, analyzing, and distributing actionable insights

- Respond – Building organizational mechanisms to continuously take action based on insights

- Disrupt – Identifying and creating experiences that differentiate your organization from competitors

6 experience management competencies

The XM Institute offers a Customer Experience Maturity Assessment that you can use to identify your organization’s strengths and weaknesses across the six experience management competencies. Improve your market share and commit to business growth by identifying where you stand now, and where you could be.

Create center of excellence for customer experience strategy

Once you’ve developed a business-wide framework to support your team and provide a customer experience that meets expectations, you’ll then need to create a customer experience strategy that takes advantage of this framework. Your CX strategies should be able to not only collect feedback, but turn it into actionable insights to create positive experiences for customers.

There are three key pillars to this customer experience strategy, as listed below:

1. Listen to and understand your customers’ perspectives

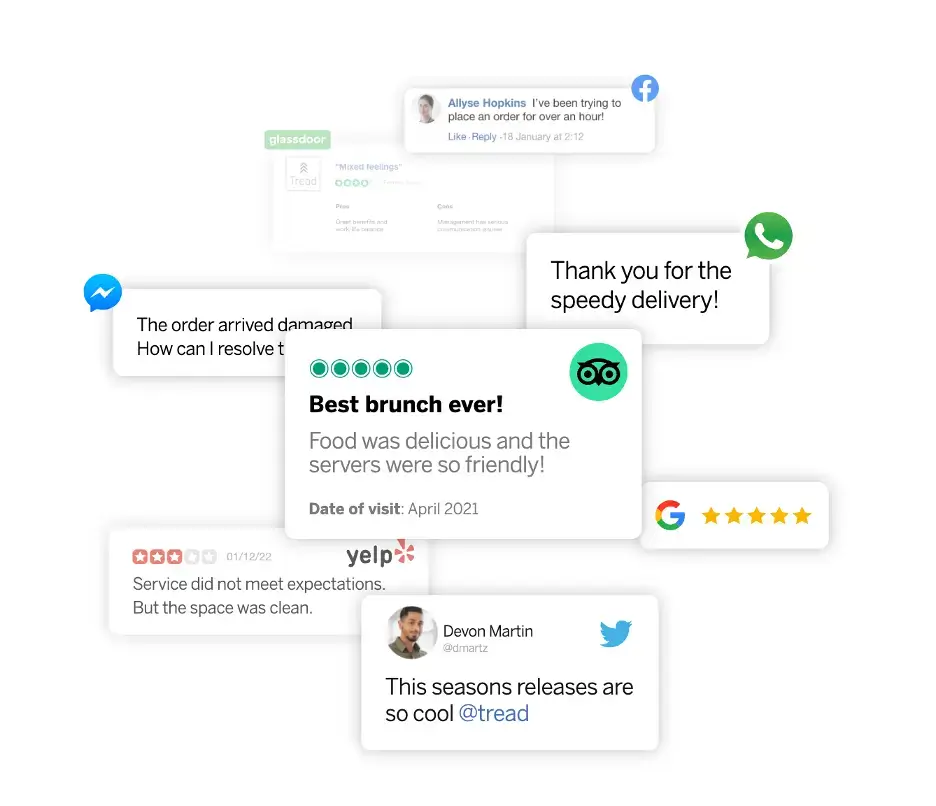

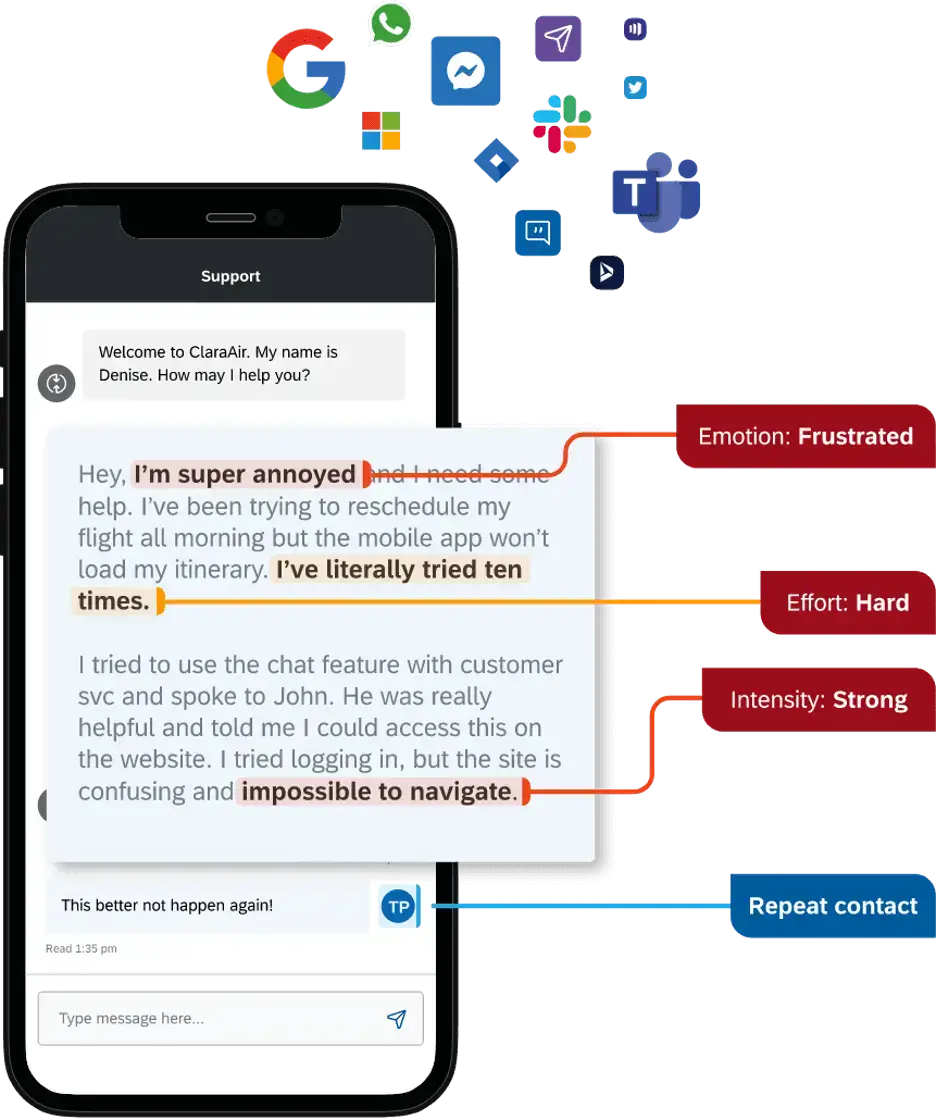

Rather than waiting for the customer to initiate their discussions about their customer experience with your brand, be proactive and source feedback. It’s not just about sending customer surveys to measure customer satisfaction – you’ll also need to examine the valuable data in conversations they’re already having with you, such as with when a customer calls customer support or engages with your website chat function. You can use customer experience tools such as omnichannel conversational analytics to help you gather experience data and understand what it means, no matter where customers are sharing it.

Customer conversations are everywhere

2. Build customer profiles for better customer satisfaction

When your audience interacts with your brand, they expect a consistent experience and recognition at each customer touchpoint in the customer experience. From marketing preferences to discussions with your customer service teams, your customers want your brand to provide a personalized experience.

Building in-depth customer profiles, complete with data on every customer interaction, allows you to personalize every detail of a customer’s experience. Rather than offering a generic customer journey that feels impersonal, your audience has an experience that’s tailored to customer needs and customer expectations. This in turn increases customer satisfaction.

Customer data is often collected in disparate silos across a business, but with an experience management framework in place, aligning teams and departments and sharing customer information across your operations becomes an in-built process. Build strong customer profiles with details on every interaction they’ve had, how they felt about it and the likely behavior they’ll display next, and you’ll be able to create customer experiences with real impact.

