What is the product life cycle?

The product lifecycle is a five-stage model developed by the German economist Theodore Levitt. It looks at the life of the product from development through to launch, and then to the end of the product’s saleability.

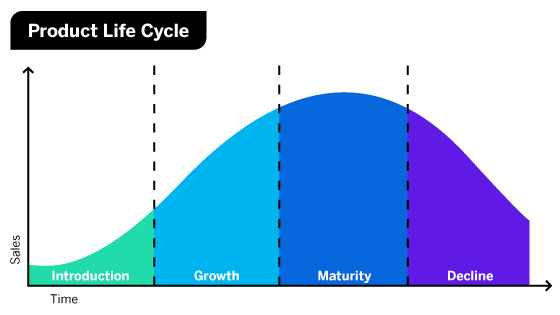

Levitt defined five stages – product development, introduction, growth, maturity, and decline. His model covers how the product is received by the target market and how it forces your competitors to react. It also indicates how your product should change as it moves through the product lifecycle stages.

As a business, it’s important to find ways to support and maintain this process in order to make the most out of every product across every stage of its life.

In an ideal scenario, there is a sixth stage at the end of the lifecycle that we recommend adding on: Iteration. This step extends the product lifecycle since ongoing feedback continually improves a product and creates a longer life span.

Free eBook: This Year’s Global Market Research Trends Report

Why is understanding the product lifecycle important?

If you know what stage of the lifecycle your product is in, or will be in, you can create a plan and develop strategies to make the most out of every stage – which is all part of product lifecycle management (PLM). We know that a product will become unattractive at some point in its life due to many factors that we’ll explore. However, we can bear the PLC (product lifecycle) in mind and help our business to:

- Make better decisions based on how the product is performing at the moment

- Get the biggest return on investment when you launch your product

- Increase revenue back to the company

- Predict the future of your product and proactively try to make the most of the course, by shifting your marketing messaging and approach to connect with audiences

- Look at your product from different angles and market it accordingly

- Become an authority in the market and compete effectively against the market in a prepared way

- Make an impact with your product’s appeal, performance reputation, and your brand’s customer loyalty