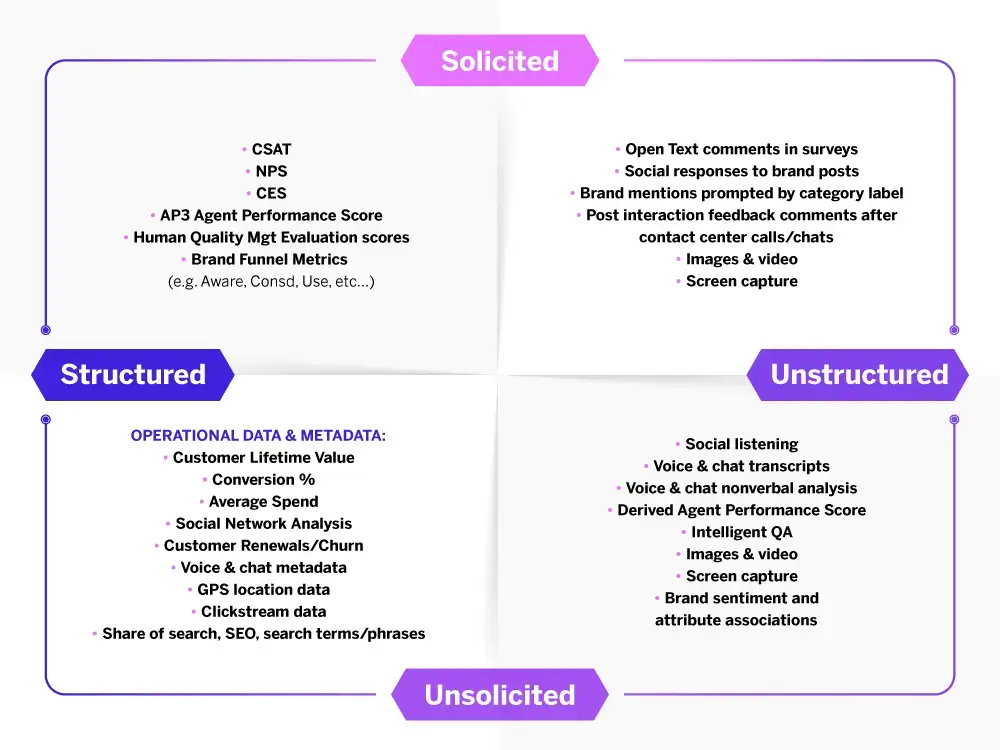

Understanding how to balance different types of feedback data

There are four key combinations of data you can gather about your customers: solicited (you ask for it) and unsolicited (you listen for it), and that data could be structured (rating out of 5 stars) or unstructured (conversational data, comments, reviews). A best practice customer experience management program should include elements from each of these quadrants:

Types of feedback

To drive action in your organization, you will also need to make sure you are connecting experience data to operational or financial data, as this is what helps you understand the impact of changes, and to prioritize investments by identifying likely ROI improvements.

KPIs are drawn from the ‘structured’ side of feedback as these contain numeric values while nuance is more derived from the unstructured side. An example of this might be correlating CSAT to average order size – intuitively we know that ‘happy customers spend more’ but the key question is….how much more? Understanding the financial impact of changes in sentiment is the most powerful way to influence decision making across a broad range of stakeholders.

3. Act with empathy to quickly improve experiences

Your audience is continuously providing you with customer information, as well as their time and money. A positive customer experience strategy makes customer relationships a two-way street, with the brand giving as much as it gets.

Collecting customer feedback is important, but demonstrating to your audience that you’ve listened and have implemented change is key to becoming a CX leader. In our 2023 research, 62% of consumers said businesses needed to care more about them, indicating the opportunity for CX leaders to move to the forefront of customer preferences.

When you harness the customer data you collect, analyze customer experience data and take action on the insights you surface, you’re able to show customers that they, and their views, matter. Real time insights allow you to make changes at lightning speed to ensure customers have a positive experience every time.