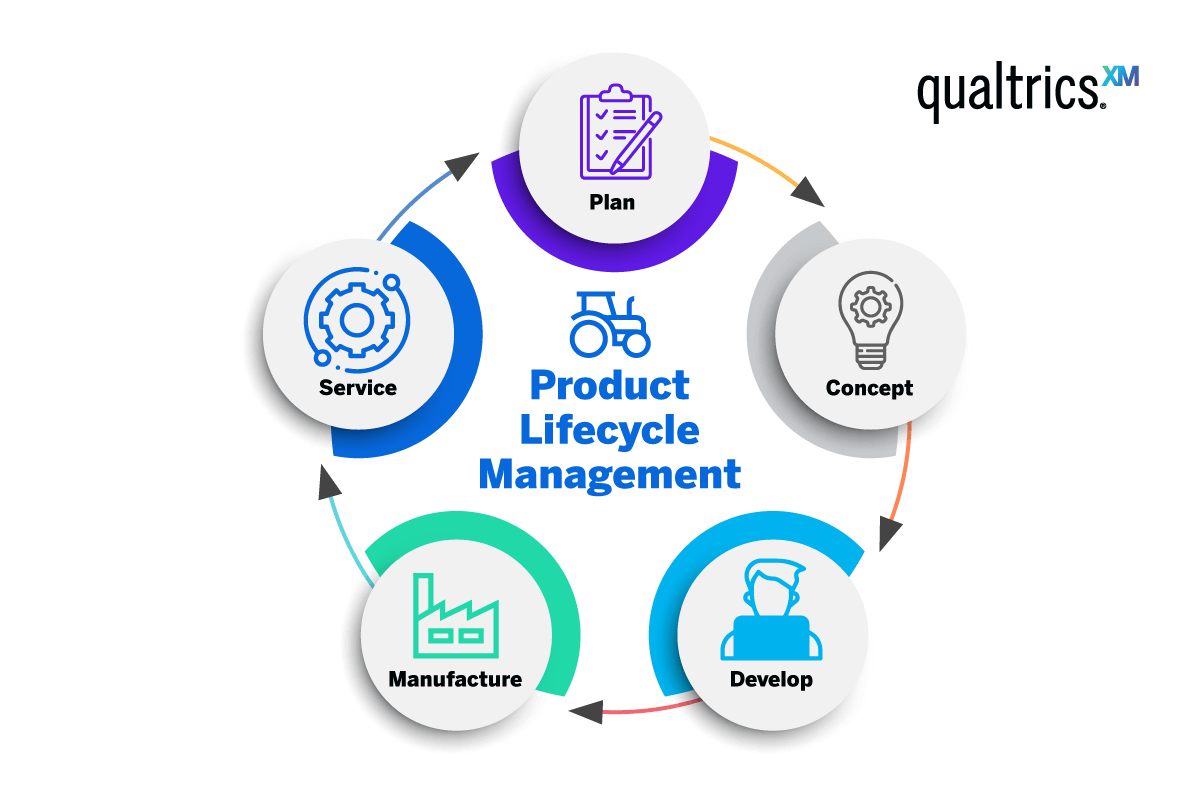

The product development lifecycle

From ideation, a product will go through several development stages internally before it ever sees the physical and online stores where the public can purchase it.

What the product development cycle does is help you to refine, strengthen, and hone your product until you find a solution that will equate to customer success.

Re-routing is part of the process, and it’s not uncommon to change direction multiple times or even go back to the drawing board. Often it takes multiple iterations and repeated steps to get things right.

Let’s look at Levitt’s product lifecycle stages in the next section to see how each stage takes the development of a new product forward.

What are the product lifecycle stages? (with examples)

Product development stage

You’ve created a fantastic product concept, based on external data observations, customer pain-points, or an opportunity in the market for a new solution. Here’s where you progress to the next step – testing the concept with real end-users.

There are various ways to connect with your customers during the product development stage. Tools and platforms like Qualtrics CoreXM provide different instruments to assess, validate and improve your ideas and perspectives.

To make sure the product lifecycle will have a good start in the market, there are four sequential steps we’d recommend investigating in your development stage:

Features: What should be included?

You’re likely to have a long laundry list of potential features for your new product. But what’s a necessity, and what’s just nice to have? (Read our free ebook about Product Concept Testing for more information.)

Customer research can help you narrow down your feature list and prioritize which items on it deserve a bigger chunk of your budget.

Function: How should it work?

How should your chosen features work together? What will the user interface of the product be like? You may be faced with a decision about whether to innovate on your product’s functionality or model it after an existing product that’s already familiar to users. Testing can help steer you towards the options customers will prefer.

Messaging: Developing a marketing strategy

Once function and features are established, you’re ready to bring in the product marketing team and decide how to present the product to its audience.

This is your product marketing strategy.

This will involve researching how customers view your business and its competitors and finding the right niche for your product in its future target market.

Your marketing strategy should span your product’s lifecycle from start to finish, but the tactics you’ll use at each stage may be different and will serve different purposes.

The different marketing tactics you employ throughout your product’s lifecycle will also be impacted by the market, and the actions of your competitors. We’ll go into this aspect of product lifecycle management in more detail later in the article.

Price: What will customers be willing to pay?

You can use surveys and studies to hone in on the exact price point where customers feel ready to purchase.

Introduction stage

Congratulations! You’re ready for the introduction stage. This is where you put your product out into the world with a product launch strategy. This stage marks the start of your sales interactions with clients and customers, and marketing is key here to position the product in advance of the launch and during release to the general public.

During the introduction stage, the product has yet to make a ripple in the market, so sales tend to be slow at first, and the demand will be low. Hence, businesses will spend the most money during this product lifecycle management stage on advertising, content marketing, and inbound marketing campaigns that raise awareness of your exciting new product.

The ideal scenario is if there has been momentum building up ahead of the release, so people’s eagerness to buy the product contributes to the intrigue and your product makes a big splash on its release date.

For example, Apple customers receive lots of hints about upcoming product releases as part of the brand’s product lifecycle strategy. This happens during the annual company conference and through advanced reviews by influencers. At product launch, queues often occur overnight and stock is limited, which drives up demand and interest.

Growth stage

The market growth stage is where the product awareness ‘takes off’ as more demand for your product builds among consumers.

Your growth phase should get your product deeply rooted in the market and draw the attention of other companies, who may start competing with you by developing a similar product.