In return for demonstrating action and care, you’ll get more than just a great customer satisfaction score – you’ll get customers that consistently show brand loyalty in the face of market and economic change. They know they can trust your brand for a positive experience.

Integrate customer relationship management into your CX strategy

Often an organization’s priority is customer relationship management, ensuring customers convert from browsers into buyers. It can often focus on the quantitative facets of customers’ experience, rather than the qualitative aspects that drive customer experience. It’s sometimes more focused on transforming a poor customer experience after the fact, rather than delivering a positive customer experience right away.

However, this is a primary concern for Customer Care teams – they are seen as the ‘cleanup crew’, tactically resolving customer problems rather than helping to fix issues systematically in the first place. Understanding the correlation between overall CX and financial performance helps these frontline teams to quantify the impact of fixing a strategic issue weighed against the ongoing costs of high support traffic.

With an improved customer experience and a customer-centric approach, customer relationship management becomes simpler and more effective. Meeting new, evolving expectations for customer relationships best supported by a customer experience management strategy that turns valuable data into vital customer insights.

Understanding AI: Your real-world CX playbook

Key elements of your customer experience strategy

Delivering superior customer experience drives improved business performance. And understanding customer expectations of your brand – and what is crucial to their satisfaction – will help you set priorities and de-risk your investments. Here are some of the core foundations of any good customer experience strategy:

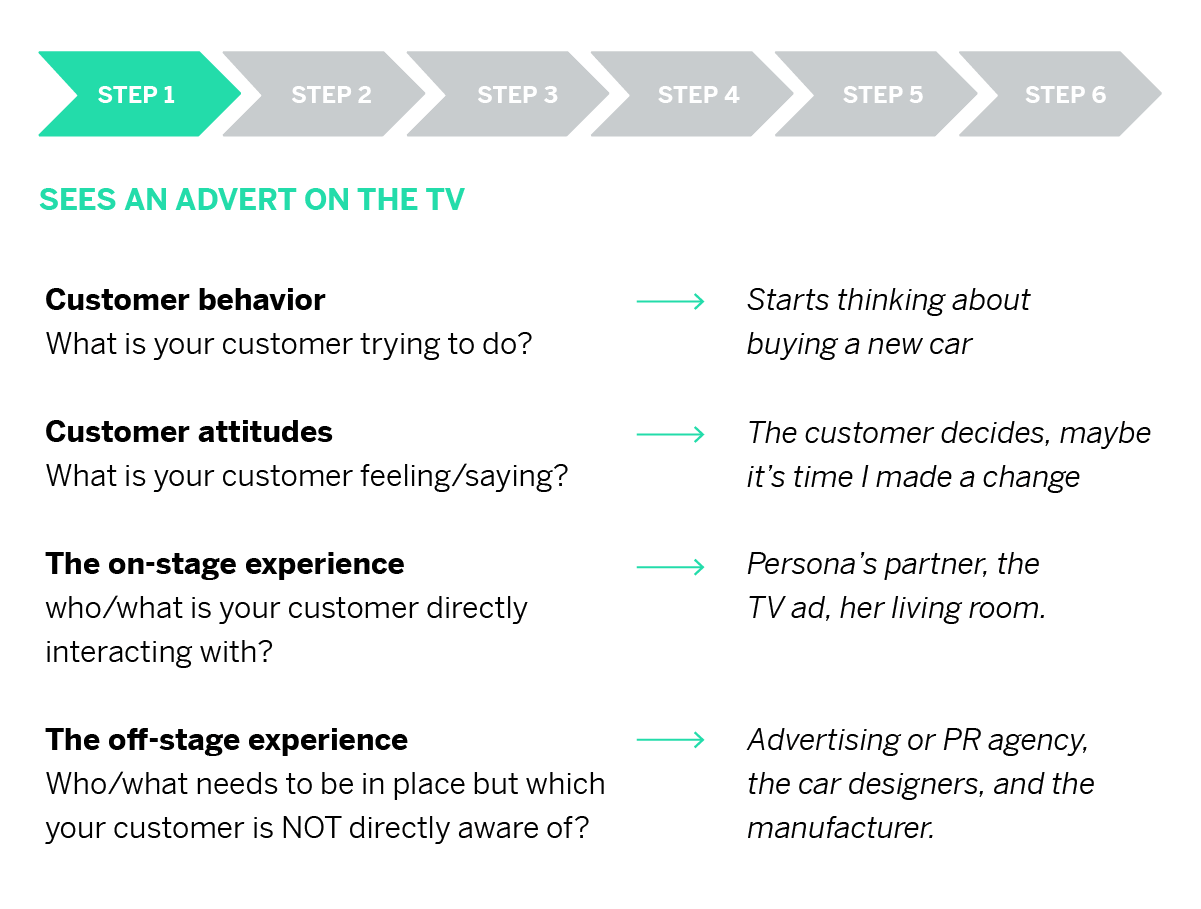

1. Customer journey mapping to understand customer journeys

The first step in understanding the current experience is often customer journey mapping: understanding the experiences your customers are having at each touchpoint in their customer journeys. Often businesses deliver well on components of that journey, but without a customer-centric view they may fail at distinct points of customer interaction. Viewing the entire customer journey as whole via a map – not just the touchpoints – helps to frame the experience from the customer’s perspective.

A customer journey map not only outlines the entirety of the customer journey as it stands, but assists you in creating a new path for customers for better conversions and improved customer experiences.

Key benefits of a journey-centric approach:

- Improved connection of measurement reflecting the whole customer journey

- A shared sense of ownership of the journey across disparate teams in an organization

- Collective understanding of where key impact points are – the ‘moment that matters’

- Better collaboration on a shared scorecard/KPIs

- Reduced organizational silos

Customer journey mapping example

Using customer journeys as a way to visualize the program for cross functional stakeholders can be a powerful tool to drive action: showing how the customer moves through their experience (e.g. onboarding, or repair, or renewal) is a way to tell the story of the data and put insights into context.

2. Cross-functional collaboration

Consistent delivery across the journey can be a challenge, often increased by siloed departments and operations. Until every part of the business understands its impact on customers’ experience, progress will be limited. For example, billing and credit operations might see themselves as removed from frontline delivery – but to a customer, difficult billing experiences can override positive store or digital experiences.

Cross-functional experience governance helps a business to break down those silos and improve the customer journey experience in meaningful ways. Committing to a customer-centric view helps to realign existing processes and allows the business to deliver improved experiences. An effective and productive customer experience strategy is built on that multi-disciplined engagement; making certain that employees understand that each person in some way touches customer experience.

3. Always-on listening

In order to design a customer experience strategy that is fully customer-centric, businesses need to understand where they currently are in delivery on the customer journey and to identify effective means of improvement.

In order to deliver consistently on the elements of the brand experience that customers most value, it is extremely productive to listen continuously. Soliciting data and reporting on unsolicited data for real-time customer feedback across the full range of touchpoints helps to identify and prioritize things to improve.

Unsolicited data can take many forms, such as conversations on social media platforms or comments on third-party review sites. It can also be hidden in phone calls to your contact center. This information can provide extra context to customer interactions, illustrating customer sentiment, emotion, effort, and intent.

Using a platform that can identify every signal from all communication channels and turn all data into meaningful insights is critical for getting the full customer picture. Equipped with text analytics powered by natural language understanding (NLU), you can automatically collect and collate data for insights with context.

Conversation analytics with sentiment analysis

4. Communication – External and Internal

Communication of actions taken to improve the experience is essential: customers want to know that you are not just listening, but acting. And the positive word-of-mouth that results from direct customer engagement on communication channels, as well as problem resolution, is a huge contributor to how the business is seen by both current and potential customers. It’s vital for improved customer acquisition, as well as lowered customer churn.