Since the market dominance you achieve with your product may become diluted by similar products, the prices you can charge may decrease as a result. However, during the growth stage of your product’s lifecycle the market demand for your product increases, and your company can quickly respond to the increased interest from customers, so increased sales numbers balance this price reduction out.

Marketing activities during your market growth stage should be around delivering the product and expanding your reach in the market, by using more distribution channels and establishing your brand presence among competitors.

This will include more targeted paid advertising to get your product in front of specific customers, as well as more ‘mass market’ tactics to grow awareness among customers of your product.

This growth stage is designed to build on the initial awareness you built during the introduction stage, and move you towards the maturity stage.

Market maturity stage

As a product’s market penetration, sales and consumer awareness really reach their peak, you enter the maturity stage of the product lifecycle.

At this point your product will have its highest market share, and is at its most profitable.

The market is saturated with competitors who are aiming for the same product niche, pricing is low and companies are offering customers attractive deals in the hope of being chosen over other market competitors.

Your supply has accumulated, but demand starts to level off, which means that you’ll have less to produce as a result.

As the product becomes well-known and familiar, companies often begin to innovate around the original idea and create alternate versions and off-shoots that cater to new markets in order to reach untapped customers and to stay fresh and stand out.

Ideally, at this product lifecycle stage, your brand is established and loved as the product leader in the market. Coca-Cola, for example, has market dominance in the soft drink market and is still popular with its customers after many decades, so its maturity stage is likely to be long-term and continuous.

Marketing during the market maturity stage targets how to keep your customers loyal so that they buy the product long-term. You can track your brand using brand tracking management software.

Decline stage

In the final stage of Levitt’s product lifecycle management model, your product nears the end of its journey.

However long and prosperous the maturity stage has been, the decline phase is an inevitable part of your product’s lifecycle. It’s represented on the graph as the slow fall from the peak of the growth stage. This is one of the most challenging stages of the product lifecycle. It may arise when:

- there is too much competition

- the product is outdated or replaced by new technology or visions

- your product has reached market saturation and there is no more potential for growth

- customers lose interest in the product

- the brand image is damaged

In the decline stage, sales fall, the company market share is reduced and low prices reduce your profit margins. During the decline phase of your product’s lifecycle, it’s best to concentrate on your loyal customers who want to keep buying from you and making sure they have the best customer experience you can offer.

As we’ve said, this is one of the most challenging stages of the product cycle, and some brands won’t survive this decline, especially when they are pitted against competitors or against new technological advancements.

For example, Blockbusters’ product lifecycle ended in 2010 when the company went bankrupt. This was because its business model of entertainment movies that you could watch in your home was based on unpopular rent charges and late fees.

This wasn’t sustainable as new contenders like Netflix’s software as a service (SaaS) model challenged Blockbusters’ existing product. It offered subscription-based pricing and on-demand cloud-based videos. In an increasingly digital world where online services were replacing in-house services, Blockbuster couldn’t compete and the market decline stage marked the end of the business.

Not all businesses end at the market decline stage. Those that manage to survive are able to adapt their existing product (by adding new features for example) to meet new demands and expectations.

Others may enter new markets in an attempt to increase or maintain sales volume. An example is Fujifilm, which was able to diversify from its core area of analogue camera film when digital photography emerged. The company not only survived but thrived by expanding into new areas such as medical and scientific equipment, cosmetics, graphic design and art supplies and even antiviral medications.

Iteration

One additional product lifecycle stage that we would recommend adding on top of Levitt’s original product lifecycle stages is Iteration. This looks at how we extend the product lifecycle by using feedback to continually improve an existing product and create a longer lifespan, particularly at the development, introduction, growth and maturity stages.

Some ways of doing this include:

- Creating new and engaging marketing strategies

- Product bundling and other pricing initiatives

- Further product lifecycle development or cross-selling

- Create new variations of the product with updated features or benefits based on customer feedback

- View other market areas globally or test new distribution channels

- Extend their product into a range, each with its own product lifecycle

The best way to do this is to gather data, feedback, and customer responses.

With your product launched, the next task is to set up and maintain an ongoing program of research. Monitor the response to your product using product satisfaction and loyalty research and customer satisfaction surveys, as well as sales and other operational metrics, to keep a pulse on how it’s performing.

Often this can serve as a pipeline for ideas on improvements to existing products, or even start the product lifecycles for entirely new products. It’s just as critical as the pre-launch testing we do because it helps us improve what we currently offer.

Free eBook: This Year’s Global Market Research Trends Report

What’s the business case for product lifecycle management?

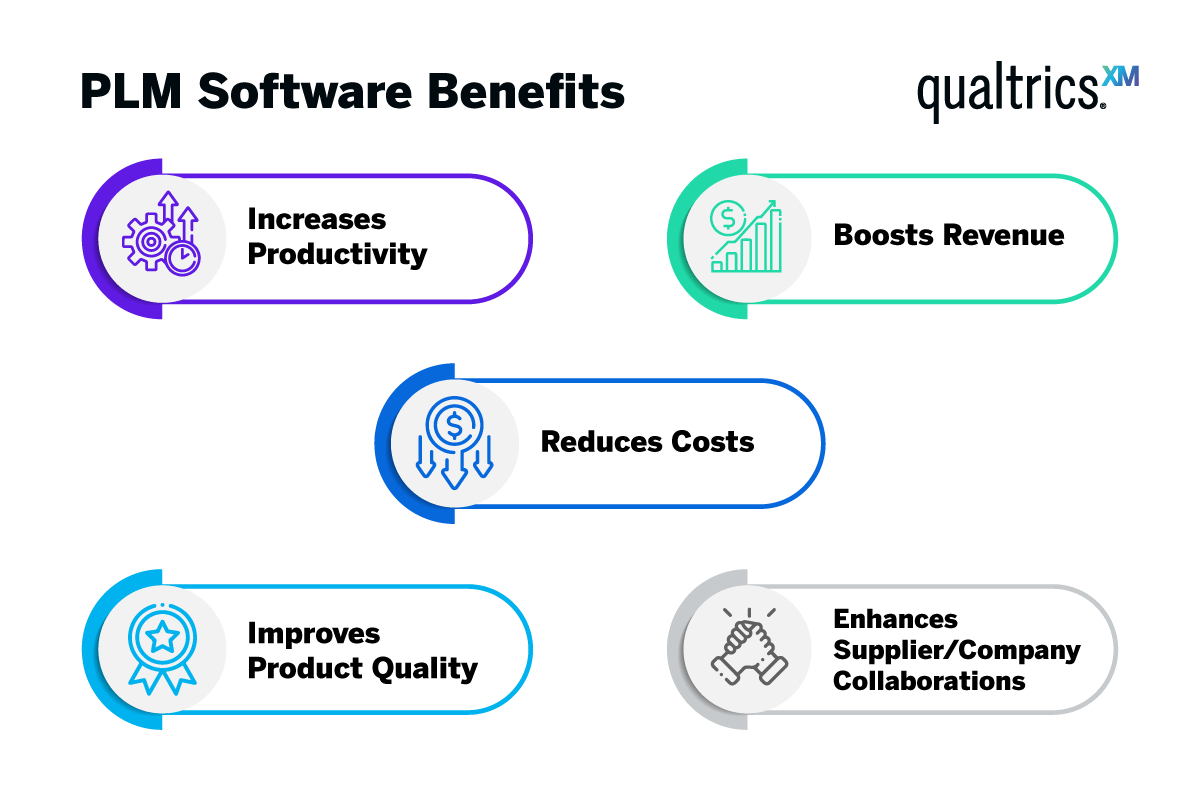

Product lifecycle management, also known as PLM, is how businesses track, measure and optimize the product lifecycle journey. Using tools and software to support the process, companies invest in product lifecycle management as a way to keep competitive and make the most out of their investments in product development, marketing and market research, among others.

Managing the product lifecycle through each stage can increase the longevity of your product and ensure you make it a success. When it comes to determining the return on investment from your product lifecycle model, there are several things to consider for both the long and short-term.

Short and long-term benefits

What will the benefits to your company be? Consider everything—from short-term reductions in manufacturing costs, to long-term profits from developing new product features based on feedback. Remember that in addition to concrete benefits like revenue contributions savings, an investment in product success can also help deliver experience improvements for both customers and employees.

What are the costs involved?