Customer loyalty is earned by consistently delivering on your brand promise, as experienced by your customers. Doing well on the aspects your customers value the most is the key to CX success. And acknowledging and resolving experience failures builds trust in the brand.

Internal communication is critical – keeping stakeholders informed on progress, and tracking against planned improvements is just one aspect. Another central element is communication to the frontline staff who are delivering daily on your brand promises. This should be a two-way channel that communicates to the frontline and also collects feedback from them. Often, while a customer may tell you that something is wrong, a frontline agent will have more context on why customers are experiencing this issue and even suggestions on how to fix it. Leveraging this channel creates a positive loop of reinforcement – driving improvement and delivering timely insights.

Measuring customer experience

Getting the full picture

The most important thing to remember about measuring customer experience is it’s not about the metrics themselves. Chasing a higher NPS or CSAT isn’t the purpose. The purpose of measuring your customer experience efforts is to:

- Track progress on actions taken

- Identify improvement areas

- Calculate the ROI of CX

- Prioritize your actions and invest in the right things

It’s crucial to combine any X-Data metrics like NPS with O-Data metrics like average spend and customer retention. Because your NPS could be sky-rocketing, but that may be because unsatisfied customers have deserted you. Getting the full picture with all your data is critical to see what drives the feedback you receive.

Hear the voice of the customer, and track your improvements

Here are some of the most common ways of soliciting customers for their views directly:

Customer Satisfaction Score (CSAT)

CSAT helps you understand how satisfied your customers are with your company’s products and/or services. When you collect this data at various touch points, you can start to identify key drivers of positive or negative experiences at different points in the customer journey. Overall satisfaction (OSAT) can also be used to measure the customer’s overall relationship with your organization.

Customer Effort Score (CES)

The Customer Effort Score can help you understand the basic functionality of your digital offering and its relevance to your customers’ needs. This metric focuses on the ease with which a customer can complete any given task. This metric is particularly useful for B2B organizations (as ‘recommendations’ aren’t so relevant – individual business users often don’t get a choice of vendor). It also performs well for tactical measures like digital experience where your competitors are just a click away and so even a small additional friction can drive customers elsewhere.

Net Promoter Score (NPS)

There is a heated debate on the value of NPS, but at a basic level NPS gives you a snapshot of overall customer sentiment. However, within your entire organization you need to set expectations around its use and limitations. It doesn’t work as well at a transactional level, and there are issues with cultural differences and a lack of alignment between scores and interpretation (e.g. if someone gives you a ‘6’ rating, are they really a detractor?). NPS is designed to measure long term customer sentiment – it correlates with loyalty even though it asks about recommendations. It is a strong metric to use at strategic level due to its long term nature – particularly useful for senior leadership. When used in conjunction with other metrics, it can give long term insights compared to the more agile CSAT or CES.

See the context with indirect CX data

Using direct customer feedback from surveys is useful, but indirect customer feedback as mentioned can also be a vital tool for getting context. It also allows you to give customers options to reach out in ways they prefer, such as video feedback, social media direct messaging, review site comments and more. By using both indirect and direct feedback, you’re able to take action with full knowledge of customer motivations and emotion.

How to improve customer experience

Measurement is just one step towards creating a brilliant customer experience every time. CX metrics can give you a solid indication of where action needs to take place in the customer experience and what you need to improve, as well as how. However, collecting customer experience insights isn’t enough – direct action is what will bring customers back time and time again.

1. Focus on delivering what your customers value most

It’s crucial to understand your customers’ view of your brand and the moments that matter most to them. A consistent, day-to-day delivery on your brand promise is crucial to retaining customers, cementing brand loyalty, and growing your base.

Understanding what elements are crucial to your customers helps you prioritize action and investment. In any list of experience elements, there will be ones that fall to the bottom. The key is to be sure that the lowest-performing elements are also the least important ones to your customers. That alignment – typically derived from key drivers – helps keep the business focused and KPIs relevant.