Developing PLM systems might provide long-term advantages, but you also need to understand the cost implications.

For example, consider long-term development and staffing costs if you plan to upgrade and develop products to extend their lifecycle, as well as additional marketing and sales resources to achieve the necessary market growth.

Should you invest in product lifecycle management software?

A good PLM system will necessarily be very broad in scope, because it needs to cover a huge range of processes, roles and business functions. As well as product data, PLM software should be able to connect with your supply chain, other business software systems, your production process and also enable design and manufacturing integration. As a consequence, it’s likely to be a costly investment, albeit one that will quickly begin to show ROI.

How to judge the ROI of product lifecycle management

While it can be difficult to quantify the ROI of product lifecycle development, one study by Forrester did help businesses understand how to calculate the financial benefits, taking into account the revenues, margins and product development operations within a company.

In all of Forrester’s product lifecycle examples used to determine ROI, each generated similar findings:

Lower product development costs

In Forrester’s product development management study, planning, software and implementation costs were all lower for companies using a PM model.

Revenue increases

Due to the reduced costs and faster deployment of new product iterations, Forrester’s study highlighted that an effective product management cycle can help to increase revenue are newer products can get to market quicker.

Lower development risks

Again, because product teams were able to reduce costs and gather input from customers and stakeholders, they were able to reduce the risks of products declining, and increase the market growth stage of their product’s life.

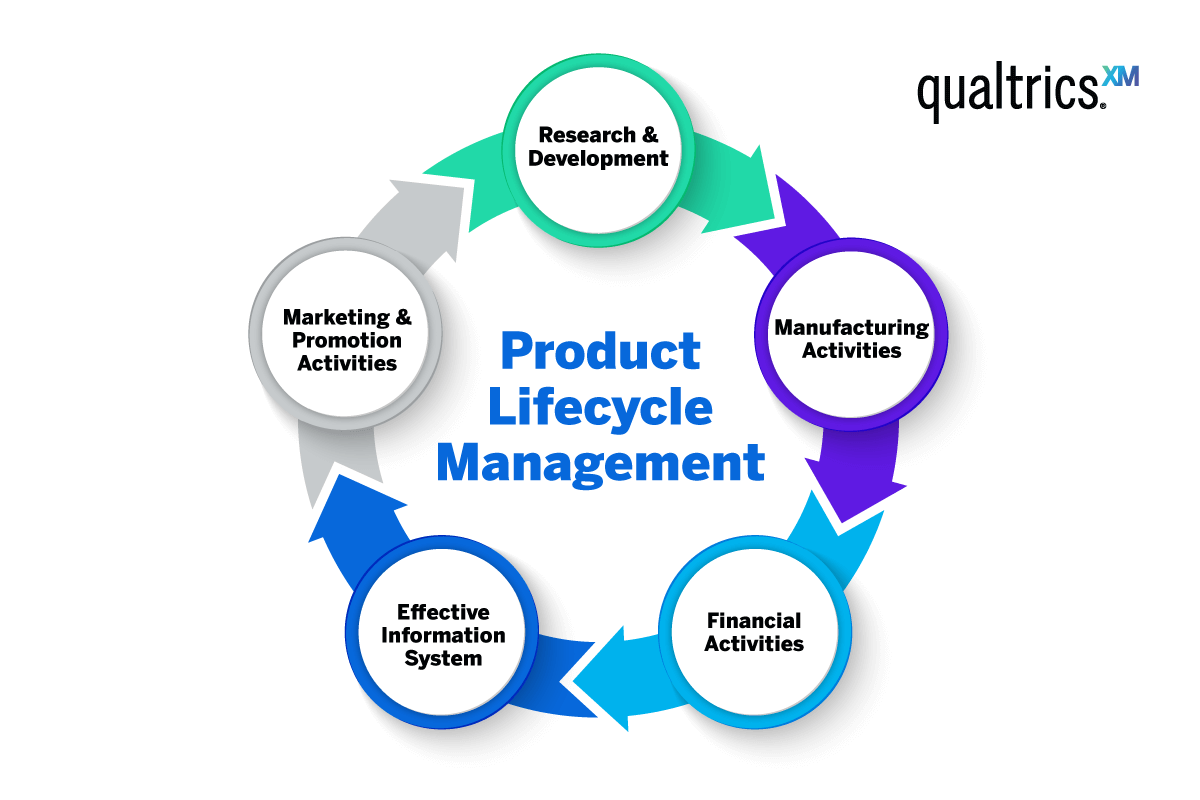

Product lifecycle management – what’s involved?

There are a huge number of business processes and tools that contribute to successful product lifecycle management.

- Information management system

Robust information and communication technology systems are crucial, as you’ll need to collect data across multiple streams in order to determine where you are in the product lifecycle journey. Good PLM software will provide you with a single source of truth or central database that helps you integrate all the different strands of your PLM process. It can also help you close communication gaps between different business processes, particularly if there is one shared PLM system that integrates with other business software.

- Product data management

Good product data management involves everything from document management and production process data to keeping track of costs and document metadata. In addition to quality and process management, plm software that offers product data management can help you build an electronic file repository of your ideas and concept iterations for future reference. - Brand management

Brand management and brand listening can help you understand how your product and company are perceived and where you currently sit in your market relative to the competition. They can also help you determine what kind of associations people have with your brand, and hence your products, which can help you develop and iterate to emphasize the aspects of your brand that resonate most with customers. - Marketing and promotional activity

In the introduction and growth stages, your marketing and advertising activities are crucial for giving your product a strong kick-start into the market. It’s essential to connect your marketing activity closely with other aspects of product lifecycle management so that the messaging developed around your product supports and enhances its appeal, while offering a feedback channel to help with iteration. Customer feedback, reviews, social mentions and the like can all emerge from your marketing and comms function, not least the social media department. Customer relationship management software is a valuable source of feedback data too.

- Finance

The product lifecycle involves significant investment with little return in the early stages, and – hopefully – a fruitful phase of high income with little outlay at a later stage. Financial budgets, portfolio management and plans for investment or borrowing must coordinate closely with other aspects of product lifecycle management, ideally using detailed data from your PLM system. - Supply chain management

Taking a product from concept to full production takes an army of contributors, from manufacturing facilities and safety testing to logistics and transport, not to mention quality management and business systems. The entire global process can quickly become disjointed without the right PLM solutions in place. Integrating your own business systems with those of your external suppliers – creating maximized supply chain collaboration – is a useful way to get more value out of your PLM software and provide a smoother experience for supply chain partners too.

- Research and development

Coming up with new ideas and executing them successfully is really at the heart of product lifecycle management, since it’s the new developments that keep the cycle turning. Whatever field you’re in, R&D will represent an important part of your business strategy. In addition to digital tools like computer aided design software and project management platforms, you can enhance your product development process with modern PLM tools that connect the R&D stage with later phases of the lifecycle. A software system that integrates data about production processes, engineering challenges and of course customer experience will only enhance the product development process.

- Service and support

PLM also involves the product experts who help customers use the product and help both customer and business understand and overcome problems with it. They can also offer a valuable feedback channel for customer experience and brand perception. In order to capture this feedback, it’s a good idea to have listening tools in place that are easy for employees to use and don’t compromise data quality.

Maximize your business advantage at every stage of the product lifecycle

As you can see, the product lifecycle is complex and involves plenty of twists and turns. Knowing where you are in the cycle and how to make the best product lifecycle management decisions means you can adjust your marketing and financial investment accordingly. When planning your product lifecycle management, we would suggest considering the following in each PLC stage:

Introduction: Now that customers are in direct contact with your product, there’s a huge opportunity to collect experience data about the product’s performance, the marketing messages around it, and how it’s perceived in terms of value.

Growth: We’ve got hundreds of tools and ready-to-use and free templates that help you grow your product lifecycles and business. These are based on best practices and tried-and-tested methods.

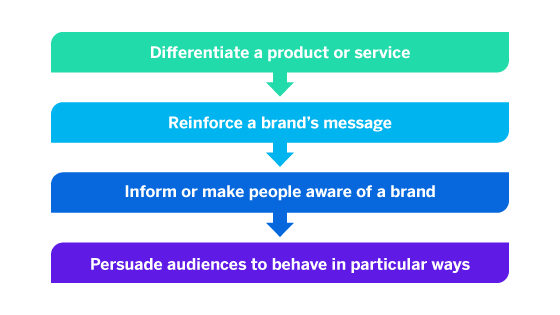

Maturity: How can you use the marketing model DRIP (differentiate, reinforce, inform and persuade) to help you gain more market share quickly?