By identifying the loyalty behaviors you’re trying to improve, you can build models that will help you demonstrate to leadership how those behaviors drive changes in key CX metrics. This will help you secure buy-in for ongoing CX spend and ensure continued improvement.

2. Listen carefully to what your customers tell you – and then act on that feedback

One very productive approach is to use closed-loop processes to respond directly to customer concerns. In B2B CX, it’s even possible to follow up with customers who give low satisfaction scores or are NPS detractors. Given you’ll usually get fewer responses than in B2C, and have a closer relationship with each customer, this kind of approach can be highly productive.

In B2C, you’ll often have a much higher response rate to any customer feedback surveys you send out. So while you should absolutely fix anything customers raise as an issue, following up with low-scoring individuals may not be as helpful. Especially if your managers haven’t been trained and coached for those discussions.

Also listen to what your employees are saying. Often employees can identify problems and opportunities faster and with more depth than what you will uncover through your customer feedback programs. In fact, companies that have mastered the employee experience by listening and acting on the voice of employees have the best CX.

3. Show you’ve taken action

Customer experience programs are ongoing discussions between a brand and its customers. As such, it’s crucial to demonstrate you are taking action on the feedback, even for those respondents who have not specifically asked for contact. Including a simple message alongside customer-led initiatives – e.g., “You spoke. We listened.” – demonstrates that providing feedback is not just a tick-box exercise within the business. Customers are far more willing to provide experience feedback if they believe the business takes it seriously and acts on it.

4. Focus on improvements, not measurements

Customer experience isn’t a metric; it’s an ongoing program that delivers substantial business benefits. And that means you shouldn’t chase numbers. Use measurements to drive improvements in your CX program that will result in tangible outcomes. Whenever presenting or reviewing CX metrics, pair them with key learnings and resulting action items.

To gain momentum for your CX program, make and share quick wins.

Communicating performance against a shared scorecard across the organization will help drive action – but make sure this focuses on direction of travel rather than specific numbers. Using the ‘delta’ – the amount of change – will also help to compare performance across divisions, product lines and regions, rather than trying to compare discrete numbers.

Your most unhappy customers are your greatest source of learning.

– Bill Gates

Customer experience and AI

Businesses are increasingly looking to implement an AI strategy to take advantage of its potential, but what is the best way to integrate it into your customer experience and your frontline operations?

Using AI directly with customers

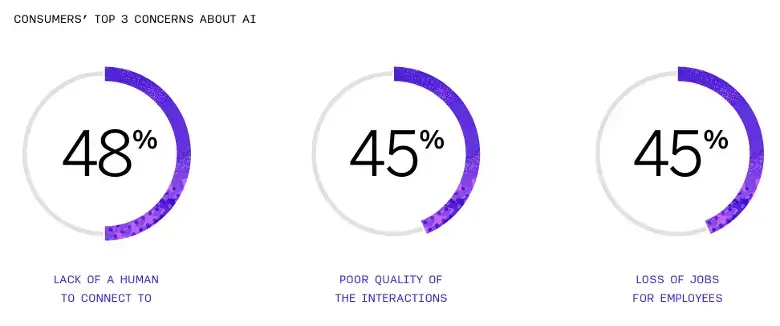

Our research has found that 48% of consumers are comfortable interacting with an organization’s AI. However, this comfort isn’t a universal feeling – it depends on the context in which an AI is encountered.

For example, though AI can make simple, rote tasks easier and more efficient, customers are still looking to have human interactions when the stakes are high. We found 73% of consumers are happy to use AI to check an order status – but their top concerns when encountering AI are that there is a lack of a human to connect to and that interaction quality will be poor.

Consumers still prefer to interact on human-led channels over AI-driven channels for issues such as resolving a bill problem. The key to an AI strategy, then, is to understand when customers want to speak to a human specifically, and to ensure that all interactions (both human and AI-led) provide a high quality customer experience.

Creating human, personal experiences will drive satisfaction with customer experiences, keeping customers loyal and ensuring they still want to spend with you. With one in two consumers reducing or stopping their spend with brands after a bad customer experience, it’s vital you focus on interaction quality.