Decline: What are the signs of withdrawal and a changing market?

Iteration: You need to look ahead at the product’s future, look backward to understand lessons from the product lifecycle so far and track where you currently are, and look at the present moment to understand what you can be doing now that can help your product perform as well as it can.

Tools to help you with product lifecycle management

You can take advantage of tools, advice, and products to support you with the different stages of the product lifecycle.

Statistics and analysis tools

To keep the product lifecycle process as efficient and effective as possible, product managers and product teams can use a range of tools and analyses to streamline and organize each part of the product lifecycle journey. They include:

Conjoint analysis

This is a popular market research approach for measuring the value consumers place on a product’s features, whether those features are presented individually or as a package. The conjoint analysis approach combines real-life scenarios and statistical techniques to assist in modeling market decisions.

Conjoint analysis is commonly used in product testing and employee benefits packages. Conjoint surveys will show respondents a series of packages where features are varied to better understand which ones drive purchase decisions.

Learn more about our conjoint analysis tool

MaxDiff analysis

MaxDiff (Maximum Difference) is an advanced survey research technique used to collect preference and importance scores for multiple items. Respondents are presented with samples from the full list of items to be assessed. They mark the item they prefer most and the item they prefer least in each set and repeat this exercise with different subsets of the items.

MaxDiff analysis is a type of Best-Worst scaling that relies on Paired Comparisons. As respondents mark their preference for specific items against a list of other items, MaxDiff seeks to find the ones preferred the most and how a ranking of the items shakes out. Using that knowledge, you can identify the features your program should be most focused on providing for customers, and the ones you can set aside.

Card sort

Card sorting is a quick way to prioritize a long list of potential features. It’s great for creating a shortlist of features early on in the product lifecycle development process.

The card sort technique helps you understand which product features most and least deliver value to a potential buyer or past customer. Card sort survey participants sort your list of potential product features so you have all the information you need to make important product decisions.

Product features are frequently grouped into easy-to-understand categories such as ‘must-have’, ‘nice-to-have’, and ‘don’t-need’ so you can see at a glance which ones matter most to different customer segments.

Learn more about our card sorting solution

Concept test

Concept testing is the investigation of potential consumers’ reactions to a proposed product or service — before introducing the product or service to market. At the right stage of the product lifecycle, organizations look to launch a product or invest in the development of an idea, so concept testing is essential to identify perceptions, wants, and needs associated with a product or service.

Learn more about our concept testing tool

Needs-based analysis

This method helps you understand how each of your product features is performing and how important they are to your customers. Needs-based analysis assesses current satisfaction and the importance of various product features so you can focus on the ones of most importance to your customers.

It allows you to spot product gaps and identify the features customers value that you’re not performing well on, so you can focus your investment on the improvements that will have the biggest impact.

Learn more about our needs-based analysis solution

Market segmentation

Customer segmentation involves dividing your market into usable groups of potential customers by analyzing demographics, needs, beliefs, spending patterns, or other psychological or behavioral criteria.

It allows you to paint a detailed picture of different groups of customers or prospects so you can maximize your appeal to different target groups. Your market segments can be used in all kinds of contexts, from the start of a product lifecycle with product research, to communications and promotions.

For more information on all the tools here and how they come together as a package for assisting with product lifecycles, view our Qualtrics Product Experience information page.

Managing your product lifecycle in an integrated way

To keep the product lifecycle on course, productive and within budget, it’s important to prioritize efficiency and accuracy in tracking performance and progress.

Qualtrics helps brands to manage everything within a single platform with the Experience (XM) Platform™. This can help you do these tasks:

- Listen: Measure and baseline product experience from target customer segments throughout the entire product lifecycle

- Understand: Prioritize and predict key drivers of product experiences, including product designs, feature preferences, messaging effectiveness, promotions, pricing, and more.

- Act: Track product experience against baselines and competition to identify where to invest for continuous product lifecycle improvements, new market opportunities, brand extensions, and new product offerings.

See the XM platform™ features and benefits and how you can use it to organize and succeed with your product lifecycles.

Free eBook: This Year's Global Market Research Trends Report