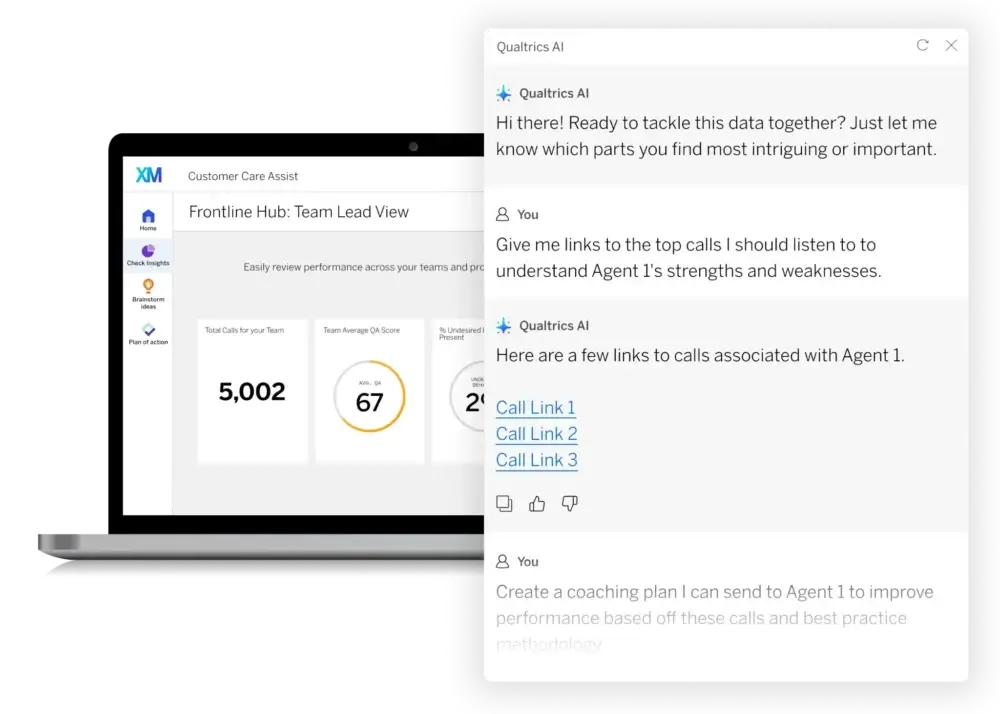

Using AI to empower your teams and provide better customer experiences

Potentially the most powerful place to deploy AI isn’t in the customer-facing part of their digital experience, but in the back end. AI-powered analytics can quickly deliver insights to your human customer service team, such as details on sentiment, emotion and effort, to enable them to take effective action.

It can also automate rote tasks. The right AI tool can free up your agents’ time by automatically writing up post-call notes. It could also automatically score all agent interactions and provide evaluation and coaching plans, to allow for fairer, more effective performance reviews and to enable improvements in team performance.

Learn more about customer experience and AI

Summary: building a comprehensive CX program

Throughout this guide we have given you some best practice frameworks – on competencies, on journey mapping, on data collection – but ultimately any program success is measured on business impact.

Designing an iterative, action-led program that focuses on capturing customer data and improving experiences with insights will have a demonstrable impact on your customer experiences and your business outcomes. Use the XMI Fundamentals of Customer Experience Launchpad to further understand what customer experience (CX) management is and how you can start building your organization’s CX management capabilities.

When creating your customer experience program, you’ll need the assistance of CX management software that can immediately flag customer experience issues and lead your frontline teams to the actions that will solve them.

To do so, your customer experience management software should be able to blend experience data, operational data and behavioral cues to build a comprehensive customer journey map. From first interaction to post-purchase recommendations on social media, your CX management software should be able to track customer experiences and reactions in real-time.

Better still, they should be able to deliver insights to teams across your business, giving your teams the understanding they need to eliminate customer friction.

Understanding AI: Your real-world CX playbook